Australian Industrial review Q2 2022

Here we look at the state of the Australian industrial market as prime yields rise for first time since 2009.

6 minutes to read

A surge in rental growth and a sustained uplift in rental values means that Australian industrial market has performed well in Q2.

In this article we will explore:

· Why vacancy has declined further in Sydney

· The nation’s largest development pipeline in Melbourne

· Brisbane’s record high up-take

· Why land values continue to spiral upwards in Adelaide

· The fastest pace of industrial rental growth in Perth

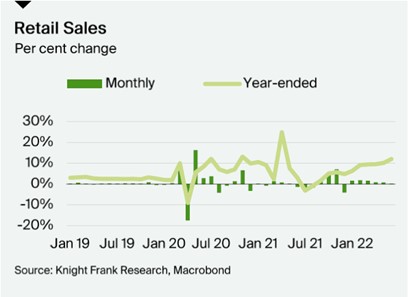

Retail spending continues to drive strong economic growth

Retail sales continue to grow rapidly, as households gradually draw down on the savings built up during the pandemic and respond to the buoyant labour market.

The latest data to end-June confirms that aggregate sales have risen by 12.0% over the past year, with strong spending across all the major categories.

The online share of aggregate spending remains high but has stabilised in recent months and stands at 10.5% overall and 16.1% for non-food goods.

While aggregate spending remains strong and continues to propel tenant demand for logistics space, recent months have seen a decided cooling in consumer sentiment globally.

In Australia, as higher inflation - including a steep rise in construction costs, including raw materials - and the anticipated impact of sequential interest rate rises feeds through.

Consumer sentiment in Australia has fallen by nearly 30% since the peak in 2021, and by 42% in the US, indicating that the pace of retail spending and aggregate economic growth is likely to slow in H2 2022.

Sydney rental growth with record low vacancy

Vacancy remains at record low levels on the back of strong occupier demand. Occupier demand in Q2 resulted in a 4% decline quarter on quarter in vacancy to measure 99,247 sqm. On a year on year basis this is a 55% decline.

Stock levels are so tight that between the Outer West and South West there is only 43,771 sqm available, in comparison with the same time last year when there was 164,169 sqm of vacant space across the two regions.

Many warehouses with upcoming vacancies are being renewed or even leased well ahead of lease expiries or being marketed for lease.

The record low vacancy in the Western precincts is a reflection of the strong demand for larger warehousing.

This low vacancy suggests there has been an increase in the number of occupiers moving away from 'just in time' inventory practices to higher inventories that require more storage space or are simply building in future resilience.

Unprecedented rental growth driven by limited stock and inflationary pressures.

Global supply chains are presenting significant headwinds to the sector at a time when demand for warehouse space is elevated, and there has been a cost shift feeding through to rental growth.

With inflationary pressures and land value prices surging, landlords have continued to push rents.

On a blended basis, prime net face rents are up 4.1% quarter on quarter (Q/Q), with incentives averaging 12.5%.

In year on year (Y/Y) terms, average prime net face rents have risen 11.3%, well above yearly growth rates of the past decade, which averaged no more than 2-2.50%.

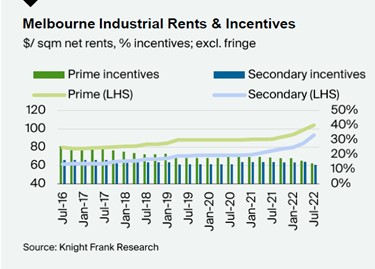

Space demand drives Melbourne rental growth

New supply is still expected to reach record levels in 2022. However most construction remains in the West (59%) and South East (32%), thus availability will remain tight in the East and North precincts.

Some respite may be expected in 2023 as early figures show nearly 30% of planned construction will occur in the North, 190,000 sqm is already pencilled in, double this years expected delivery.

Even in those areas where construction is occurring there is high levels of pre-committed building taking place.

In fact, of the 1.194million sqm expected to be built in 2022, 58% is already pre-committed or owner occupier builds. Also much of the 42% speculative development already has interest shown or has commitments on it.

Rents continue to rise as demand outpaces supply

Strong rental growth across all precincts continued as tenant demand continued to outpace supply.

For prime industrials, the West precinct led the way with net face rents up 8.8% Q/Q (16.5% Y/Y) to $99 sqm. Rents in the East showed the largest Y/Y growth of 19.6%, with 6.8% this quarter alone to $110 sqm on the back of very tight supply.

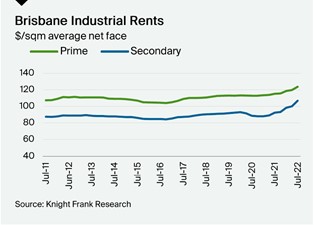

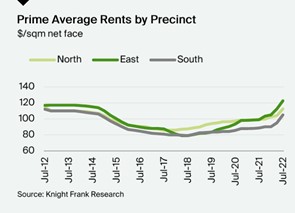

Brisbane Rental growth accelerating with tenant demand high

Average prime face rents increased by 7.3% Y/Y to $124/sqm net, average incentives have ticked down across existing stock to 14.2%.

The secondary market has jumped by 15.6% Y/Y to $107/sqm net, now at record highs after exceeding the past peak of 2008-09, responding to the particularly tight vacancy.

Economic rents continue to be pushed by land and construction cost appreciation and softer capital markets.

Adelaide land and rental values surge

Both blended prime and secondary yields have remained relatively stable to sit at 5.55% and 6.65% respectively this quarter.

The combination of high rental rates and low land values in Adelaide compared to the eastern states has highlighted South Australia (SA) as a prime location for all investor groups.

27-30 Sharp Court, Cavan SA, comprising a community titled distribution facility made up of two fully leased office warehouses, sold for circa $23.25 million reflecting a market yield of 4.21% and GLA rate of $2,825/sqm.

Current investment volume for industrial assets as July 2022 is $284.47 million, with approximately $135.7 million or 47.7% occurring within the Outer Northern industrial precinct.

Outlook for further growth in rents and land values

As the speculative developments that commenced in the second and third quarters of 2021 reach practical completion, this will alleviate supply pressures.

However, land values and rental rates are still expected to increase further as parties that are still seeking suitable facilities compete over incoming stock.

Rental growth fastest in Perth

Demand is strong across the board, but particularly in the East and South precincts and this is increasing the pressure on supply levels and driving sustained rental growth.

After taking longer to feel the onset of rising tenant demand associated with e-commerce, and hence the onset of rental growth, the Perth market is catching up with the performance of the larger East Coast cities and has recorded the strongest average rental growth over the past year.

Perth prime rents rose by 9.1% on average during Q2 to record 18.6% growth over the past year. This has been led by the eastern and southern precincts with 24% and 19% growth (Y/Y) respectively, with similar growth rates for both warehouses and manufacturing facilities.

The rapid growth is a function of tight supply but also escalating construction costs which are increasingly understood by tenants and impacting negotiations on pre-commitments and hence wider market sentiment.