Monday property news update - 19th April

Banks ramp up mortgage lending, a big week in retail and polarised attitudes to working from home

5 minutes to read

Mortgages

Every three months the Bank of England surveys lenders to better understand trends and developments in credit conditions. It covers everything from mortgage lending to credit card availability.

A new survey suggests lenders are preparing for a surge in mortgage lending fuelled by the rosy economic outlook, a desire to build market share and growing appetite for risk, according to analysis from Knight Frank Finance.

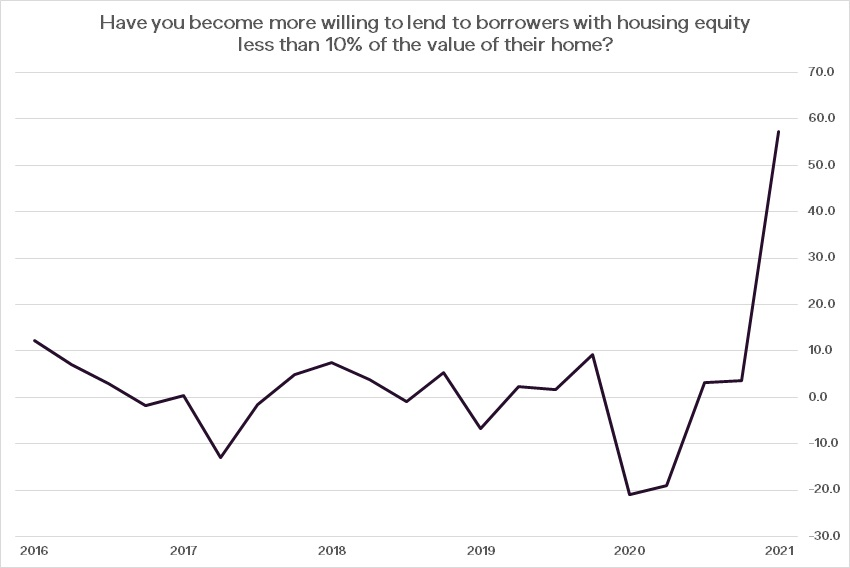

A net balance of +37.6 of survey respondents said they planned to increase mortgage lending over the next three months, the highest reading on record. Meanwhile, willingness to lend to borrowers with small deposits has soared to a net balance of +57.2 (see the chart below).

Signs of a thaw in higher loan-to-value lending will be big news for the government, which has introduced a mortgage guarantee scheme to help buyers with 5% deposits get a foot on the housing ladder. Take up will ultimately depend on the rates and affordability criteria imposed by the lenders. Meanwhile, the FT reports that some lenders intend to exclude new homes from the scheme.

Downside risks

Housing market data is coalescing around a very buoyant spring season and early summer, though pressure points are likely to emerge later in the year. The stamp duty holiday will begin to taper off from June and autumn will see the winding down of the government’s furlough scheme.

Tom Bill unpicks the latter in a new Property Market Outlook. His analysis looks at the impact of furlough on sales activity in local housing markets.

For the 20 local authorities that experienced the largest increase in the number of properties going under offer in the year to March, according to OnTheMarket data, the average rate of furloughed employment was 15%. For the 20 local authorities that experienced the lowest rise in the number of properties under offer, the average furlough rate was 14%.

Those numbers suggest the link between rates of furlough and housing market activity is limited, though how many hold onto jobs beyond the wind down is important. On that front, the picture looks increasingly positive. The ONS now expects unemployment to peak at 5.9% in 2022, far below initial forecasts.

Lockdown's cash pile, continued...

We've talked before about the lockdown cash pile. Consultancy Capital Economics estimates households had saved a record £140 billion by the end of 2020, 5% of which the Bank of England thinks will be spent in a consumer-led recovery as lockdown eases.

This is another of the pandemic's global themes. The FT reports on Moody's data suggesting consumers around the world have stockpiled an extra $5.4tn, equating to more than 6% of global gross domestic product.

Booming global consumer confidence suggests shoppers will be willing to spend again as soon as shops, bars and restaurants reopen - in the first quarter of this year the Conference Board global consumer confidence index hit its highest level since records began in 2005, with significant uplifts in all regions of the world.

A big week in retail

With the reopening of non-essential retail in the UK last Monday, we have some data to assess how that consumer-led recovery is taking shape. On the day of reopening, footfall across all destinations was up by a massive +516% year-on-year, with Shopping Centres seeing the largest uplift (+657%), followed by High Streets (+544%) and Retail Parks (+308%), according to a new analysis from Stephen Springham

Comparisons with past years, however, provide a clearer illustration of the long road to recovery faced by UK retailers. Compared to the corresponding Monday in 2019, footfall across all destinations was down -15.9% (Shopping Centres -16.5%, High Streets -26.7%, Retail Parks +7.8%).

As Stephen notes, this is a more realistic reflection of a market that is still constrained by a number of factors. Some consumers (34%, according to Mintel) still feel unsafe visiting stores, while ongoing social-distancing is still a constraint on capacity. These will ease over time, reinforcing the picture that the sector's recovery will be a marathon not a sprint.

The future of the office

A new Deloitte survey covered in the Telegraph highlights polarised attitudes to post-pandemic working habits. Almost a quarter of office workers want to work from home permanently, meanwhile 28% are keen to get back to the office. Some 42% want a balance between the extremes, with at least two days at home each week.

Like other measures we've covered, working from home has been more difficult for certain groups, in this case those under 35. Last month we covered research from Nationwide and Ipsos Mori suggesting the wellbeing of parents while WFH appears significantly worse than all adult households, plus women are taking on the lion's share of childcare and are more likely to lose or quit their job.

Meanwhile David Bourla has this analysis of an improving Paris office market.

In other news...

Anna Ward analyses the impact of Barking & Dagenham’s freeport on local housing markets, Stephen Wong on the next phase of Asia-Pacific REITS and a new Rural Market Update from Andrew Shirley.

You can hear more from Andrew on why Brexit isn’t going to trigger a slide in UK land values, or how the ESG agenda is breathing new life into UK farmland as an investment in a new webinar tomorrow at 9am. Register here.

Plus, global Covid-19 cases hit a weekly record, HSBC top staff to hot desk as the lender scraps the executive floor, Oxford starts first study to reinfect recovered Covid patients, and finally, how Birmingham is emerging from London’s shadow.

Photo by Joe Stubbs on Unsplash