US Election Outcome and Its Impact on Asia-Pacific Markets

2020, marked by a pronounced level of global turmoil and disruptions, arrived at another major turning point with the US Presidential Election.

3 minutes to read

This passing election cycle represents one of the most pivotal moments in recent history due to its implications on geopolitics and global economics. President-elect Joe Biden’s victory is expected to have implications on Asia-Pacific (APAC) real estate markets. However, with a senate majority still yet to be decided, uncertainty has yet to be weeded out entirely. Below we examine what impact the results may have on the APAC’s real estate markets.

Cautious Optimism as the Dust Settles

With the US presidential race in the rear view, all eyes look towards the race for the senate majority. Analysts and market commentary agreed, before the election, that a Blue Wave outcome was optimal for the US economy, as President-elect Biden would have unfettered control over foreign and domestic policies. It remains to be seen if he could garner sufficient bipartisan support to achieve some of his key goals in office under a split Congress.

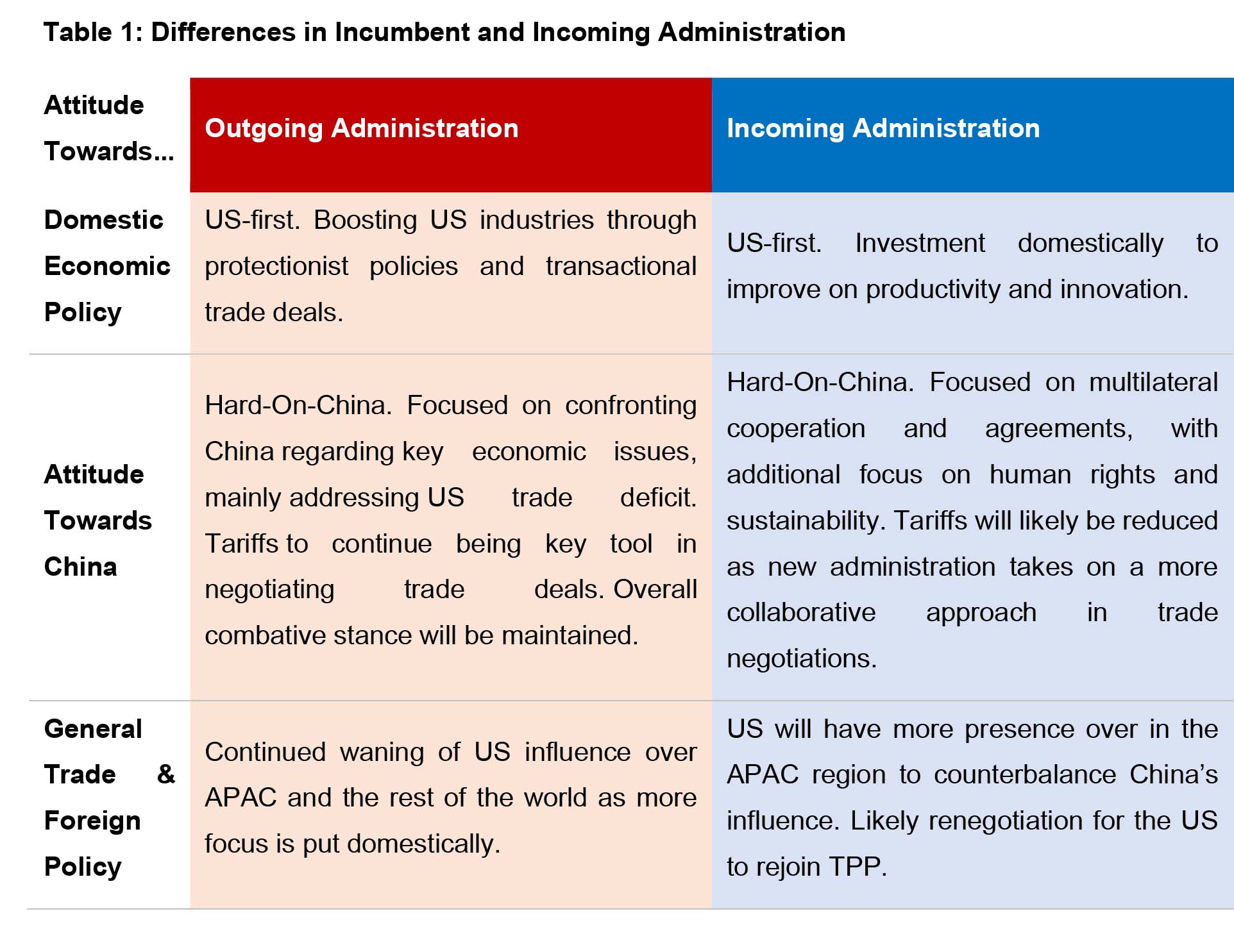

The next presidential term will not be a complete 180-degree reversal of the policies introduced under the incumbent president. US-First and Tough-on-China will remain key themes under the new administration. However, the way policies shape up would be dissimilar. The tough-on-China tactics would play out differently as blunter economic policies such as tariffs would be replaced with multilateral cooperation and agreements. The focus of this tension is likely to shift from an almost purely economic focus to one with a greater spotlight on human rights and sustainability.

For APAC Real Estate players, this should be relatively good news as they can expect better US economic performance to spill over into the global economy. US capital outflows, particularly into the APAC region, may increase due to the improved economic outlooks and a general sense of predictability in geopolitics compared to the incumbent administration.

APAC looks set to enjoy an added boost to its recovery cycle as Covid-19 comes under control in more cities. In the nearer term, it would likely lead to a boost in transactional activities across APAC as investors seek to make moves ahead of an anticipated rate hike as the US economy is projected to return to health.

However, not all markets within APAC would receive this news with the same level of enthusiasm. Mainland Chinese investors may take the change of regime in the US White House with more caution in the near term, as there may be a lack of certainty on how closely Biden would maintain the status quo of US-China relations. Markets that have been candidates for firms’ China+1 strategy may see some level of investment influx slow, as multi-national corporations take a moment to reassess their geographical strategies. The possible reassertion of US economic and political influence into the APAC region could also slow down Mainland China’s Belt and Road Initiative, which would impact a major economic engine for some of the region’s economies. Biden’s promise to have the US rejoin the Trans Pacific Partnership (TPP) will further muddy the waters in terms of how new equilibriums will be arrived at.

While the dust has yet to fully settle from the US election outcome, APAC investors can expect that the proceeding period is much less uncertain. The road ahead for real estate players is to assess where the new normal is and calculate a new set of strategies that make sense in the context of a Biden administration, with or without the support of, a Democratic-majority senate in congress. Generally, his victory spells good news for the region’s economy in the longer-term, but near-term impacts still hinge on many relative unknowns.