Vicious cycle of low supply lingers as autumn market begins

UK property market outlook: 11 October 2021

3 minutes to read

There were 13 new buyers for every property listed in the UK in September.

Over the last five years, the only time demand has exceeded supply to a greater extent was in January 2020.

It was the first month of the short-lived Boris bounce following the general election of December 2019. New buyer registrations spiked after a year of domestic political turmoil.

As the autumn selling season gets underway, unseasonably low supply has caused the latest imbalance.

The below four charts examine these market dynamics in more detail and explore what is likely to happen next. They highlight the differences between this year, last year and the period before the pandemic.

In summary, transaction volumes and price growth will be strong despite the underlying lack of stability.

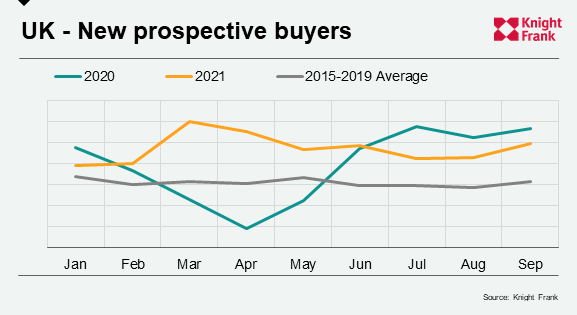

Chart 1: Demand.

Demand has not been a problem since the UK property market re-opened in May 2020. The number of new prospective buyers in September was 57% above the five-year average between 2015 and 2019. In fact, the figure was only 13% below last September’s figure, two months into a stamp duty holiday and during a period of post-lockdown exuberance.

The UK economy is facing inflationary pressures this autumn but near-zero interest rates and low unemployment have underpinned demand, even as the stamp duty holiday wound down. The rising cost of living, however long it lasts, may cause some fraying around the edges but demand is likely to remain robust over the next six months.

Chart 2: Supply.

The vicious circle of low supply won’t become a virtuous circle overnight. More prospective vendors will come forward as they find their own purchase options, a process that is underway but requires time. Sales instructions have hovered around the five-year average this year but the shelves are emptying more quickly, creating the kind of disruption seen in other parts of the economy.

As a result, supply didn’t pick up this September as it has in previous years. The number of instructions to sell was 26% below the five-year average and 51% below September 2020.

Tighter supply means a greater proportion of buyers and sellers will be needs-driven over the next several months. However, there will be a seasonal injection of new supply next spring.

For now, the imbalance is keeping upwards pressure on prices even though the stamp duty holiday has ended. As supply and demand normalise, the main UK house price indices should continue to slowly deflate.

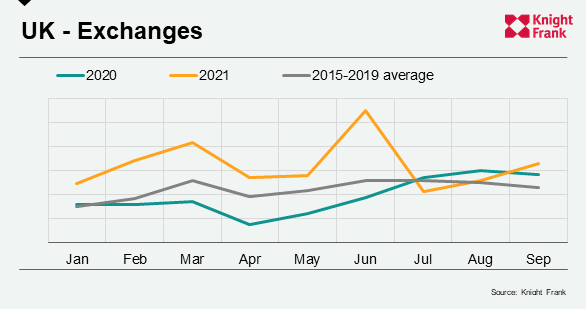

Chart 3: Sales Volumes.

The impact of the stamp duty holiday is clear. A spike in sales volumes in March 2021 (the original deadline before a deferral) is followed by a larger peak in June (maximum saving of £15,000) and a smaller rise in September (maximum saving of £2,500).

As a result, the number of exchanges this September was 45% above the five-year average between 2015 and 2019 and 16% above the same month in 2020.

The obvious question is whether this momentum will continue without the stamp duty holiday in place. A lull in October is to be expected given what happened in April and July but it should be no more than a blip.

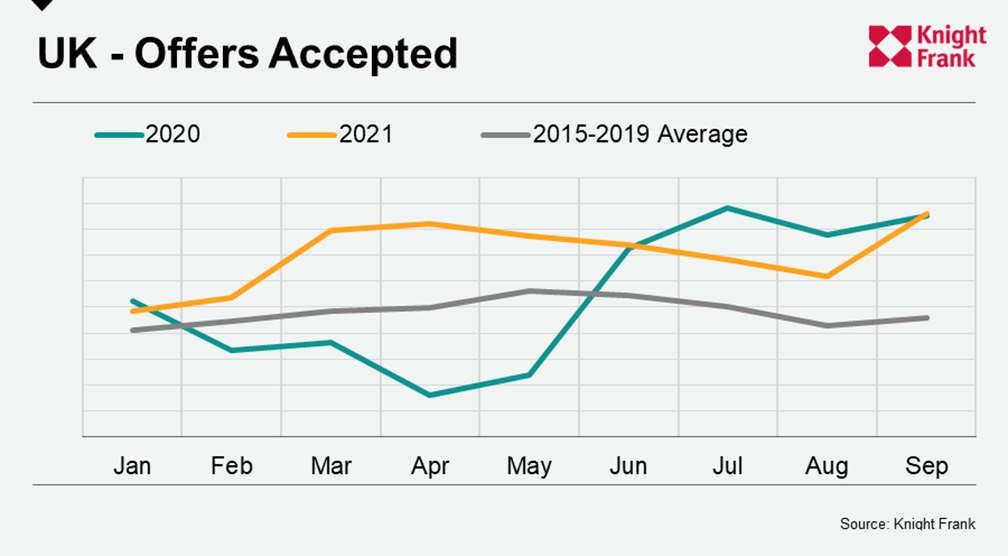

Chart 4: Future Activity.

The other reason to believe sales volumes will hold up is the strength of the transaction pipeline.

The number of offers accepted in September was fractionally higher than the same month last year – two months into a stamp duty holiday.

It was also 88% above the pre-pandemic five-year average, underlining just how active the run-up to Christmas will be.

Despite questions around supply, the desire for more space is still driving decision-making, particularly as offices re-open and working patterns become clearer. Meanwhile, as we reported last week, London flats are back on the agenda for some who have already moved outside the M25.