The BoE cuts: what next?

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

The Bank of England's decision to cut the base rate for the first time since 2020 will have a limited impact on mortgage rates, but it will be big for sentiment.

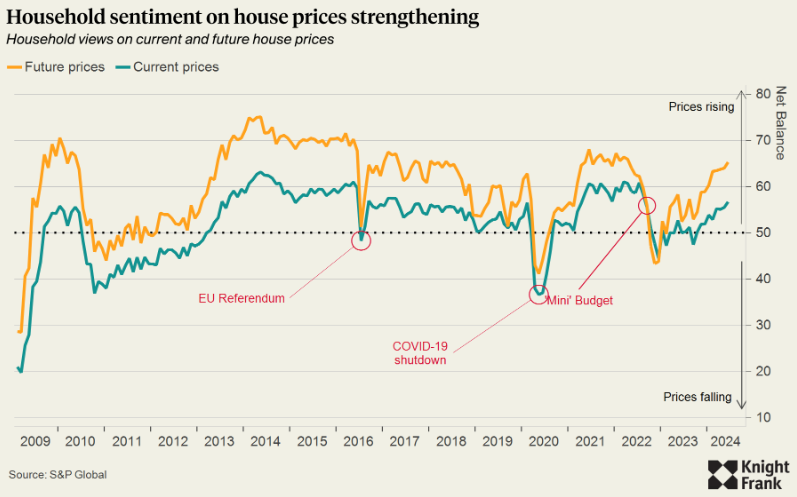

The major lenders have been steadily whittling down their margins and have little room left to manoeuvre. However, optimism is contagious and all the indicators suggest it is spreading. Household views on the current and future trajectory of house prices climbed steeply in the wake of the election (see chart). Consumer sentiment is at a two-and-a-half year high. The latest Lloyds barometer of business confidence is at an 8 year peak.

The Bank's forecasts for growth look sluggish, but it really is all relative. The outlook is mercifully benign, at least for now. The period since the Bank's last rate cut in March 2020 has been unprecedented for property markets, upending long held views on what property should cost, where it should be, and how it is used. Views have steadily moderated on many of the key issues and borrowing costs are now following. Will we end up back where we started, with rates near zero? Governor Andrew Bailey doesn't think so.

The outlook

The vote was close. Four of the nine members of the Monetary Policy Committee voted to hold the base rate at 5.25%, believing that progress in bringing inflation back to target was largely due to external factors, like easing international food and energy prices, whereas domestic pressures have become entrenched by repeated economic shocks.

The prevalence of this view suggests we'll see a measured, slow cutting cycle, but the majority believe that monetary policy is restrictive enough to keep inflation at target. In fact, if the Bank opts to cut once more this year, and continues to bring the base rate down to 3.5% by 2027 as markets expect, then inflation will drop below target in two years' time, according to the forecasts published alongside the decision.

Growth will be relatively weak, with GDP expanding 0.8% in the year to Q3 2025, before picking up to 1.4% and 1.7% during the following two years. Unemployment will remain fairly steady, rising from 4.4% in Q3 2024 to peak at 4.8% in 2026. All of this points to a steady glide down for mortgage rates and a robust recovery in residential market activity.

A slow recovery

House prices are recovering, albeit slowly for now. Values climbed 0.3% during July, Nationwide said yesterday. That brings the annual growth rate to 2.1%, which is the fastest since December 2022.

We'll need to see mortgage rates come down further for a broader recovery to take hold. As Nationwide chief economist Robert Gardner noted, for borrowers with a 25% deposit, the rate on a five-year fixed rate deal has been around 4.6% in recent months, more than double the 1.9% average recorded in 2019. For an average earner buying a typical first-time buyer property, the monthly mortgage payment is equivalent to around 37% of take-home pay, well above the 28% prevailing pre-Covid and the long-run average of c30%

Mortgage approvals data published by the Bank of England earlier this week suggest purchasing activity has plateaued around 10% below pre-pandemic levels.

The US perspective

Any move by the Federal Reserve next month will give global sentiment a shot in the arm. The last round of inflation data delivered what policymakers were looking for, and unemployment is now ticking up.

Payrolls data out later today should show another marked cooling, and traders are already betting that the Fed will cut in September, November and December.

In other news...

Labour sets out its stall on increasing housebuilding: Oliver Knight tallies the views of Knight Frank experts.