Third of UK developers say homes held up by power shortages

Supply crunch looms for England as support for change in government grows

2 minutes to read

A third of developers across the country say the progress of their housing schemes has been impacted by National Grid power constraints.

That’s according to Knight Frank’s latest survey of 50 volume and SME housebuilders published alongside its Q1 2024 Land Index.

Around 15,000 of their new homes are currently held up by a lack of grid connections.

To put this in context, our poll of 50 housebuilders and developers together build 70,000 homes across England each year.

In further comments, some respondents reported difficulties with utility firms delivering connections in a timely manner which they said is causing them problems with plot handovers and costing thousands of pounds in temporary connections or portable generators.

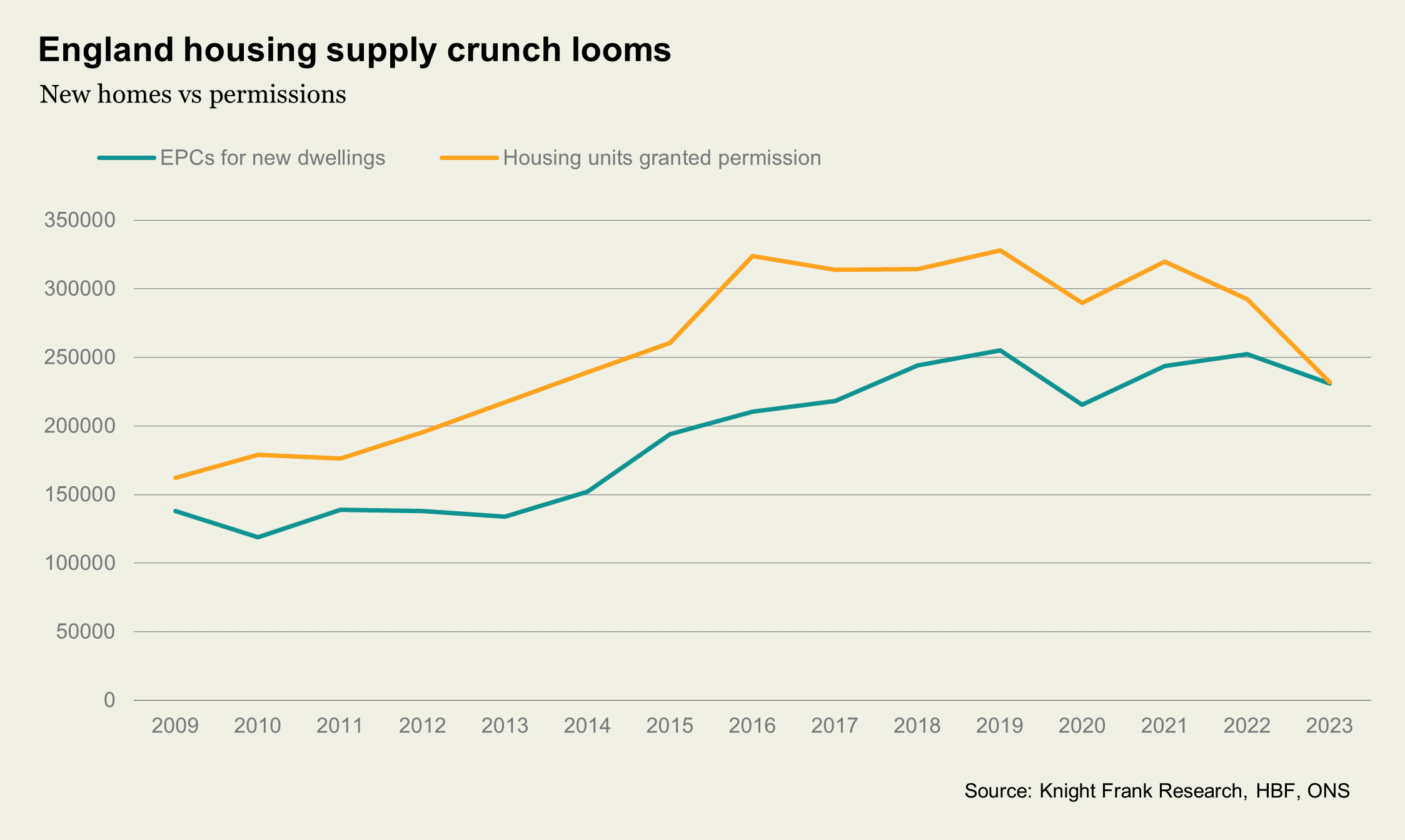

UK housing supply is already constrained by multiple factors, but power shortages have emerged this quarter as a key concern in our survey. This situation has emerged at a critical point for the sector: the number of new homes coming forward in England is falling, particularly in London where build costs are higher. Historically, the number of homes receiving planning permission has always trended a healthy distance above completions.

But last year, permissions fell over 20% to nearly match the number of homes being built, using Energy Performance Certificate data as a proxy for completions (see chart). Given the time lag for new development, this means we are yet to see the full impact, but all signs point to a supply crunch in the medium term.

![]()

Support for Labour government grows

UK housebuilder support for a change in government is on the rise. Overall, 80% of respondents said they thought that a Labour government would enhance the land and development market the most, up from 70% last quarter.

A focus on a change in leadership comes as housebuilders are closely watching the direction of the UK economy.

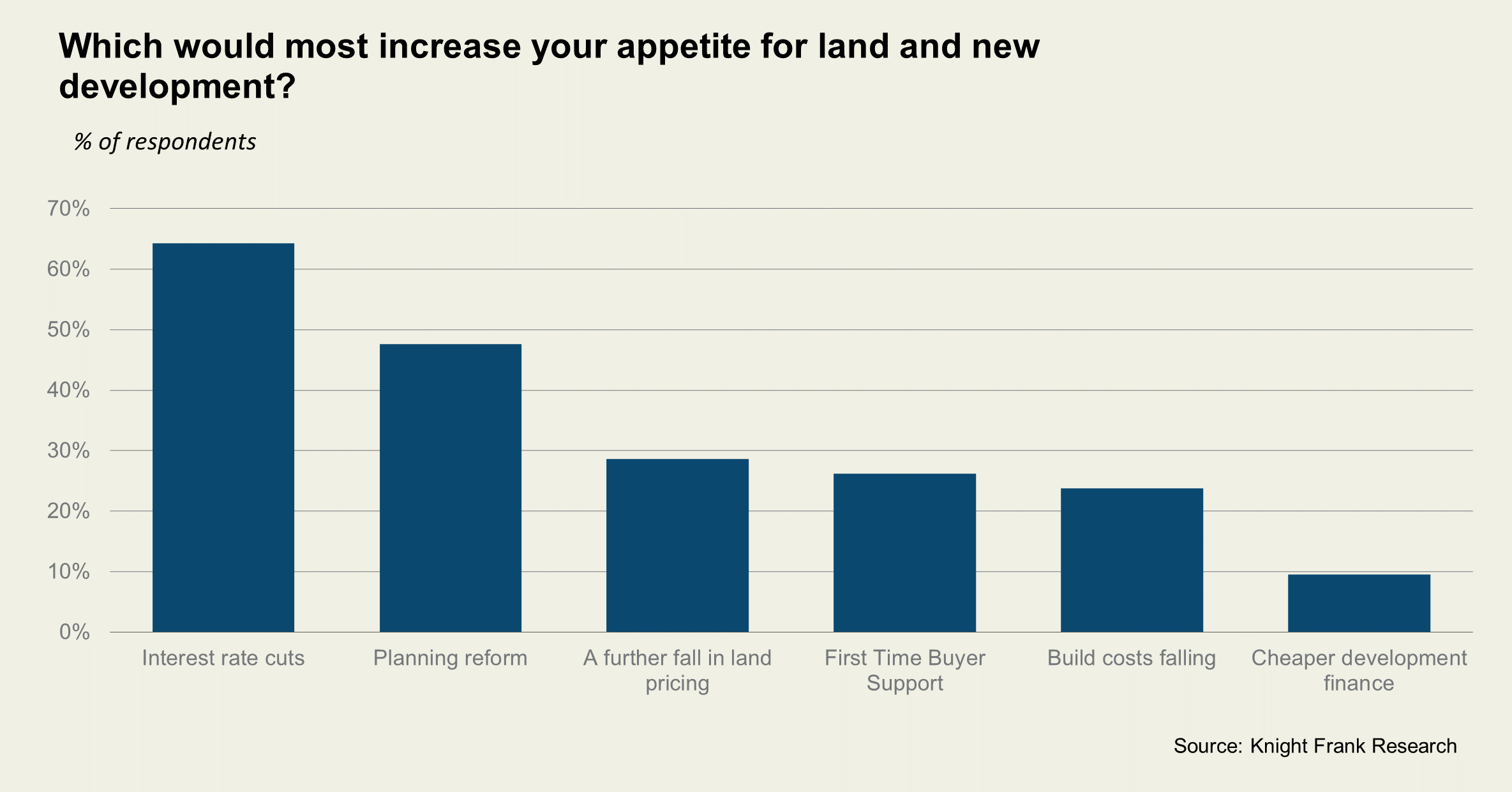

Over 60% of respondents said that an interest rate cut is top of their wishlists.

When asked what would increase their appetite for land and new development the most, this ranked more highly than either planning reform (48%), a further fall in land pricing (29%) and more first-time buyer support (26%).

Photo by Robert So