Prime London and the pandemic: 2021 vs 2020

December 2021 PCL sales index: 5366.5

December 2021 POL sales index: 265.2

2 minutes to read

The Omicron Covid-19 variant has placed the prime London property market at a crossroads.

Interest rates may stay flatter for longer, demand for space could increase and rising supply may stutter if the new variant proves to be more serious than the early anecdotal evidence suggests.

The holding pattern that activity and prices have been in for the last six months could be prolonged.

Equally, there may be a bounce in transactions early next year if the impact of the new variant is less severe than feared, with supply accelerating to catch up with demand, which itself would be boosted by the return of more international buyers.

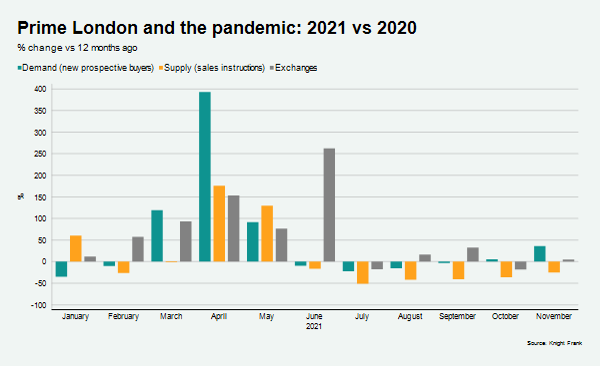

Until greater clarity emerges, comparing how the market performed this year with 2020 provides the most useful indicators for what will happen next, as the chart below shows.

Frustrated buyers

The dip this January in new prospective buyers compared to last year underlines the large number who registered in the first month of 2020 after the December 2019 general election. The short-lived Boris bounce ran into February but the pandemic had started to have an effect on sentiment by March, as the comparative increase in 2021 shows.

Huge increases in activity in April and May this year are unsurprising given the market shutdown last year.

Which brings us to June, the month that the £15,000 stamp duty saving ended. It was the highest month for transactions since 2005, according to HMRC.

The fact the stamp duty holiday had such a marked impact on the number of June exchanges in prime London markets, where £15,000 represents a proportionately lower percentage of the sale price, underlines the extent to which tax breaks effect the behaviour of buyers and sellers across all price brackets.

There was even a second smaller spike in exchanges in September before the window closed on a £2,500 saving.

What next?

Supply and demand are still rebalancing after the shelves cleared so quickly during the stamp duty holiday, as the figures for the second half of the year show.

Supply is rebuilding but it has lagged demand, indicating the presence of a large number of frustrated buyers as we go into 2022.

Average prices in prime central London increased 1.3% in the year to December, reflecting the static market conditions seen over the last nine months. It compared to a decline of 4.3% recorded in December 2020.

Meanwhile, in prime outer London, average prices rose 3.2%, which was the strongest annual rate of growth since February 2016 and reflected the robustness of demand for space and greenery during the pandemic. The increase compared to a decline -3.2% recorded in the year to December 2020.

We expect prices to rise further across London next year, with a more notable upswing in PCL when international travel resumes.