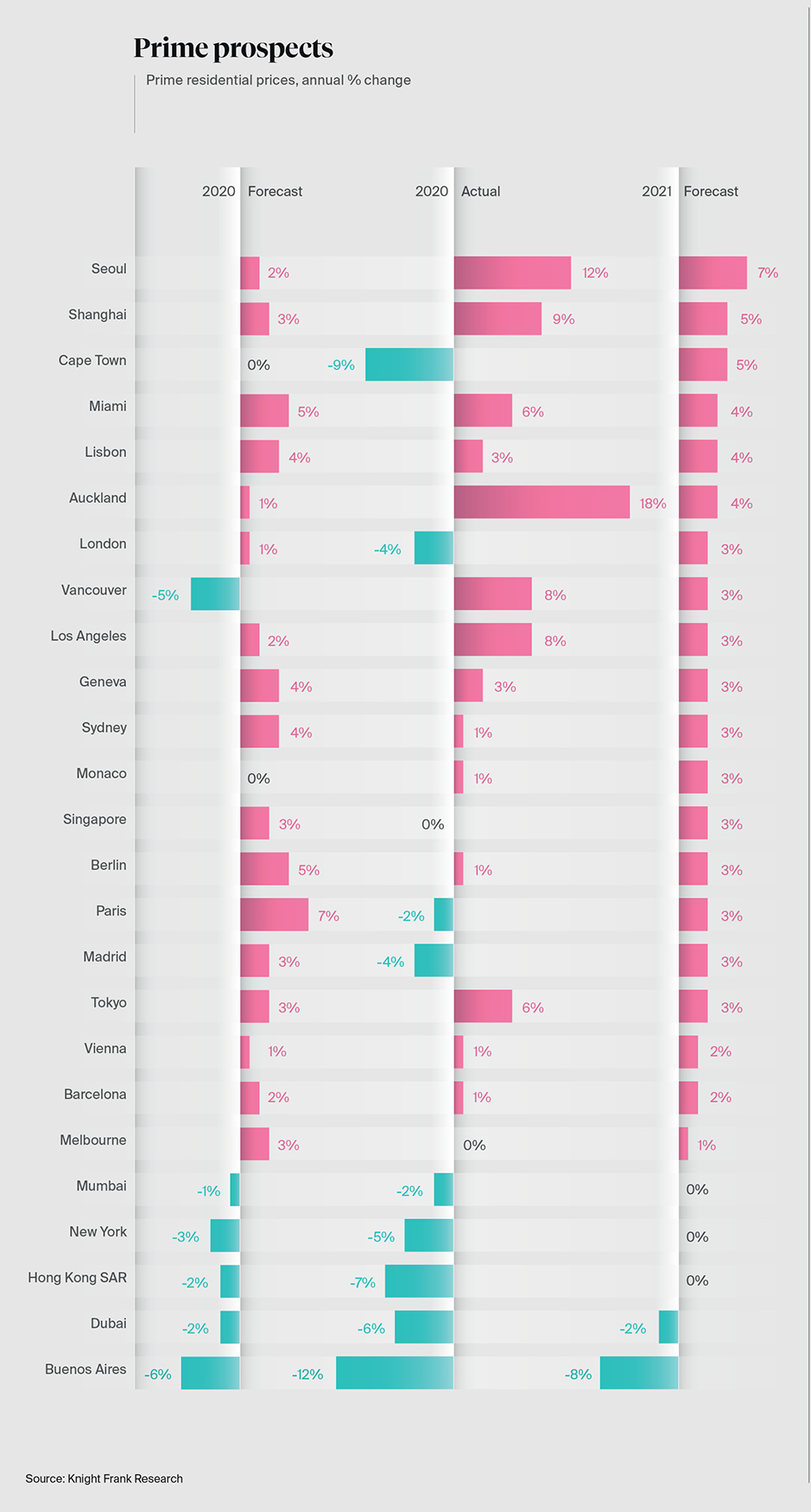

2021 luxury residential property price forecasts in 25 key cities

We reveal our forecasts for prime residential property prices in 25 key locations around the world during 2021.

4 minutes to read

At a glance:

- Markets reliant on large inflows of international demand, such as Monaco and Dubai, saw prime sales volumes decline

- Governments are focused on replenishing public finances through tax changes

- Property in a coastal or resort destination are in demand

- Among Asian and African UHNWIs education is the motivation behind around 10% of property purchases

- With greater flexibility around remote working, expectations for second homes are increasing

Luxury housing markets performed better than expected in 2020, with 66 of the 100 markets featured in our Prime International Residential Index (PIRI) seeing growth and prices, on average, rising by almost 2%.

Looking ahead, the picture for 2021 is a similar one, with prices again predicted to rise by an average of 2% but, as our selection of 25 prime locations shows, within this there is wide variance in forecast performance.

Seoul leads with growth of 7%. Despite 20 rounds of cooling measures, demand continues to outstrip supply in a city with a population larger than that of either London or New York.

Shanghai and Cape Town share second place with a 5% mooted rise, albeit for contrasting reasons. Economic recovery in the Chinese Mainland’s commercial hub is already well underway with China’s GDP forecast to grow by over 8% in 2021.

In Cape Town prices are rising from a low base, having seen a decline on the back of economic weakness, currency volatility and the drought of 2018.

Miami, Lisbon and Auckland share fourth place with price growth of 4%. We expect pent- up demand, a benign tax regime and low interest rates to be their respective drivers.

London is one of a number of locations set to see 3% price growth in 2021. A stamp duty holiday, an end to Brexit-induced political uncertainty and the potential relaxation of international travel restrictions will likely offset a new surcharge for foreign buyers and a potential strengthening of the pound.

Taking control

Markets such as Auckland and Vancouver, which saw strong pent-up demand post Covid-19 lockdowns, will see sales volumes and price growth moderate. Policymakers in both markets have a proven track record of intervening to curtail price inflation.

Sydney, Singapore and Los Angeles sit mid-table with forecast price growth of 3%. All have seen tight prime supply levels exacerbated by the pandemic.

US cities have the capacity to surprise on the upside in 2021. If the dollar weakens to the extent some analysts are predicting, this could motivate more overseas buyers. A rethink of the state and local tax (SALT) deduction could also be on the cards, redirecting attention back to states such as New York and California.

In Europe, steady and sustainable growth (3%) is the outlook for Berlin, Paris and Madrid, with comparative value, limited new stock and the delivery of high-grade projects their respective market drivers. All three cities have regeneration projects planned in the coming decade that will upgrade stock and improve accessibility.

Only two cities, Dubai (-2%) and Buenos Aires (-8%), are forecast to see prime values decline. Latin America, with a limited vaccine rollout, is set to recover more slowly than other regions. Dubai’s rate of price decline should slow as travel restrictions ease and the postponed Expo 2020 (hopefully) takes place.

Of course, forecasting in such turbulent times is fraught with risk.

How did we do in 2020?

Notwithstanding a global pandemic and the largest economic downturn since the Great Depression, we came within fewer than three percentage points of getting it right in 11 of the 25 markets tracked, and we were firmly on the money with Vienna and Mumbai where our forecast was accurate to within less than half a percentage point.

Auckland and Vancouver wrongfooted us but, in our defence, a pandemic-fuelled post-lockdown surge was hard to foresee at the end of 2019.

Our European city forecasts proved mixed. We were within one percentage point when it came to Lisbon, Geneva and Monaco, but less accurate in relation to Paris, Madrid and Berlin. All posted weaker price growth than we envisaged, as international travel bans clipped the wings of investors and prime buyers alike.

Hit by four waves of Covid-19 and heightened political tensions, Hong Kong dipped lower than we anticipated. For London, our upbeat forecast has been put back a year: not even a stamp duty holiday could offset a spring market shutdown and travel bans. New York eluded us by 2%. We’d priced in a bumpy year… we just didn’t know how bumpy.

What we'll be watching in 2021

Travel recovery

The speed with which commercial air travel resumes and the Airbnb model recovers.

Renters return

How soon overseas students and corporate tenants return to gateway cities.

Close to home

Whether UHNWIs focus on second homes with better connections to their primary residence.

Push and pull

The roll-out and roll-back of “golden” and “welcome” visas, and citizenship by investment schemes.

Projects take a hit?

The impact of Covid-19 on the scale of future infrastructure projects like the Paris Olympics and China’s Belt and Road Initiative.

The need for speed

The extent to which second-home buyers prioritise destinations with fast broadband for home working.