Tanzania Shines in IMF's Top 10 African Countries GDP Growth Forecast for 2024

Tanzania's Economic Triumph: IMF forecasts 6.1% GDP growth, resilience amid challenges shapes promising real estate landscape.

4 minutes to read

Written by Boniface Abudho, senior research analyst, Knight Frank Africa

Significant economic challenges experienced across Africa in 2023, stemming from global commodity price fluctuations, political events, supply and demand shifts, and economic uncertainties, left most countries facing substantial economic challenges.

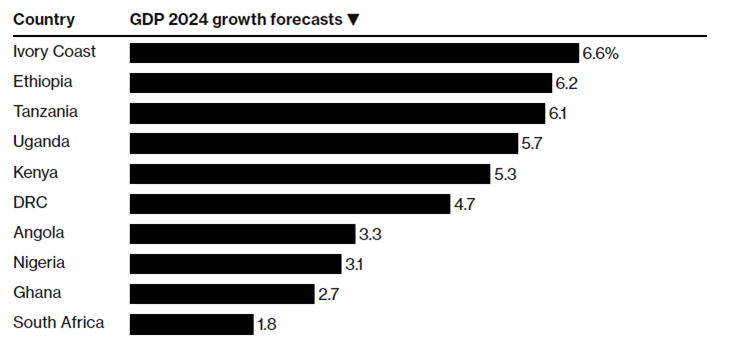

However, a positive trajectory emerges as Africa's economic outlook shows signs of recovery in 2024, as highlighted in the latest report by the IMF, which predicts that six of the top 10 performing economies globally in 2024 will be from Sub-Saharan Africa. Notably, Tanzania, where Knight Frank has had an office since 1998, takes a commendable third position, following Ivory Coast and Ethiopia.

The IMF findings project a significant economic expansion for Tanzania, 6.1%, which signifies a substantial increase from the 5.1% growth recorded in 2023, underscoring the country's resilience and promising economic prospects on the international stage.

Source: International Monetary Fund

In the East African economies, Tanzania's projections for real GDP growth position it ahead of regional powerhouses such as Kenya and Uganda, with anticipated average growth rates of 5.3% and 5.7%, respectively.

Historically, Tanzania's economic stability and steady growth have significantly influenced the real estate sector. Dar es Salaam is the focal point for property investment, with its port making it a gateway to East and Central Africa. Furthermore, Dar es Salaam's status as the financial, if not political, capital of Tanzania stimulates demand for residential and commercial property.

Against the backdrop of this forecasted economic growth, the commercial real estate sector faces oversupply challenges, posing potential impediments to short-term rental increases. Tenants remain in the driving seat, particularly in the office sector, where oversupply has been driven by excessive parastatal development. In response to market challenges, landlords exhibit adaptability, adjusting lease terms, offering rent reductions, and actively renegotiating rents to safeguard occupancy levels, presently averaging around 70%. The oversupply dynamic exerts downward pressure on prime office rents, currently at c.US$ 15 psm per month, reflecting a 12% decline from their 2020 levels.

The formal retail market in the country is in its nascent stages, as the current retail landscape is shaped by an informal shopping culture, wherein approximately 90% of food and beverage sales occur through traditional small stores, street vendors, and unregulated markets. International entrants to the market, such as Shoprite and Game from South Africa and Nakumatt and Tuskys from Kenya, have failed to penetrate the sector, leaving opportunities for future international investment.

In addition, there is an oversupply of retail space, which will be exacerbated by the impending completion of Morocco Square and Dar Village, which collectively will introduce in excess of 65,000 sqm of additional retail space. Reflecting the subdued uptake of formal retail space, prime rental rates have stagnated at US$ 16 psm per month for the past five years, while occupancy rates have contracted to an average of around 65%. Our outlook for the country's retail market remains positive, however, driven by strong economic growth and diminishing inflation, which are anticipated to boost consumer spending.

Elsewhere, the residential market, particularly in prime areas like Oyster Bay and Masaki (Peninsular), remains a focal point for heightened demand. The influx of expatriates, driven by investment prospects, has catalysed this demand, leading to a consistent average occupancy rate of prime residential units at approximately 80%. With some existing units reaching full occupancy, developers are capitalising on this opportunity by embarking on new residential developments strategically positioned in select areas around the Msasani Peninsular.

For the industrial sector, heightened investment and trading activity have led to an increase in warehouse demand, particularly along Nyerere Road, the city's prime industrial area. This increasing need for warehouses and storage facilities is a direct consequence of the thriving manufacturing and logistics sectors, which has led to the sustained stability observed in prime industrial rents, holding steady at US$ 5 psm per month over the past four years.

The trajectory of demand in Tanzania's industrial sector is poised for further growth, driven by recent offshore natural gas discoveries and planned infrastructure projects. Notably, the government's strategic focus on enhancing infrastructure development to attract Foreign Direct Investments (FDIs) is evident in initiatives such as the ongoing US$1.9 bn railway infrastructure project. The railway is part of a bigger 1,219-kilometre railway network, increasing Tanzanian trade with its neighbours.

Overall, Tanzania's economic trajectory, characterised by international recognition and optimistic forecasts, appears to indicate sustained development. The government's emphasis on economic diversification, poverty reduction, and pro-investment policies is creating an environment ripe with opportunities. As Tanzanians seize these prospects, the collective impact is expected to drive demand in the office and residential segments in the medium term.