Labour opts to squeeze landowners in its quest for 1.5 million homes

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

How much should a landowner be paid for a field that might receive planning permission for new homes?

It depends on the likelihood of consent. Under the current system, it would be somewhere higher than the land's existing use value but lower than if consent was 100% certain. The final number, referred to as 'hope value,' rises in line with the likelihood that a piece of land will find an alternative use.

The government's plan for a massive increase in housebuilding should be a boon for landowners, then. Ministers are currently consulting on changes to the National Planning Policy Framework that include proposals to force councils to identify enough land to meet their future housing needs - including, where appropriate, in the green belt. Landowners with green belt sites that suddenly become eligible for housing would usually be the big winners here, but this morning's Times leads on plans to set a lower "benchmark" value for the land, capping the gains for landowners.

Where values can't be agreed upon, Ministers tell the paper that councils and Homes England will use compulsory purchase powers, including "use of directions to secure ‘no hope (of development) value’ compensation where appropriate and justified in the public interest.”

A platform for growth

The prospect of further falls in mortgage rates and pro-development reforms to the planning system should underpin a recovery in the delivery of new homes. Last week, Persimmon said it expects to deliver approximately 10,500 completions this year, which is at the top end of its previous guidance.

Bellway on Friday issued a trading update with similar sentiments. It completed 7,654 homes during the year through July, slightly ahead of previous guidance. The private reservation rate per outlet per week climbed 10.9% to 0.51 during the period. At the end of July, its forward order book stood at 5,144 homes, up from 4,411 homes a year earlier.

"While we remain alert to future potential risks to customer demand and cost inflation, the good levels of customer enquiries and relative stability in reservation rates in recent months have been encouraging," the company said. "Against this positive backdrop, we welcome the new Government's focus on addressing the ongoing shortfall of housing and its recognition of the importance of housebuilding to drive sustained economic growth... If market conditions remain stable, Bellway's strengthened forward order book together with its healthy outlet opening programme and work-in-progress position provide an excellent platform to return to growth in financial year 2025."

Inflation

The feel-good factor provided by the first Bank of England rate cut earlier this month will probably dissipate a little this Wednesday when the ONS reports an anticipated rise in the annual inflation rate.

Energy bills fell dramatically in July 2023, which will drop out of the annual comparison. That will push the inflation rate back up to 2.3%, after the rate remaining at the 2% target during May and June, according to economists surveyed by Bloomberg.

Nothing meaningful changes. This rise has been in the BoE's forecasts for months - it expects a 2.4% print - but it will provide a reminder as to why the Bank will pause before cutting again. Markets still expect two more quarter-point cuts before the end of the year.

Prime central London

Average prices in prime central London fell 2.4% in the year to July, which was the same annual reading for the third successive month, according to our updated index. Prices are down 4.5% on their pre-Covid levels.

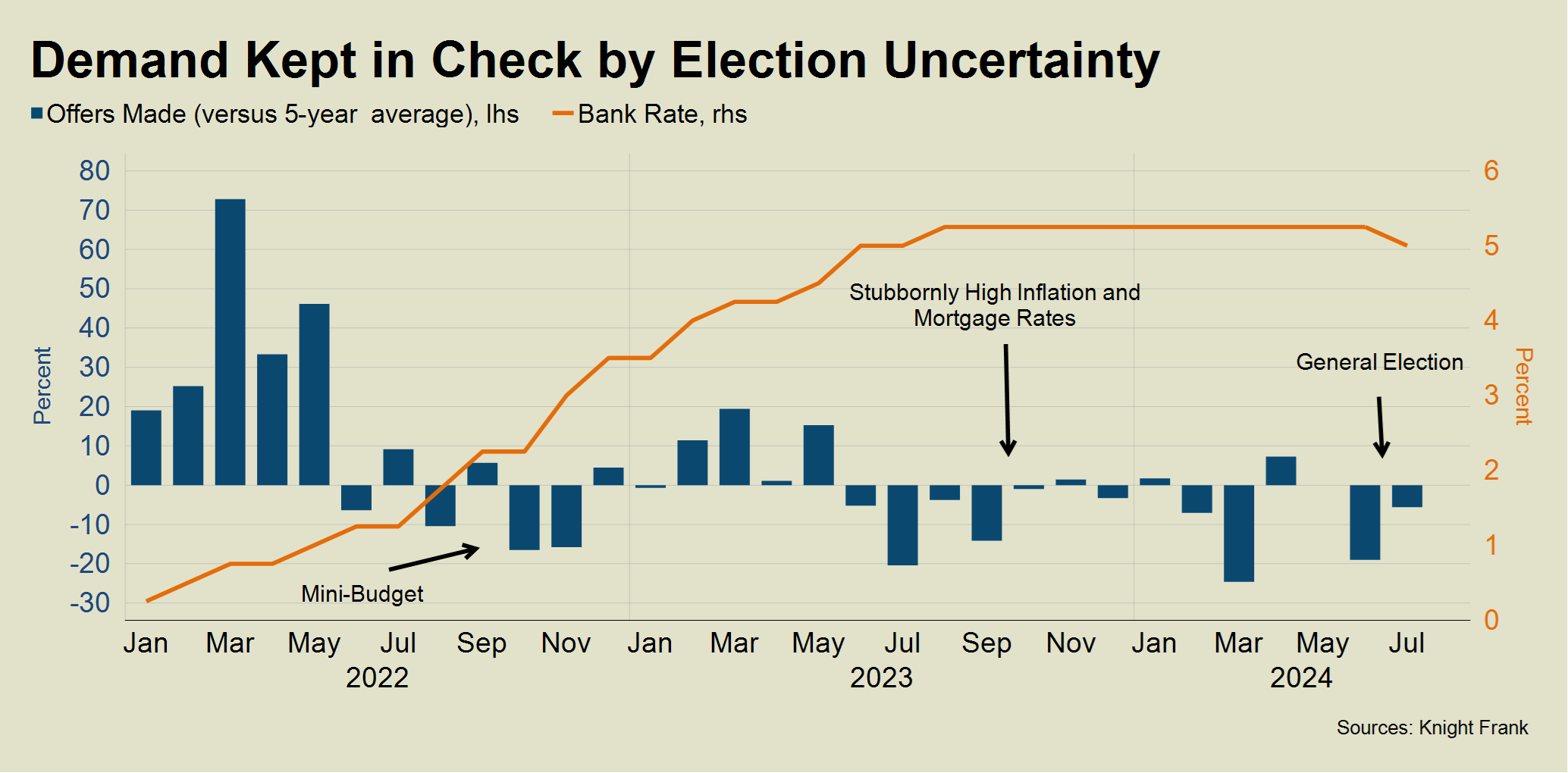

The prolonged wait for a rate cut and the distraction of a general election called on 22 May both weighed on activity through the summer. The number of offers made declined over the last two months, as the chart shows. The figure was 19% below the five-year average in June and 6% down in July.

Demand should rise in the autumn, buoyed by cheaper mortgage rates, though the Budget on 30 October provides an extra obstacle for prime markets. For example, the decision to impose VAT on private schools from January could curb demand in some higher-value areas when people return from their summer break. Buyers could be squeezed further if changes are made to pension tax relief, inheritance tax or capital gains tax.

However, there is now a little more clarity on how the government intends to change the rules for non doms, the 74,000 individuals living in the UK who do not pay tax on their non-UK income. Tom Bill has the details.

In other news...

Just as the prospect of tax rises in the Budget is causing uncertainty in the prime London sales market, Labour’s revival of the Renters Reform Bill is doing the same thing in the lettings market.

Elsewhere - FTSE 100 chief executives’ pay rebounds to 2017 levels (FT), business rates put 17,000 shops at risk of closing (Times), ‘free accommodation’ if students sign up to clearing before results day (Times), ECB to cut rates six times before the end of 2025, survey shows (Bloomberg), and finally, would building 1.5m homes bring down British house prices? (The Economist),