UK Housing Market Forecast: November 2024

Sales forecasts are revised down slightly after the Budget while rental value growth is expected to increase marginally.

4 minutes to read

Revising our UK forecasts before assessing the full impact of the Budget is challenging.

What will be the consequences of raising employer national insurance for inflation and the labour market?

Will protests such as the one organised by farmers last week sway the government as it consults on its plans?

Conversations around a tiered tax regime for overseas investors are still taking place, but how actively is the government listening?

In simple terms, we don’t yet know if the Budget will work and therefore by how much rates could fluctuate in the years ahead.

However, we have seen a jump in borrowing costs since the Chancellor set out her economic plans and expect more downwards pressure on prices and transaction volumes in the short-term. Indeed, gilt yields are notably higher than recent Office for Budget Responsibility forecasts, as we explored here.

As a result, mortgage lenders are reluctantly pushing rates higher, which will eventually feed through into house prices.

There is less uncertainty facing the rental market, but the passage of the Renter’s Rights Bill through Parliament is one key area of concern for landlords.

Our previous forecasts from August 2024 can be found here.

Sales

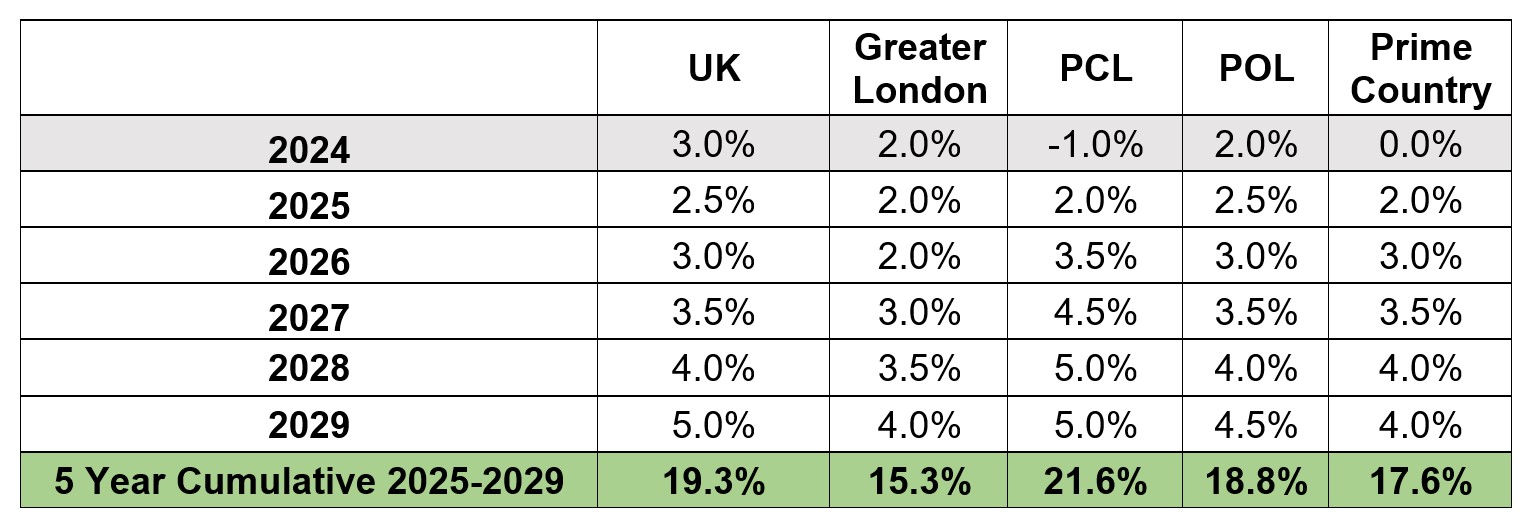

As a result of the more adverse rate environment, we now expect average UK house price growth of 2.5% in 2025, 3% in 2026, and 3.5% in 2027 down from our August forecast of 3%, 4% and 5%. Over the five-year period, we expect cumulative growth of 19.3%, which compares to an equivalent figure of 20.5% three months ago.

Similarly, our forecast for the Greater London mainstream market has come down slightly for future years, with cumulative growth of 15.3% expected between 2025 and 2029. We think affordability pressures will continue to be felt more acutely in the capital than other regions of the country.

UK house price growth was 2.4% in October, according to Nationwide, which was lower than the figure of 4.2% recorded by Halifax. Our forecast of 3% for 2024 therefore appears largely on track.

Prices in prime central London (PCL) are also expected to end this year close to our forecast of -1%. They fell 1.8% in the year to October, with the annual rate of decline having narrowed from -2.6% in April.

We now expect a slower rate of recovery in the short-term in PCL due to changes in how overseas investors and entrepreneurs are taxed and the higher additional rate of stamp duty for second homes. We forecast 2% growth in 2025, down from 3% in August. See our full reaction to the Budget here.

However, demand in prime London postcodes comes from a broad range of buyers and global wealth creation is expected to increase next year, according to our Wealth Report.

Furthermore, average prices in PCL are 18% down from their last peak in mid-2015. Due to this combination of relative value, greater political certainty, a higher presence of cash buyers and rising levels of global wealth, we expect the price recovery to gather pace over the five-year period and produce stronger cumulative growth (21.6%) than that forecast in August (16.4%).

Prime outer London and prime Country markets will also be supported by higher levels of equity than mainstream markets as well as the presence of more needs-driven buyers, which has bolstered demand this year.

In a similar way to PCL, we expect lower levels of growth in the short-term but a higher figure over the five-year period. The forecast for POL is 18.8% (15.4% in August) and 17.6% in prime Country (13.5%).

The changes to our forecasts are not dramatic and we will be in a better position to assess the outcome of the Budget and other policy decisions early next year.

Rents

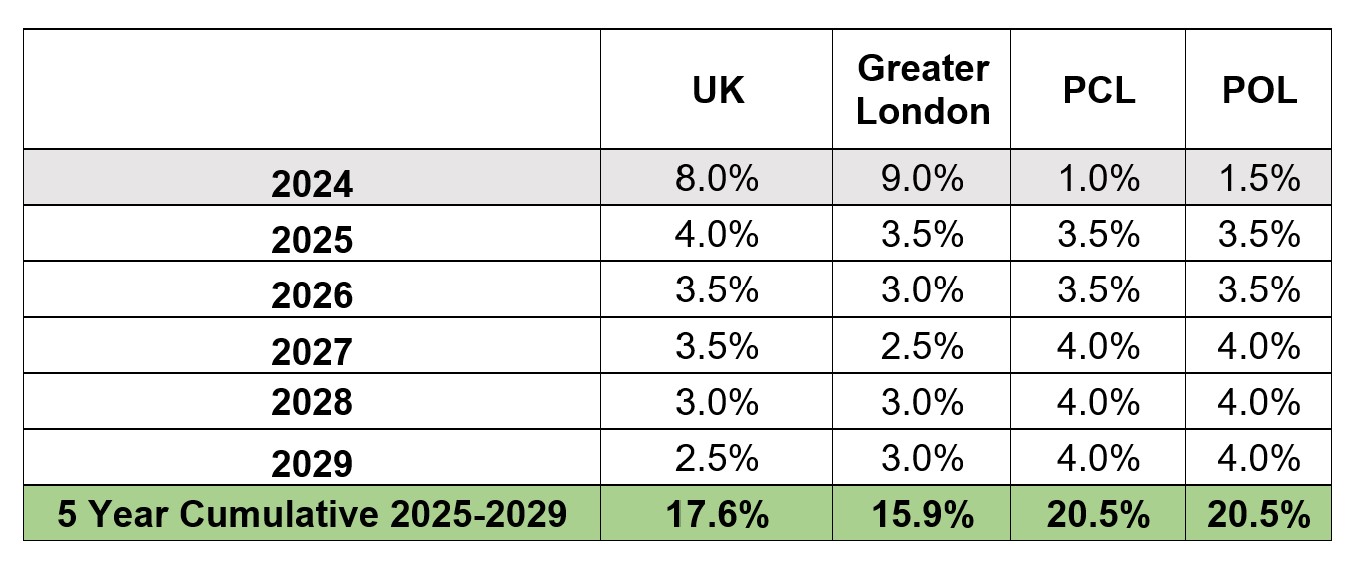

While we have revised down our sales forecasts slightly in the near-term, we have edged up our rental numbers to reflect the uncertainty surrounding the Renters Rights Bill.

Again, the change is small but reflects the risk that supply may become more constrained due to legislation that tips the balance of power in favour of tenants. Plans include the scrapping of no-fault evictions and tighter rules around rent increases. Full details can be found here.

A number of landlords have already sold due to a succession of tax and legislative changes in recent years, so we are not expecting a further material drop in supply.

However, we have revised up our forecasts for prime central and outer London.

In both PCL and POL, we expect growth of 3.5% in 2025 rising to 4% in 2027 (up from figures of 3% and 3.5% in August).

Meanwhile, our mainstream rental forecasts are largely unchanged.

We believe slowing wage growth will increase affordability pressures for tenants, which means rental value growth is expected to calm down from the heights of the pandemic, a period that was also distorted by a lack of supply.

Rightmove data shows that new UK rental listings are still a fifth below pre-pandemic levels and, combined with the uncertainty of the Renters Rights Bill, we expect mainstream rental value growth between 2025 and 2029 (17.6% in the UK) that is still marginally higher than the historical norm.