Examining ski chalet prices: ski property index results 2023

We explore the results of our ski property index 2023 as Swiss resorts dominate the price increase results.

2 minutes to read

This article forms part of the Ski Property Report 2024 series giving insight into the latest market trends, property data and investment volumes across key ski locations.

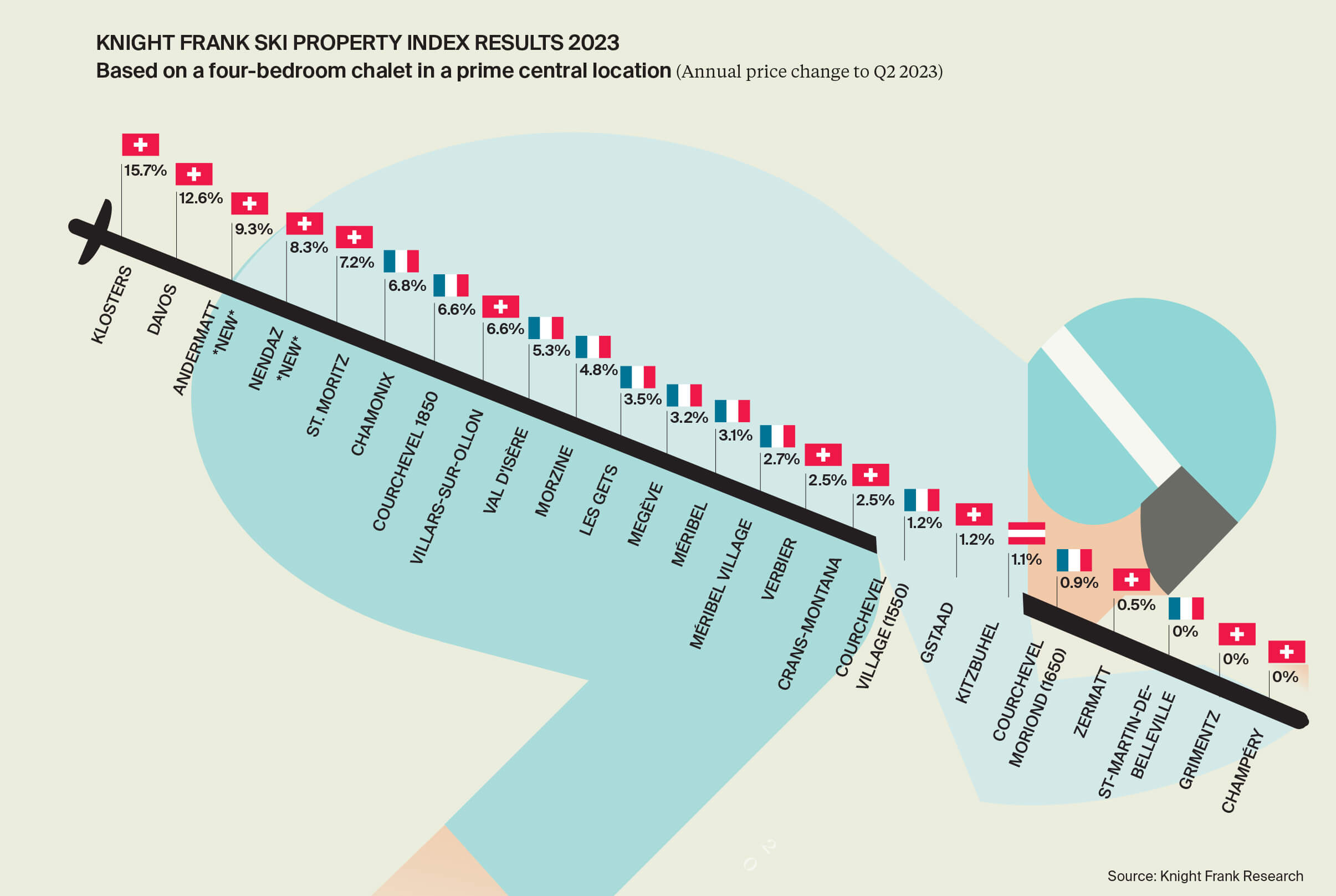

The price of a luxury ski chalet increased by 4.4% on average in the 12 months to June 2023. Discount the pandemic years, and it represents the strongest rate of growth since 2014.

Top three price growth

Swiss ski property resorts lead the rankings for the second year running with three German speaking resorts occupying top spots, including one new addition (Andermatt).

- Klosters (16%)

- Davos (13%)

- Andermatt (9%)

A severe lack of stock and infrastructure improvements in each resort are pushing prices higher.

Chamonix (7%) retains its title as the top-performing resort in the French Alps, a true year-round resort whose population swells from 10,000 to 130,000 during peak season.

The resort attracts a broad demographic, from skiers to mountain bikers, hikers, parapenters and trail runners, and plays host to a busy calendar of sporting events which in turn drives investor demand.

Two trends emerged in 2023 as we saw buyer motives split. High altitude resorts (St. Moritz, Val d’Isère, Courchevel 1850) and year-round resorts (Chamonix, Verbier) outperformed.

Buyers either prioritised snow-sure resorts with longer ski seasons, or targeted locations offering a broader mix of ski and non-ski activities and a livelier resort during the summer months.

Why are ski property prices still rising?

With a rocky start to the 2022/23 ski season, a challenging macroeconomic landscape, and the pandemic-induced surge in demand starting to fade, most commentators envisaged a slowdown in price growth for ski resorts this year. Instead, most Alpine markets are posting stronger growth than global housing markets.

The high proportion of cash buyers in the world’s top ski resorts means the higher interest rate environment has had little impact on their appetite for a ski home. Add in the transition to hybrid working, the renewed focus on health/wellness and accumulated savings during the pandemic years, and demand remains robust.

Discover more

For more market insights from leading experts, the latest price trends, buyer sentiment and more, download below or visit the Ski Property Report hub.