Why foodstores present a better investment opportunity compared to other segments and assets

A new tide of investment demand is being driven by a perfect storm of massive growth in investors searching for income, combined with a stabilisation of the trading performance of the Big Four says Dominic Walton, Knight Frank Retail Investment.

7 minutes to read

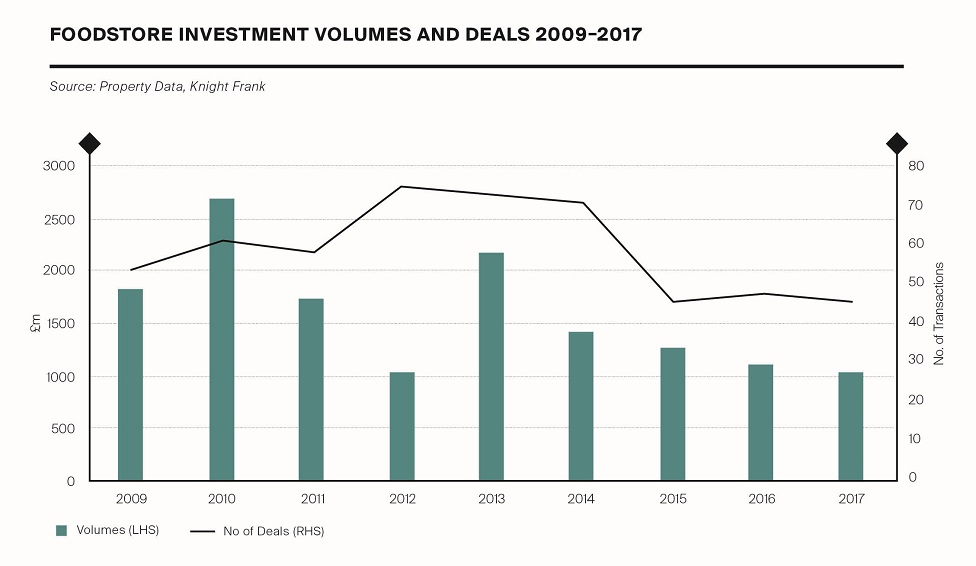

Foodstores have been in and out of favour with investors in recent years. The high water mark for investment volumes came in 2010 (£2.7bn) and for number of deals in 2012 (75).

The initial tide of investor appetite was driven by an expectation of ongoing rental growth. As the space race ground to an abrupt halt and the Big Four hit a well-documented wall of malaise, sentiment quickly turned against the sector.

Investor demand is slowly returning, albeit on a different basis than before and not without a large degree of caution. This new tide is being driven by a perfect storm of massive growth in investors searching for income, combined with a stabilisation of the trading performance of the Big Four.

The net result is that perception of the large format foodstore sector is generally improving amongst a growing number of property investors.

Strong fundamentals – and income

The fundamentals of grocery retailing remain strong. One of the key attractions for investors is long leases. Foodstores still offer leases typically longer than other retail sectors – and, indeed, the other key property segments, industrial sheds and offices.

"As the last recession showed, times of austerity and uncertainty can actually play into the hands of core retail segments such as grocery. This increasingly positive sentiment extends beyond the Big Four operators."

A run-of-the-mill 11/12 year lease on a supermarket compares favourably with many other property assets. Growth in annuity style funds has increased competition and caused significant yield compression (perhaps to past record levels) for 20+ year leases with indexation – with annual indexation definitely preferred to five yearly.

Covenants are also perceived to be strong. Despite their trials and tribulations of recent years, there is absolutely minimal risk of failure amongst the Big Four. More generally, the grocery sector is regarded as something of a ‘safe haven’ within the wider retail industry and the fact that its lifeblood is non-discretionary spend, it is more removed from the raft of challenges that many high street retailers face.

As the last recession showed, times of austerity and uncertainty can actually play into the hands of core retail segments such as grocery. This increasingly positive sentiment extends beyond the Big Four operators. Investor appetite for discounter stock – Lidl and Aldi – is massive due to longer (15-20 year) leases and indexation.

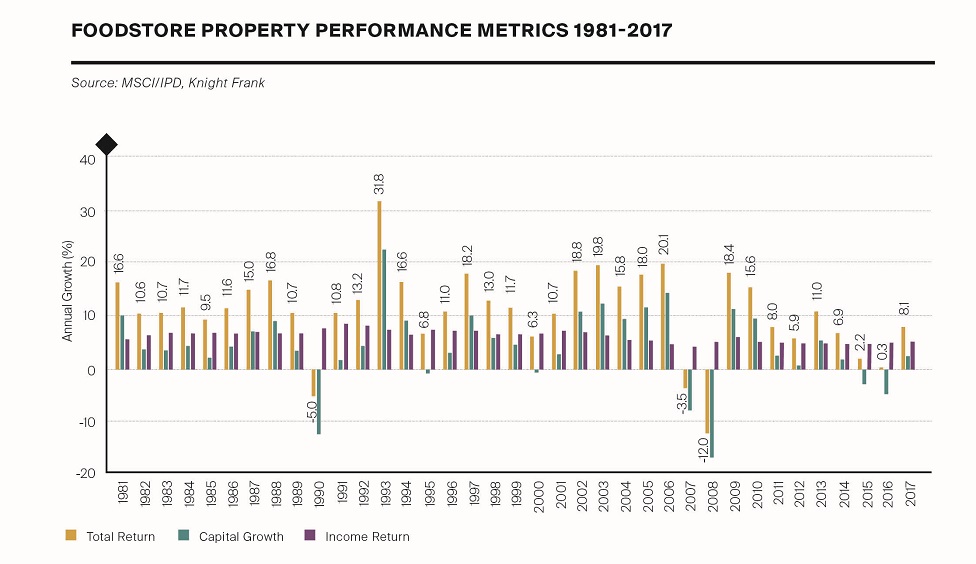

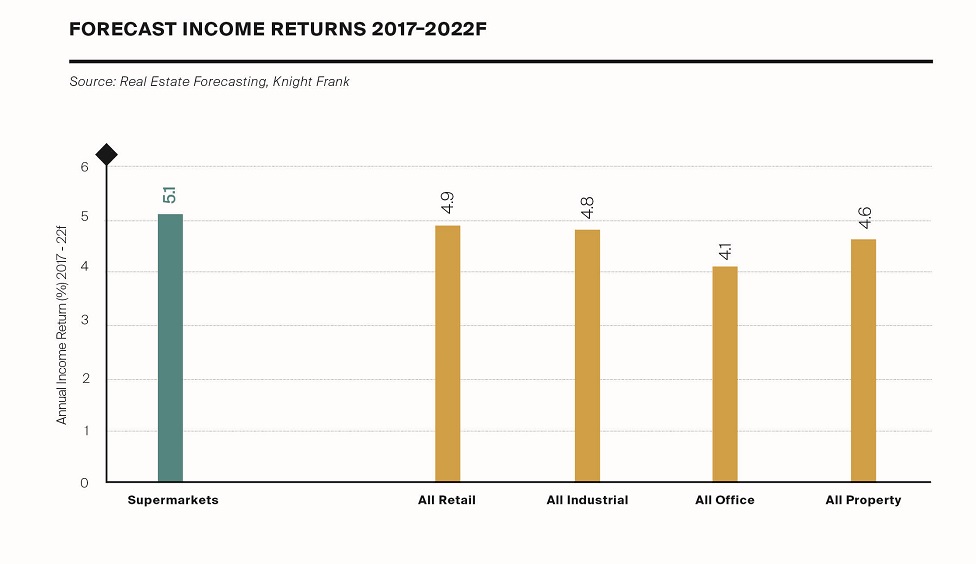

"Annual income returns in foodstores have averaged 5.2% over the last decade (5.3% in 2017). Our forecasts suggest that they will generate consistent annual income returns of 5.1% over the next five years."

Tenant contentment, a key factor across the retail property investment market, is perceived to be particularly high amongst the discounters as they continue to blaze a trail and aggressively gain market share. The discounter story remains a good one, investors continue to buy into it and they generally like the trajectory. Investors are also increasingly targeting income, and foodstores likewise score well on this measure.

According to IPD, annual income returns in foodstores have averaged 5.2% over the last decade (5.3% in 2017). Our forecasts suggest that they will generate consistent annual income returns of 5.1% over the next five years.

Again, this compares favourably not just with other retail assets (+4.9%) but also with other property classes (industrial +4.8%, offices +4.1%).

More fundamentally, there is a growing feeling that many of the over-supply scare stories of a few years ago may have been exaggerated. Large foodstores have been challenged, but very few have closed. They are internet compatible and are ultimately where the food operators make most of their money.

More fundamentally still – there is a finite supply of land in the UK and foodstores occupy large sites.

Key questions

The two main questions investors ask are:

1) How does the store trade

2) What is the residual underwrite of the site.

Store-level trading information is gold dust in retail property investment decisions, but can be very hard to come by. Perceptions can also be deceptive. A shiny new foodstore that presents well and appears busy may actually trade on a below par sales density.

"Appetite is stronger for foodstores with 20+ year leases as these seem slightly incubated from ‘closure concern’."

Conversely, a seemingly dated and under-invested store may actually be far more productive. Understanding these performance relativities and where the store sits in the hierarchy of the overall portfolio is key to second-guessing the retailer’s strategy for it going forward e.g. willingness to renew at lease expiry, possible rental upside etc.

Whilst perceptions of the sector have improved vastly, there is still a degree of nagging malaise, rekindled in part by the proposed merger between Sainsbury's and Asda. Despite all evidence to the contrary, some investors still see store closures as a risk.

Appetite is therefore far stronger for foodstores with 20+ year leases as these seem slightly incubated from ‘closure concern’, due simply to lease length. Stores with leases of 8-12 years are subject to far greater scrutiny in terms of trade quality – and hence, the significance of residual value.

In many cases, investors are looking to underwrite the value of the land. Obviously this brings into play huge regional variations. However, residential value underwrites appear only to really work in London and South East. Few other areas offer residential land values of £1m and above.

Re-gears – unchartered waters

The subject of re-gears is a key topic and one that will inevitably rise up the agenda going forward. There is already some evidence of foodstore tenants happy to agree to re-gears and we suspect that this will gradually develop more momentum. As this unfolds, this will afford investors further comfort.

The challenge here is investors having confidence on, say, an 11 year term, that the tenant will re-gear rather than close – again, underlining the questions raised as to trade quality.

Then, of course, there is the question of pricing cost of re-gear. Current evidence would suggest 12-18 months’ rent free, with some rents remaining the same, some changing (depending on the level of passing rent and again, the trading story).

Given the search for income i.e. length of term, yield compression is obviously massive for longer leases. Clearly, some foodstores will be considered over-rented, especially any that are £29/sq ft+. This will raise the difficult question of ERV. In the current market, this is tricky as no new deals are being agreed for evidence.

In the absence of actual evidence, there is the question of affordability and how the parameters may have shifted in recent years. In the past, the investment market played on this factor thinking rents would still be affordable at £35/sq ft+.

The mechanics of affordability have since been re-based considerably and broadly the comparable figure now is likely to be closer to £20/sq ft (although this will vary considerably by location and by trading story).

For investors, there is clearly some rental trade off to be had in favour of longer lease terms. Few grocery retailers would be averse to cutting their rent bills for the sake of longer commitment. Clearly, there is considerable scope for two-way negotiation that benefits both parties.

Key investors and direction of travel

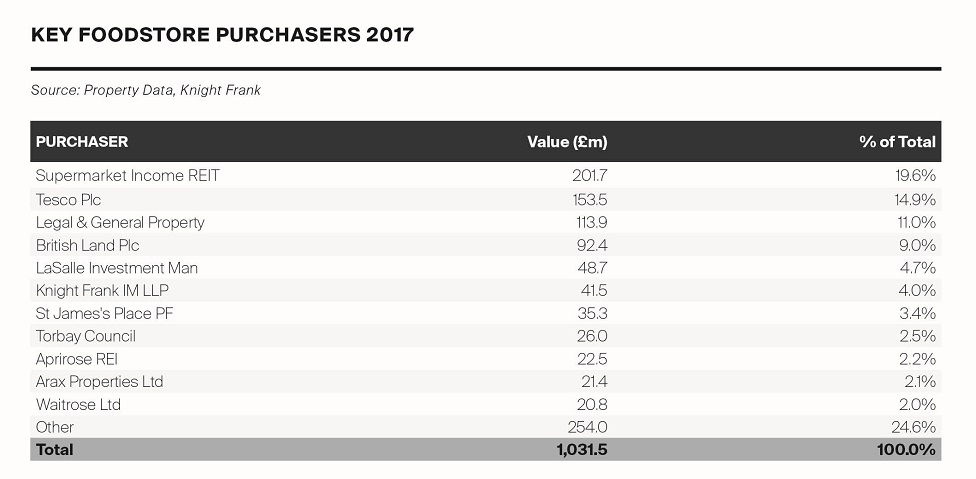

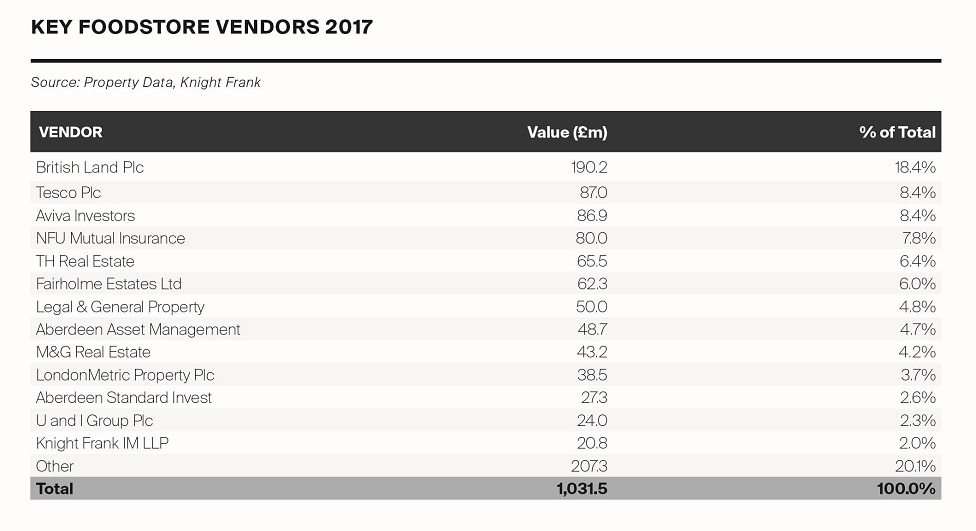

The depth and type of investors currently varies, particularly by geography. In London and the South East, the key investors are the UK institutions. For large format (100,000+ sq ft) foodstores with indexation outside the South East, investor interest is largely from overseas, particularly Middle Eastern syndicated cash. Bank debt is seemingly readily available.

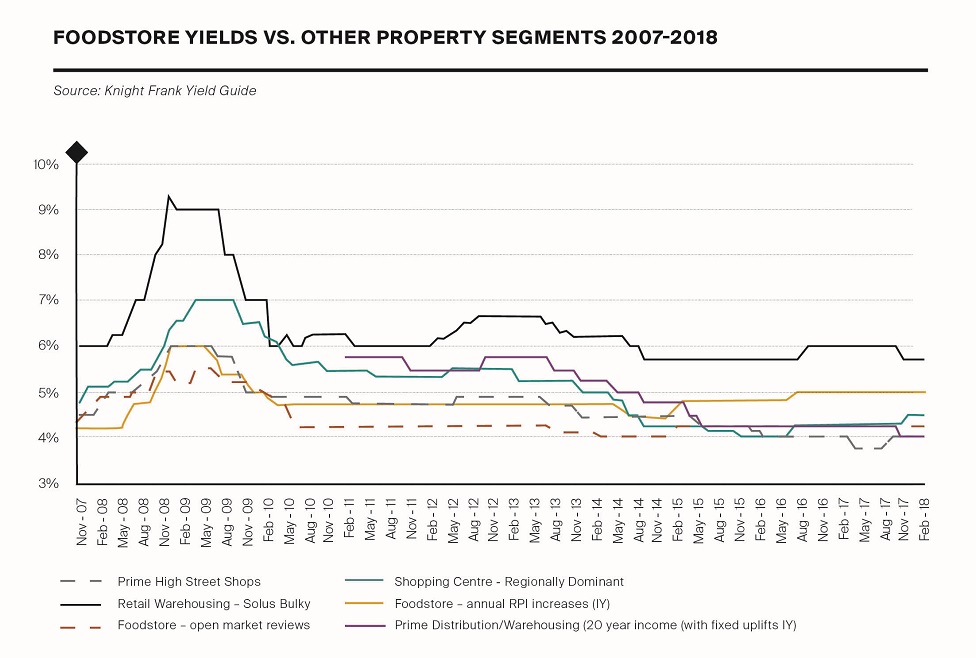

Looking forward, our opinion is of further improvement, in tandem with accelerating stabilisation of the Big Four and increasing ‘market fitness’ generally. According to Knight Frank’s Yield Guide, yields for foodstores with open market reviews are stable at 5.00%.

Those subject to annual RPI increases are keener at 4.25%. Although market sentiment is positive, this is still a 25bps discount to other property assets, such as prime distribution sheds.

Actual comparable evidence points to an even bigger gap. The Sainsbury’s store in South Woodford traded for £36.75 (4.00%) in December 2017.

Compare this with the 3.20% Net Initial Yield recently paid for a multi-let industrial estate in Battersea. Huge investor demand for logistics stock capable of fulfilling ‘last mile delivery’ is currently compressing yields for sheds, but the pricing gap with foodstores is questionable and possibly unsustainable.

After all, foodstores should carry the same alternative use premium. As a more leftfield suggestion, they may be able to fulfil a dual function of both foodstore and ‘last mile delivery’ hub – what price then?