UK Industrial and Logistics: the price is (almost) right

With signs prices are starting to stabilise, investment activity looks set to improve, but occupiers are facing rising costs and difficulties in raising capital, therefore a focus on high quality assets and income will be key.

4 minutes to read

Yields to stabilise in early 2023

Repricing has been rapid. Yields have moved out 175-200bps since June last year. While some further repricing is anticipated, future movements are expected to be modest. Signs of the slowing pace of repricing is evident in Knight Frank’s January Yield Guide, with yields across the sector reported as stable month-on-month.

The long-term average spread between industrial yields (prime 15-year income) and gilts is around 300bps, while the current spread is c.200bps. Bond yields have moved out from a monthly low of 0.14% in July 2020, to reach around 3.33% at present (29th January). However, prime industrial yields are not anticipated to move out by the same degree. This means the spread will be tighter than in the past.

The structural changes the sector has undergone, coupled with the paradigm shifts in the e-commerce market over the past ten years, should give investors comfort in accepting a lower “risk-premium” for prime logistics assets. In the secondary market however, the downside risks to the occupier market may mean that investors are less willing to accept a lower spread, thus secondary yields could soften further in the secondary market, increasing the spread between prime and secondary yields.

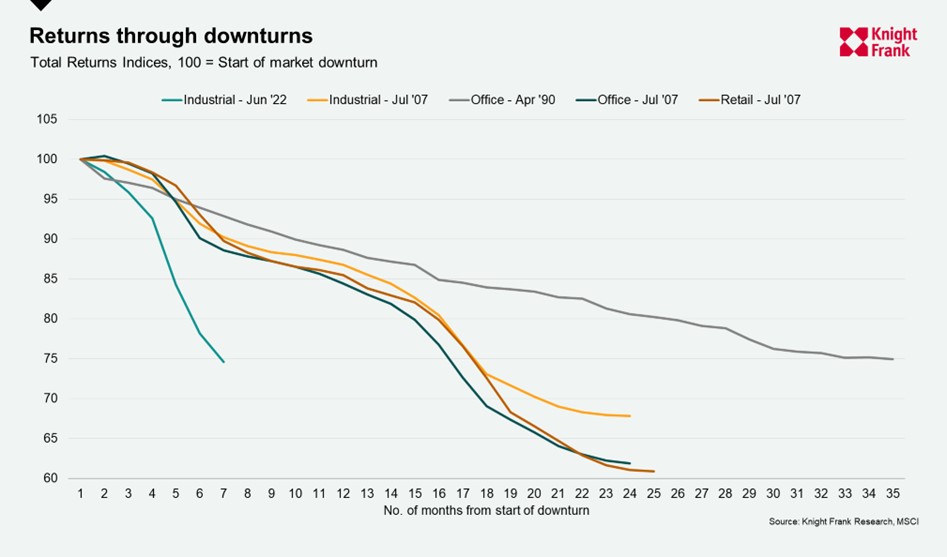

When looking at returns through market downturns, the pace of the current repricing in the sector is evident. In seven months, we have seen the same downturn in returns as recorded in the office sector downturn in the early 1990’s, which took 35 months, or took 17-18 months (depending on sector) during the GFC downturn that began in 2007.

Investment activity to improve

The disparity between buyer and seller expectations continues, but the gap appears to be closing, with 2023 showing signs that investment activity is improving. There continues to be a lot of dry powder and with pricing beginning to show signs of stabilising, we expect investment activity to pick up throughout the course of the year.

Investors will need to look to income to drive returns

Expectations for capital growth are negative in 2023, RealFor are forecasting -1.9% capital growth for the year, with relatively modest growth expected in 2024. Active asset management will therefore be crucial to driving returns over the next few years.

The fundamentals of the sector remain strong

With low vacancy rates, good (albeit moderating) rental growth prospects, and occupier demand from manufacturers and 3PLs is helping to plug the gap left by the online retailers. While the monthly figures show online retail sales to be down, the expectations remain for further growth in the long term (due to demographic factors and improving online platforms and infrastructure). Retail market intelligence agency Mintel forecast the UK’s online retail market to grow by 29.1% between 2022 and 2027.

Headwinds for the occupational market

In April, occupiers will face higher energy bills along with higher business rates. Business rates are set to rise an average of 34% for the sector. The current Energy Bill Relief Scheme comes to an end in March, and while the Government has announced a new Energy Bill Discount Scheme, it offers a lower level of protection, with the price cap being replaced with maximum discounts.

Businesses must therefore think proactively on how to manage energy consumption and costs. Those operating from less energy efficient facilities may be less able to mitigate cost rises.

Activity in the occupier market has been boosted in recent years, by a number of a new, emerging sectors, often characterised by high-growth but loss-making businesses. These firms are typically highly reliant on venture capital.

The collapse of Britishvolt in January, though an isolated case, demonstrates the difficulties some nascent sectors or start-ups are facing when seeking additional funding. Electric vehicle manufacturer Arrival has also announced their difficulties in raising funds, citing this as a factor in their plans to cut their UK workforce by half. Arrival has taken up a number of logistics facilities, predominantly in Banbury and Bicester, in recent years.

Recession impact

The UK economy will undoubtedly be in recession in 2023 but a deeper, more prolonged recession with persistently high inflation would weaken the prospects for the sector. Real estate tends to perform poorly in an environment of stagflation, with inflation driving assets into over-rented positions while market rents lag due to a weakening occupier market. A focus on tenant covenant and quality of income will be important for investors looking to shield themselves against these downside risks.

Read more or get in contact: Claire Williams, head of UK and European industrial research

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up below.

Subscribe here