Mixed signals for the logistics market

Looser monetary policy and expanding occupier demand boost sentiment amid infrastructure cuts and weaker growth prospects

6 minutes to read

Amazon returns to expansion mode

In spring 2022, online retailer Amazon announced that it intended to slow the take up of new warehouse space, and in 2023, it went further by looking to offload or sublease space. This pullback from the market led to a fall in overall demand, which was felt most within the largest size bands.

Despite this retreat from the market over the past two years, since the start of 2019, Amazon has taken up 25 million sq ft of industrial and logistics space (over 50,000 sq ft), equating to more than 10% of the total market. If we look only at the biggest boxes, Amazon accounts for a 25% share of take up in the 400,000 sq ft market (since 2019).

In the past two years, take up of units over 400,000 sq ft has averaged just 2.2 million sq ft per quarter, compared with 5.0 million in the previous two years. However, in May this year, Amazon signalled their return to expansion mode with an announcement confirming its plan to build a 2m sq ft warehouse at SEGRO Logistics Park close to junction 15 of the M1 in the East Midlands.

Amazon currently has various sizeable requirements in the market, including both land and assets. This active demand should boost take up in the second half of the year, particularly within the larger size bands.

Big box supply squeeze

Supply levels are at a ten-year high. The vacancy rate is 6.9%, the highest it's been since 2014, with 78 million sq ft of space currently available. However, the headline figure masks the composition of this space that's currently available. Depending on the size, location and quality requirements, many occupiers will find that the current stock available cannot satisfy their requirements.

Over the past five years, occupier demand has increasingly focused on new and grade-A space, with almost three-quarters (73%) of take up comprised of this type of space. Yet, of the 78 million sq ft of space currently available, 38 million sq ft comprises lower quality stock.

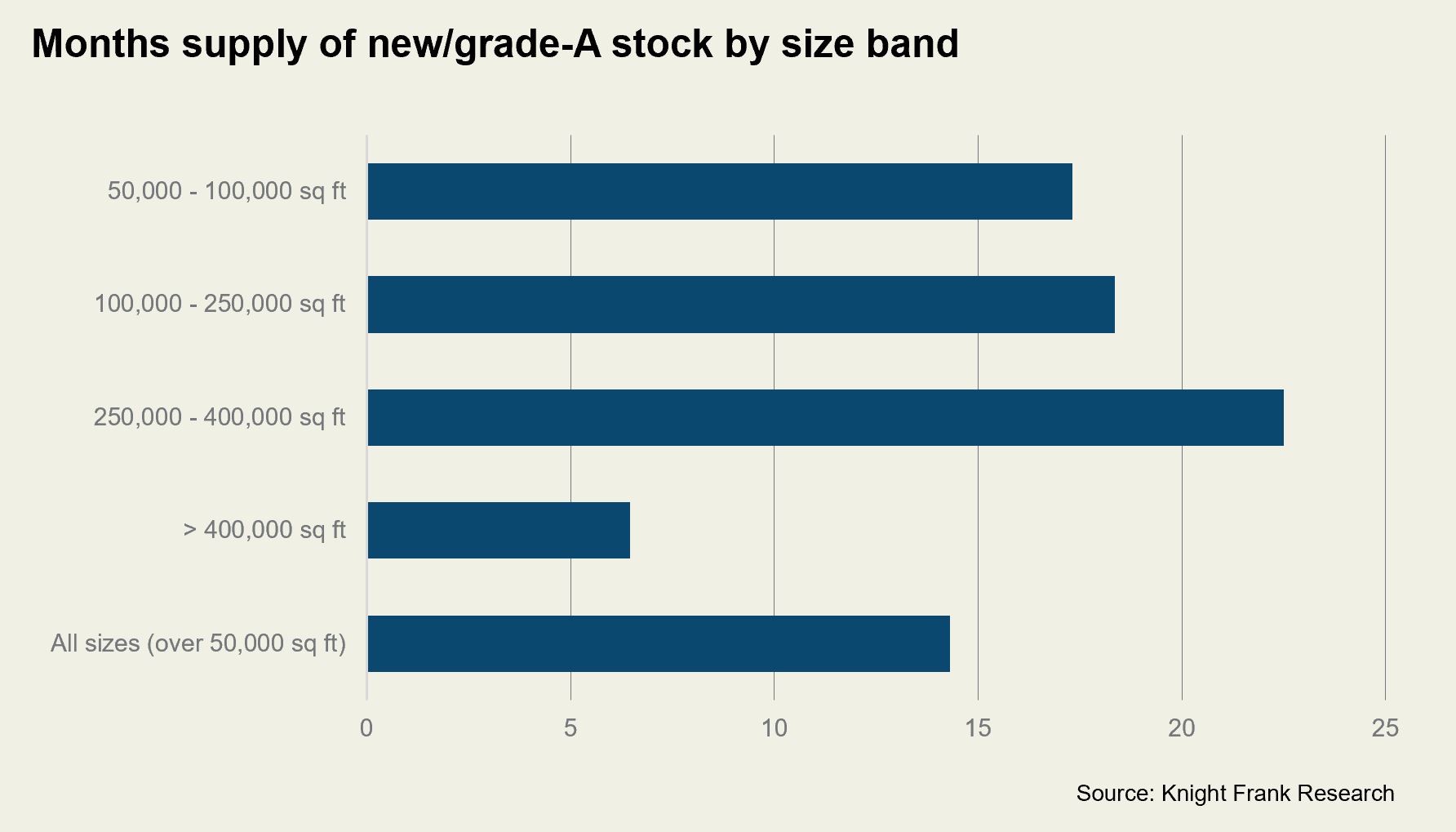

Supply levels are also highly uneven across different size bands. Supply is most heavily constrained within the largest (400,000 sq ft +) size band, with less than 7 million sq ft of new/grade A space available across 12 buildings. This equates to roughly 6 months' supply based on average take up volumes. While in the 250,000-400,000 sq ft size bracket, available grade-A/new space represents 22.5 months' supply.

Demand at the bigger box end of the market tends to be much lumpier than the mid-box or multi-let markets. A few major players dominate occupier demand in this market segment, Amazon being the most obvious, and network expansion has come in waves, resulting in peaks and troughs of demand.

On the supply side, most speculative development occurs in smaller size bands. The 100,000-250,000 sq ft size band is the most popular. The rise in financing and development costs in recent years has led to a reluctance amongst developers to commit to building very large units without first having an occupier in place.

Q2 2024 recorded a strong level of demand, with 9.3 million sq ft of take up representing the strongest quarter for almost two years. There are several operators with significant requirements in the market and we therefore expect robust levels of activity in the second half of the year. Where the supply response is inadequate to meet demand, we will see competition and continued pressure on rents.

The first cut

Real estate investors were keenly awaiting the first drop in rates. Expectations around the timing of the first cut have been repeatedly pushed back, weighing on investor sentiment and tempering expectations for when a recovery will occur.

The Bank of England's Monetary Policy Commission met on the 1st August and voted to cut the Bank Rate 25bps to 5.00%. The decision was reached with a slim (5-4) majority, with four members voting to maintain the Bank Rate at 5.25%. Though the MPC's new forecast suggests further rate cuts are on the cards, the committee will take a cautious approach to loosening policy. Oxford Economics expects the Bank Rate to remain at 5% in September before another 25bps cut at the November meeting and 100bps of further loosening in 2025.

Though another rate cut may be a few months away, this first cut in rates sends investors an important signal and will hopefully help unlock some of the backlog of investors seeking exits and deliver much-needed liquidity to the industrial real estate investment market.

As interest rates fall, gilt yields are expected to sharpen, making current industrial and logistics real estate yields more attractive (relative to fixed-income investments) for investors. Ten-year government bonds are expected to be 4.00% in Q4 2024, reducing further throughout 2025, to reach 3.67% by Q4 2025 (Oxford Economics). This should boost investment market activity through the second half of 2024 and into 2025.

Logistics under labour

A new Labour government took power at the start of July. Prior to the election, manifesto pledges offered little in the way of detail but included commitments to "kickstart economic growth", to remove planning restrictions and "get Britain building", and to develop a long-term strategy for transport to ensure that infrastructure is delivered efficiently and on time, and "align infrastructure strategy with industrial strategy and regional development priorities, including improving rail connectivity across the north of England". The logistics sector viewed these commitments positively, with opportunities for growth and the potential for efficiency gains.

However, by the end of July, the Chancellor, Rachel Reeves, had announced cuts in infrastructure spending. Among the transport projects to be scrapped are the Restoring Our Railways Scheme, the A303 (Stonehenge tunnel) and A27 Arundel bypass. According to Logistics UK, this will limit the logistics sector's ability to kick-start economic growth.

Tax rises ahead?

The Chancellor presented the Treasury's audit of government spending plans at the end of July. The analysis concluded that departmental spending in fiscal year 2024-2025 was likely to be around £22bn (0.8% of GDP) higher than the totals included in March's Budget.

The speech was seen by many as an attempt to pave the way for tax rises in the Budget on 30th October. Capital Gains Tax (CGT) is one of the taxes being looked at, which could have a knock-on impact for real estate investors and landlords.

The Resolution Foundation think tank findings show that increasing CGT rates to marginal income tax rates and reintroducing a relief for inflation could generate up to £7.5bn in additional tax revenues per annum. Their report shows that, assuming reliefs such as business asset disposal relief were abolished, those with gains from commercial property would be amongst those hit hardest.