Green investment is having a moment

Whether it be due to international desire to rebuild economies upon sustainable principles, or the possibility of a change in White House administration to one that has committed to net-zero emissions no later than 2050, green investment is having a moment.

2 minutes to read

Three of Asia’s largest economies have made net-zero pledges in the past two months, joining the EU, UK and others. Last week, South Korea joined China and Japan by pledging 2050 as the target date, matching Japan’s ambitions and 10 years ahead of China’s. This came with announcing plans to spend $7bn on green-focused growth as part of the post-pandemic recovery.

Investment into climate and environmental projects is breaking records. September marked a record month for the issuance of green bonds with more than $50bn according to BloombergNEF. Since the market began in 2007 there has now been more than $1 trillion issued. Despite the pandemic, 2020 could be on for a record year with issuance up 12% in the first nine months of 2020.

Societal impact investing is following suit. The European Union’s recent sale of SURE program bonds attracted the highest-ever demand for an issue, with bids almost 14 times the issue. According to Reuters, there were more that €233bn of bids for the first €17bn sale under the €100bn. The proceeds of the SURE bonds will go to help support employment through the pandemic.

One major economy which has yet to join peers in a commitment to net-zero is the US, even though some states have made their own commitments. If Joe Biden claims a victory this week then there will be a shift in this mentality accelerating the green agenda. Biden’s climate and environmental justice proposals foresee federal investment of at least $2 trillion over the next 10 years.

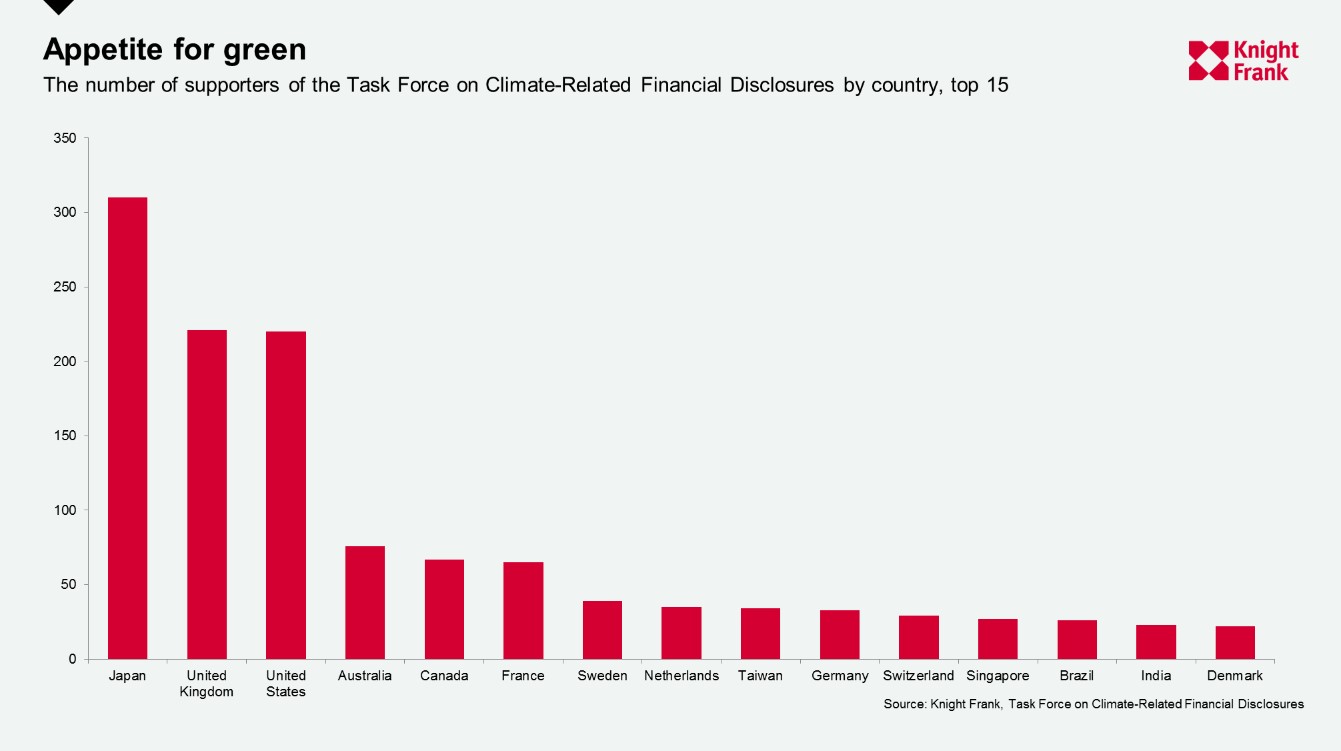

This will build on the already large number of US companies who committing to a more sustainable future. The figure below shows the number of supporters to the Task Force on Climate-Related Financial Disclosures (TCFD) by country and the US has the third highest with over 200.

If there is a step change at the governmental level this will only increase, and an even greater emphasis globally will be placed on environmental sustainability. It is clear that this has to be at the forefront of decision making and there are opportunities for investors in abundance.

Photo by Nicholas Doherty on Unsplash