January data paints a mixed picture for UK property market

Mortgage approvals hit a low but there are reasons for cautious optimism.

4 minutes to read

Reports of the housing market’s demise may have been exaggerated.

While there has been plenty of negative data in recent weeks and signs that the sector is slowing down after two pandemic-inspired boom years, suggestions of a crash feel off the mark.

Prices and volumes continued to retreat in January in the sales market, according to RICS.

New buyer enquiries slipped to -47%, down from a reading of -40% in December. Listings remained depressed at -14% and with market valuation appraisals low, RICS concluded that supply would remain tight across the market in the short-term.

The net balance score represents the difference between the number of respondents that saw an increase in the month and those that saw a decrease.

While agreed sales were -39% in January, the comments from contributors had a more upbeat feel, with several stating that buyers are adjusting to higher borrowing costs and an appetite to purchase remains.

“The market is property led, with sensible pricing being the key. As inflation and interest rates settle, confidence is starting to return to the market,” said one.

That chimed with Knight Frank data from January that suggests, all things considered, that it was a much stronger start to the year than had been expected.

Household sentiment also increased for the first time in four months in January, according to IHS Markit. A score of more than 50 in the index represents strengthening sentiment, and the current house price series gained 6.2 percentage points in January reaching 50.7. Expectations about house prices in 12-months’ time was even stronger, gaining 8.7 percentage points to reach 52.5.

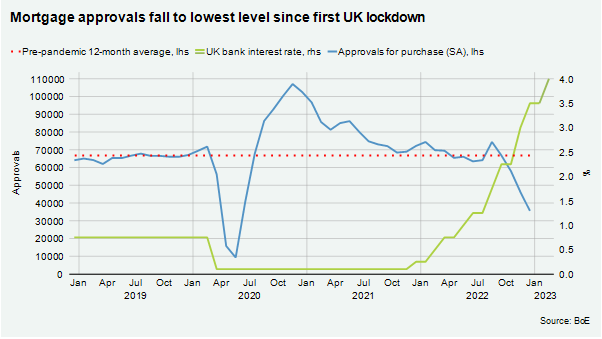

This could mean that mortgage approval data for December, released last month, may turn out to be a low point. At 35,612 mortgage approvals it was the lowest monthly figure since the closure of the property market during the UK’s first lockdown at the onset of the Covid-19 pandemic (see chart).

House price data was also mixed. Nationwide reported a monthly fall of 0.6% taking the annual rate of house price growth to 1.1%. However, Halifax said there had been no change in monthly prices after a fall of 1.3% in December. This reduced the annual rate of house price growth to 1.9% (December 2.1%).

Either way, both indices appear headed for an annual fall.

It suggests that much of the current data is still showing the impact of September’s tax-cutting mini-Budget, which spooked financial markets and caused a spike in borrowing costs. It makes judging the true health of the UK property market tricky ahead of the traditional spring selling season.

What is certain is that the period of ultra-low borrowing is over. While mortgage rates have fallen back from mini-Budget highs, the best deals are still 200bps+ higher than they were a year ago, and this will act as a brake on volumes.

We believe the reduction in spending power combined with other factors will see UK house prices fall 5% this year.

Prime London Sales

The London property market has also started the year better than expected.

The third week of 2023 saw the fourth highest number of offers accepted in London during a single week in January in ten years, Knight Frank data shows.

New demand is also proving resilient. The number of new prospective buyers registering in the first three weeks of the year was 6% higher than in 2020, during the so-called ‘Boris Bounce’ that followed the December 2019 general election.

Prime London Sales Report - January

Prime London Lettings

The supply of lettings property in prime London postcodes is finally increasing. Not to the point that it has become a tenants’ market, but more balanced conditions are returning.

In the first three weeks of January, the number of new lettings instructions in London was 10% higher than the equivalent period last year, Knight Frank data shows.

However, the number of new prospective tenants registering the final quarter of 2022 was 30% above the five-year average. So, while we expect upwards pressure on rents to relent as supply picks up from a low base, rental value growth won’t go into reverse

Prime London Lettings Report - January

Country Market

After a volatile end to 2022 in the regional UK property market, the new year has started with a relative bounce.

The ratio of new buyers (demand) to new instructions (supply) in the UK (excluding London) reached 12 in January, the highest it has been in the past year

The number of offers accepted was up 34% in January in the UK (excluding London) versus the five-year average.

UK country market sees surge of interest at start of the year