Asia-Pacific residential market: challenges and opportunities ahead

The future of the Asia-Pacific region looks bright. With a combination of economic growth, favourable demographics, and increasing urbanisation rates, the region is poised for unprecedented development.

4 minutes to read

By 2030, over 30 megacities, 19 of which are located in the Asia-Pacific region, will have populations exceeding 10 million. As the global population continues to rise, the demand for housing will also increase. This demographic shift, coupled with robust economic conditions, sets the stage for a thriving residential market over the next decade.

While the long-term outlook is optimistic, the short-term landscape has been marked by price volatility. The aftermath of interest rate hikes led to a reversal of the pandemic-era boom in home sales, triggering pockets of price corrections. Despite this, limited housing supply and robust household formation are expected to prevent significant declines in property prices across the region.

Milder-than-expected price corrections

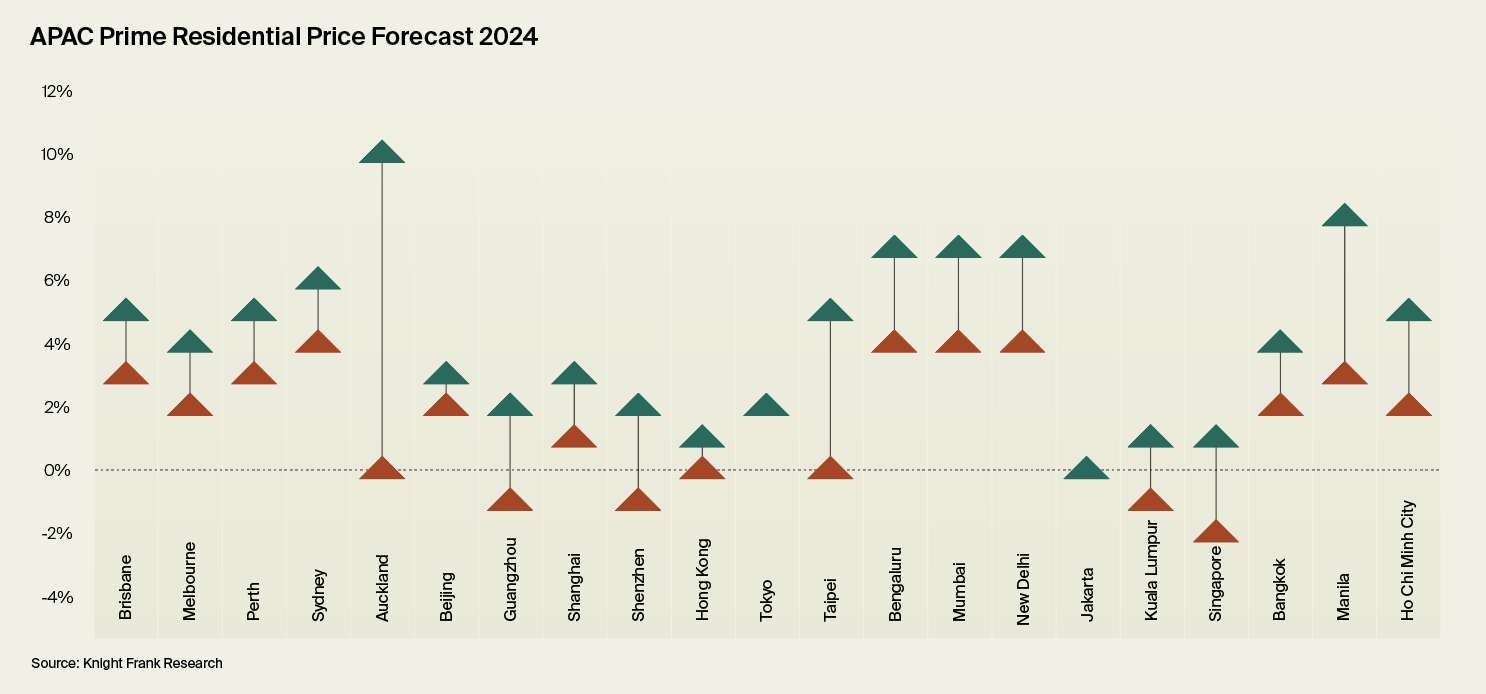

Despite initial concerns, the decline in prices of prime Asia-Pacific housing markets was much less severe than expected. In 2023, there was a minor correction of only 0.5% year-on-year, indicating the market's resilience. This slight correction can be attributed to pent-up demand for housing and a quick recovery when interest rates were put on hold. Additionally, several factors such as the absence of economic shocks, the return of buyers when interest rates were paused, the lack of distressed sales, historically low unemployment rates contributing to wage growth, and a shortage of construction labour all played a role in the resilience of property prices in Asia-Pacific. As sentiment recovers and investor confidence is restored, the region is expected to return to mid-single-digit growth in 2024.

Bright spots

Bright spots have emerged in the real estate markets of Australia, New Zealand and India. In the prime residential market, Australia and New Zealand have seen a reversal of sentiments due to immigration and a limited supply of assets, with Auckland and Sydney expected to grow by 5% in 2024. Mumbai is anticipating a 5.5% increase in prime residential prices, driven by high demand and strong economic growth in India.

"The limited number of exceptional, and most desirable, prime residential property listings and luxury new builds continues to create a price floor under many Australian homes. In pockets of prime suburbs around the country, record sale prices are being achieved, with some taking place before an advertising campaign takes place. Many of these properties are located on the waterfront, large estates and on the upper levels of apartment towers with panoramic views."

_Michelle Ciesielski, Partner & Head of Residential Research, Knight Frank Australia

"The underlying fabric of the residential market has altered significantly with the premium segment constituting a record high of 35% of total sales in Q3 2023. And while still evolving, we see this as a strengthening trend, with homebuyers in this segment having the ability and willingness to sustain current demand levels despite higher interest rates and property prices. Our estimate for prime residential price growth in 2024 also reflects the demand increase in this segment."

_Reshmi Panicker, Executive Director, Land Services and Residential, Knight Frank India

Stability in South-East Asia

The property market in Southeast Asia is showing signs of stability in the coming years, with Manila leading the way with a projected growth of 5.9% in 2024 and a substantial 21.2% annual rise in prime residential prices. This growth is fuelled by the increasing presence of fintech and startups, as well as strong domestic and foreign investments. Singapore, on the other hand, is seeing cautious investors due to high historic prices and a subdued economic outlook. Meanwhile, Bangkok and Jakarta are experiencing sideways movement as concerns about economic growth and higher interest rates persist. Overall, the market remains promising and ripe for investment opportunities.

Mixed Outlook in the Greater China

The economic recovery in the Chinese mainland has been slower than expected, which has led to a decrease in market sentiment in both the Chinese mainland and Hong Kong SAR. Despite easing cooling measures, the results are yet to materialise due to supply outstripping demand. Nevertheless, there may be value-buy opportunities that arise in these markets. Additionally, the return of expatriates, strong demand from Chinese top talents and a surge in non-local students have contributed to growth in residential leasing in Hong Kong SAR.

"Hong Kong SAR government’s Top Talent Pass scheme has effectively attracted some overseas talents to work and live in the city, providing strong support for the prime residential leasing market. Given the prevailing high-interest rate environment, the majority of overseas talent relocating to Hong Kong will choose to rent properties rather than purchase. The luxury rental market will continue to outperform the sales market over the next 3 to 6 months, resulting in an increase in rental yields."

_Martin Wong, Head of Research & Consultancy, Knight Frank Hong Kong

In conclusion, despite the existence of short-term challenges, the residential market in the Asia-Pacific region is strategically placed to take advantage of demographic tailwinds, which guarantees continuous growth in the coming years. However, investors and developers need to be cautious in their approach and take advantage of the region's overall resilience by exploring emerging opportunities in specific markets.