Where next for global housing markets in 2024?

We assess the tailwinds and headwinds for prime residential markets globally.

2 minutes to read

In the dynamic landscape of 2023, headlines have been dominated by surging inflation and consequential interest rate hikes. Despite these challenges, global economies have displayed surprising resilience, with recent inflation figures suggesting a turning point.

While two major geopolitical crises unfold, presenting human tragedies and potential global economic implications, astute observers note varying approaches among central banks. Leaders in Canada and the UK have signalled their intent to address inflationary risks linked to higher oil and gas prices. In contrast, counterparts in Europe and the US appear more relaxed in their stance.

Amid this backdrop, the ‘higher for longer’ trend persists, leading to a notable shift in buyer behaviour. Our global research network reports that 52% of prime buyers are now opting for cash purchases, an increase from 46% six months ago.

Governments are grappling with mounting challenges, as public debt in the affluent world reaches historic levels relative to GDP, surpassing post-Napoleonic War figures, as reported by The Economist. The inevitable consequence appears to be rising taxes, with policymakers likely to target property and wealth.

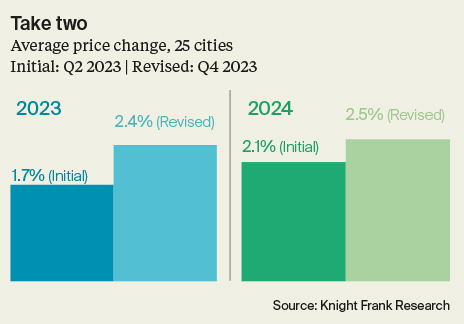

In the face of these headwinds, our overall prime price forecast for 2024 has grown from 2.1% to 2.5% since our mid-2023 global research team assessment. However, the outlook for 2023 has seen the biggest improvement. At the midpoint of the year, our researchers projected a 1.7% average price increase. However, with just a month remaining, this figure has surged to 2.4%.

What drives this positive shift in outlook? Some prime buyers appear confident that the worst is now behind us. On the demand side, with inflation receding and interest rate hikes entering their final chapter, buyer appetite has strengthened in some markets. Meanwhile, on the supply side, we're seeing a reluctance among mortgaged households to move, plus, high construction costs, persistent labour shortages, and planning delays are collectively contribute to a shortage of new stock entering the market.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here