The Knight Frank Rural Property and Business Update – 29 March

Our weekly dose of news, views and insight from the world of farming, food and landownership

4 minutes to read

A few weeks ago the government set out five legally binding principles that would form the backbone of its forthcoming Environment Bill. It has now released an encouraging new report that details how government departments will ensure rural areas are taken into account when designing and delivering new policies. It will be interesting to see how harmoniously these two sets of ambitions work together over the coming years. Next week The Rural Update will be taking a break for Easter.

Please do get in touch with me or my colleagues mentioned below if you’d like to discuss any of the issues covered. We’d love to hear from you

Andrew Shirley, Head of Rural Research

In this week’s update:

• Commodity markets – A roaring start to the twenties

• Capital Gains Tax – Chancellor kicks the can on “Tax day”

• Borrowing – Loan costs remain low

• Rural economy – Defra releases future proofing plans

• Overseas news – Fertile land more susceptible to bomb risk

Commodity markets – A roaring start to the twenties

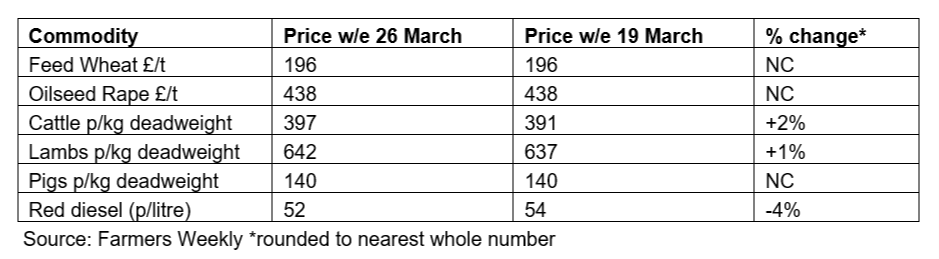

It’s been a strong start to the year for agricultural commodities as the first quarter comes to an end. Pre-Christmas feed wheat was £188/t per tonne and it broke the £200 barrier as soon as trading opened in the New Year. So far most of those gains have been held on to, despite the rise in the value of the pound. Oilseed rape has surged and is up over 20% on the year. Sheep have also performed well, up by almost a third. Unfortunately, red diesel has also risen as the world starts to move again, but prices are still below pre-pandemic levels.

Capital Gains Tax – Chancellor kicks the can on “Tax day”

Accountants were warning that the so-called “Tax day” last week, when the Treasury said it planned to release a number of new policies and consultations, could be more significant for landowners than the Budget itself.

In the end, however, most described it as a “damp squib” with most of the 30 or so announcements on the day dedicated to making the tax system more efficient. The anticipated reform of the Capital Gains Tax system, which could have had significant implications for farms and estates, failed to materialise.

The government did though announce it will legislate to tighten tax rules for second home owners meaning they can only register for business rates if their properties are genuine holiday lets.

Read the full list of new policies

Shooting – Lead shot facing its Waterloo

Lead ammunition could be phased out under government plans to help protect wildlife and nature, Environment Minister Rebecca Pow announced last week. There will be a two-year review and public consultation. A ban would fall under the UK’s new post-Brexit chemical regulation system – UK REACH. Countryside organisations support the move.

CLA Deputy President Mark Tufnell said: “The shooting sector has recognised that there needs to be a transition to non-toxic shot for game shooting and recommended a five-year period to allow the cartridge manufacturers to change over a year ago.”

Read the government’s full statement

Rural borrowing – Loan costs remain low

Country houses, estates and farms continue to be attractive proposals for banks with competition increasing by way of low rates, says my colleague Rachel Barnett, an agri-lending specialist at Knight Frank Finance.

Private banks are now agreeing variable rates as low as 1.9% with the high street even lower. Fixed rates have increased over the last few months due to market movements however five and ten-year fixed rates remain attractive.

“It is a good time to review financial arrangements against land and property,” says Rachel.

Do get in touch with Rachel if you need help with any borrowing requirements

Rural economy – Defra releases future proofing plans

A new report Rural Proofing in England 2020: Delivering policy in a rural context, published last week sets out how government departments are working to ensure rural areas are taken into account in designing and delivering policies.

It claims these policies will help to strengthen the rural economy, develop rural infrastructure, deliver rural services and manage the natural environment.

Read Defra’s full rural proofing plans

Overseas news – Fertile land more susceptible to bomb risk

Naturally farmers prefer to grow crops on their most productive land, but that’s not always the case in Cambodia. A fascinating piece of geo-spatial analysis in last week’s edition of The Economist showed that the 1.8 million tonnes of ordnance dropped on the country during the Vietnam war was least likely to have detonated if it landed on softer, more fertile soils. Since the end of the war tens of thousands of farmers have been killed by unexploded bombs, as well as landmines from other conflicts. The resulting reluctance to use the best land has seen a drop in rice yields, hitting the country’s economy.