Higher education revolutionising Spain office market

Educational operators are breathing life back in to prime central locations as growing international student numbers attracts investment into living sectors.

6 minutes to read

There are are around 90 universities in Spain, 5% more than five years ago. During the 2021/2022 academic year, almost 60% were public institutions, although it is in the private sector where new educational centres are being created, with an increase of around 15% in the last five years, while in the public sector they have remained stable.

The Andalusia region leads the number of students in public education, followed by the Community of Madrid and Catalonia, while in the private sector, the majority of enrolments have occurred in Catalonia, followed by the Madrid region and the Valencian Community.

However, the highest growth in higher education enrolment compared to the previous academic year has occurred in the Canary Islands and La Rioja, where there has been an increase of more than 18% in the private sector. These communities also lead the growth of enrolments in the public sector, but the growth has been much more modest, 3.3% in La Rioja and 2.5% in the Canary Islands.

International student appeal

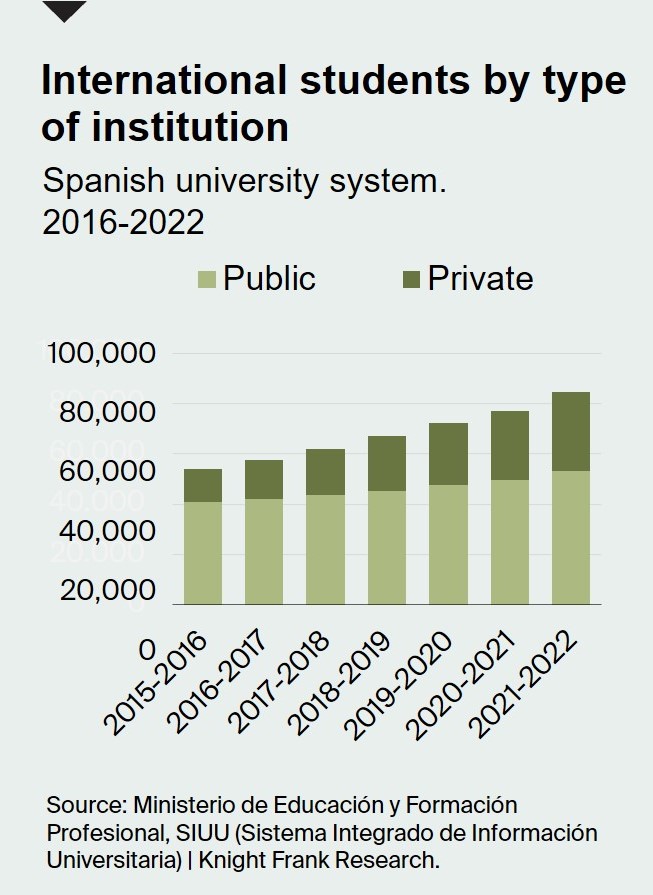

During the 2021/22 academic year, the students in higher education institutions in Spain exceeded 1.3M enrolments, of which 6% were international students, not including students in master's programs, which accounted for an additional 55,000.

Although this figure is much lower compared to domestic students, its annual historical increase is highly significant. After the sharp decline caused by the pandemic, international student numbers increased by almost 10% during the last academic year, compared to a -0.4% decline among domestic students.

The majority of international students are choosing public institutions, accounting for approximately 65%. The largest proportion comes from the European Union, followed by Latin America/Caribbean and Asia/Oceania.

Spain offers a wide range of institutions that provide higher education, including private and public universities with affiliated centres, as well as private schools or institutions of higher education. The adaptation of the education provided to new models of study and work, increased flexibility through in-person, hybrid, or online modalities, as well as a careful selection of campuses/facilities, are contributing to Spain's position in top rankings of higher education.

One of the most prestigious rankings, the Shanghai Ranking, which analyses a total of 1,000 universities, placed the University of Barcelona among the top 200 universities worldwide in 2022 (first in the national ranking). Meanwhile, the annual Financial Times ranking five Spanish business schools among the top 30 in Europe. One of them, ESCP Business School in Madrid, achieved the third position.

The education sector in Madrid occupier office

The Spanish capital has become a focal point where prestigious business schools proliferate, new centers are established in affiliation with existing universities, and better locations are sought for existing institutions.

The city's reputation as a great place to live, coupled with its stock of quality office buildings or the possibility of their optimal rehabilitation, is driving the private education sector to enter the office market with force, something that was not seen before.

Madrid offers opportunities for recent graduates, as large cities usually have greater collaborations with local companies, facilitating their early integration into the job market.

Moreover, both national and international students see the city as a hub for quality education that has successfully adapted to new models of subjects and study formats (in-person, distance, or hybrid), while also offering a wide range of cultural and gastronomic experiences. Additionally, Madrid enjoys nearly 3,000 hours of sunshine per year.

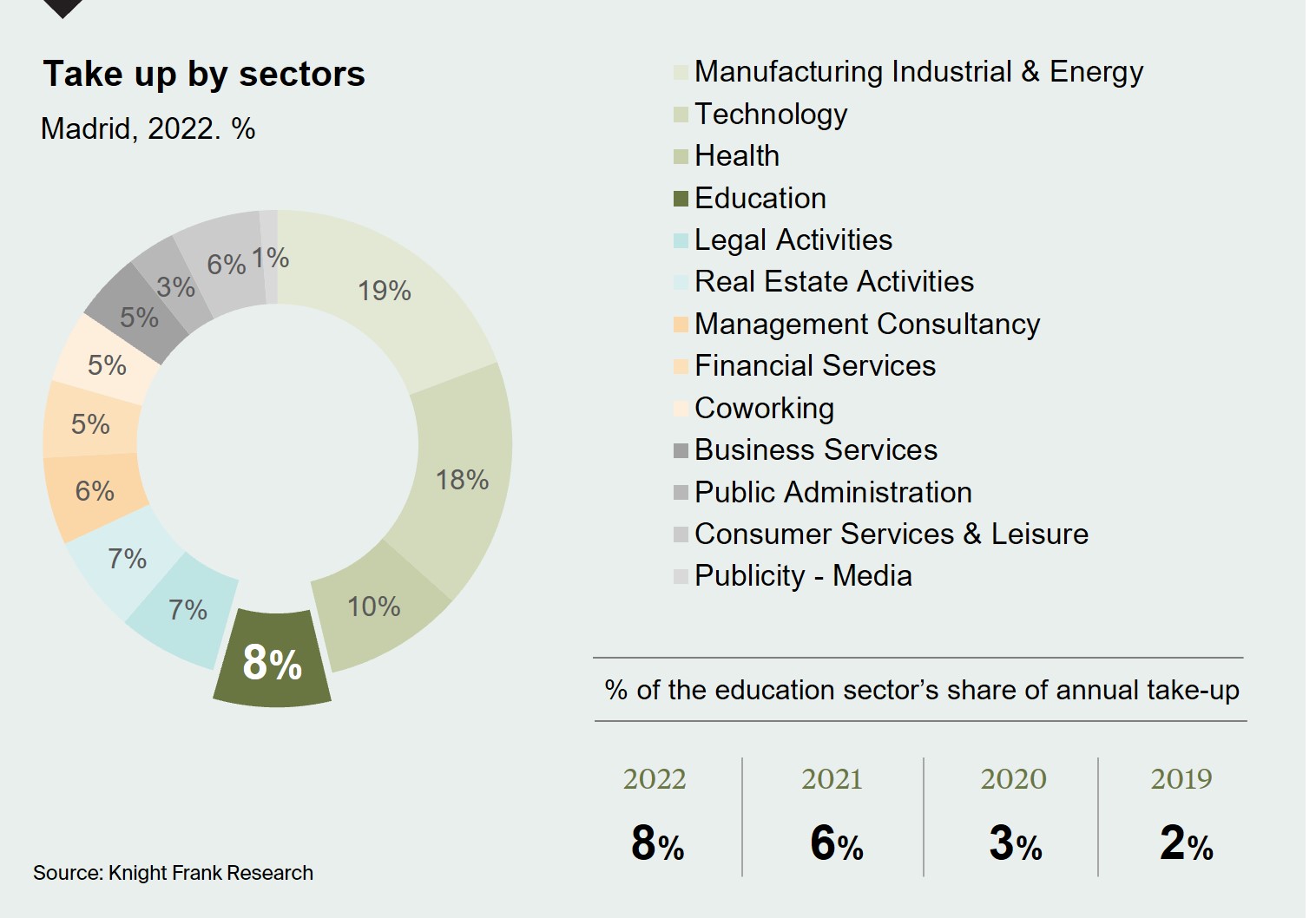

As of the end of 2022, the education sector has accounted for 8% of the total compared to the figures recorded in 2019. Currently, the education sector is experiencing significant growth, similar to the technological and healthcare sectors.

In terms of the contracted area, the education sector has surpassed 28,600 square meters, which is the highest volume recorded in the past decade.

This area is distributed among nine transactions, with the largest one being the operation carried out at Arapiles 13, where Alfonso X University will occupy nearly 14,000 square meters in an exclusive office building. Another notable transaction during the year was made by CUNEF, which rented approximately 8,500 square meters on Almansa Street with the intention of occupying the entire complex, consisting of four buildings, in the near future.

Prime locations top choice

Analysing the evolution by areas of the capital where space is being rented for educational purposes, during the last year, nearly 65% of the educational sector's leasing activity has taken place in the prime area of the city, the Central Business District (CBD), followed by the Secondary Centre with around 30%.

A smaller portion is located outside the M-30 area. Comparing these figures with the average of the previous five years (2017-2021), a change in trend for this type of center can be observed. These data reflect the commitment of universities, currently private ones, to improve their locations.

In addition to location, there is a preference for state-of-the-art buildings or those that offer possibilities for rehabilitation to meet educational quality standards, which in turn enhance the reputation of the institution behind the operation.

This has been the case for the American university Schiller, which has leased over 3,200 square meters for its Madrid campus in a historic building in the heart of the city, on Paseo de Recoletos.

This positive trend in the education sector is also occurring in other Spanish cities. In Barcelona, an educational institution has secured a lease for 13,000 square meters in the Kudos Innovation Campus Inneo, owned by Starwood Capital, in the municipality of San Joan Despí. This transaction represented the largest leasing deal in the Catalan office market in 2022.

How do global investors view education sector?

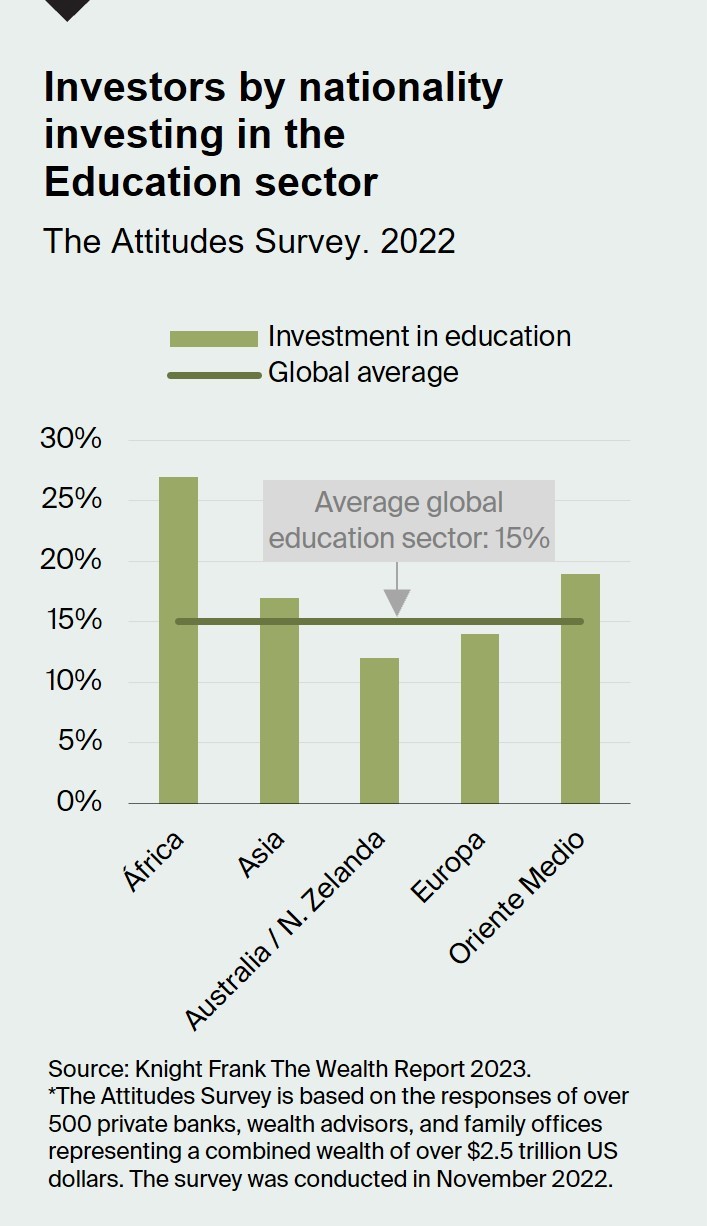

Knight Frank's Attitudes Survey, the survey on trends and attitudes included in The Wealth Report study, is based on responses from over 500 private banks, wealth advisors, and family offices representing a combined wealth of over $2.5 trillion.

When asked about which branch of the real estate sector they are investing in, an average of 15% of all respondents selected the education sector.

Africa had the highest percentage at 27%, while the remaining regions recorded around 15-20%.

Regarding criteria related to environmental, social, and corporate investment, regardless of its intended use, an average of 57% of respondents stated that the energy source powering the building is one of the most relevant factors.

This was followed by the opportunity for building rehabilitation, chosen by 33% of respondents. The materials used and their impact on the carbon footprint, accessibility, and social impact were next on the list, with approximately 30% each.

Building accreditations and the availability of electric vehicle charging facilities were deemed important by around 25% of respondents. Finally, bicycle facilities were selected by 9% of respondents.

Investment in the Spanish teaching market

If there is a market with great potential in Spain that offers stability and profitability, it is the education sector. It is worth noting that this segment has the characteristic of being counter-cyclical, so when we experience an economic crisis, this sector experiences a boom.

It has been observed that during these situations, the population tends to seek to improve their educational level, and as a result, investors start to focus on this sector.

Although there haven't been many registered operations in this sector, in recent years there have been significant acquisitions, such as the one made by Permira Fund of Universidad Europea from Laureate Education, for 770 million euros.

This acquisition also included campuses in Valencia and the Canary Islands, as well as the Portuguese Universidade Europea in Portugal and the Portuguese Institute of Marketing Administration.

Another major operation in this sector is the alliance between Universidad Alfonso X El Sabio and the British risk management firm CVC through its Fund VII, which amounted to around 1.1 billion euros.

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here