Back to Basics

As interest rates have risen, so too has a degree of risk aversion amongst real estate investors as pricing the fundamentals of performance becomes clouded by an uncertain outlook.

3 minutes to read

Back to Basics

As interest rates have risen, so too has a degree of risk aversion amongst real estate investors as pricing the fundamentals of performance becomes clouded by an uncertain outlook. We believe current pricing reflects an above average risk premium compared with the long-run average. Moreover, higher obsolescence risk and weaker prospects for rental growth in average quality buildings will see a return of wider yield spreads to prime.

Shabab Qadar – London Research Partner

Pricing the fundamentals

In previous London and Active Capital Reports we’ve discussed how institutional investors are increasingly attracted to knowledge and innovation driven economies and sustainable investments. However, in a climate of greater risk and uncertainty, investors will seek a premium above the level of interest rates to reflect the higher risk of investing in commercial real estate.

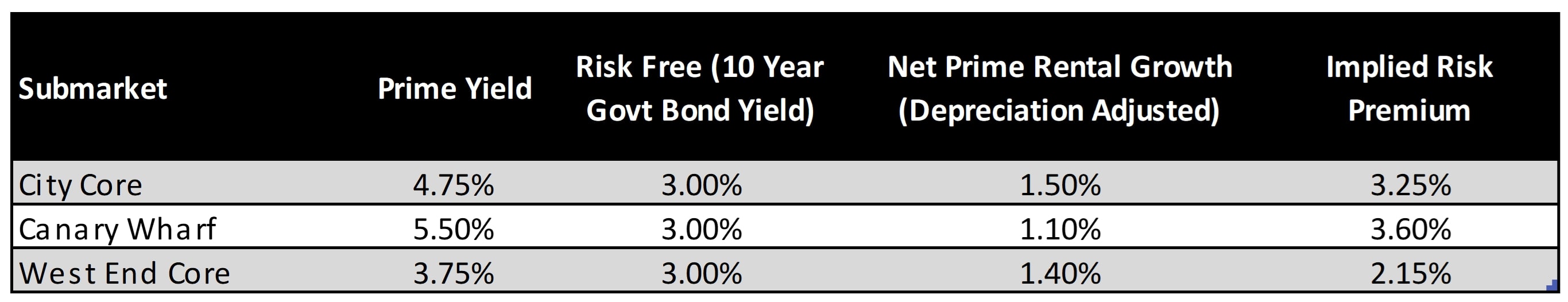

We’ve deconstructed current prime yields using the fundamental investment pricing equation to calculate the implied risk premium in London’s three main business districts:

Yield + Expected Net Rental Income Growth = Risk-Free Rate of Return + Risk Premium

There is a vast body of academic literature that shows the long-run risk premium for investing in London offices is 2%. If we use this figure in our deconstruction analysis it suggests investors are expecting annual rental growth of 0.3% in the City Core, -0.5% in Canary Wharf and 1.25% in West End Core. We believe prospects for net rental income growth especially for prime buildings is stronger than these implied figures.

Independent forecasts for 10-year government bond yields (risk free rate) suggest interest rates will fall to 2.25% by the end of 2026 as inflation subsides to the Bank of England’s target of 2%. We’ve used an average over this period of 3%.

Our latest forecasts for prime rents are annual average growth of 2.5% in the City Core, 2.1% in Canary Wharf and 2.4% in West End Core. Theoretically, obsolescence risk in prime buildings is low to negligible, however, we’ve adjusted our rental growth figures by an annual average of 1% for depreciation to be prudent.

Breaking down pricing fundamentals into its component parts shows the implied risk premium is highest in Canary Wharf at 3.60% followed by 3.25% in the City Core and 2.15% in the West End Core.

Table 1 – Implied risk premia above long-run average of 2%

Source: Knight Frank Research

Our estimates of the implied risk premium are higher in all three office submarkets suggesting that current pricing incorporates an additional return to investors due to perceptions of higher market risk.

Disconnect with the leasing market

The expectations for rental growth are a key element of this analysis. In previous periods of risk aversion such as the global financial crisis the underlying occupier market was characterised by a high number of vacant prime buildings following a surge in development activity and prospects for further speculative completions. Not surprisingly, prime rents were expected to fall and the implied risk premium reflective of the more uncertain outlook.

In the absence of any financial market dislocation, the current period has the features of a more orderly re-pricing of London office assets. Performance of the occupier market has been resilient throughout 2022 with above trend levels of take-up for prime buildings. We expect demand for prime buildings will remain robust in 2023. Furthermore, in this cycle we have seen far lower levels of financial leverage combined with institutions that have undertaken significant steps to ensure they are well capitalised.

Yield spreads to widen

In a climate of higher market risk, the difference in the quality of buildings will be subject to greater levels of due diligence and reflected in pricing. In recent years, the spread between prime and secondary quality buildings has narrowed considerably. Recent data shows the spread was 1.6% in the City Core and 2% in the West End Core while during previous periods of high inflation the spread has been as wide as 3.5% in the City and 4.5% in the West End.

We expect that greater levels of obsolescence risk with secondary quality buildings are likely to lead to a return of much wider spreads to the best quality buildings.