The big inflation debate, and why it matters

Inflation impacts on several aspects of property markets, from rents to the cost of construction, to real returns and the price of debt.

2 minutes to read

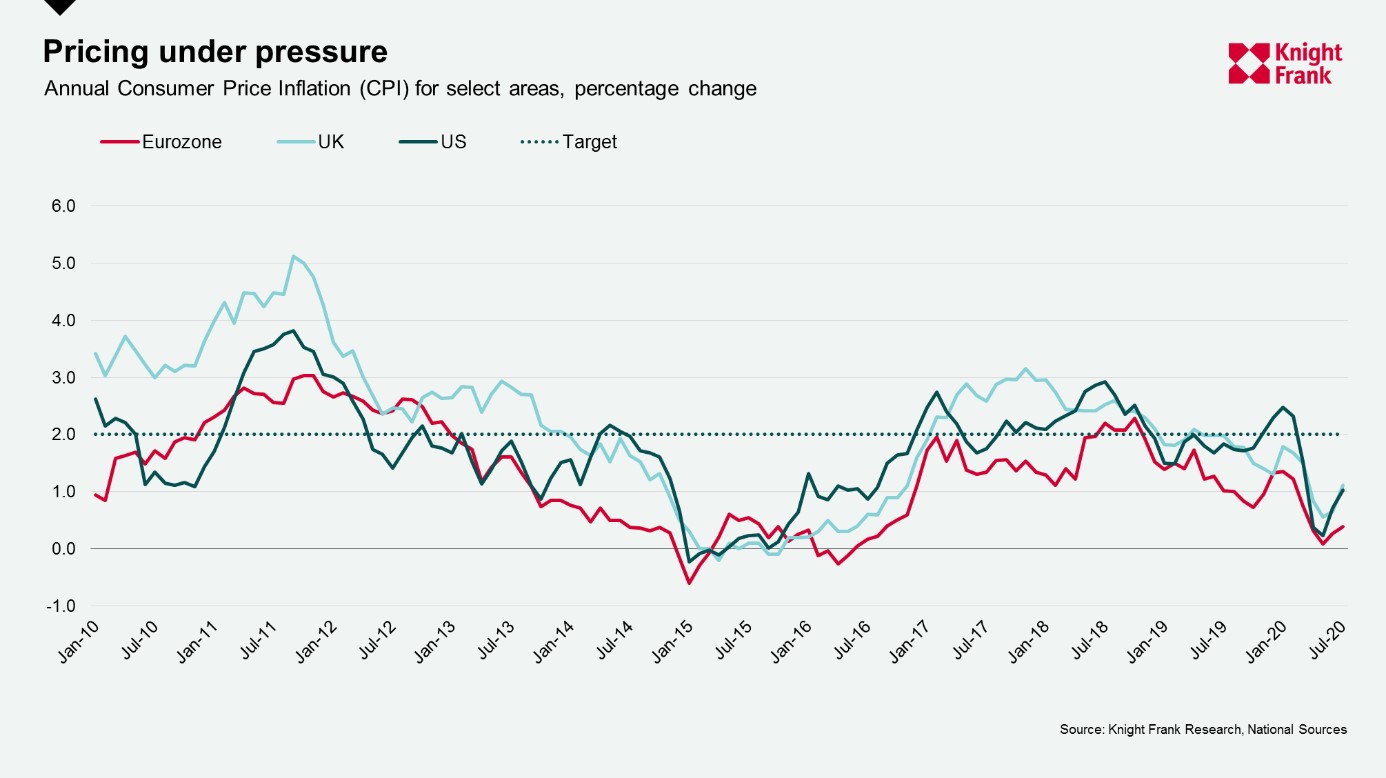

Economists are split over the direction of inflation. Some argue the unprecedented level of government and Central Bank intervention will spur inflation. Others say the level of the demand shock from the pandemic will keep a lid on prices, and may even prompt deflation. Either scenario will have implications for property owners and investors.

Why it matters

Bloomberg have succinctly set out the case for and against inflation. Usually, growth in monetary supply from a growing Central Bank balance sheet and fiscal stimulus would spur inflation. Across Europe, broad money growth accelerated to a 12-year high in July, meaning more funds have been transferred into the hands of corporations and households.

Rising inflation is good news for anybody holding a lot of debt, provided wages keep pace, as it erodes the real value of that debt. However, it can mean growth in capital values/house prices is more muted, and with little rental growth inflation can limit returns. For example, prime house prices in Edinburgh have risen by 24% over the past five years, though when accounting for inflation they have risen by a more modest 14%.

I’m in the opposing camp and believe inflation will remain lower for longer. The data suggests people remain cautious about spending. Savings rates have increased across many economies as uncertainty and unemployment woes weigh on consumers. In addition, we have seen low inflation for several decades and these expectations feed into the willingness of producers to raise prices and consumers to pay them.

Having said that, the latest inflation figures surprised on the upside. During July, inflation stood at 0.4% in the Eurozone, and at 1.1% and 1% in the UK and US respectively – these all represent a small uptick both from June’s figures and the low point in May. However, the data is likely to ebb in August, particularly in the UK, due to VAT cuts, a stronger currency and unemployment capping wage growth.

With low levels of inflation, and in some cases near deflation, then policy makers are likely to keep interest rates low. For housing markets this can support transactions as mortgage rates remain at or near record lows. Muted inflation can also keep the cost of construction materials down, which may maintain levels of affordability.

We’ll learn more as autumn approaches, but whether supply or demand pressures win out, understanding the impact of inflation can help investors position themselves in times of uncertainty.