Italy doubles flat tax for wealthy new residents

Prime Minister Meloni increases the annual levy for ultra-high-net-worth individuals to help raise revenue

3 minutes to read

What’s happened?

Yesterday, Italy’s Prime Minister Meloni's announced plans to double the country’s flat tax on worldwide income from €100,000 to €200,000 with immediate effect.

Ultra-high-net-worth individuals (UHNWIs) already resident in Italy will continue to pay the €100,000 annual levy, the €200,000 charge will only apply to new applicants.

The move underscores a broader European trend of tightening fiscal policies while trying to attract foreign investment.

Despite the increase, Italy is likely to remain appealing to ultra-high-net-worth individuals (UHNWIs), who value the country's lifestyle, security, and culture as much as its tax advantages.

How does Italy’s flat tax work?

Italy's flat tax refers to a simplified tax regime introduced by the Italian government primarily aimed at attracting wealthy foreigners, retirees, and high-net-worth individuals to move to Italy. There are two main types of flat tax regimes in Italy:

1. Flat Tax for New Residents

- Target Audience: High-net-worth individuals who have not been tax residents in Italy for at least 9 of the previous 10 years.

- Tax Rate: A fixed annual tax of €200,000 on worldwide income regardless of the actual amount of income earned, prior to 7th August 2024 this figure was €100,000.

- Family Members: Additional family members can also benefit from the regime for an extra €25,000 per person annually.

- Duration: This regime can be applied for up to 15 years.

- Benefits:

- No need to declare worldwide income in Italy

- Exemption from wealth and inheritance taxes.

- Does not impact the taxpayer's global assets.

2. Flat Tax for Pensioners

- Target Audience: Foreign retirees who transfer their tax residency to specific municipalities in southern Italy, particularly those with fewer than 20,000 inhabitants.

- Tax Rate: A flat tax rate of 7% on all foreign income.

- Duration: Applicable for up to 10 years.

- Requirements:

- Must not have been an Italian tax resident in the last 5 years.

- Must transfer tax residency to eligible municipalities in regions like Sicily, Calabria, Sardinia, or Campania.

- Benefits:

- Simplified tax reporting and a significantly reduced tax burden.

When and why was it introduced?

The flat tax regimes are part of Italy's broader strategy to attract affluent individuals and foreign investments, thereby boosting the local economy, especially in underpopulated and economically challenged regions.

Italy’s budget deficit sits at 7.4% of GDP in 2023, more than twice the limit set by the European Union.

How popular has the initiative been?

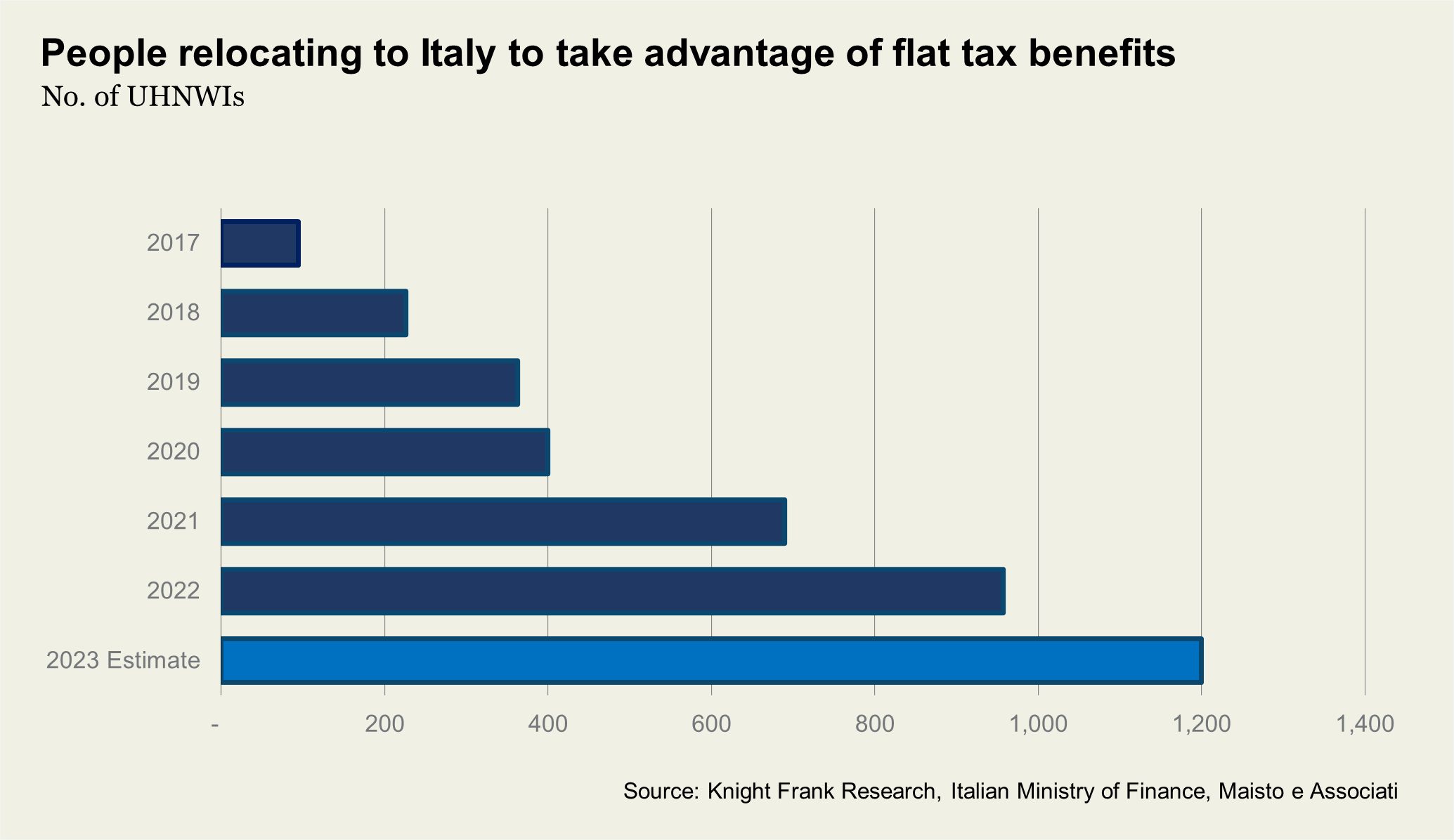

According to the Italian Ministry of Finance, 2,730 individuals signed up for Italy's flat tax between 2017 and 2022. Italian tax lawyers from Maisto e Associati estimate a further 1,200 UHNWIs took advantage of the initiative in 2023 taking the total to close to 4,000.

The flat tax saves money for those with large amounts of foreign income, though anything they earn in Italy is subject to the same tax regulations as everyone else.

There are a further 90,000 people, mainly Italians, benefitting from an expat scheme that gives a 50% to 90% reduction on taxable Italian income for those moving back to Italy, depending on the location they move to.

For more information download our Italian Homes 2024 report or the Prime Italy Report

Alternatively, contact Andrew Blandford-Newson and Issy Foster to discuss current conditions in Italy’s prime residential markets.