What do HNWIs think will happen to prime residential markets in 2023?

Here we look at why it's valuable to understand the thoughts and motives of high-net-worth individuals (HNWIs) themselves, their attitudes to real estate and how they differ globally.

2 minutes to read

This year, we polled HNWIs across four markets: the US, the UK, Singapore and the Chinese mainland. The survey was conducted between 21st and 30th September 2022.

House prices

The results reveal that Singaporean HNWIs are the most optimistic about the direction of house prices over the next 12 months, with 86% of respondents expecting an increase.

Singaporean respondents may be buoyed by recent performance. According to Knight Frank’s Prime Global Cities Index, luxury prices increased 6% in the 12 months to September 2022.

US respondents and those from the Chinese mainland have a similar upbeat outlook with 66% and 64% confident that house prices will increase in the next 12 months respectively. Yet only 59% of UK respondents, buffeted by political turmoil and recessionary fears, expect prices to climb higher.

The market with the highest proportion of HNWIs expecting prices to fall is the Chinese mainland (30%), higher than their UK counterparts with 16%.

Home ownership

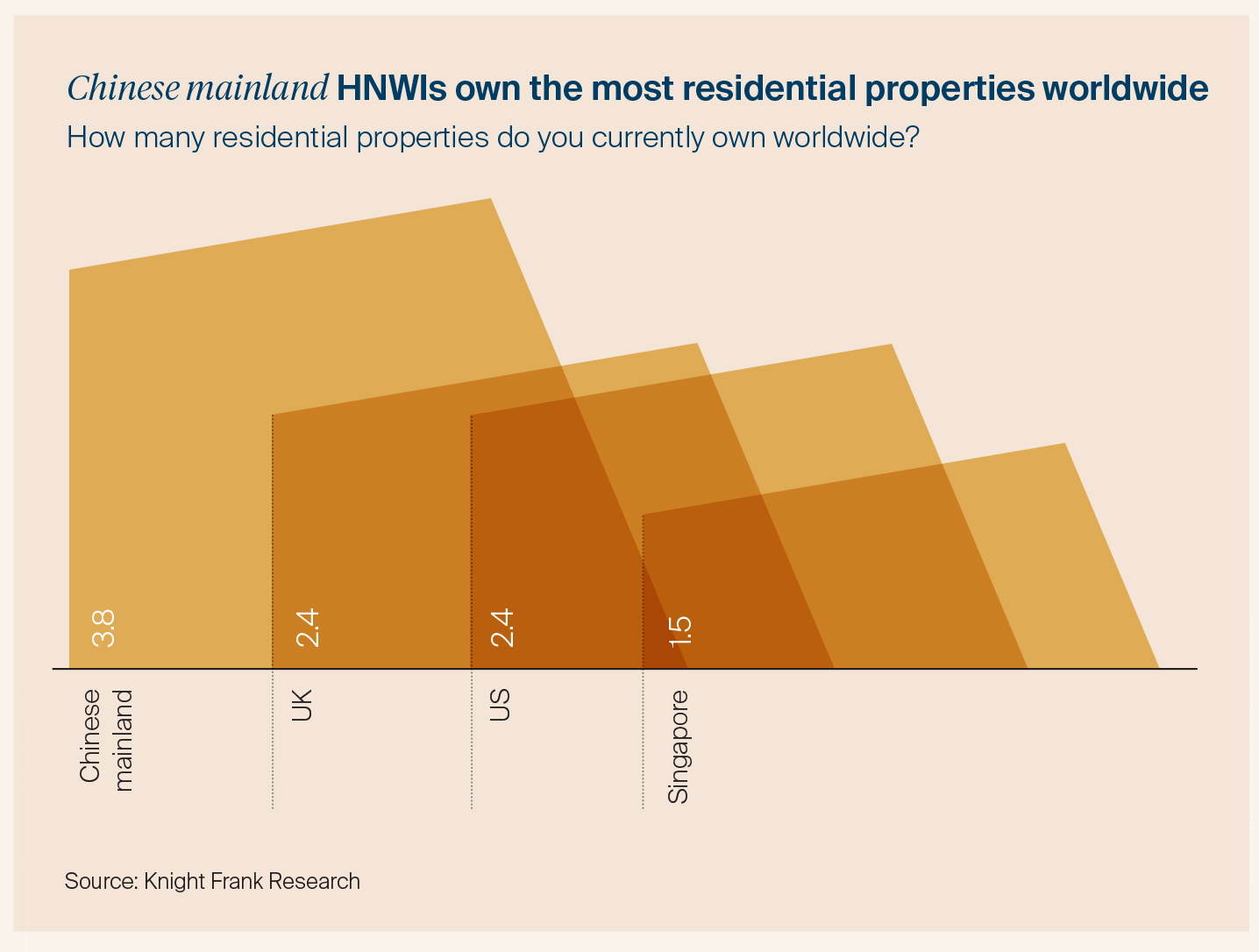

The number of homes owned globally varies significantly from country to country. HNWIs in the Chinese mainland top the rankings, owning 3.8 properties on average. With strict capital controls in place, it is likely the bulk of these are located domestically rather than abroad. Delving deeper into the data reveals that 68% of HNWIs in the Chinese mainland own three or more properties.

UK- and US-based HNWIs sit jointly in second place, owning 2.4 homes on average. Ranking the lowest out of all markets are HNWIs in Singapore, with an average of 1.5 properties per person.

Purchase plans

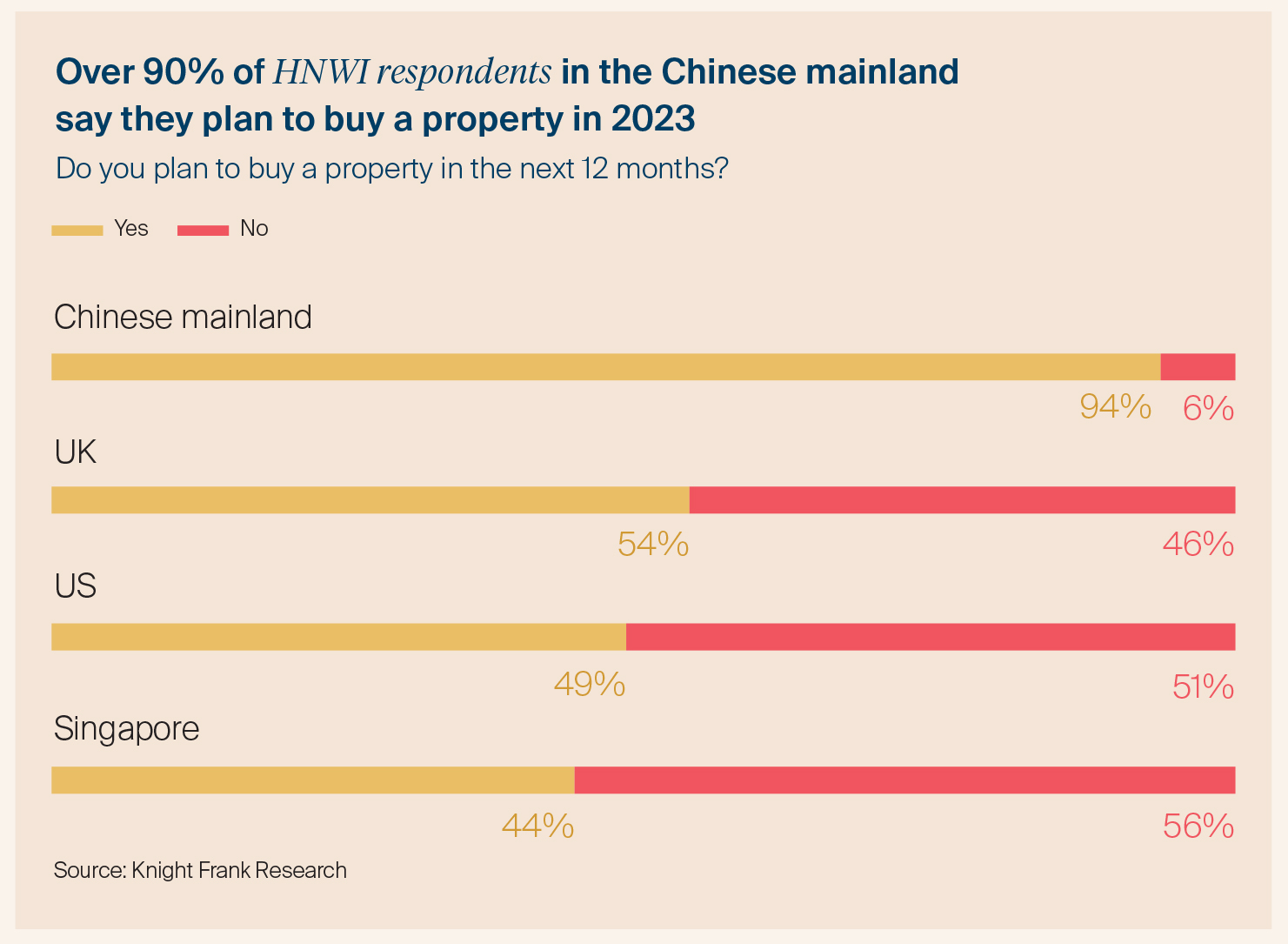

Most motivated purchasers are HNWIs based in the Chinese mainland, with 94% planning to buy a property in 2023. The data suggests economic headwinds are weighing on UK and US-based respondents with 54% and 49% respectively considering a purchase. Singaporeans are the most cautious, with only 44% of respondents looking to add to their real estate portfolios in 2023, and this despite them being the most optimistic on future price performance.

Most popular cities

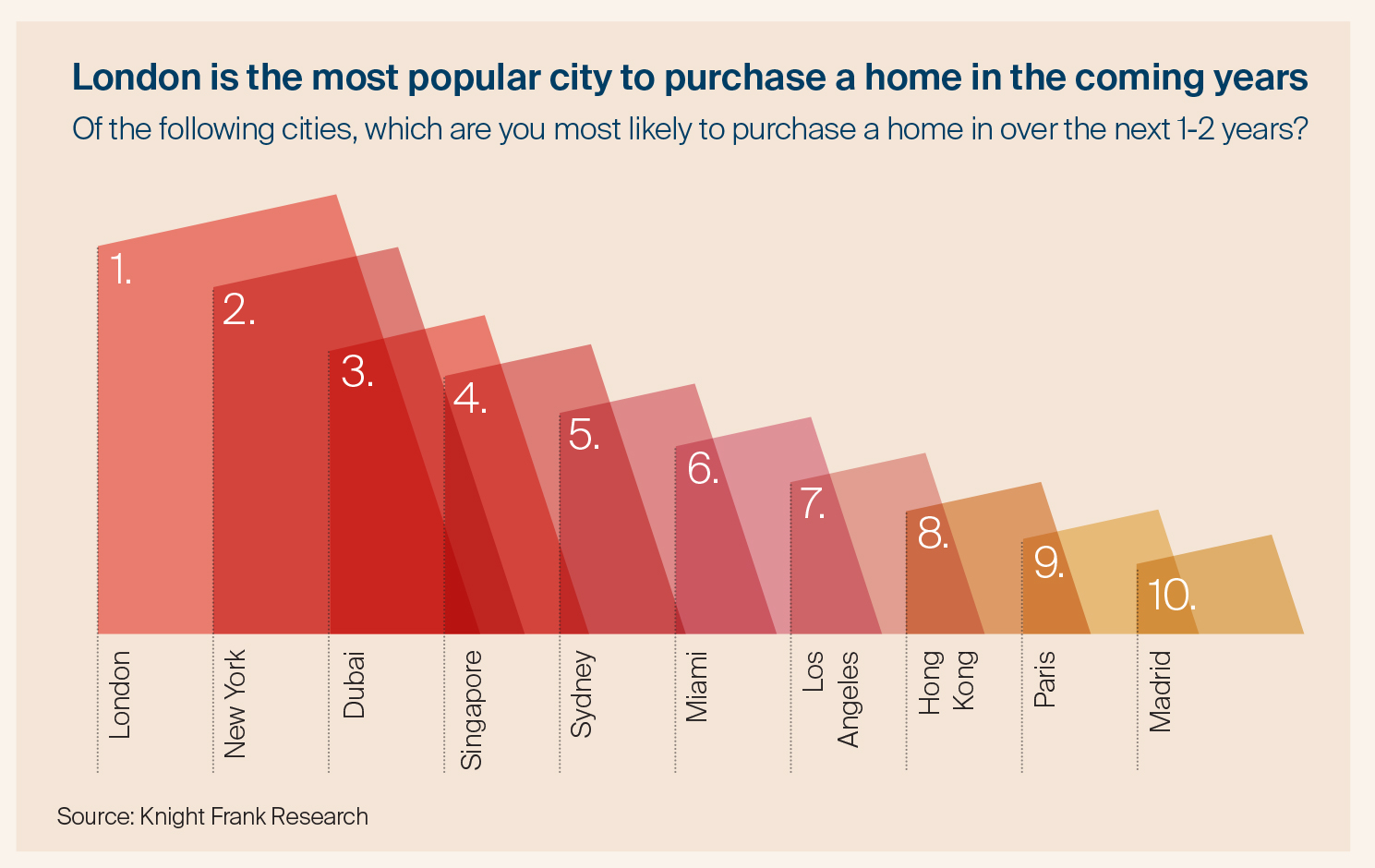

When asked which city they are most likely to purchase a home in over the next one to two years, London comes out on top overall. New York sits in second place but ranks highest with HNWIs in the UK and US. Dubai sits in third place and is most popular with HNWIs based in the Chinese mainland.

Key concerns

Rising mortgage rates and higher taxes are considered by the HNWIs polled to be the biggest threat to house prices. Higher taxes are the main concern for the wealthy in the Chinese mainland, while those in the UK, US and Singapore are most troubled by rising mortgage rates.

Download the full report

Download the full report for more in depth analysis and the latest trends relating to global wealth.

Download the report