Why all eyes are on the resilience of labour markets

Your international property and economics update tracking, analysing and forecasting trends from around the world.

3 minutes to read

Labour markets

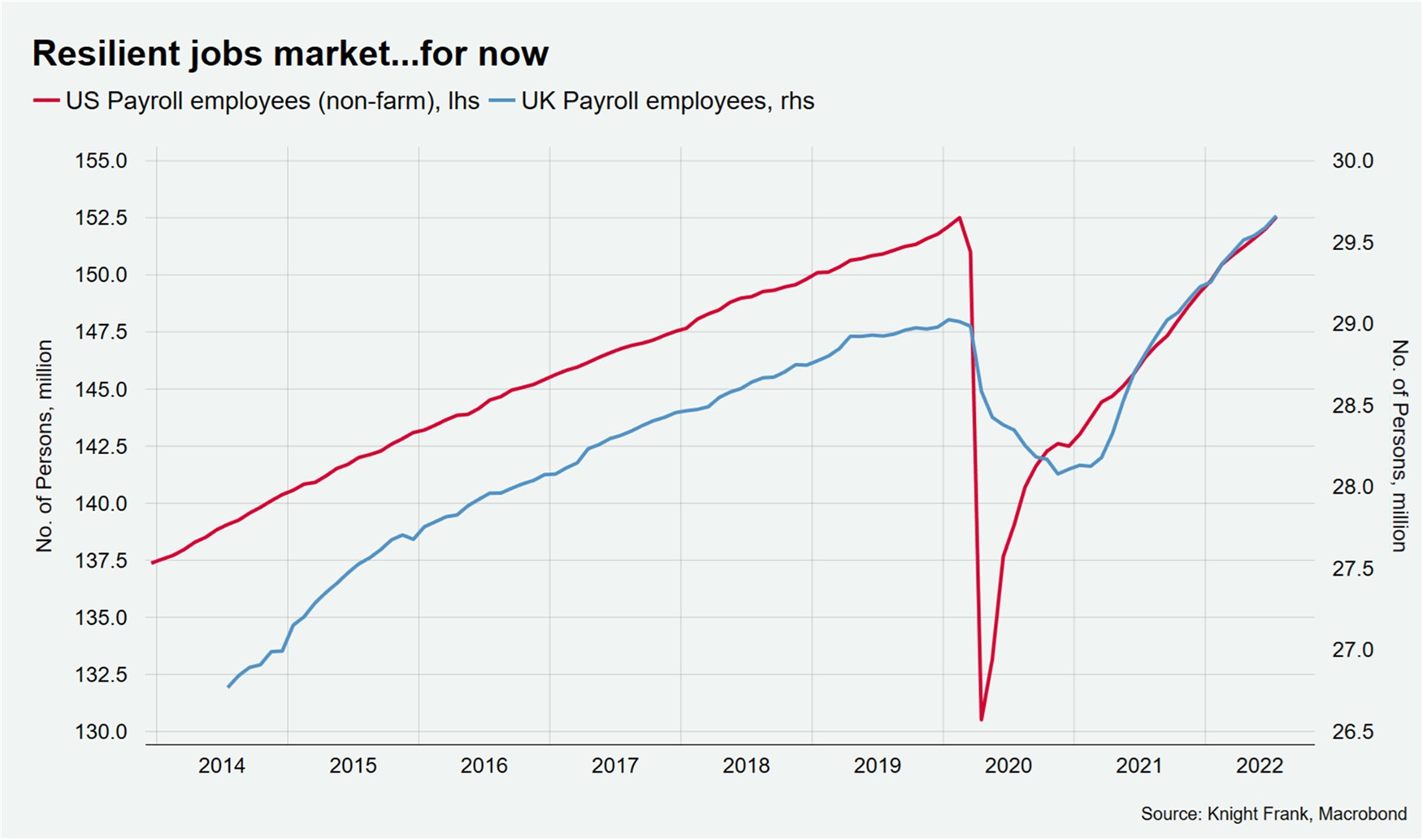

The health of labour markets could determine the scale of the slowdown in global housing markets. Higher unemployment leads to more forced sellers; this could be the difference between a short sharp slowdown and a protracted downturn.

To date payroll figures across the US, UK and several advanced economies have looked surprisingly robust (see chart below). In the US, 528,000 new jobs were added in July, more than double the number expected and in the UK, payrolled employees rose by 2.9% in July year-on-year.

However, one sobering survey from PwC reveals that half of the 700 US executives the firm polled are terminating workers or plan to, 52% have implemented hiring freezes and a large number are doing away with sign-on bonuses that had become commonplace in a tight job market. We’ll be tracking employment figures and mortgage defaults closely in the coming months.

To date house prices, whether mainstream, luxury, in cities or nationally continue to display relative resilience, except for a few outliers such as New Zealand, Malaysia and Morocco but we expect this group to expand as recessionary fears start to bite and buyer sentiment dips. We’ll be releasing our Global House Price Index and Global Residential Cities Index next week, sign up here to be the first to receive the latest results.

Europe’s second homes

Enquiries for European second homes are up 35% on pre-Covid levels according to Knight Frank data.

Stock-starved markets are slowly starting to see inventory levels pick up offering some solace to those buyers who have waited patiently on the side-lines in markets like Provence, Tuscany, Zurich and the Swiss lakes.

US buyers remains active, driven by strong currency discounts. However, unusually Europe’s resort markets are chiming with our friends across the pond as strongly as the region’s cities. The usual August lull was less pronounced this year than in pre-Covid times, but we may yet see something of a September sales bounce as supply increases.

Our recently-released Global Prime City Forecast predicts Edinburgh (8%) and Dublin (7%) will lead the way in Europe in 2022 when it comes to annual price growth with London (6%) and Madrid (6%) taking over the baton in 2023.

China

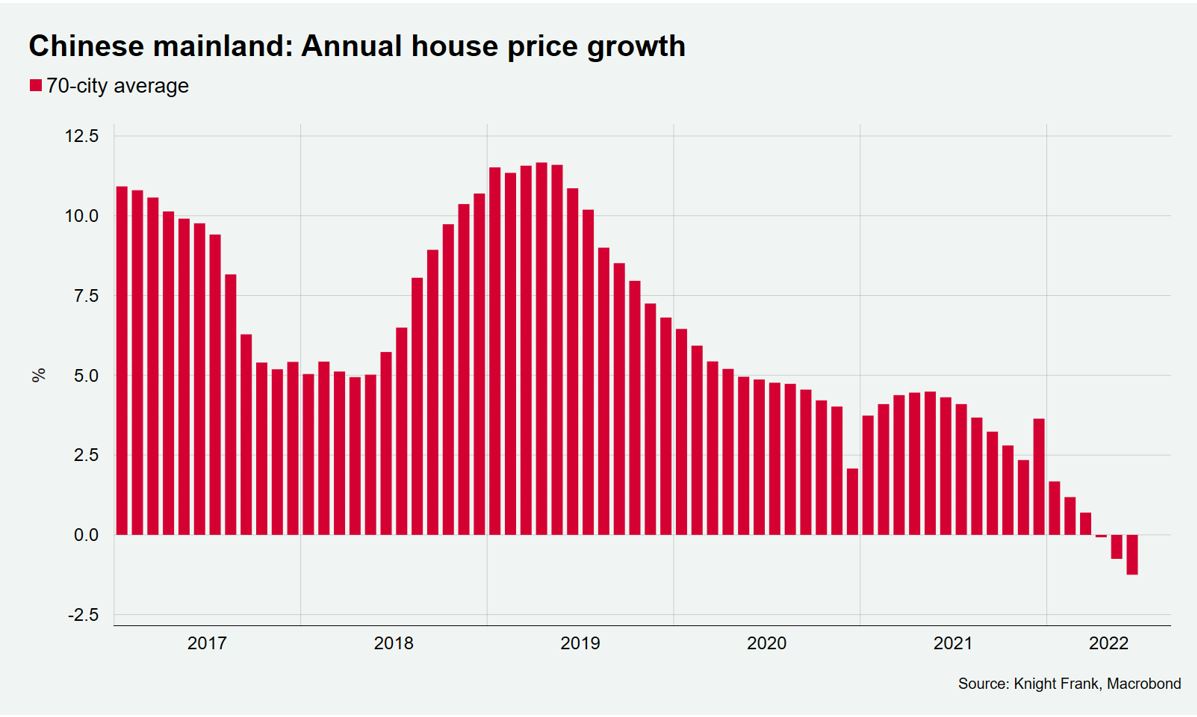

The world’s second largest economy has bucked the global trend and opted to lower interest rates, signalling how seriously the country’s property market slump is being taken by President Xi Jinping.

China lowered the five-year loan prime rate (LPR) by 15 basis points to 4.45%, more than the five or 10 basis points tipped by most economists in a Reuters poll.

China’s property sales fell in April by their fastest rate in 16 years and the latest data shows prices across 70 cities are down 1.3% year-on-year.

The current developer debt debacle is impacting the Chinese mainland’s middle-class households leading to mortgage defaults in over 320 projects across 100 cities.

S&P Global Ratings estimates that around 40% percent of mainland property developers are now in financial distress and although a rescue fund has been approved, pay-outs will be managed directly by local governments, rather than having financing provided directly to builders.

The challenge for Xi Jinping as he approaches the five-yearly National Congress, likely to be in November and at which he will seek a renewed mandate to continue as President, is to orchestrate a soft landing.

If sentiment weakens in the housing market, once borders fully reopens Chinese households may look more favourably on overseas markets once more despite the capital controls in place.

In other news…

The Middle East is set for a $1.3tn oil windfall due to elevated prices boosting the coffers of the region’s sovereign wealth funds according to the IMF (FT), Turkey joins China and goes in the opposite direction by slashing interest rates despite inflation of almost 80% (FT) and there are signs Asia is opening up with Hong Kong considering allowing bankers in this November (Bloomberg) and Japan increasing its tourist numbers (Bloomberg).