Housebuilder concerns grow over short-term outlook for UK economy

Over 40% said that the state of the UK economy and mortgage availability and costs were their biggest challenges in the second quarter

3 minutes to read

Our latest survey of nearly 50 volume and SME housebuilders shows that the short-term outlook for the UK economy is one of the key concerns for the industry.

The sluggish economy has led to greater caution towards land buying, with deferred payment structures, renegotiated purchases and withdrawn or deferred purchases all on the rise.

Just over 40% of respondents said that the short-term outlook for the UK economy had been the most challenging factor for their business in Q2, up from 20% who cited this factor in Q1. Likewise, 44% selected ‘mortgage availability and cost for purchasers’ as the most challenging factor, up from just 15% in the first quarter. Looking ahead, over half thought that ‘mortgage availability and cost for purchasers’ would have the greatest impact on the housebuilding sector in the third quarter, second to planning delays.

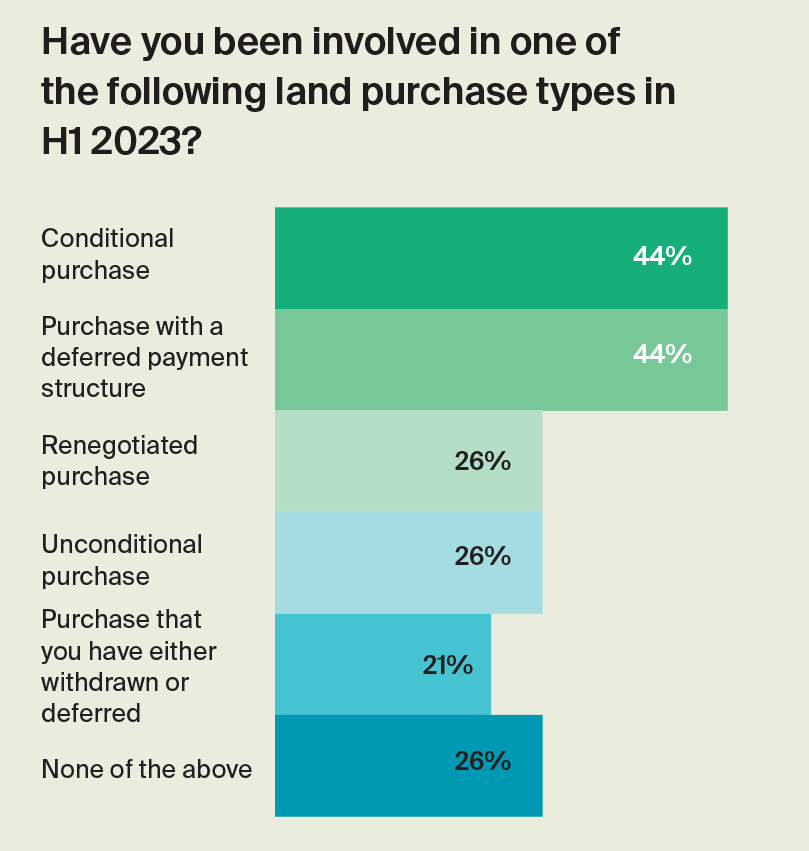

Over 40% of housebuilders said they had either been involved in a conditional land purchase in the first half of 2023 another 40% had agreed a purchase with a deferred payment structure, while a quarter said they had renegotiated a purchase and a fifth said they had either withdrawn or deferred a purchase.

Looking ahead, 60% of respondents said they expected start volumes to fall over the next three months (July to September) and over half said they thought land prices would fall over this period.

Land values

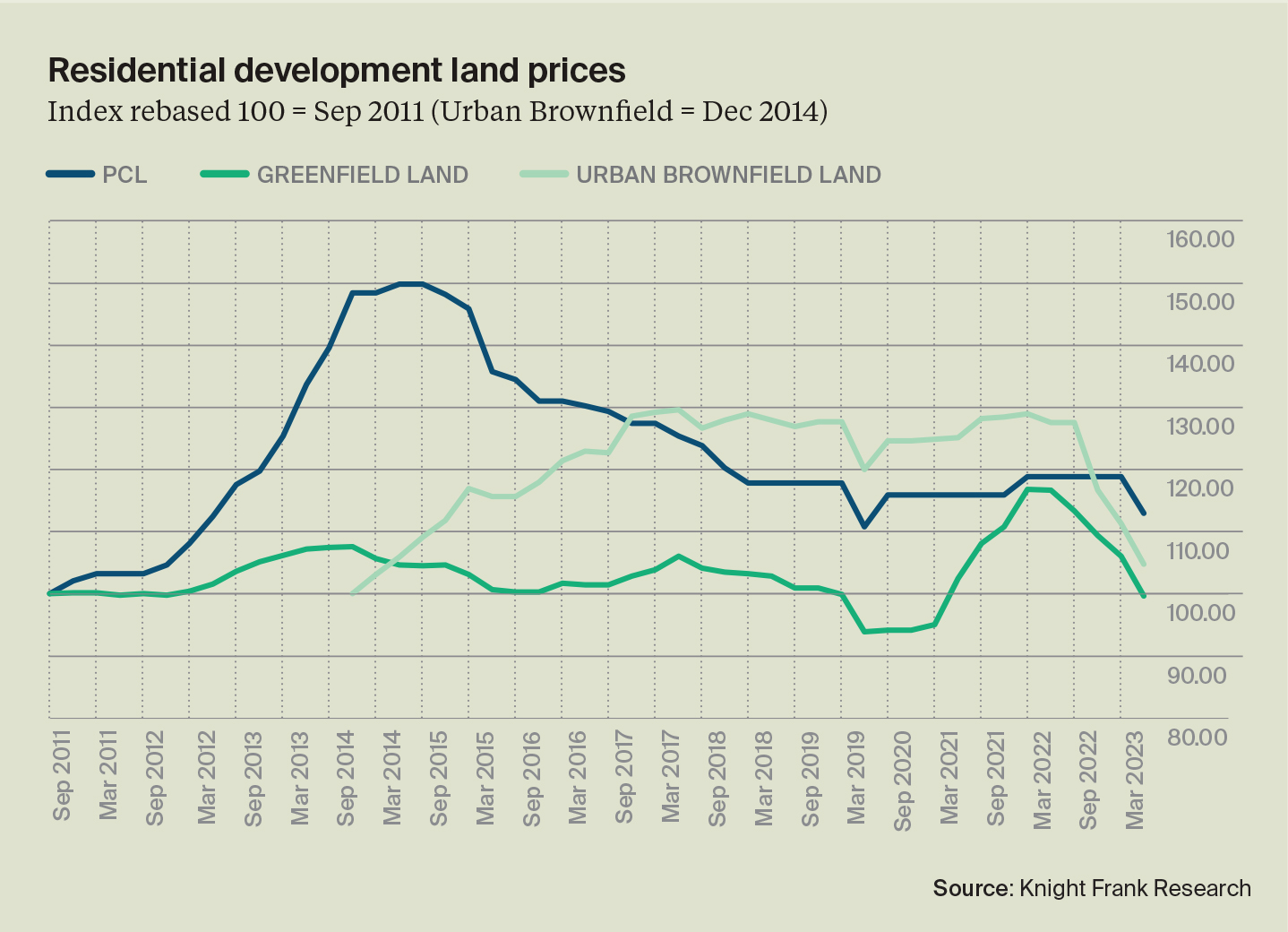

The UK’s worsening economic outlook weighed on the residential development land market in the second quarter, leading to a slowdown in activity and a decline in prices across the board.

Average greenfield land prices fell 6.1% in Q2, taking the annual drop to 14.6% - the biggest quarterly and annual decline on record. Brownfield values fell 5.9% on quarter and 17.9% annually – the steepest quarterly drop since the mini budget impacted Q4 2022 and the largest annual decline on record.

In Prime Central London, average prices fell 5% on quarter and annually – the first quarterly decline on record since Q2 2020 and first annual fall since Q1 2021.

While the price falls are significant, residential land values are volatile given the uncertainty around future values of locations earmarked for development. As the economic situation improves and inflation eases, we could see a rebound in land values.

Planning slowdown

Planning delays are a recurrent issue, with half of housebuilders allowing over a year to secure reserved matters approval on an allocated site. Typically, this approval process should take eight weeks or three months for large developments. Our survey shows that 18% of respondents would allow up to two years, with just 13% building in up to six months of approval time. New development projects have stalled amid uncertainty over the future direction of planning and the subdued state of the property market.

England had the slowest start to the year in Q1 2023 since 2009 in terms of major residential planning decisions granted, government data shows. Decisions granted fell 16% compared to Q1 2022 to 1,037.

Our survey suggests that build costs are still rising, but at a slower rate than the surges seen in recent years. Just over half said that prices for key building materials had increased in Q2 compared with Q1, while just under 40% said that labour costs had risen. The BCIS is forecasting build costs will increase by 5.1% overall this year and by 10.6% between 2024-2027.

While the immediate picture for the land market is challenging, a reduction in cost inflation should eventually help reduce pressure on margins. The longer-term fundamentals for the new homes market also remain robust, with supply shortages likely to support pricing.