Algeria

An increase in demand for offices is imminent, as the country’s core economic pillar, the oil and gas sector, experiences a ramping up in investment and job creation rates.

3 minutes to read

Office demand expected to bounce back

There is a relatively low level of purpose-built offices in Algiers. The office stock in the CBD is composed of buildings constructed by indigenous developers, with small floor plates and little or no parking provisions. Newer additions to the city’s supply in peripheral areas such as Bab Ezzouar, have mostly been developed by corporate occupiers, some international, many of whom have been offered tax breaks to encourage owner-occupation. These buildings tend to be of a higher quality than elsewhere in the city as they are built to an international specification. Unsurprisingly, these buildings have fared better than their CBD counterparts in terms of their popularity amongst international occupiers in the wake of the pandemic.

"The office leasing market is on the cusp of experiencing a resurgence in demand."

That said, we believe the rental market is on the cusp of experiencing a resurgence in demand as the oil and gas industry roars back to life, bringing an influx of supporting international businesses and workers.

Retail remains resilient

The retail sector has developed significantly in Algeria over the past decade, and although it was hit hard by the coronavirus pandemic and recent economic headwinds, the sector is generally buoyant and the outlook positive.

Our optimistic expectation is backed by the expansion of Carrefour in 2020, taking the total retail space occupied by the supermarket giant to 10,500 sqm across two locations. Furthermore, 2021 saw the addition of the 25,000 sqm Lifestyle Mall in Cheraga, which was rapidly leased and houses brands such as Zara, Mango and Massimo Dutti.

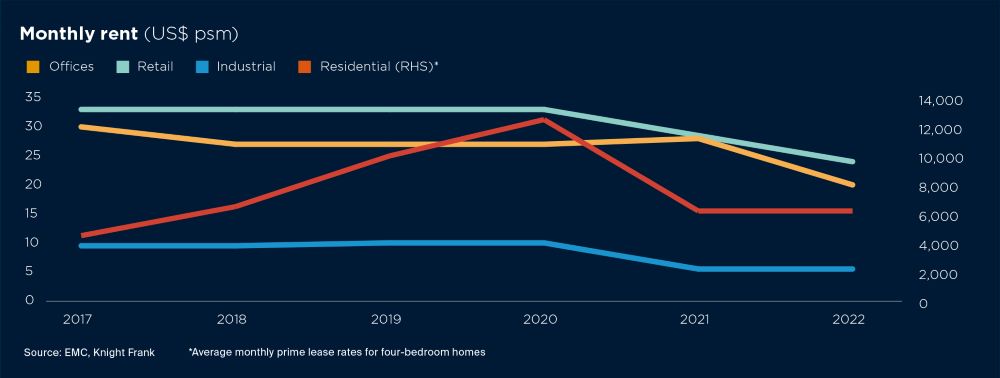

Housing market was severely hit by Covid-19

Residential values have been in a state of decline for several years. The pandemic, devaluation of the Dinar and the general drop in purchasing power have added to the residential market’s malaise. With Algeria’s borders effectively shut to international visitors for two years, confidence in the market waned, with transactional volumes slipping to near record low levels.

Indeed, both sales prices and lease rates have widely fallen by 10%-20% across board. Furthermore, there has been a significant outflow of expatriates during the pandemic. This cohort is a key driver of demand for luxury residential property and in their absence, the top end of the market has been especially hard hit. We anticipate this to begin reversing as oil and gas job creation rates ramp up and expats begin returning to Algeria.

For now, contractors and development companies in the housing sector continue to struggle to find their feet. Reflecting the pain inflicted on the sector is the fact that some 150,000 jobs have been lost since the start of the pandemic (The Algerian Association of Contractors).

New laws boosting industrial activity

Previously, businesses could not operate in Algeria without a local Algerian partner, with a controlling (majority) stake. This has been a major inhibitor to inward investment.

That said, the reforms brought on by the 2020 Finance Law which removed the prohibition to finance projects with funds from outside Algeria and the 49/51 Majority-Ownership Law have now been passed and are designed to encourage foreign investment, which is already translating into rising demand, particularly for industrial facilities and assets.

It is worth noting that the 2020 Finance Law does not apply to certain sectors, including oil and gas, mining, and pharmaceuticals.