Demand grows for sustainable London offices

Net zero commitments, and the need to attract and retain talent, are driving occupiers to more sustainable buildings.

4 minutes to read

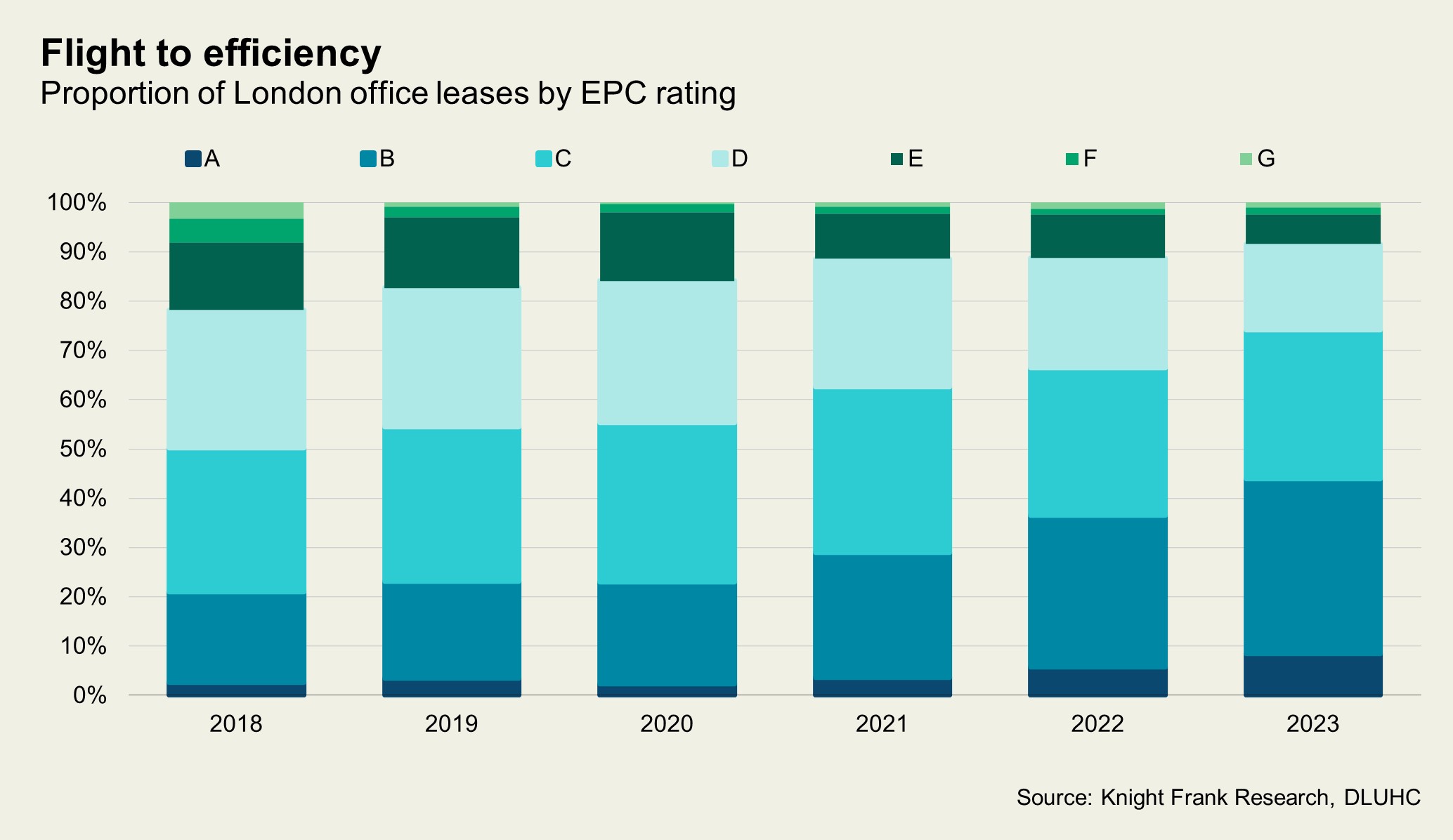

More than 40% of London office leases in 2023 so far are for EPC A or B rated buildings.

The recently implemented Minimum Energy Efficiency Standards (MEES), where a minimum Energy Performance Certificate (EPC) E is required to let a non-domestic building, with the potential to raise this to EPC B by 2030, has been widely touted as driving the need for property owners to improve their building's efficiency.

However, it is not just regulatory pressures as occupiers increasingly seek more sustainable and healthier buildings.

Our analysis of the past five years of London office leasing data, from 2018 to 2023 (YTD), demonstrates the shift towards more efficient buildings. The proportion of London office leases with an EPC rating of C or above has risen from half in 2018 to almost three-quarters in 2023 thus far. More than 40% of London office leases in 2023 (YTD) have been for EPC-rated A or B buildings, up from 21% in 2018 and 37% in 2022.

Highlighting the shift in demand, when assigning an EPC rating a number from 0 to 7, with 0 relating to the worst, the average rating for new leases signed in 2018 was 3.41 and experienced a gradual increase each year, reaching 4.15 in 2023.

Higher energy efficient buildings more likely to attract longer leases

Not only are occupiers demanding better space, but they are also willing to lease them for longer.

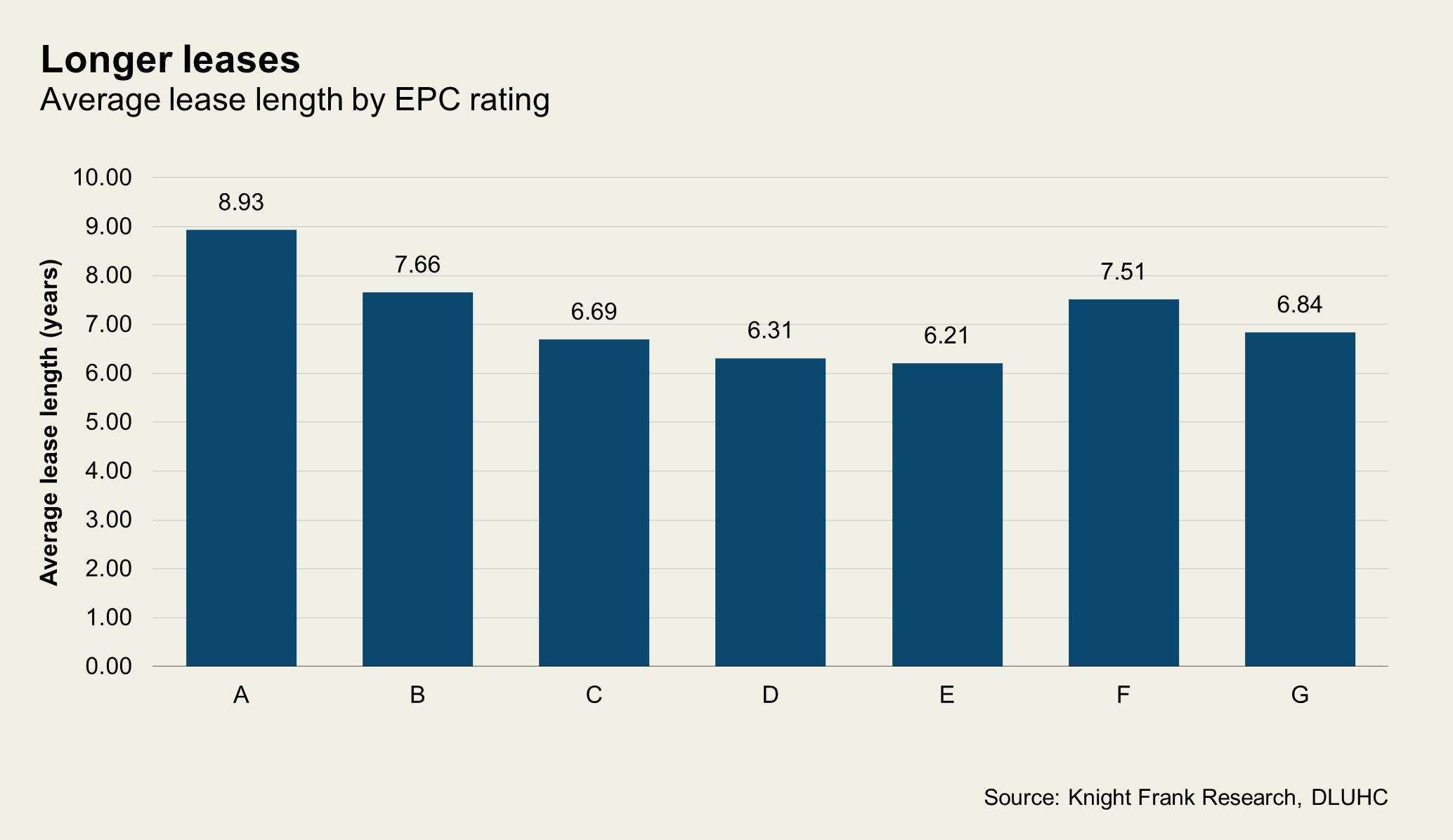

Our analysis found that over the past five years, the highest EPC rating, A, corresponds to an average lease length of 8.93 years, the longest among all ratings.

Whilst we recognise that lease terms for certain buildings may be influenced by factors other than energy efficiency, this is a consideration. The average lease lengths for EPC ratings C, D, and E are fairly similar, ranging from 6.21 to 6.69 years.

Laura Beatson, a Knight Frank London Lease Advisory partner, points out that "higher EPC-rated buildings not only have better energy efficiency but are likely to be a higher specification. Landlords can demand the longer lease terms and tenants are more likely to commit to them as refurbished or new space is more likely to be in this category. In addition, occupiers are focused on ensuring they are in MEES compliant buildings for the duration of their lease".

Indeed, our research shows that take-up of new and refurbished space in the London office market hit a new high in 2022, with 7 million sq. ft leased, or 60% of all transactions – up from 52% in 2018. The shift towards better-rated buildings could partially explain this.

Of the leases in refurbished office buildings in 2022, just under a half were in offices with an EPC A or B rating. Similarly, for new-build leases, 63% were rated A or B in the same period.

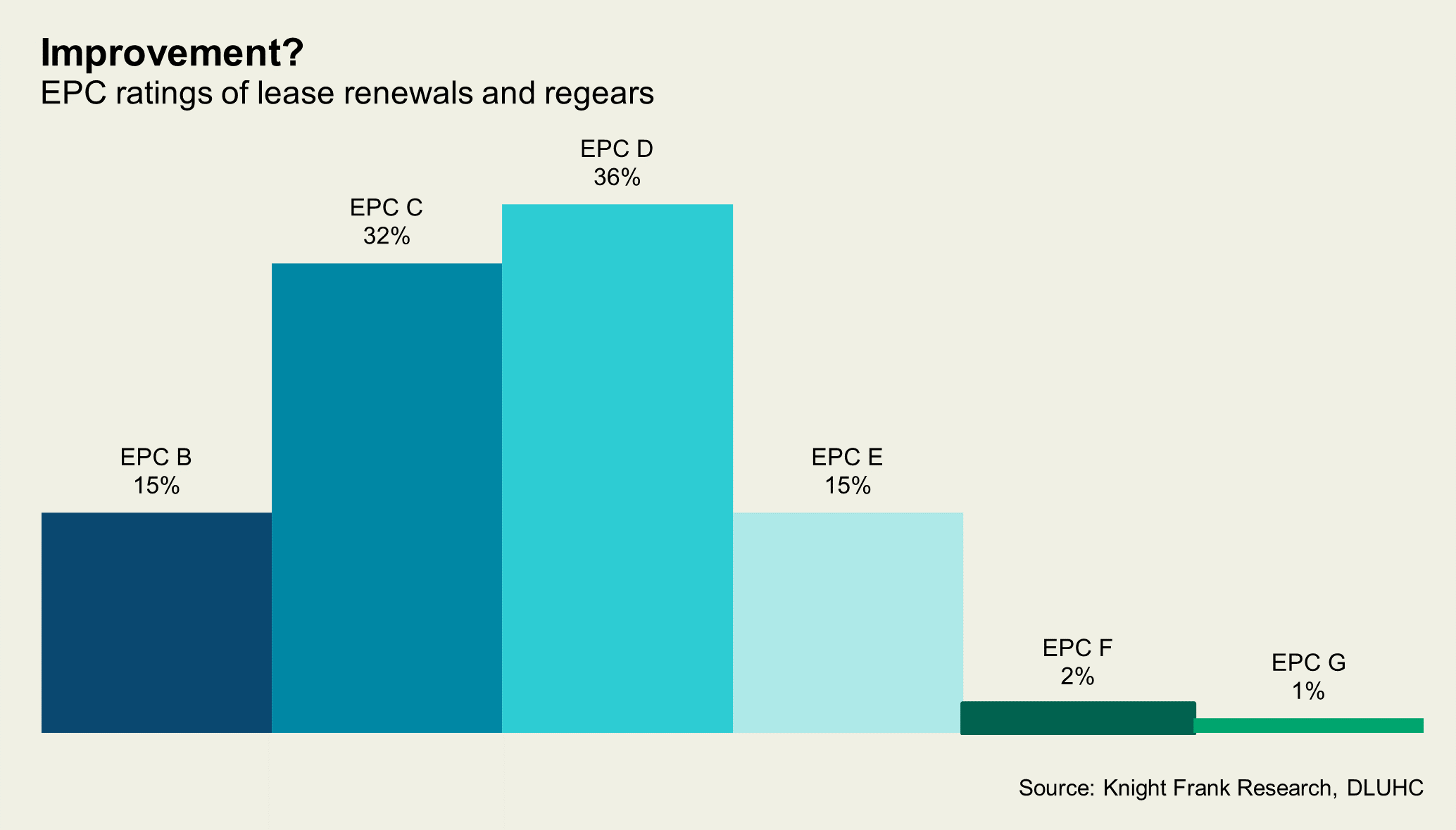

Beatson notes a trend towards regearing or extending existing leases is currently underway. "There is certainly a flight to quality, yet with economic constraints and, more importantly, a lack of available options, many tenants are opting to extend their existing leases alongside a commitment from the landlord to improve the quality and efficiency of the space, tying in with the documented benefits of refurbishing rather than rebuilding.”

Over the past three years the number of lease renewals and regears has more than doubled across London. Over two-thirds (68%) of those events were for offices with an EPC C or D rating (see chart below).

What's driving energy efficient building demand?

Net zero commitments and the need to attract and retain talent are driving occupiers to more sustainable and healthy buildings (see last month's newsletter).

The World Green Buildings Council has 176 net Zero Carbon Buildings Commitment signatories, covering around 20,000 assets. These signatories' commitments vary, yet they often include a pledge to occupy zero carbon in operation buildings by a specific date, e.g., 2030.

The latest Knight Frank (Y)OUR SPACE report highlighted that almost all respondents said ESG strategies and commitments would influence their real estate decisions. This is pushing more towards buildings with 'green' certifications and well-being amenities.

Over half of (Y)OUR SPACE survey respondents expect their staff to demand facilities to support mental well-being, 44% expect gym facilities to be a required provision and 34% need cycle storage.

As these pressures grow, we will likely see the trend towards more energy-efficient buildings continue. With the prospect of greater regulation from a landlord/owner perspective, the supply will start to catch up.

Subscribe for more

For more market-leading ESG research, expert opinions and forecasts, subscribe below.

Subscribe here