What is driving home purchases in Saudi Arabia?

Achieving lifelong goal cited as top reason for purchasing a home with tenants aspiring to transition to home ownership in Saudi Arabia.

2 minutes to read

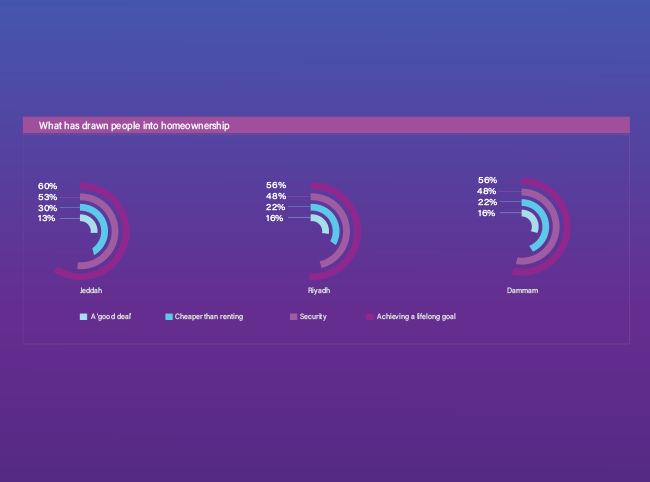

Knight Frank’s 2022 Saudi Arabia Real Estate Market Survey showed, amongst homeowners, the achievement of a lifelong goal (57%) is the primary reason for opting to purchase a home, with those in Jeddah (60%) citing this reason more frequently than those in Dammam (57%), or Riyadh (56%).

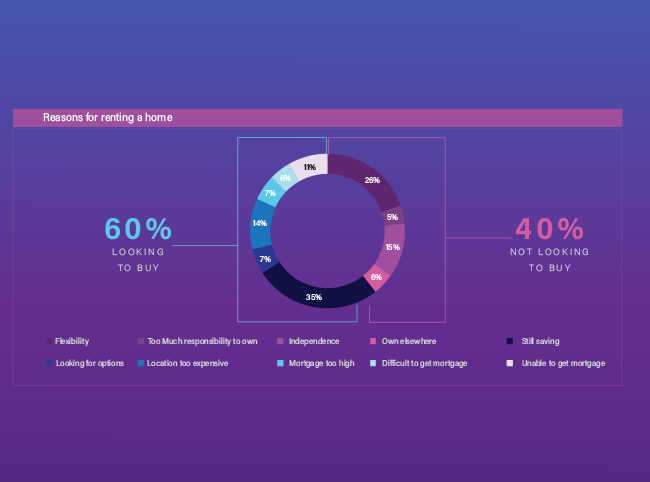

Unsurprisingly for homeowners, the achievement of a lifelong goal is the primary driver to purchase a home. In our survey, most of the tenants (35%) say they value the flexibility that comes with renting a property, while a smaller proportion (5%) currently owns a home elsewhere.

Interestingly, those earning less than SAR 40,000 say this sense of achievement of owning their own home is far more important to them than it is for higher income brackets. For those earning SAR 20,000-40,000 per month, for instance, this figure stood at 65%, compared to 50% for those on a monthly salary of SAR 40,000-60,000.

Nationwide, this sense of reaching the pinnacle of the property ladder through homeownership (57%) trumps reasons such as the security offered through buying your home (50%) and the fact that owning is cheaper than renting (25%). Attractive mortgage rates (15%) do not appear to be a significant homeownership driver. This is presumably due to the attractive rates available in the market and programmes such as Wafi (off-plan sales and rent program) and Sakani (home ownership initiative) that have facilitated easier access to the housing ladder since the launch of the National Transformation Plan in 2016.

Tenants want to transition to homeownership

Of our respondents who are tenants, most claim to enjoy the freedom offered through renting a property (35%), while a smaller group (5%) already own a home elsewhere. In Riyadh, just 36% say they enjoy the flexibility of renting, compared to 46% and 47% in Dammam and Jeddah, respectively, suggesting there is pent up demand amongst tenants in the capital who are looking to transition to homeownership. Equally, this could also be reflective of the increasing number of domestic migrants that are temporarily relocating to Riyadh in search of better employment opportunities.

Interestingly, 60% of tenants who would buy are hamstrung by the need to continue saving for a deposit (35%), while others claim prices are too high for what they would like (24%) and 6% say they are actively trying to find suitable options.

Key findings

- 57% of homeowners choose to purchase a home for sentimental reasons (fulfilling a lifelong goal).

- Tenants in Dammam have the highest percentage of those looking for home purchase options (11%).

- Tenants in Riyadh appear to least enjoy the flexibility offered through renting a home (36%).

- In our sample, there was a very limited number of households earning tenants earning over SAR 60,000 per month

Discover the full Saudi Arabia Report 2022