The skills shortages threatening the green transition

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

Needs-based buyers are driving a moderate recovery in UK housing activity.

Sales volumes are running about 12% above this period last year - when the market was still recovering from the shock of the mini-budget - according to Zoopla figures out this morning. The company expects UK housing transactions to hit 1.1 million this year, up from 1 million in 2023.

Higher mortgage rates are preventing a fuller recovery and house prices are largely flat, according to the various indexes. Separate figures from Halifax published on Friday revealed that smaller homes have recorded the strongest increases in price growth in the early part of this year, "as buyers adjust their expectations to compensate for higher borrowing costs." First-time buyers made up 53% of all homes bought with a mortgage last year, the highest proportion since 1995, the lender said.

“Not only do higher mortgage rates mean tighter budgets, demand for housing also becomes skewed towards needs-driven buyers," says Tom Bill, Knight Frank's head of UK residential research. "As a result, first-time buyers, growing families and people moving for work have driven demand in lower price brackets over the last year. Those in bigger properties or sitting on more housing equity tend to be more discretionary and some will be waiting for the appearance of more mortgages starting with a three."

Back in the market

The near-term outlook looks uncertain given the lack of clarity as to the path of inflation in the US and the degree to which the Fed's policy will constrain the Bank of England (more on that in a minute).

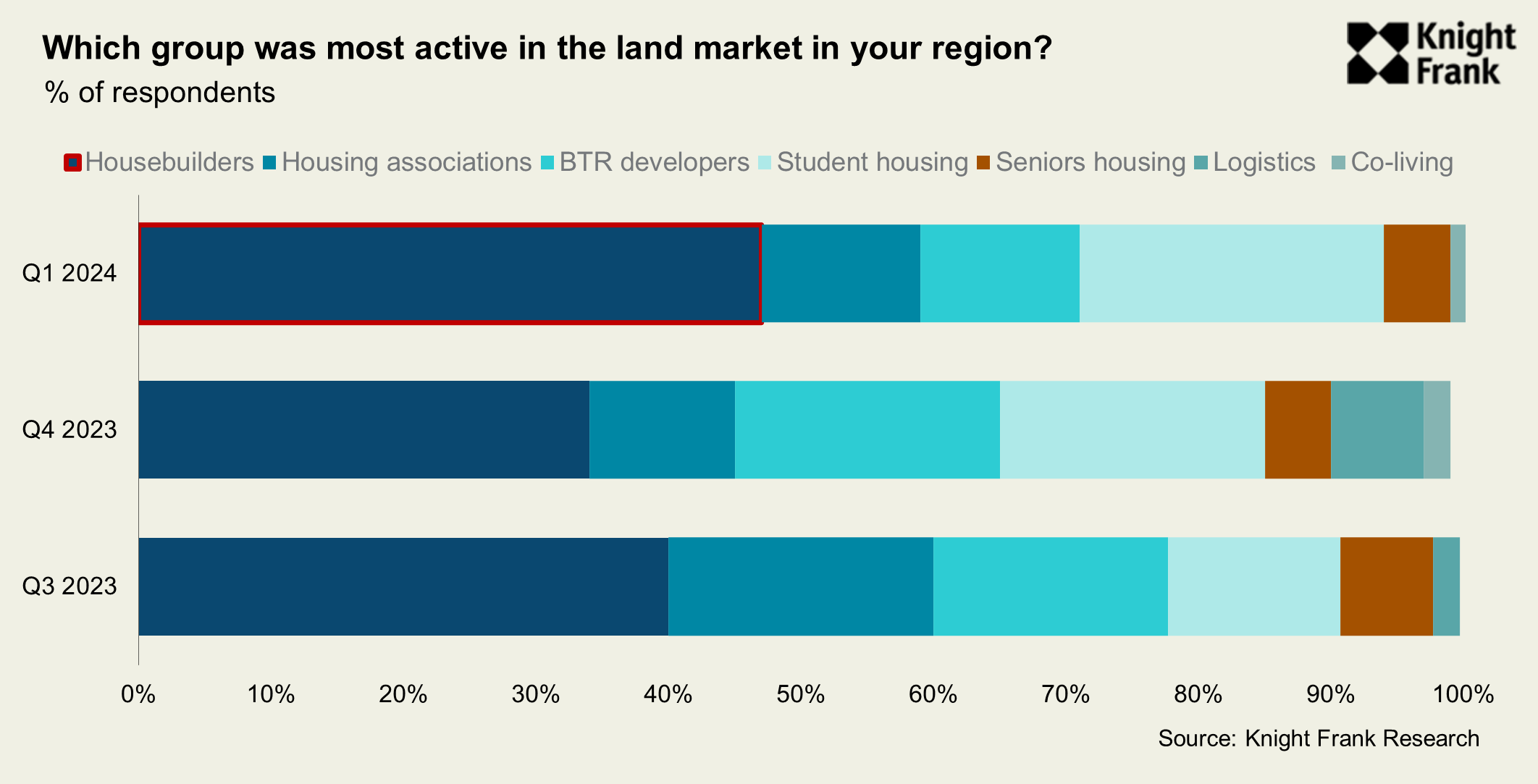

Housebuilders have to look past a lot of this due to the time it takes to buy land and move it through the system. Our Development Land Index, due for release this week, will show that housebuilders are back in the market for land in greater numbers following a hiatus in 2023 (see chart). However, while deals are underway as firms look to replenish their pipelines, for the most-part there is still not much land changing hands. For that to change, more than 60% of our survey respondents said that an interest rate cut is top of their wishlist.

Planning reform came in second. Figures obtained by Bloomberg under a Freedom of Information request offer a glimpse of the dysfunction in the planning system and the amount of money going to waste as a result. The share of rejected planning applications ultimately overturned at appeal rose to more than 30% last year, the highest proportion in at least 10 years, the figures show.

The cost of handling appeals rose to more than £30 million in the last published financial reports for the Planning Inspectorate. Of those costs, roughly £10 million was spent reversing local government decisions.

Confidence

For the housing market, much of what we're seeing in the UK data is moving in the right direction.

Consumer confidence is back at a two-year high, according to figures published late last week. The jobs market continues to cool - vacancies fell 17% in March compared to the same period a year earlier, according to Adzuna figures out this morning.

Yet, economic data from the US hangs over the Bank of England. Friday’s data on personal consumption expenditures, the Fed’s preferred gauge for measuring inflation, hit 2.7% in the year to March, surpassing economists’ expectations again. Swaps traders now see only one Fed rate reduction for this calendar year, down from roughly six quarter-point cuts they expected at the start of the year.

This is a good FT piece unpacking why the drivers of UK and Eurozone inflation may well be different from the US, but the risks of outpacing the Fed are clear: the euro is already down about 3% against the dollar this year. If it falls to parity, that would add 0.3 percentage points to eurozone inflation during the next year, according to the European Central Bank's own research.

The skills gap

Interest rates and the upcoming UK election loom large in the minds of investors, but big challenges lie on the other side that an incoming government must address.

I have written a lot about the UK's failure to get its housing retrofitting policy off the ground. Even if the government manages to spark enough demand for heat pumps, for example, there aren't enough people to install them. The current number of accredited heat pump engineers is estimated to be about 3,000, but we will need at least 27,000 by 2028 to meet the government’s target, according to the Climate Change Committee.

This situation is mirrored across the UK’s major infrastructure projects. Randstad estimates shared with the Times this morning suggest that the industry needs to hire 500,000 people to meet demand for the big projects under way and new schemes, including the Lower Thames Crossing, the expansion of the National Grid and the Stonehenge Tunnel.

Early retirement

The construction industry has been shrinking for more than a decade, but was hit particularly hard by the pandemic. Randstad reckons the construction labour force was 2.6 million-strong in 2008 and has lost 465,000 workers since then.

Demand is only going in one direction: analysts at the IPPR, a left-leaning thinktank, believe that as many as 1.6m new jobs could be created in the transition to a green economy - that isn't solely construction.

We are yet to see how Labour will address this. Shadow chancellor Rachel Reeves has previously indicated an unwillingness to look again at immigration, for example.

In other news…

Levelling up policy like a half-built cathedral, admits Michael Gove (FT), Chinese property shares lead market rebound as optimism rises (Bloomberg), Saudi capital cuts population goal (Bloomberg), and finally, Canary Wharf offices lose £900mn of value (FT).