Australia’s super prime property market has record third quarter for sales

This year Australia’s super prime residential property market has clocked up the highest number of third quarter sales ever recorded, demonstrating strong demand for luxury housing in the midst of the pandemic and recession, according to the latest Knight Frank research.

2 minutes to read

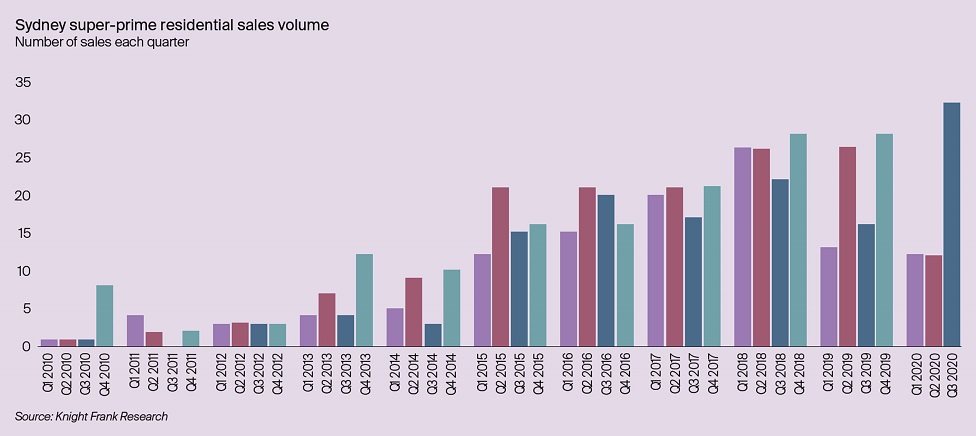

In total 39 transactions of super prime properties were recorded with a collective value of $594 million over the three months to the end of September; the highest tally of third quarter transactions on record.

The total number of national super prime sales grew by 4% year-on-year as at the end of the third quarter this year.

The super-prime market is considered to be those property sales transactions above $10 million in Sydney and Melbourne, whilst the remaining cities would need to meet a sales threshold of $7 million to be included.

Sydney accommodates the most established super-prime market in Australia. In this pivotal third quarter of 2020, sales of super prime property in the city totalled $470 million – the second greatest volume recorded for any one quarter, only eclipsed in the fourth quarter of 2018 with $580 million.

The number of Sydney’s sales transactions in the third quarter of 2020 were 94% higher than the same quarter a year ago. When combining the number of sales from the second and third quarters, 2020 is the second highest year historically.

Knight Frank’s Head of Residential Research Australia Michelle Ciesielski said transactions at the top end of the prime market – that is, the super prime market – in Australia were resilient in 2020 despite the ongoing pandemic.

“The record for third quarter transactions this year was reached when the majority of cities in Australia had eased lockdown restrictions, but it was incredibly impressive given Melbourne was still in a lockdown over this time,” she said.

“After a period of confinement, it’s not surprising buyers are seeking more space, and this will be a priority for some time to come, whether it’s upsizing to a standalone home with resort-style living and maritime facilities, or rightsizing, the downsizing trend towards luxury apartment living with house-like proportions.

“But buyers in Australia are currently faced with very little choice of established and new super-prime stock, which is driving competition for what is available and leading to record transaction volumes.”

Knight Frank National Head of Residential Shayne Harris said the stellar performance of the super prime market this year and the ongoing undersupply provided optimism for a strong finish to 2020 and start to 2021.

“These factors, along with knowing seven out of the past ten years have recorded their strongest results in the last quarter of the calendar year, including the past three consecutive years, gives an indication the year may round out better than one anticipated at the start of the pandemic,” he said.

“As many of the Australian ultra-wealthy population is unlikely to travel overseas while the borders remain closed, there’s a higher chance more money will be spent locally so it’s likely this flurry of activity will carry throughout 2021.

“Globally, the Sydney property market accommodates only a limited number of super-prime properties and this stock continues to be tightly held.”