Short term lets are back in the spotlight as New York takes action

Plus, why house prices in the US and UK are moving in opposite directions.

4 minutes to read

To receive this regular update straight to your inbox, subscribe here.

Short term lets

Earlier this month New York authorities introduced a new law that requires rentals of 30 days or less to be registered and hosts to be in the property during the stay. The law took effect on 5 September with Airbnb referring to it as a ‘de facto ban’.

The aim is to stamp out illegal rentals which add to the city’s affordable housing crisis.

The number of short-term rental listings is reported to have dropped from 22,500 three months ago to 4,600 as of 10th September, a drop of 77% according to travel industry website Skift, citing data from AirDNA. Hotel prices in the city are expected to rise as a result.

New York isn’t the only city to take steps to curb the mushrooming of key boxes.

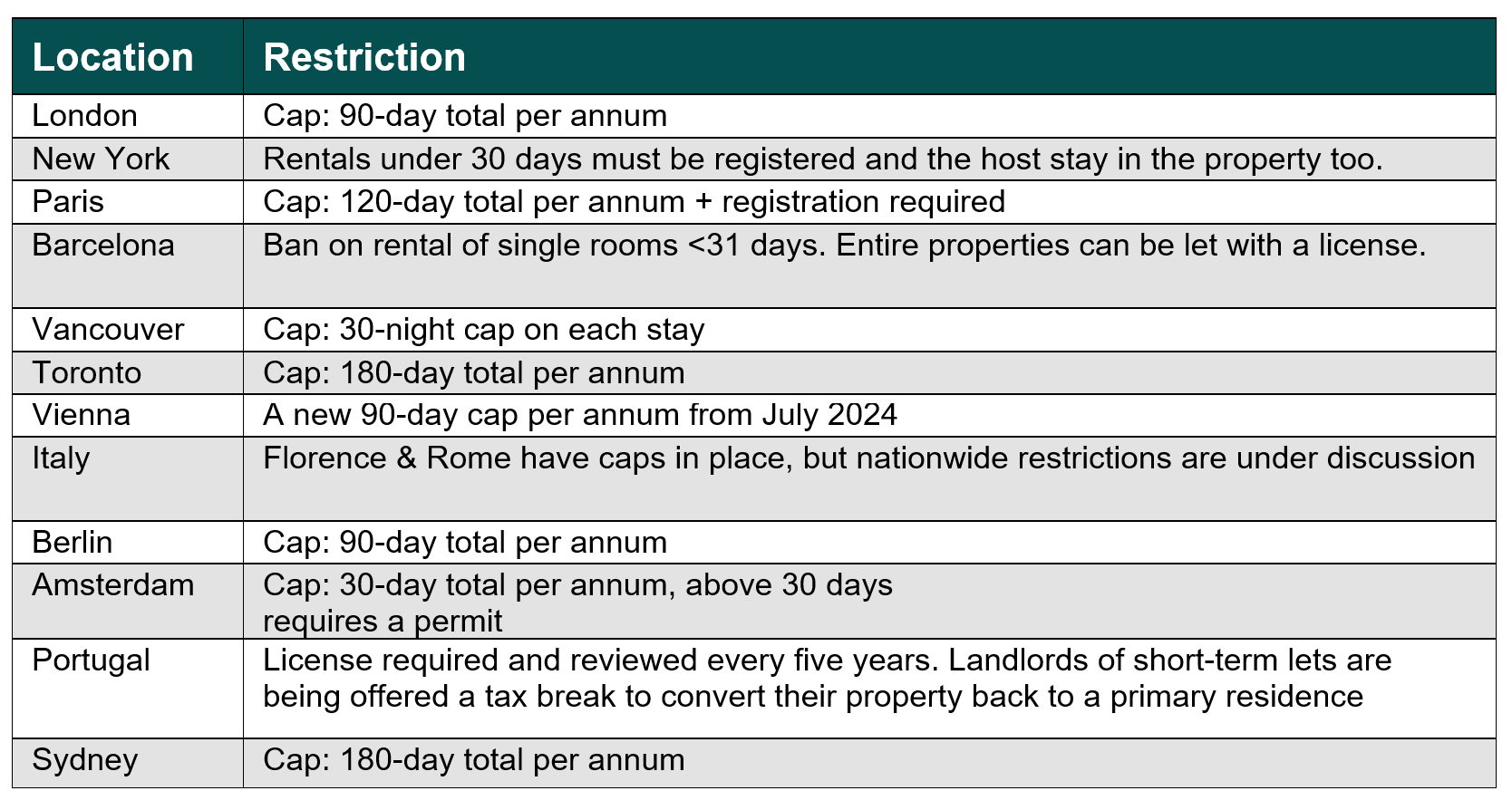

To date, most other cities have stopped at a cap, limiting the number of days a property can be rented each year. Until now, Barcelona was arguably the most draconian with a blanket ban on specific rentals.

Below is a quick summary of the state of play across key cities:

The key concern for holiday rental platforms such as Airbnb and Vrbo is whether they start to see a co-ordinated move by cities (or countries) either via bans, taxes or caps to curtail the short term rental market. Such a move has the potential to reshape global property markets, a trend we flagged in The Wealth Report 2023.

US vs UK

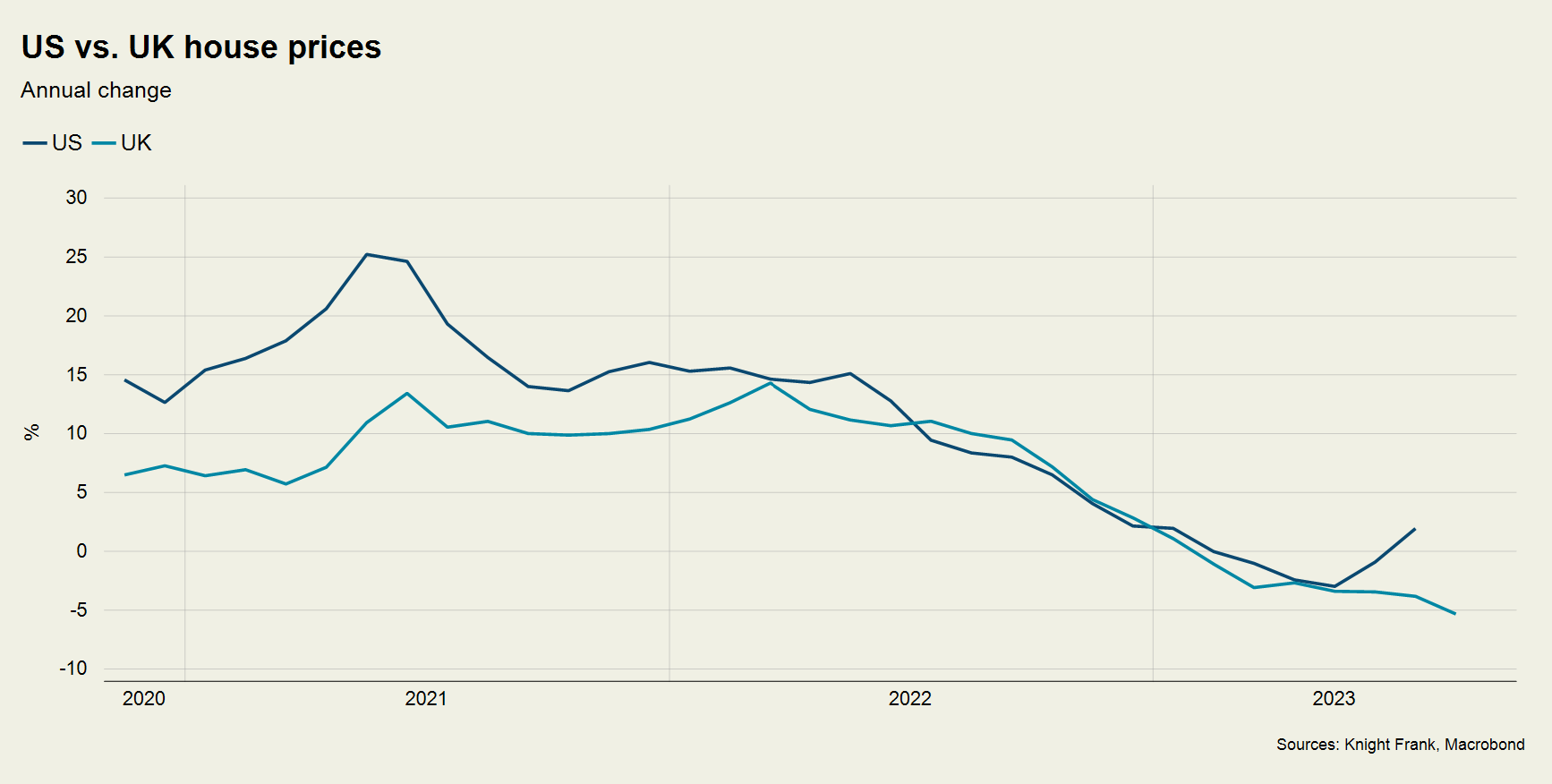

Prices are moving in different directions on either side of the pond.

US house prices were up 1.9% in July year-on-year according to the National Association of Realtors whilst UK house prices are falling at a rate of 5.3% on an annual basis according to Nationwide.

Both countries have seen mortgage rates increase, both are failing to meet their housebuilding targets and both are starting to see household savings, accumulated during the pandemic, start to wane. So, what’s behind the divergence?

The main reason is that in the UK most borrowers take out mortgages at fixed rates for two, three or five years although the full sum usually takes 25 to 35 years to repay.

As UK households remortgage the impact of the higher rate environment is being felt, impacting buyer sentiment.

In contrast, US borrowers taking out a 30-year loan can lock in the rate for the entirety of the loan with no need to remortgage. In the current climate it means a large proportion of US borrowers have yet to feel the effects of rates shifting from 3% to 7% over the last 18 months.

This mortgage market nuance also explains why sales in the US are moving in the opposite direction to prices. US residential sales were down 17% in July year-on-year as homeowners opted to stay put and avoid taking out a new mortgage on a higher rate. This lack of inventory is also putting a floor under prices.

US dollar

Yesterday, the Fed paused interest rate hikes as inflation slowed and the labour market softened. With rate rises on hold, most economists would usually expect the dollar’s bull run to start to weaken.

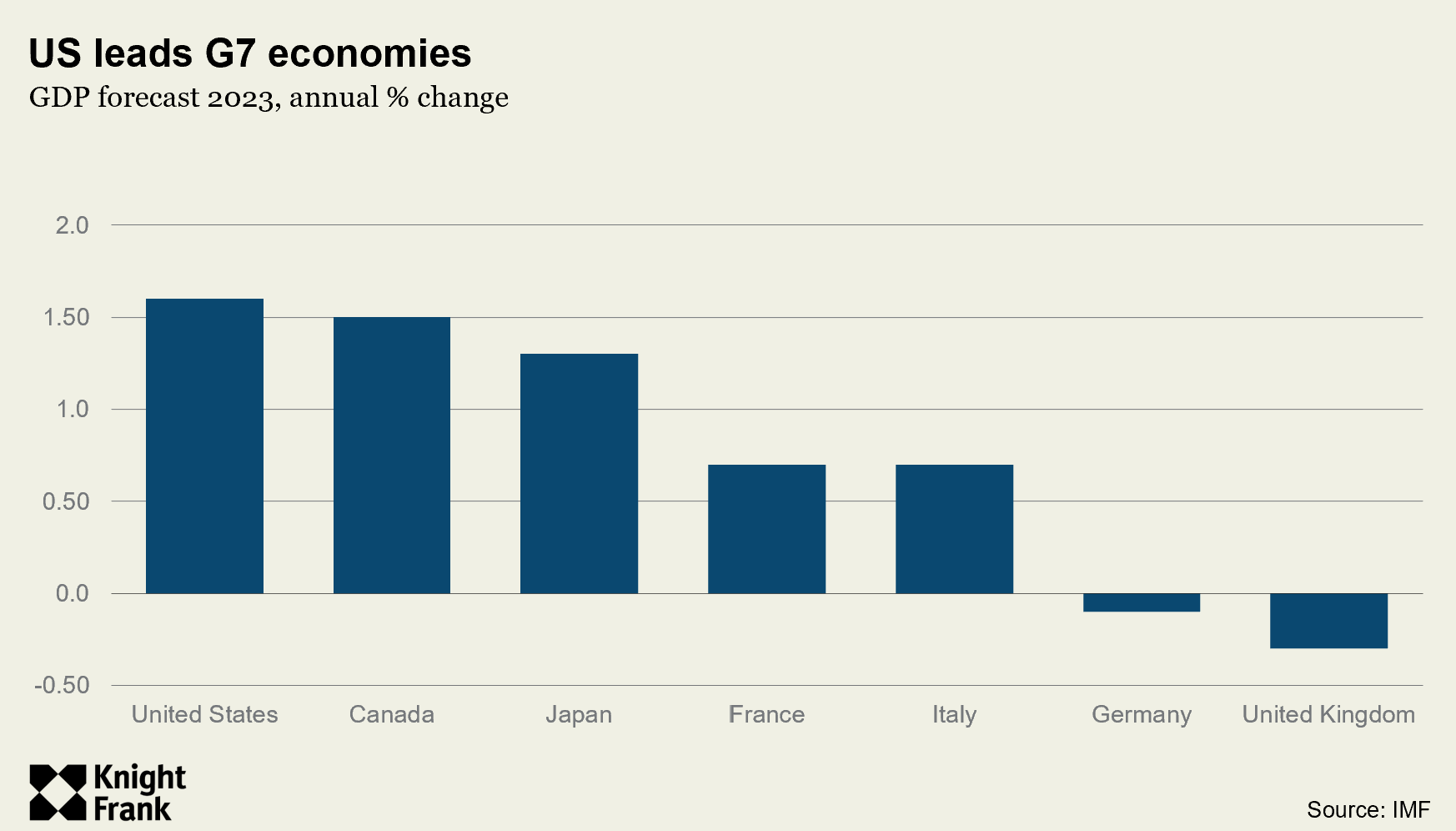

However, the US economy looks on track for a soft landing, and whilst it may narrowly avoid a recession, it is forecast to continue outperforming its major peers in 2023 according to the IMF.

As a result, the strong purchasing power of US buyers in overseas markets will persist. It will have similar repercussion for those markets pegged to the greenback (Hong Kong, UAE, Saudi Arabia etc).

The appeal of international real estate as a means of delivering portfolio diversification and managing risk via currency, asset class and geography is increasingly a priority for ultra-high-net-worth individuals and family offices.

This summer, US and Middle Eastern buyers have been active in Europe’s prime residential markets with London, Paris, Florence, Venice, the Balearic Islands and the South of France high on their shopping lists.

Motivated primarily by a weak euro and/or the stability of the Swiss Franc, many are also seeking to diversify their portfolios and spread risk across multiple asset classes and geographies.

In other news

Australia’s supply of rental homes is shrinking fast (Bloomberg), Eurozone housebuilding declines at its fastest rate since the start of the pandemic (FT) and cash buyers wield a new level of power in the property market (FT).