For borrowers in Europe, Covid-19 won’t be the same as the GFC

By Lisa Attenborough, Partner, Capital Advisory

Amid global uncertainty, I am regularly asked about the potential distress in the debt market; when is it going to happen; how much of it will there be; and is this going to be a repeat of the Global Financial Crisis?

4 minutes to read

It’s understandable that these questions are at the forefront of people’s minds – it feels like we’ve leapt from one crisis to the next in a relatively short period of time. However, the outlook for borrowers across Europe shouldn’t be so bleak. Here’s why.

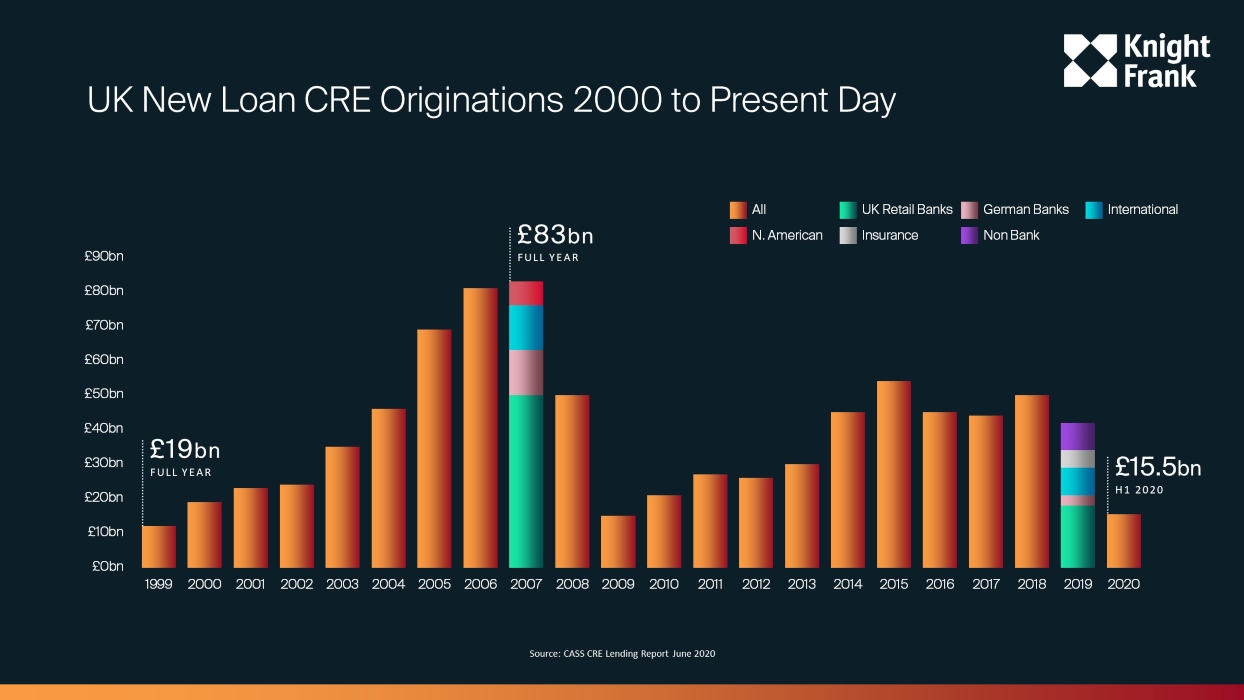

In 2007, just before the onset of the Global Financial Crisis, the amount of new commercial real estate loan originations in the UK peaked at around £83bn. Using the UK market as a reference point, the loan market back then was dominated by retail banks, which accounted for around 60% of new loan originations in that year.

Winding the clock forward, the range of active lender types has increased compared to 2007. UK retail banks accounted for 43% of new loan originations in the first half of 2019, followed by international lenders and non-bank lenders, which, as a lender type, didn’t exist in CRE lending in 2007. This is a trend that has been replicated across Europe to varying degrees and this increased liquidity in the market is a key differentiating factor between the GFC and today’s pandemic.

In addition to the wider range of lenders in the market today, leverage is at historic lows. Prior to the Global Financial Crisis, senior lenders were providing loans at around 80% loan to value (LTV), and in some cases, even higher. Coming into 2020, the average LTV for commercial real estate was closer to 55%. Lower leveraged positions in a post-Covid environment will give borrowers more headroom should values decrease, unlike post-GFC.

Finally, a key point to note is that lenders came into 2020 with a far stronger capital base compared to pre-GFC and more crucially, from their experience in handling defaulting loans post-GFC, have approached this crisis with a different mind-set. This time around, we have witnessed (for the most part) a more collaborative approach from lenders in terms of how they are working through potential defaults with borrowers. In many cases, covenant testing holidays have been granted for up to 12 months in order to give borrowers time to work through this difficult period.

Taking all of that into account, we don’t believe this will be a repeat of the GFC. The combination of low leverage, a wider range of debt providers and a debt community with a stronger capital base has created a more resilient debt landscape which has the ability to weather this storm.

This, of course, doesn’t mean that the debt market will be distress-free. Over the past six months, we’ve seen a polarisation of appetite from lenders with regards to the various sub-sectors of real estate finance. At one end of the spectrum, debt finance is readily available for both the logistics and residential sectors. This abundance of supply has ensured that debt pricing has been maintained at competitive levels for transactions within those sub-sectors.

In Spain, the Netherlands and Germany, we have obtained post-Covid debt financing terms for logistics assets at all-in rates ranging between 1.50% and 1.80%. Furthermore, due to a sharp decrease in reference rates post-Covid, debt secured against logistics and residential properties is now, in some cases, priced at lower rates than before the pandemic. At the opposite end of the spectrum, lender appetite for retail and hospitality assets has contracted.

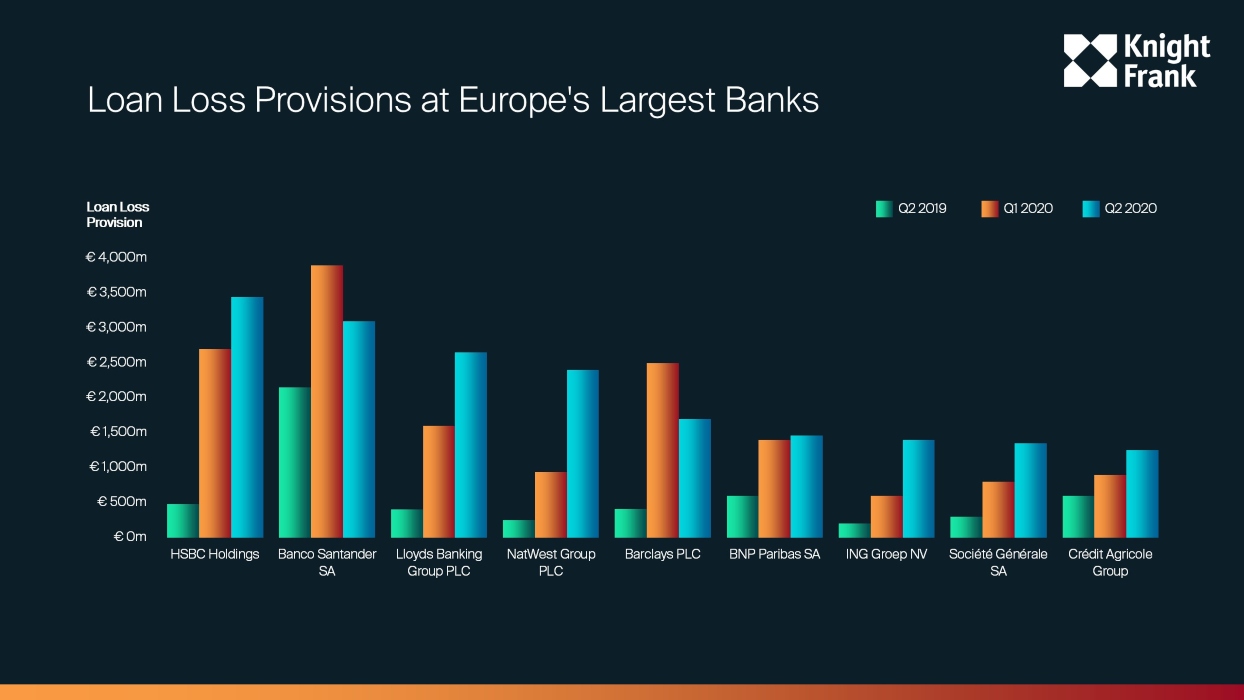

A potential indicator of distress on the horizon in the banking sector is the number of bad debts lenders are beginning to provide for. As you can see in the chart below, lenders across Europe have increased loan loss provisions in Q1 and Q2 of 2020, and whilst changes in the way that UK banks have to provision for loan losses will have driven an increase in bad debt provisions, the underlying numbers are still far higher than in 2019.

So, when will lenders begin to call on these bad debts? We know that the effects of Covid-19 were felt across Europe at the start of Q1 of 2020, and it was at that point that lenders began to deal with an influx of covenant waiver requests. Guided by a series of supervisory and policy measures which were designed to help maintain financial stability to ensure that customers were being treated fairly, lenders were encouraged to demonstrate forbearance.

As a result, in many cases, covenant testing holidays were granted for a period of up to 12 months. With that in mind, we predict that from March 2021, we will begin to see more activity being driven by lenders looking for borrowers to restructure and recapitalise their facilities.

2020 has been a year of unexpected events, and whilst there is still some way to go before we fully understand what the new normal will look like, debt providers across Europe have demonstrated resilience.