European office occupier market Q2 2022

Office markets around Europe continue to perform despite economic uncertainty.

6 minutes to read

Updated quarterly, the European dashboards provide a concise synopsis of occupier activity in Europe's markets.

Discover vacancy rates, up take and prime rents from cities across Europe in more detail by exploring the dashboard for Q2 2022 at the bottom of each section.

See the latest reports from Q3, including Warsaw and Prague.

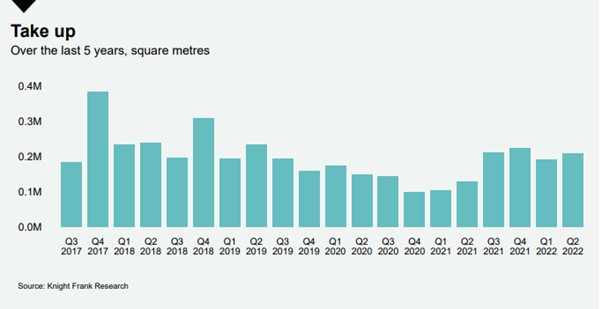

Barcelona office market

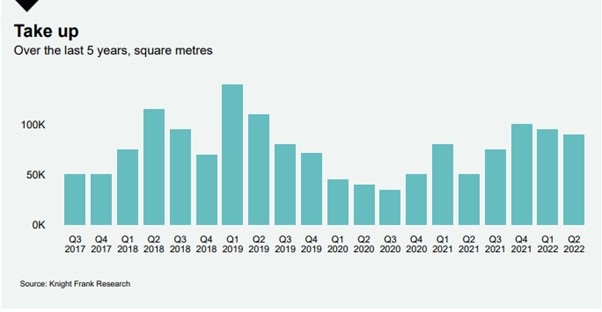

The Barcelona office occupier market remained resilient. Despite a 5% decrease in take-up in Q2 2022 compared to the previous quarter, Barcelona office take-up remained 11% above the 5-year Q2 average.

The vacancy rate in the Barcelona office market stood at 7% in Q2 2022. Given the robust leasing activity, prime office rents held up at €336 per sqm per year and the outlook for prime rents remains stable.

The largest office leasing transactions in Barcelona in Q2 included the uptake of 9,417sqm in Carrer dels Almogavers and 4,900sqm in Carrer de Pamplona 101.

Download latest dashboard

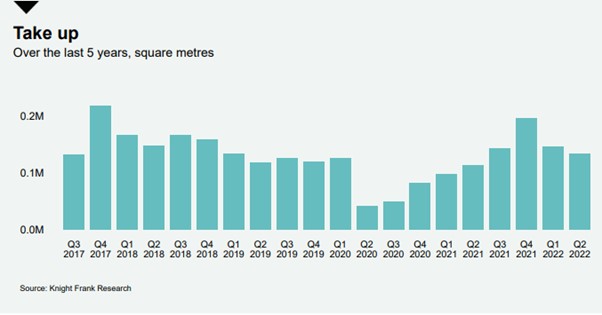

Berlin office market

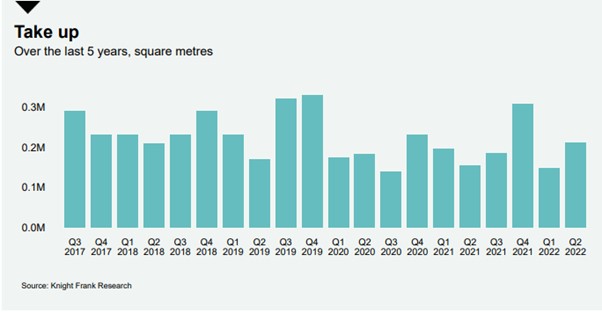

Take-up in the Berlin office market in Q2 2022 totalled 211,600 sqm, resulting in an overall take-up of 360,200 sqm in the first half of the year. Compared to previous year’s result, this is an increase of 2.3%, but it is 9% down on the 5-year average. Unlike in Q1 2022, when no deal took place for over 10,000 sqm, two deals were registered in Q2. These two deals contributed 15% to the overall take-up in Q2.

With approx. 1.4 million sqm in the pipeline, construction activity is still at a high level. However, due to ongoing material shortages and rising construction costs, projects are currently facing delays.

In view of rising construction costs and current inflation forecasts, a further rise in rents is expected. This is despite a minor increase in the vacancy rate.

Take-up in the Berlin office market in Q2 2022 totalled 211,600 sqm, resulting in an overall take-up of 360,200 sqm in the first half of the year. Compared to previous year’s result, this is an increase of 2.3%, but it is 9% down on the 5-year average. Unlike in Q1 2022, when no deal took place for over 10,000 sqm, two deals were registered in Q2. These two deals contributed 15% to the overall take-up in Q2.

With approx. 1.4 million sqm in the pipeline, construction activity is still at a high level. However, due to ongoing material shortages and rising construction costs, projects are currently facing delays. In view of rising construction costs and current inflation forecasts, a further rise in rents is expected. This is despite a minor increase in the vacancy rate.

Download latest dashboard

Bucharest office market

After a good start to the year, activity in the Bucharest office leasing market slowed somewhat following the invasion of Ukraine. The second quarter closed at a similar level as in 2021 but demand for office space was 20% higher in the first half of the year compared to the same period the previous year.

Several factors including a smaller number of new projects in the pipeline and higher construction costs led to an increase in average gross rents in the good quality buildings that are due to be delivered.

Amid the lack of approvals of new building permits we estimate a smaller number of projects will be delivered in the next few years. This means the Bucharest office leasing market will likely change to a landlord market, which will put further upward pressure on rents.

Download latest dashboard

Madrid office market

Despite a decline in take-up in the Madrid office market in Q2 2022 compared to the previous quarter, the occupier market remained active. Total office space take-up for the first half of the year is 50% higher than for the same period last year.

Total expected construction completions in 2022 amount to around 88,700 sqm of which 29,500 sqm were completed in the first half of the year.

Prime office rents rose to €396 per sqm per year, a 1.5% increase compared to the previous quarter. Prime office rents are likely to remain under upward pressure in Q3 2022.

Two major office leasing transactions in Madrid in Q2 2022 included the 5,234 sqm letting in the Velazquez 86 D building and the 5,219 sqm letting in the Puerto de Somport 21-23 building.

Download latest dashboard

Munich office market

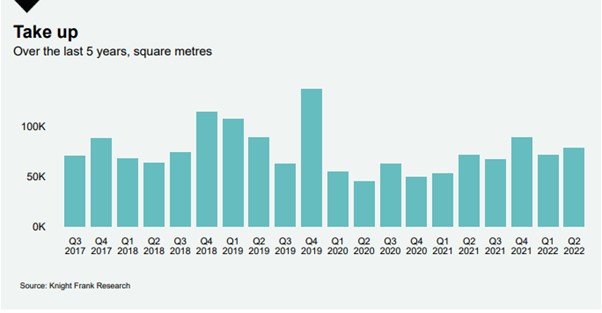

The Munich office leasing market continued to remain stable in the first half of the year. Take-up in Q2 2022 totalled 208,400 sqm which is above the quarterly average for the past five years, bringing total take-up for the first six months to 399,800 sqm.

The office vacancy rate increased moderately to 5.1%. This corresponds to an absolute vacancy rate of just over one million square meters.

The prime rent continued to increase to €42.5 per sqm per month. This is the highest rental value ever achieved on the Munich office market.

Despite the economic uncertainties, the Munich rental market will continue to remain stable over the next few months. The shortage of space and the high demand for office space in central locations will continue to put upward pressure on prime rents. The vacancy rate will level off at the 5% mark.

Download latest dashboard

Paris Central Business District office market

Activity in the Paris CBD office market remained very robust in Q2 2022. Take-up in the first half of the year was 36% higher in the same period in 2021.

The CBD has even outperformed the first half of each of the five years prior to the outbreak of COVID19, with a 12% increase, supported by the vitality of the two sub-sectors Opéra (+34%) and Etoile (+1%).

The CBD has the highest pre-letting rate in the Greater Paris Region (53%). With a number of large transactions in the process of being finalised, the scarcity of Grade A supply will be more pronounced by the end of 2022.

The trend towards a scarcity of supply and the strong demand for quality office space will maintain upward pressure on prime rents in the Paris CBD.

Prime rents reached €950 per sqm per year by the end of the first half of 2022, boosted by several transactions in excess of €900 per sqm in the 8th arrondissement.

Download latest dashboard

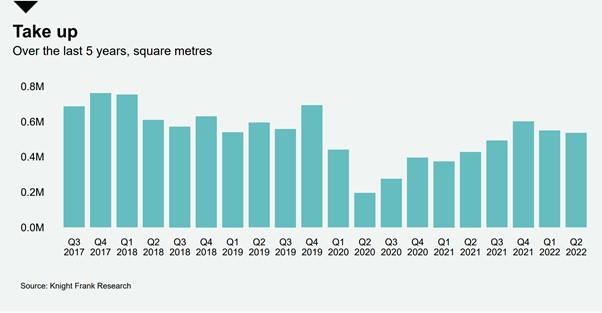

Greater Paris office market

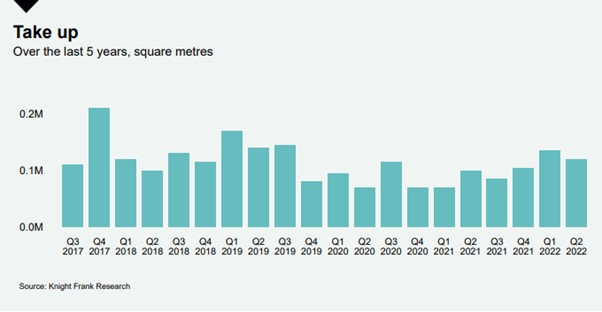

The Ile-de-France or Greater Paris office market recorded a total take-up of nearly 535,000 sqm in Q2 2022. In the first half of the year, take-up totalled nearly 1.09 million sqm, up 33% from the same period last year. Significantly, take-up in the first half of the year exceeded the usual benchmarks for the Greater Paris Region market, with an increase of 7% compared with the ten-year average.

Grade A offices accounted for nearly 80% of the >5,000 sqm office space take-up in the Greater Paris Region, compared with an average of 74% over the past ten years, showing the importance occupiers place on environmental performance and quality.

There is no shortage of immediate supply and even more to come in the near future. Following the delivery of some 380,000 sqm of newly restructured office space over 5,000 sqm in the first half of the year in the Greater Paris Region, nearly 700,000 sqm more is expected by the end of the year (72% of which is still available).

Download latest dashboard