UK interest rates: a pause or the peak?

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

For the first time in almost two years, the Bank of England's Monetary Policy Committee yesterday voted to hold the base rate at 5.25%, a move that will boost sentiment among investors and quicken the pace of falling mortgage rates.

It was a close call - five members of the MPC voted to hold against four that wanted to hike to 5.50%. Loosening in the labour market, Wednesday's inflation figures, downbeat reports from the Bank's twelve regional agents and a PMI reading consistent with falling GDP was enough to coax a majority into pausing the fastest rate hiking cycle in decades.

Whether the decision represents a pause or the peak will depend on whether the trends in Wednesday's inflation report hold. Measures of wage growth and services inflation are still rising at a pace that is inconsistent with meeting the Bank's 2% inflation target sustainably in the medium term, according to the four members that wanted to continue tightening. Meanwhile, Wednesday's positive inflation surprise "appeared to have been driven mainly by volatile components and had followed recent upside surprises."

Money markets place about a 70% chance of another hold in November, up from a coin flip before Thursday's vote. Sterling fell 0.7% to $1.2263.

Mortgage rates

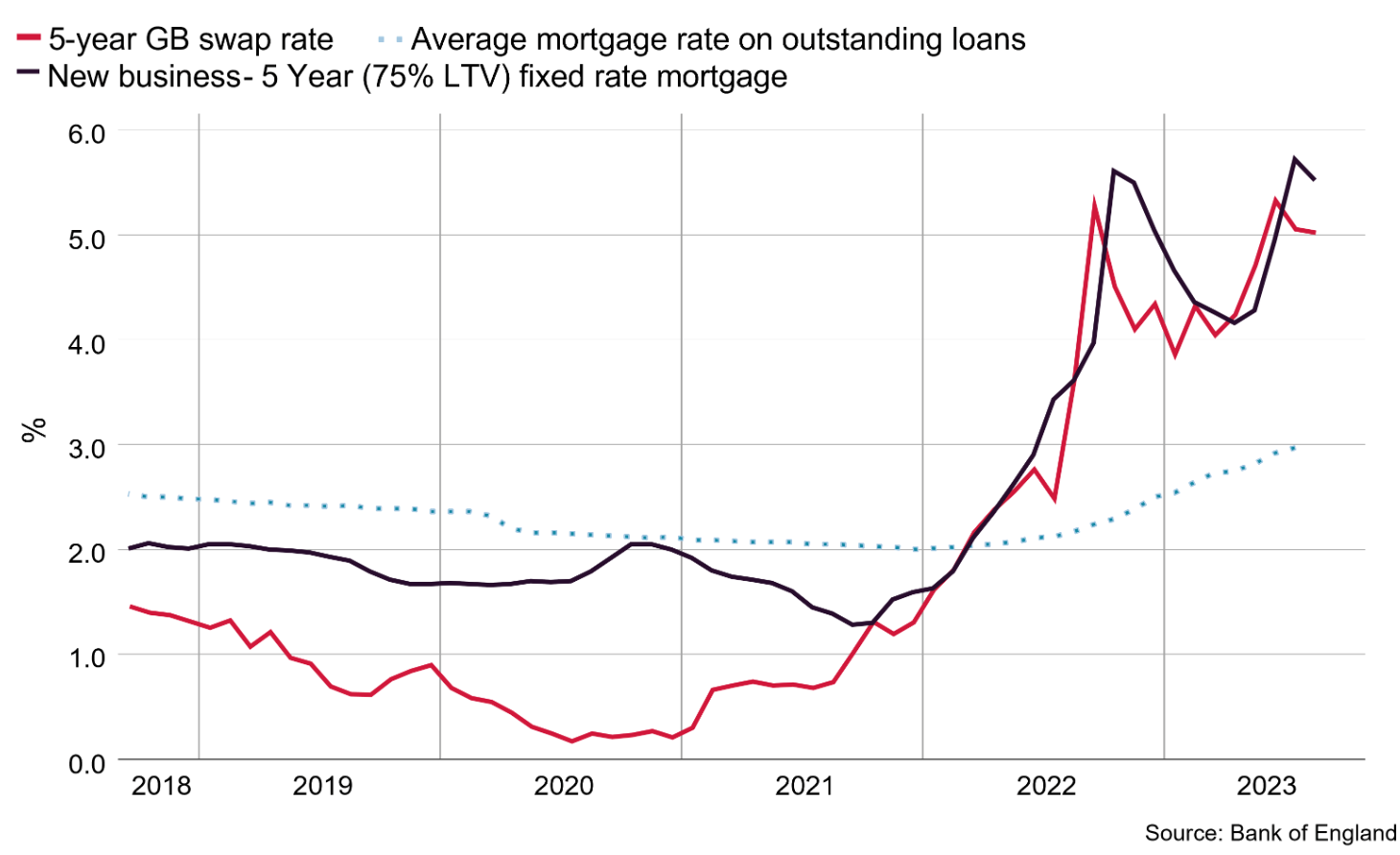

Swap rates have been easing since late July, when green shoots first appeared in the official inflation figures. That gave lenders scope to cut mortgage rates, which has developed into a battle for market share amid subdued transaction activity.

Swap rates have tumbled in the past 48 hours. NatWest, Nationwide and TSB were first out of the blocks with cuts to their ranges yesterday. Last week, sub-5% fixed rate mortgages reappeared for the first time since June.

This will improve sentiment, but only to a point. Mortgage rates will eventually ease to a plateau, and fixed rates starting with a four will be as good as it gets until rate cuts arrive. That could happen as early as May, US bank Citi said earlier this week, but Bank of England officials are eager to play down the prospect while so much remains uncertain. Almost six in ten property owners remortgaging this year are rolling off deals with sub-2% rates, so even the best mortgage deals will cut significantly into the discretionary spending of most people.

Yesterday's decision means that, for now, the typical two-year tracker mortgage remains slightly cheaper than a two-year fixed rate product, according to Knight Frank Finance. Borrowers that opt for a tracker product could end up saving even more over the next two years if the Bank begins cutting the base rate next year as analysts expect. Of course, the trackers come with the upside risk that hiking resumes, but that risk will do little to dampen the rising pace at which borrowers are opting for floating rates.

The Fed

The path to a soft landing was always going to be narrow, whether in the UK, the US or the Eurozone. Bringing inflation back to target with an instrument as blunt as a key interest rate without prompting a recession was considered highly unlikely by economists this time last year.

It helps explain why Federal Reserve Chair Jerome Powell is so eager to play down the prospect, despite the fact that the US economy continues to hum in the face of 18 months of rapid tightening. The Federal Reserve on Wednesday opted to hold the federal funds rate in a range of 5.25% to 5.5%, as expected, but Powell's fellow officials are spooked by the strength of the jobs market.

In quarterly projections released following a two-day policy meeting, 12 of 19 officials said they still expect to raise rates again this year. By the same token, officials now see fewer rate cuts than previously anticipated next year. A thin majority believe that rates should still be above 5% by the end of 2024.

As Matthew Klein notes, if there is going to be a substantial reset lower in rates, it is not projected to happen until 2025-2026 - that is a notable change from the prior consensus. The yield on the 10-year Treasury rose following Wednesday's decision. Mortgage rates have now notched higher for two consecutive weeks.

In other news...

For more on global interest rates, see the latest Leading Indicators. Also this week, Kate Everett-Allen looks at NYC's efforts to stamp out illegal rentals.

Elsewhere - Jeremy Hunt says it's unclear when taxes can be cut amid interest cost pressure (Reuters), and finally, consumer confidence rises to 20-month high (Times).