Strong growth in H1 profits for the UK Hotel Market

2 minutes to read

Download the latest hotels dashboard here

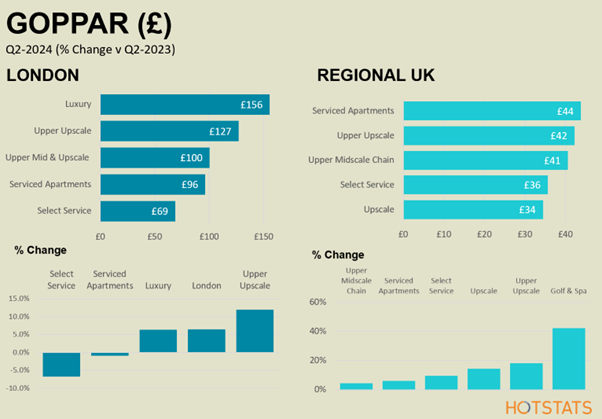

The pace of costs increasing has slowed significantly in Q2 versus the previous year, this combined with a forceful rise in revenues, has seen respectable profit growth in the UK hotel sector. For the first six months of 2024, London has seen GOPPAR grow by 6.1% to £87, whilst across Regional UK profits have increased by 8.1% to £33. H1 profits are now ahead of H1-2019 levels, with GOPPAR up by 8% in London and 14% across Regional UK.

Across the UK there has been a healthy uplift in departmental operating income year-on-year, with London recording Q2 growth of 4.8% PAR and Regional UK seeing a rise of 6.6% PAR. Upper-Upscale hotels have outperformed the market, with strong growth in TRevPAR supporting a 10% rise in departmental operating income in London and Regional UK. A stellar trading performance by Golf & Spa hotels in Q2 has led to a y-o-y rise of 23% in departmental operating income, with the growth in ancillary departmental income instrumental to this performance.

The uplift in departmental operating income has been the key driver behind Q2’s GOPPAR growth, with London recording Q2 GOPPAR growth of 6.5% y-o-y and the GOP margin converting at 45.5%. But it has been a mixed performance, with London’s Upper-Upscale hotels recording Q2 GOPPAR growth of 12%, whilst Select Service hotels have seen profits decline by almost 7%, challenged by declining TRevPAR and leaner operations making it more difficult for efficiencies to be achieved.

Regional UK has seen y-o-y GOPPAR surge by 11% in Q2, rising to £45 and achieve a GOP margin of 34%. Golf & Spa hotels unsurprisingly were outperformers in terms of improved levels of profitability, with Q2 GOPPAR rising by a staggering 42% to £123.

For further detailed analysis of the UK Hotel Market Trading Performance, including a visual overview of Q2 hotel investment volumes, take a look at Knight Frank’s new look UK Hotel Dashboard.