Households and their Logistics Needs

Adapting spaces and the evolving demand for industrial and logistics property in response to changing lifestyles and consumer trends.

7 minutes to read

Demand for industrial and logistics property from the perspective of the household

As households’ locations, lifestyles and demands have changed, businesses have responded, resulting in growing demand and shifting uses of industrial and logistics property.

The logistics sector provides the critical link between the manufacturing and processing of goods and consumer markets.

Consumer demand, economic expansion, and productivity growth all contribute to demand for industrial and logistics property.

Demand for logistics as a service and for industrial and logistics property has grown as the number of households has increased. The number and distribution of residential properties shape the locations and quantum of space required for logistics. They are the delivery addresses of customers and the homes of workers. New residential developments mean additional customers and extra delivery points for logistics firms.

Download Future Gazing 2024

The relationship between households and their logistics needs continues to evolve, and future demand (per household or property) will likely change due to several key trends, including the expansion of the digital economy and the reconfiguration of supply chains.

Lifestyles are changing, from shopping habits to ways of working, technology is advancing, and supply chains and trading relationships are evolving. As a result, demand for industrial and logistics facilities is shifting regarding the locations, types and sizes needed.

This year’s Future Gazing research will explore our changing relationship with and requirements of industrial and logistics real estate. How changes in lifestyles, shopping habits, population dynamics, shifting trade dynamics, and attitudes towards the environment are changing the demands on the sector in terms of the quantum of space, as well as the locations, sizes and types of space needed.

"For each dwelling in the UK, there is 109 sq ft of occupied industrial and logistic space"

We delve into the lifestyle, demographic and consumer trends that shape our relationship with industrial and logistics property. From logistics to support evolving retail habits to further up the supply chain, we look at space used to provide consumers and businesses with services, and the wholesalers and distribution firms that supply them, as well as the changing composition of the manufacturing sector to determine what our requirements for industrial and logistics properties may be over the next five years and beyond.

Planning for logistics and industrial needs

The strategic placement of logistics and industrial properties along the supply chain is contingent upon various factors, including the distribution of residential properties, demographic trends, income levels, and lifestyles. Proximity to customers is crucial for distribution purposes, while proximity to ports is essential for import/export operations, and access to labour pools is a key concern for firms across the sector from manufacturing to distribution.

Most planning decisions are made at a local or regional level, while logistics networks and supply chains are considered on a national or international scale. The misalignment between these perspectives results in a failure to consider the sector's needs as well as society's distribution needs in a wholistic manner. Furthermore, local governments often seek to prioritise other sources of employment or uses of industrial property over logistics and distribution.

The lack of flexibility and responsiveness in the planning system, coupled with the failure to acknowledge changing lifestyles, shopping, and working habits, has led to an oversupply of retail property in some instances and an undersupply of industrial and logistics space across the UK. This has led to extremely low vacancy rates and double-digit rental growth.

The UK’s national planning policy and the prioritising of housing over other sectors has reduced the amount of industrial land available for the development of logistics space. A lack of flexibility or agility in the planning system remains a barrier to not allocating enough land in suitable locations. The location of industrial land is still closely tied to outdated uses and modes of transport; for example, large swathes of industrial land can be found alongside rivers and canals, and while these may now be better suited for housing, the need for industrial land, particularly for logistics, needs to be considered according to the needs of the population, both in terms of the quantum of space and the locations of that space.

Download Future Gazing 2024

The relationship between housing and industrial and logistics stock

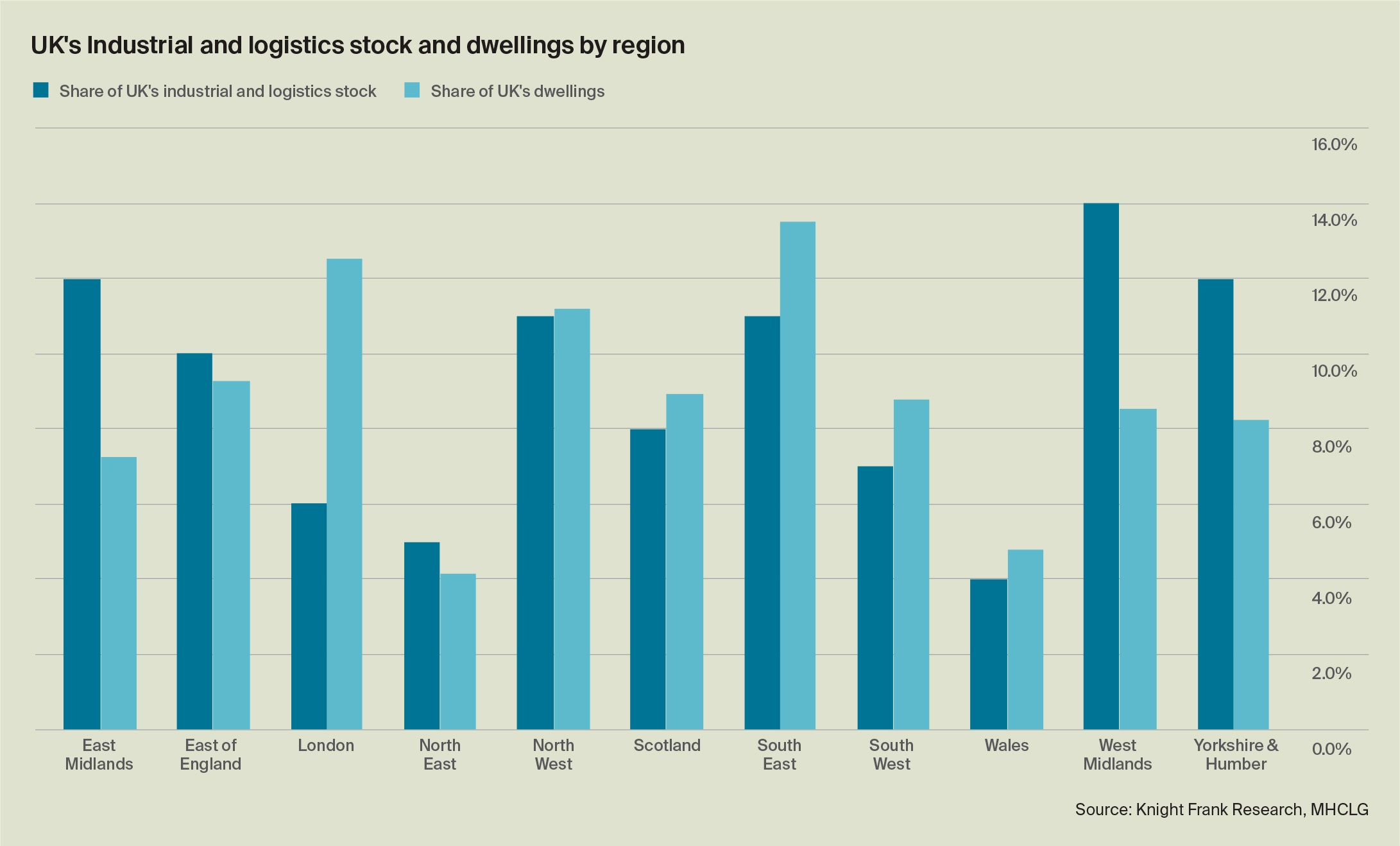

Currently, there is 109 sq ft of occupied industrial and logistics floorspace for each dwelling in the UK. This figure includes all unit sizes and all types of usage, including light industrial properties.

As the distributions of both industrial and logistics stock and homes vary significantly by region, the amount of occupied industrial and logistics floorspace per dwelling varies across different geographies of the UK. The Midlands (East and West) and Yorkshire & Humber regions together account for 38% of the UK’s industrial and logistics floorspace but just 24% of housing stock.

"The Midlands (East and West) and Yorkshire & Humber regions together account for 38% of the UK’s industrial and logistics floorspace but just 24% of housing stock"

The East Midlands has the highest proportion of occupied floorspace per dwelling, with 183 sq ft per dwelling in the region. This is followed closely by the West Midlands, with 182 sq ft per dwelling. The Midlands is a strategic logistics location and home to many national distribution operations. The Midlands Golden Triangle, which is generally defined as an area encompassing Nottingham, Birmingham, and Northampton, offers a strategic position within a 4-hour drive of 90% of the UK population and is easily accessible by the M1, M6 and M42 motorways, making it a prime distribution location.

The Yorkshire and Humberside region follows the Midlands, with 154 sq ft per dwelling. Yorkshire has risen in prominence as a logistics location, appealing to distribution firms seeking a base from which to serve the north of the country. One of the region’s key advantages over the Midlands Golden Triangle is the cheaper rents, with prime rents for big box units in South Yorkshire currently at £8.20 per sq ft (Sheffield), compared with £10 per sq ft in Northampton or £11 per sq ft in Birmingham in the Midlands. Availability of labour is another factor attracting occupiers to the region.

London has the lowest level of industrial and logistics stock per dwelling, with just 55 sq ft per dwelling; this is not surprising given the high density of residential properties in the capital and high land values. Large swathes of industrial land have been lost to residential and other uses in the capital, reducing the amount of industrial and logistics floorspace within the region. Intense competition for space, particularly for last-mile distribution, has led to rapid rental growth in recent years. Average rents across Greater London have risen 46.4% in five years (to September 2023), compared with 34.2% across the UK (MSCI).

Download Future Gazing 2024

How has this changed over the past ten years?

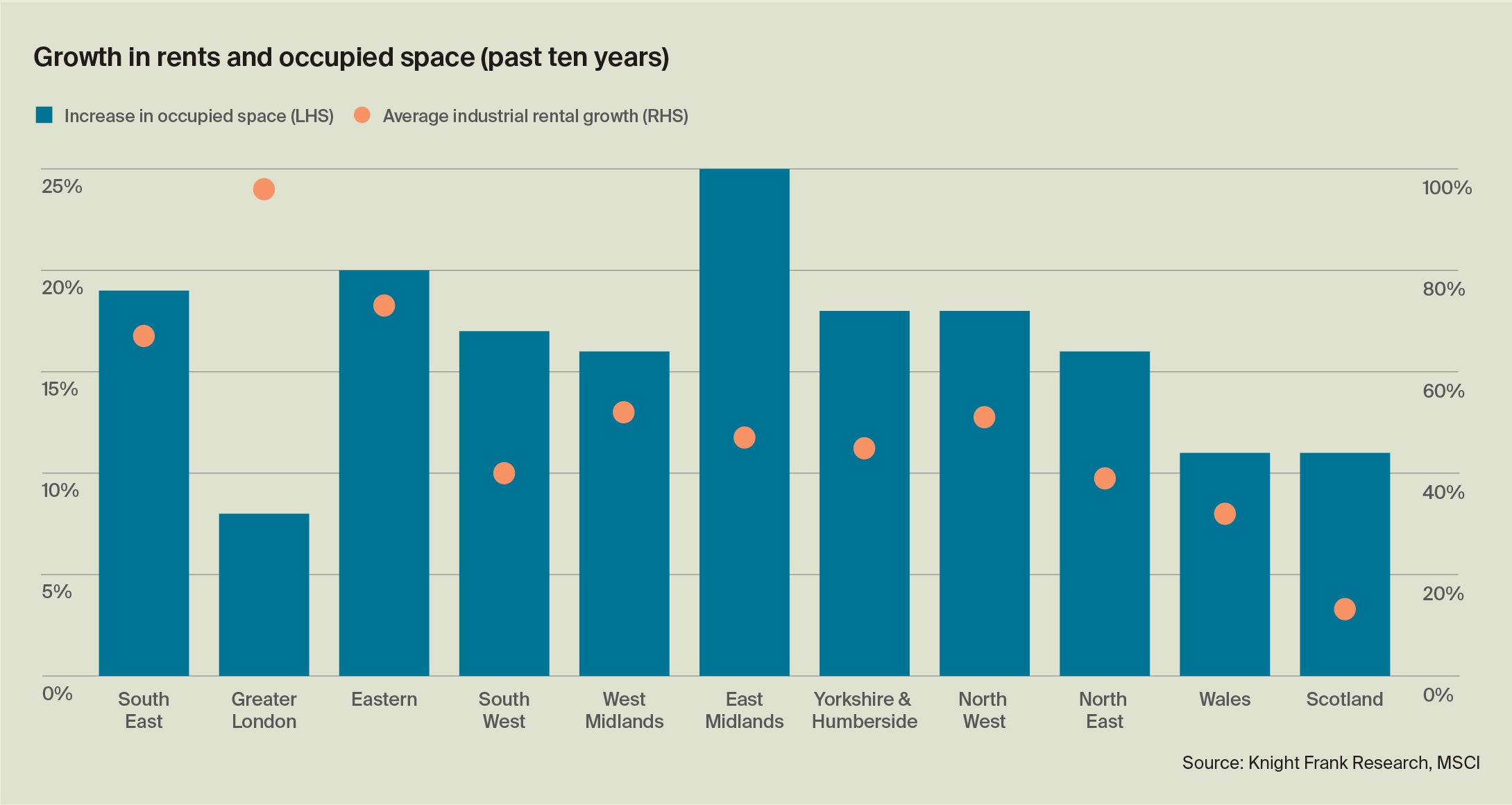

Over the past ten years, occupied floorspace per dwelling has grown 7.5%, from 102 sq ft per dwelling in 2013 to 109 sq ft in 2023. The fastest growth has been in the East Midlands, where floorspace has increased 13.1% (per dwelling) over the ten years. This has been followed by Yorkshire and Humberside (+10.3%) and the NorthWest (+9.8%).

The only region with negative growth over the ten years was Greater London (-3.6%). Despite a slight increase in the amount of occupied industrial and logistics floorspace over the period, the number of dwellings has increased faster. The region has seen the amount of occupied industrial and logistics floorspace per dwelling decrease since 2016. There are limited amounts of industrial land in London, making it difficult to increase the amount of floorspace; the region has seen occupied floorspace increase by just 8% over the period, compared with 17% across the whole of the UK. Furthermore, the need for additional housing in the capital has been prioritised by government, leading to the reduction in the amount of allocated industrial land.

Occupied industrial and logistics space has increased faster than total inventory. While occupied industrial floorspace has risen approximately 17% over the last ten years, the total stock has risen more slowly. This has driven down vacancy rates, from 9.2% at the end of 2013 (units over 50,000 sq ft) to 5.2% currently (Q3 2023) and pushed up rents. Market rents have risen 63% on average across the UK, while prime rents (units over 50,000 sq ft) have almost doubled over the past ten years (+93%) across the UK. Indicating demand, particularly for well-specified, well-located facilities, is outstripping supply.

"Market rents have risen 63% on average across the UK, while prime rents (units over 50,000 sq ft) have almost doubled over the past ten years (+93%) across the UK"

London has witnessed the strongest rental growth on a regional basis, with average rent rising 96% over the past ten years. Over the same period, occupied space has increased by just 8%, the lowest increase across any UK region.