UK house price forecasts: October 2023

Sentiment will become more positive in UK housing market as the economic picture improves but a general election looms next year.

4 minutes to read

It’s no surprise that mortgage rates are more than three times higher compared to three years ago.

The cost of borrowing has risen after an exceptional period that followed the global financial crisis, when rates hovered close to zero for more than a decade.

It’s a return to normality where the journey rather than the destination has been the problem. Anyone buying, selling, or re-mortgaging a property in the last 18 months has faced market volatility caused by the mini-Budget and inconsistent inflation data.

The cost of borrowing has lurched erratically, and sentiment has been eroded, which has put downwards pressure on house prices and, to a more noticeable extent, transaction volumes.

The five-year swap rate dipped below 5% in September but that compares to a figure of less than 1% two years ago.

Now, some stability appears to be on the horizon. The Bank of England held at 5.25% in September after inflation that fell by more than expected and we have updated our house price forecasts to reflect the recent changes.

UK house prices to fall

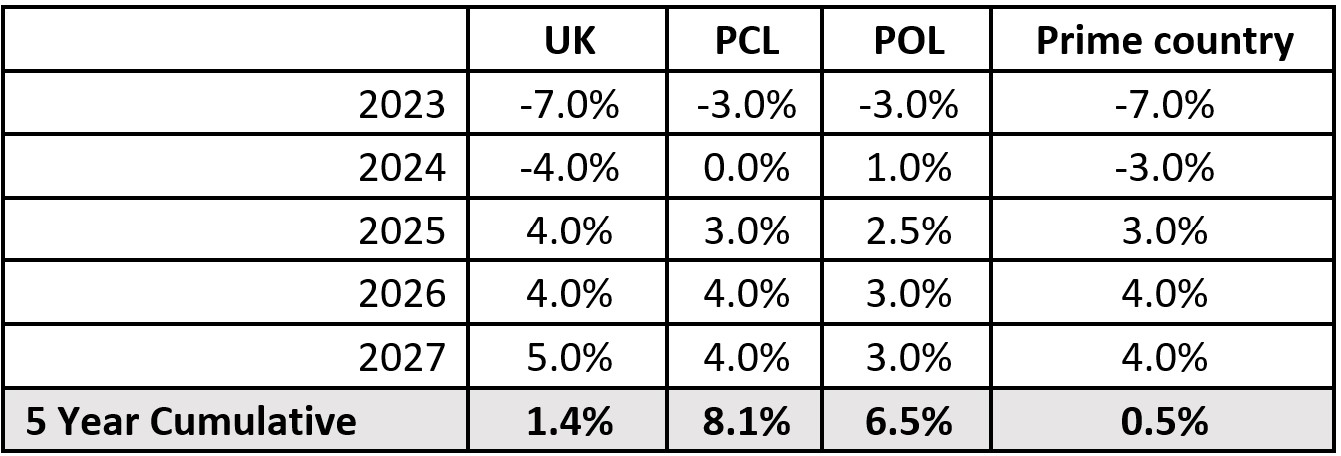

The volatility this summer means that we now expect UK house prices to fall by 7% this year, more than our forecast of -5% in March.

Next year, we expect prices to fall by 4%, less than the 5% we forecast earlier this year, as the economy stabilises, and speculation turns to when the first (small) rate cut will come. Improving sentiment will be key.

The number of people moving from lower fixed-rate mortgages will not fall in 2024, but the backdrop will not be such an unpredictable flow of economic data and 14 consecutive rate rises.

That said, a general election is likely in 2024 and uncertainty ahead of any vote typically suppresses demand. A change of government represents a higher risk for prime markets in particular, but higher rates of tax around property and wealth has been the global direction of travel for more than a decade.

UK sales forecast

We still think prime central London (PCL) will experience a smaller correction, due to a combination of more cash sales (around half inside zone 1), the fact prices are still more than 15% below their last peak in mid-2015 and the fuller return of international travel.

We have left our forecasts for PCL unchanged but expect a slightly smaller fall (-3% rather than -4%) this year in prime outer London (POL) and a marginally stronger recovery from 2026. POL continues to benefit from demand that is more domestic and needs-driven.

We expect prices in Country markets to fall by more than we expected in March, declining 7% this year rather than 5%. The main reason is that Country markets are coming down from a relatively higher point during the pandemic compared to London.

Prices in the Country had risen by 20% at their peak and even after a 7% decline this year, they would still be 6.7% higher compared to Q1 2020. They would also be 3.4% higher than their pre-pandemic level at the end of 2024 if there was a further 3% decline next year.

UK rents forecast

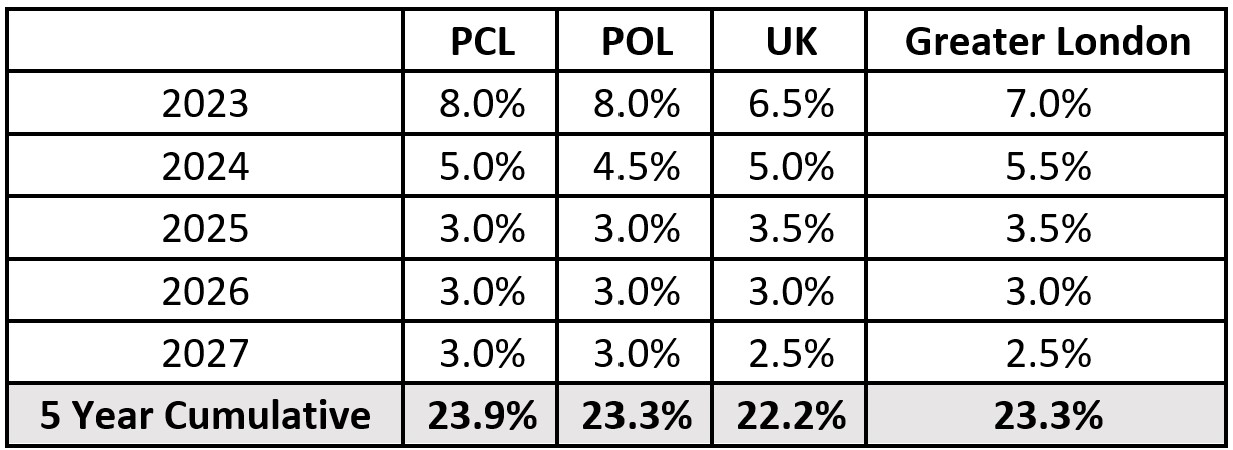

In the rental market, we think there will be stronger growth this year and next in PCL and POL as the imbalance between supply and demand takes more time to correct. As we have explored before, some landlords have left the sector in recent years due to the mounting tax burden and increased red tape.

There is evidence the balance is correcting in the capital’s prime markets due to the discretionary nature of owners, some of whom have decided to let out their property due to the uncertain trajectory for prices.

As a result, we expect a 23.9% increase in rental values in PCL by 2027 and a 23.3% rise in POL.

Across the UK, annual growth for across the UK stood at 5.5% in August, according to the ONS, the highest rate since records began as the wider UK rental market grapples with the same supply-demand issues.

Demand for rented homes continues to be driven by multiple factors. The strength of the labour market and job creation is a key driver, as are higher mortgage rates, which are keeping more would-be buyers in the rented sector.

Nationwide data points to a 25% fall in leveraged first-time buyer numbers in 2023 compared to pre-pandemic levels. At the same time, data from Rightmove suggests that rental listings are more than 50% lower than the 2017-19 average.

The result is that the current supply-demand imbalance shows no sign of reversing. We therefore expect rental prices will continue to increase over the upcoming three months and have revised up our rental growth forecasts for 2023 to 6.5%, with a further 5% growth forecast in 2024.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here