European Property Market Shifts

Plus, Italy’s tax update and the changing policy landscape

3 minutes to read

Momentum

A gradual recovery looks to be underway across European residential markets, supercharged by the European Central Bank’s decision to cut interest rates in June.

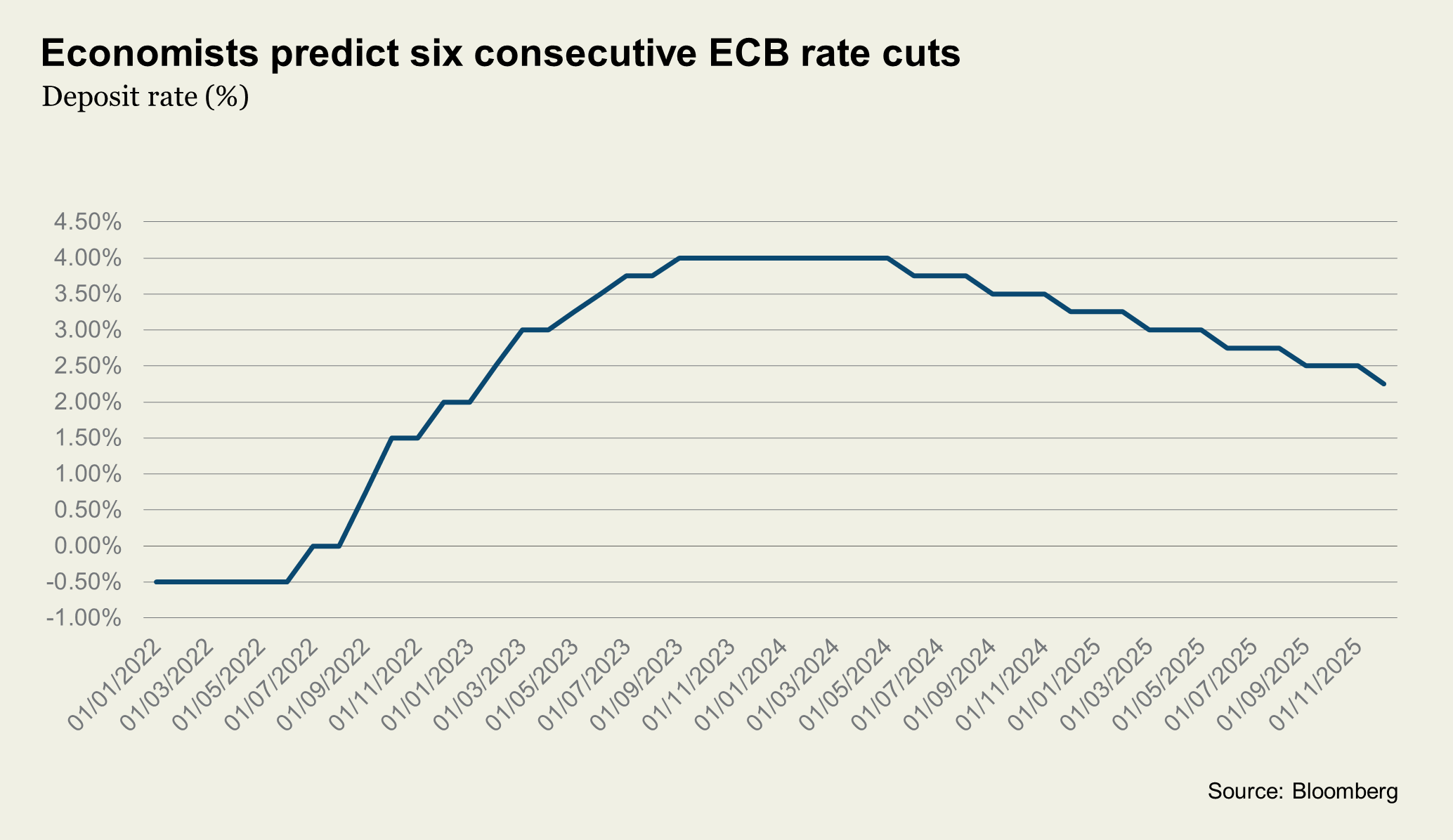

This week, a Bloomberg poll of economists predicted six consecutive rate cuts lie ahead, putting the base rate at 3.25% by the end of 2024 and 2.25% by the end of 2025.

Such an outcome could generate momentum, and if the euro weakens as typically expected when rates fall, it might further encourage overseas buyers who have been waiting on the sidelines.

Knight Frank’s sales teams have observed an increase in enquiries since June, but it's challenging to assess the full extent of interest in August due to the seasonal slowdown.

Italy

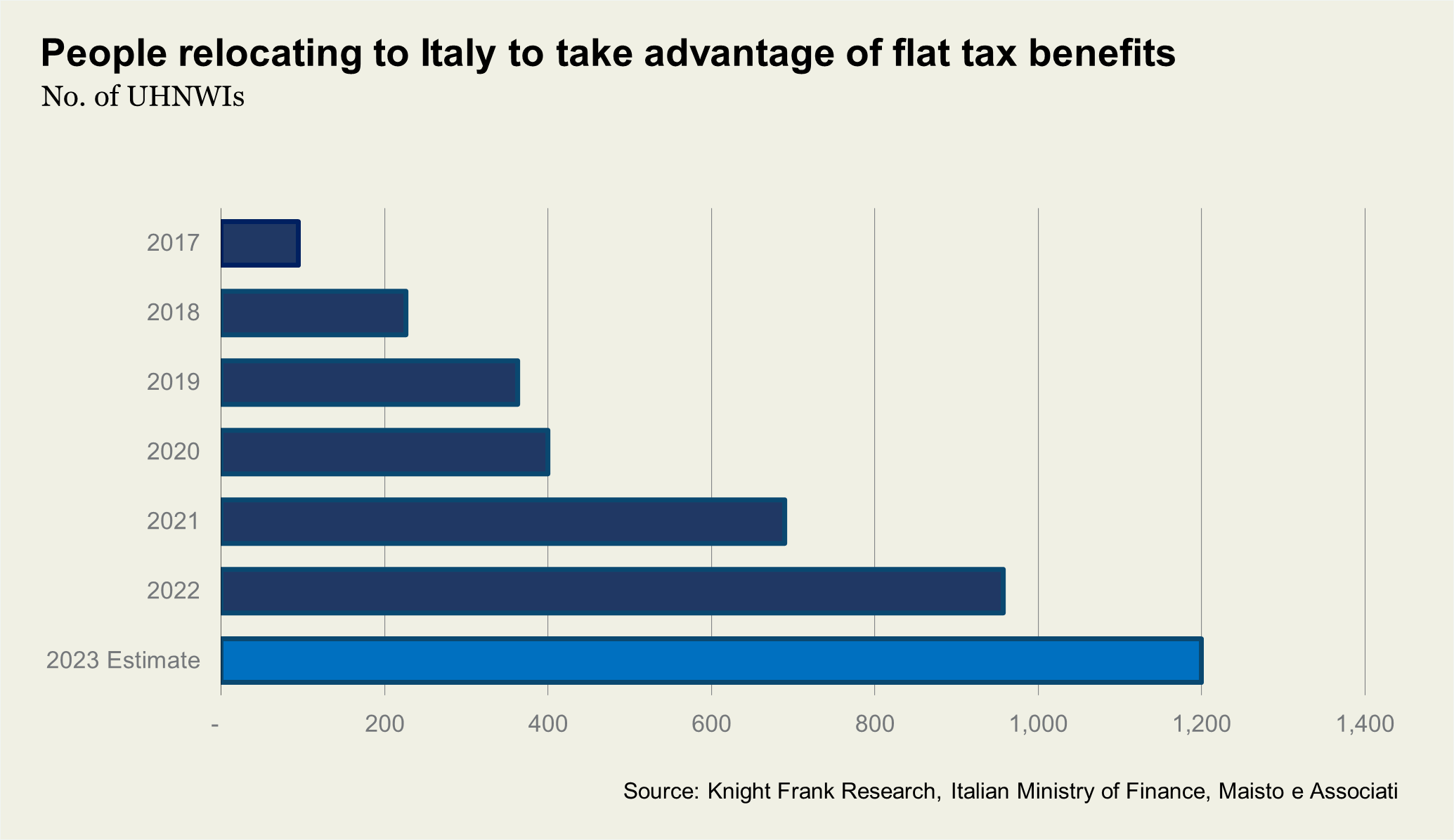

Last week, Italy doubled its annual flat tax from €100,000 to €200,000. While the move drew some attention, the Italian Government’s decision might, ironically, strengthen Italy's position at a time when much of Europe has yet to clarify its stance on tax and policy changes. You can read my detailed analysis here.

By providing a clear direction at a time when most governments are still scrutinising their budgets and weighing how to balance attracting foreign investment with fulfilling growing public service obligations, Italy may enhance its appeal. It might be more advantageous for Italy to have established its approach early.

According to the Italian Ministry of Finance, 2,730 individuals signed up for Italy's flat tax between 2017 and 2022. Italian tax lawyers from Maisto e Associati estimate a further 1,200 UHNWIs took advantage of the initiative in 2023 taking the total to close to 4,000.

Policy

The two major uncertainties right now are France's political trajectory and the specifics of the UK's non-dom policy changes, both of which could impact wealth movement in the region.

Macron has postponed appointing a Prime Minister until after the Olympics, giving him potentially until September 8th, when the Paralympics conclude. This delay has sparked speculation about who might be in the running, with many hoping for a centrist pick to ease concerns about significant tax reforms, including changes to the wealth tax.

Regarding the UK's non-dom policy, we have a bit more information, as my colleague Tom Bill discusses here. However, the full details are anticipated in the Autumn Statement on October 30, 2024.

With income tax, national insurance, and VAT adjustments ruled out, there are growing rumours that the Chancellor might target capital gains tax. We highlighted where the UK’s rate of 28% currently sits in relation to its European neighbours in June’s newsletter.

In summary, various factors are currently in flux, and it is crucial for buyers, sellers, investors, and lenders to stay informed to make well-informed decisions.

With numerous announcements anticipated in the coming months, be sure to sign up here to be among the first to receive our new European Lifestyle report. Launching in the first week of September, this report will offer an in-depth analysis of the current landscape and a comprehensive overview of the latest policy changes.

In other news…

An amnesty law for Ibiza’s rural homes (Villa Contact), several key European economies still have inflation above 2% (Bloomberg), Portugal exempts under 35’s from Municipal Transfer Tax (IMT) and Stamp Duty on a property up to €316,000 (Portuguese Chamber of Commerce).