Sydney’s prestige residential price growth forecast higher than global average

Sydney's prime residential market has remained strong in the face of the global pandemic, with predictions for price growth in 2021 higher than the global average, according to Knight Frank’s latest global research.

4 minutes to read

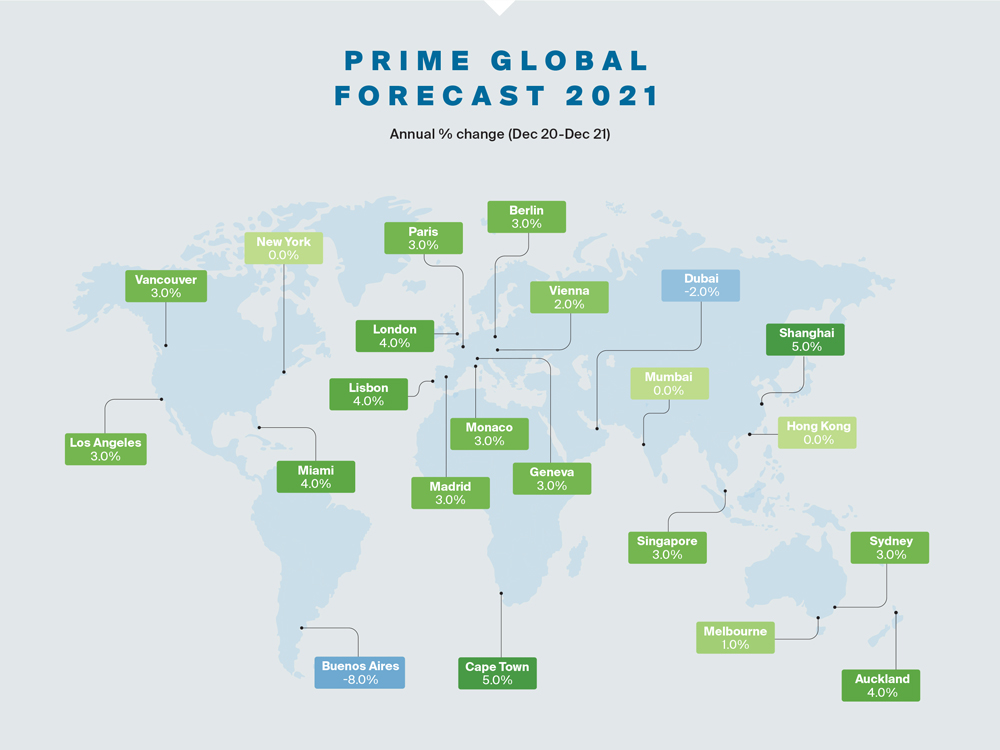

Knight Frank’s Prime Global Forecast 2021 report, in which analysts have provided their prime price forecasts for 22 cities around the globe in 2021, as well as assessing future market drivers and risks, found Sydney’s prime residential market was expected to see price rises of 3% next year, compared to the global forecast of 2%.

Prime demand in Sydney was expected to rise slightly, along with prime sales, despite a marginal increase in new supply in 2021.

In Melbourne, prime price growth for 2021 is forecast in the positive territory at 1%, with prime sales expected to pick up post lockdown although demand is expected to remain lower in 2021 with a solid pipeline of new prime supply.

Knight Frank’s Head of Residential Research Australia, Michelle Ciesielski said the top three key prime property market drivers for Sydney are the pandemic-fuelled domestic demand, supply shortage and low interest rates.

“These will be balanced out by the risks identified in the report’s Risk Monitor – for Sydney prime property the biggest risks ahead are the global and local economic performance, travel restrictions and the government’s ongoing response to the pandemic,” she said.

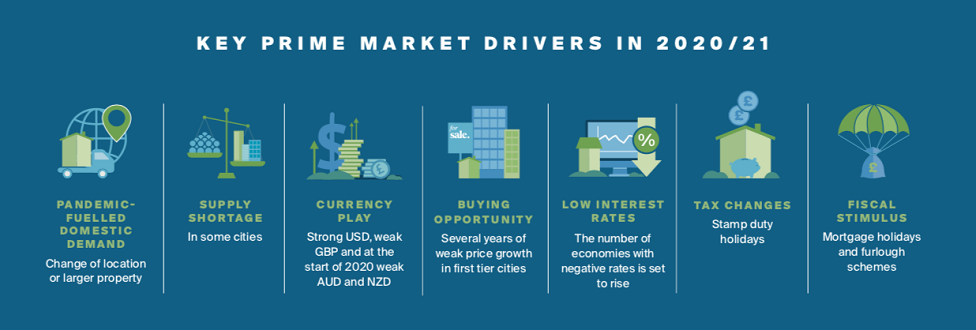

The Prime Global Forecast 2021 report found other main drivers for global prime property markets over the coming year include key currency plays, buying opportunities for those impacted markets in 2020, tax changes and fiscal stimulus, while other risk factors include higher taxes, geopolitical crises, currency shifts, the balance of new luxury stock, stamp duty holidays and Brexit.

Ms Ciesielski said Knight Frank’s Prime Global Forecast was undertaken in October, prior to Pfizer’s COVID vaccine announcement, which could positively charge the forecast and kickstart a wave of renewed growth in prime property markets around the world.

“The rollout of a vaccine would see travel restrictions ease and foreign buyer activity start to recover, pushing our forecasts for 2021 higher,” she said.

“In 2021, we expect 20 of the 22 global cities to see prices remain flat or increase, a reversal of the trend expected at the end of 2020, where nine cities are likely to close the year with lower prices.

“In 2020, prime prices across the 22 cities are, on average, expected to remain static, before rising by two per cent in 2021.

“While we experienced great challenges this year with COVID-19, our data shows that prime property markets around the world have remained largely resilient, and this has particularly been the case in Australia, with our biggest cities of Sydney and Melbourne continuing to see growth despite lockdowns.”

The Knight Frank Prime Global Forecast found Shanghai and Cape Town lead the expectations for prime price growth in 2021, with annual price growth of 5% forecast.

Three broad groups look set to emerge in 2021, according to the report:

-

Those markets where prime prices are expected to rebound, assisted by low interest rates, pent-up demand, tax holidays or because of firm market fundamentals, and these include Sydney, London, Paris, Berlin and Madrid.

-

Secondly, there are some markets where the pandemic will have little impact on prime pricing, in some cases because growth was already weak and will remain so (Buenos Aires), because the market has already picked up where it left off prior to the pandemic (Shanghai) or because prime prices were accelerating and are expected to do so again due to strong investment in infrastructure (Lisbon).

-

Finally, there are a handful of markets that unexpectedly saw activity surge in 2020 as residents looked to upgrade to larger properties with more outdoor space. These include Auckland, Vancouver, Geneva, Los Angeles and Miami. Here, prime price growth will moderate slightly on the back of a frenetic 2020, but still remain in positive territory.

Knight Frank National Head of Residential Shayne Harris said prime property sales were back to pre-pandemic levels in Sydney, while that was not yet the case in Melbourne.

“In Sydney, we are seeing a higher than expected volume of wealthy expats wishing to return home, which will grow the buyer pool for prime residential property as international travel restrictions ease over the coming months and years.

“Many of the wealthy population are considering expanding their property portfolios while the prime market records modest growth and low interest rates cheap.

“As confidence continues to grow in the new year, we’re likely to see more prime properties listed and only a low number of new prime homes built, so this will underpin our forecast for Sydney prime prices.

“Although Melbourne is slowly easing out of lockdown, the city now lags other major Australian cities in the recovery of their prime property market, though there’s still the prospect of price growth by the end of 2021 with the wealthy considering their next move after an extended lockdown. The ongoing impact of a lack of overseas immigration and education investment will hamper residential development market growth and confidence.

“There have however been some exceptional new homes built in Melbourne recently, with more in the pipeline, so this will place pressure on the prime market given limited new wealth migrating to the city.

The Knight Frank Prime Global Forecast report found 24% of respondents in its global buyer survey said they were more likely to move in the next 12 months due to the pandemic.

Meanwhile, 45% of cities reported that prime sales were already back to pre-pandemic levels in Q3 2020.