The Rural Update: Honest conversations about food, farming and the environment

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership

8 minutes to read

Viewpoint

One of Energy Minister Ed Miliband's first actions after Labour's general election win last year was to fast-track approval for several large and highly controversial solar farms in the East of England.

Within the past few weeks, an industry-leading, environmentally friendly vertical farming business with a large facility in Lincolnshire has been forced to call in the administrators, while one of the UK’s biggest pig and poultry producers has had its application to upgrade its farms in Norfolk to become more efficient turned down by planners.

While not wishing to pass judgment on individual cases, these decisions do raise interesting questions about the government’s and the public’s attitudes toward land use, the environment, climate change, food security and farming in general.

These are questions that need to be discussed openly and honestly, especially in the context of the government’s new farm-profitability review and the launch of its Climate Adaptation Research and Innovation Framework.

Sign up to receive this newsletter and other Knight Frank research directly to your inbox.

Commodity markets

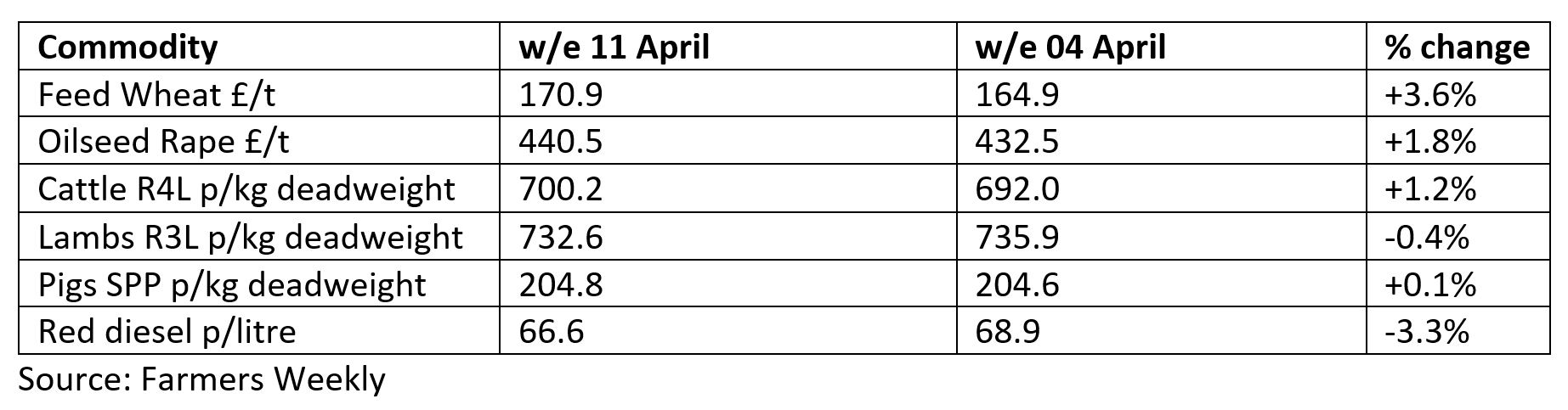

Beef hits new high

Deadweight beef prices broke through the £7/kg barrier for the first time last week as demand continues to outstrip declining cattle numbers. How much longer consumers will continue to support the market at these levels remains to be seen.

The retail price of rump steak has risen by around 13% to £17.60/kg this year, according to the AHDB's latest survey of supermarket red meat prices.

Oil - how low can it go?

Brent crude, which started the year at $76/barrel, remained under pressure last week, falling to under $63/barrel at one point, as Donald Trump’s on/off trade tariffs continued to unsettle markets.

However, some analysts reckon prices could go much lower. A note from Goldman Sachs predicts that in a worst-case scenario, the market could slump to $40/barrel by late 2026, a level not seen since the beginning of the Covid-19 pandemic in early 2020.

Currency boosts UK wheat

Global wheat markets rebounded last week as speculators returned to the market. A 3.5% slide in the value of sterling against the euro since the beginning of the month added some momentum to UK farmgate feed wheat values. A weaker pound makes imports more expensive, while our exports become more competitive on the global market.

The headline

Adapting to climate change

A new report, created jointly by Defra and the Government Office for Science, identifying the research and innovation needed to support the UK to adapt effectively to climate change was published by the government last week.

The Climate Adaptation Research and Innovation Framework (CARIF) is the first time the UK's research needs across government and sectors have been brought together in one place.

CARIF covers 11 sectors including nature, working land and seas, food security, water supply, energy, telecommunications and ICT, transport, town and cities and community preparedness/response, buildings, health, and business and finance.

In the US, meanwhile, it has been reported that the Trump administration has cut funding for the federal government’s National Climate Assessment.

The Congress-mandated report is published every four years and analyses the effects of rising temperatures on human health, agriculture, energy production, water resources, transportation and other aspects of the US economy.

News in brief

Government won't back British

Despite calls from the Liberal Democrats and countryside organisations like the CLA to “buy British” in the face of Donald Trump’s trade tariffs, the government has refused to add its voice to the campaign.

A spokesperson for the Prime Minister said the UK remains “an open-trading nation” and that the government would not dictate where people should shop. Chancellor Rachel Reeves said such a campaign was “inward-looking” and “not the way forward”.

Profitability review parameters

Meanwhile, the factors that the recently announced six-month review of farm profitability, led by Baroness Batters, should consider for its report to the government have now been published.

They are: how farmers can reduce barriers to profitability; how the supply chain can support farm profitability through greater transparency, cooperation and ensuring a fairer distribution of risks, rewards and responsibilities; and whether there are other ancillary activities that farmers can undertake to support profitability and wider economic growth.

Vertical farming failure

Coincidentally, Jones Food Company was put into administration last week. The Ocado-backed vertical farming business opened its first operation at Scunthorpe in 2018, and claimed that its 15,000 square-metre facility in Gloucestershire was one of the world's largest and most sophisticated indoor farms.

Although lauded as an industry leader, critics say the costs of vertical farming in the UK don’t stack up against traditional production methods, even when using renewable energy.

Pig expansion refused

In other food-production news, pork-and-poultry producer Cranswick has had its application to significantly extend its indoor livestock-rearing facilities at Methwold in Norfolk turned down by the local planning authority.

The controversial so-called “megafarm”, which would have housed 714,000 broiler chickens and 14,000 pigs, was labelled as bad for the environment and animal welfare by protesters. Cranswick is likely to appeal the decision.

Environmental permit reform

The government has just opened a consultation on plans to streamline environmental permitting regulations relating to flood risk activities, waste operations, water discharge activities and groundwater activities in England and Wales.

It says its proposals “would make the permitting regime more agile in managing environmental risk and provide greater business certainty and transparency”.

Beaver development rules

As well as the infamous development-blocking bats and newts, developers and local authorities will now have to consider the impact of any new developments on beaver populations.

New guidance has just been issued following the government's recent decision to allow the release under the licence of beavers, which are considered a critically endangered species, in England. A survey by a qualified ecologist may be required.

KF expert judges eco award

Knight Frank's James Shepherd has been asked to join the judging panel for the Royal Agricultural Society of England’s prestigious annual awards.

James will help judge the Natural Capital category, sponsored by Trinity Natural Capital, which celebrates farmers who are leading the way in sustainable agricultural practices and demonstrating how agriculture and the environment can thrive together.

Find out more about the awards, enter or nominate somebody.

F&M restrictions tightened

Defra has tightened the rules regarding the import of meat products to the UK in response to the ongoing foot-and-mouth outbreak on the continent.

The list of prohibited meat or dairy-containing products that travellers from the EU can no longer bring to the UK now includes sandwiches, cheese, cured meats, raw meats or milk, regardless of whether packed or packaged, or whether purchased from duty-free outlets.

Avian flu rules widened

The avian influenza prevention zone (AIPZ) housing measures, which require all poultry flocks to be kept inside, were extended by Defra last week.

They now include County Durham, Tyne and Wear, Cumbria and Northumberland, in addition to Cheshire, City of Kingston Upon Hull, the East Riding of Yorkshire, Herefordshire, Lancashire, Lincolnshire, Merseyside, Norfolk, Suffolk, Shropshire, Worcestershire, York and North Yorkshire.

Property of the week

Essex vineyard estate opportunity

Budding winemakers looking for a cracking country estate will want to take a look at the Stokes Hall Estate in Essex's Crouch Valley, which is fast becoming a viticultural hotspot.

Much of the 327-acre estate, which includes an imposing classically inspired nine-bedroom house, is suitable for planting vines. There are five further dwellings, and planning consent to build another five.

The guide price for the whole is £19.9 million, but the sale is split into 10 lots with options for those just looking for blocks of land to establish vines.

Please get in touch with Georgie Veale for more information.

Discover more farms and estates on the market with Knight Frank.

Property markets

Farmland Q1 2025 - Values resilient

The farmland market in England and Wales is holding steady in the face of mounting sector pressures. Despite wider challenges across the agricultural sector and ongoing policy uncertainty, values have remained largely stable, underlining the market’s resilience.

The Knight Frank Farmland Index, which tracks the average price of bare agricultural land across England and Wales, showed a marginal drop of 1% in the first quarter of 2025 to £9,072/acre. This follows a similar small decline in the final three months of 2024, bringing the annual fall to just 1.9%.

“While farmer protests and policy reform have dominated headlines, the farmland market itself has experienced a fairly uneventful start to the year,” says Will Matthews, our Head of Farms and Estates.

“Values have remained steady, and relatively few new properties have been put up for sale so far in 2025.” Just over 8,000 acres were publicly launched during the first quarter – a drop of 11% compared with the same period last year.

Country houses Q1 2025 - Mixed picture

The average price of desirable homes in the countryside slipped by just 0.3% in the first quarter of the year, according to the Knight Frank Prime County House Index.

Over the past 12 months, values have fallen by 1.6%. "Expectations of an extra base-rate cut by the Bank of England this year could help steady markets," says Tom Bill, Head of UK Residential Research.

However, the top end of the market is faring less well as wealthier buyers worry about Keir Starmer’s reforms to the non-dom tax regime and general attitude towards the rich.

Average prices for properties over £5 million have fallen 3% on an annual basis, with the number of new applicants falling 15% in the first quarter compared with the same period in 2024.

Development land Q4 2024 - Housing delivery down

Only 2% of the 50 housebuilders recently surveyed by Knight Frank believe that the sector will deliver the 300,000 new homes that the government is targeting for 2025.

The gloomy prognosis is contained in the latest instalment of our Residential Development Land Index report, compiled by researcher Anna Ward, which reveals that the price of green and brownfield development land remained flat in the final quarter of the year, despite Labour’s ambitious housebuilding targets and planning reforms.

Download the full report for more insight and data.