Record-breaking investment charging Spain PRS market

Investments in assets in Spain Private Rented Sector sees volume increase of 160% compared to 2019.

3 minutes to read

The Private Rented Sector (PRS) in Spain is becoming increasingly relevant each year, among other factors, due to the great potential of the residential rental market in the country compared to the rest of Europe.

The average population living in rental housing is 30.1% elsewhere in Europe, compared to Spain's 24.2%, according to the latest data published by Eurostat at the end of 2021.

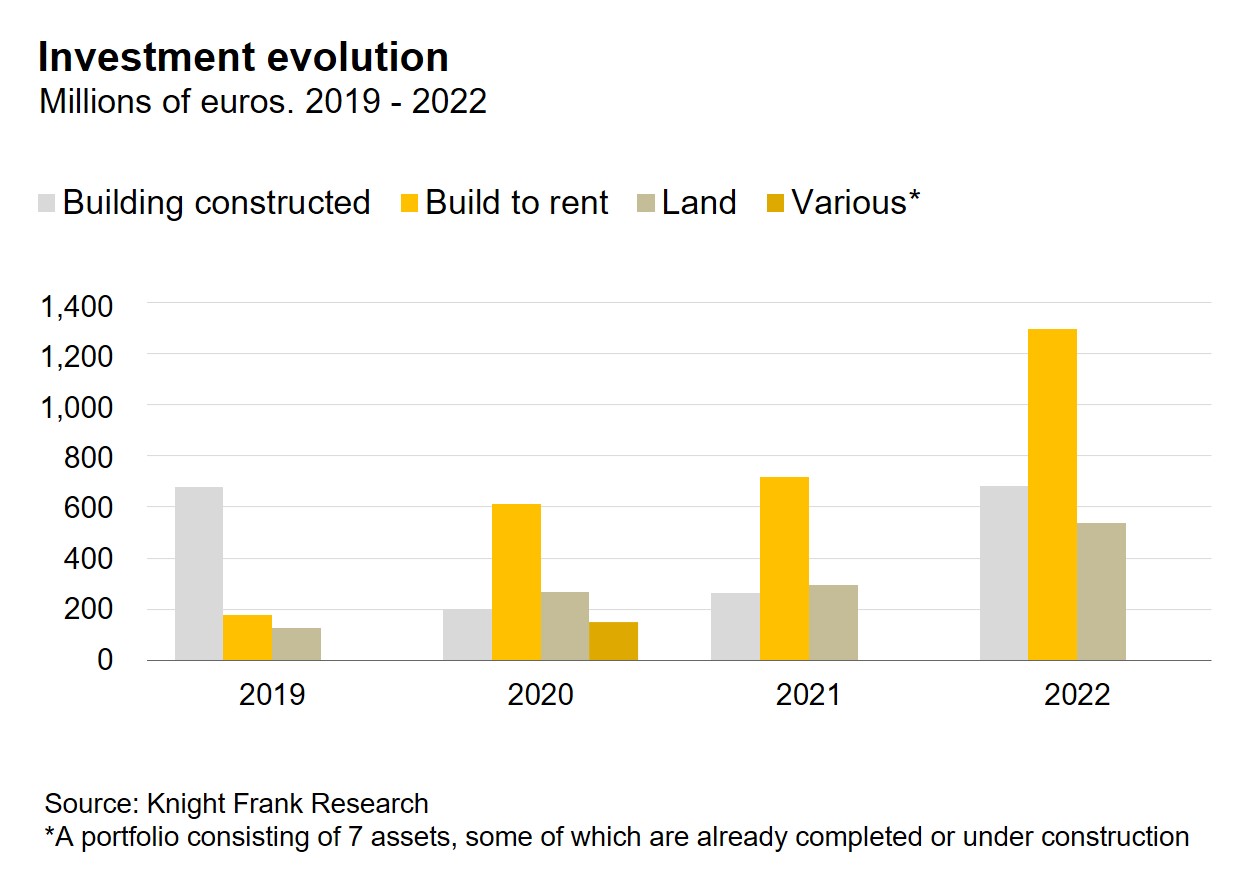

As of the end of 2022, investment in this sector has exceeded €2.5 billion, nearly double that of the previous year, with the build to rent typology being the most noteworthy, having registered around €1.3 billion.

This typology has experienced a significant increase compared to previous years and has accounted for more than 50% of the total investment in 2022.

However, investment in completed buildings has had the highest growth compared to 2021 (+150%) and has accounted for nearly 30% of the total investment in PRS. The purchase of land designated for this purpose has also increased compared to the previous year (+80%) and has accounted for more than 20% of the total investment in this sector.

Record-breaking investment

Investment operations with record breaking high volumes were recorded in 2022. The two largest operations of the year were build to rent projects.

Patrizia led the first one with an investment of €600 million to build 1,500 homes in Barcelona, and Greystar completed the second largest operation with nearly €290 million invested in a project to build 2,500 rental residential units.

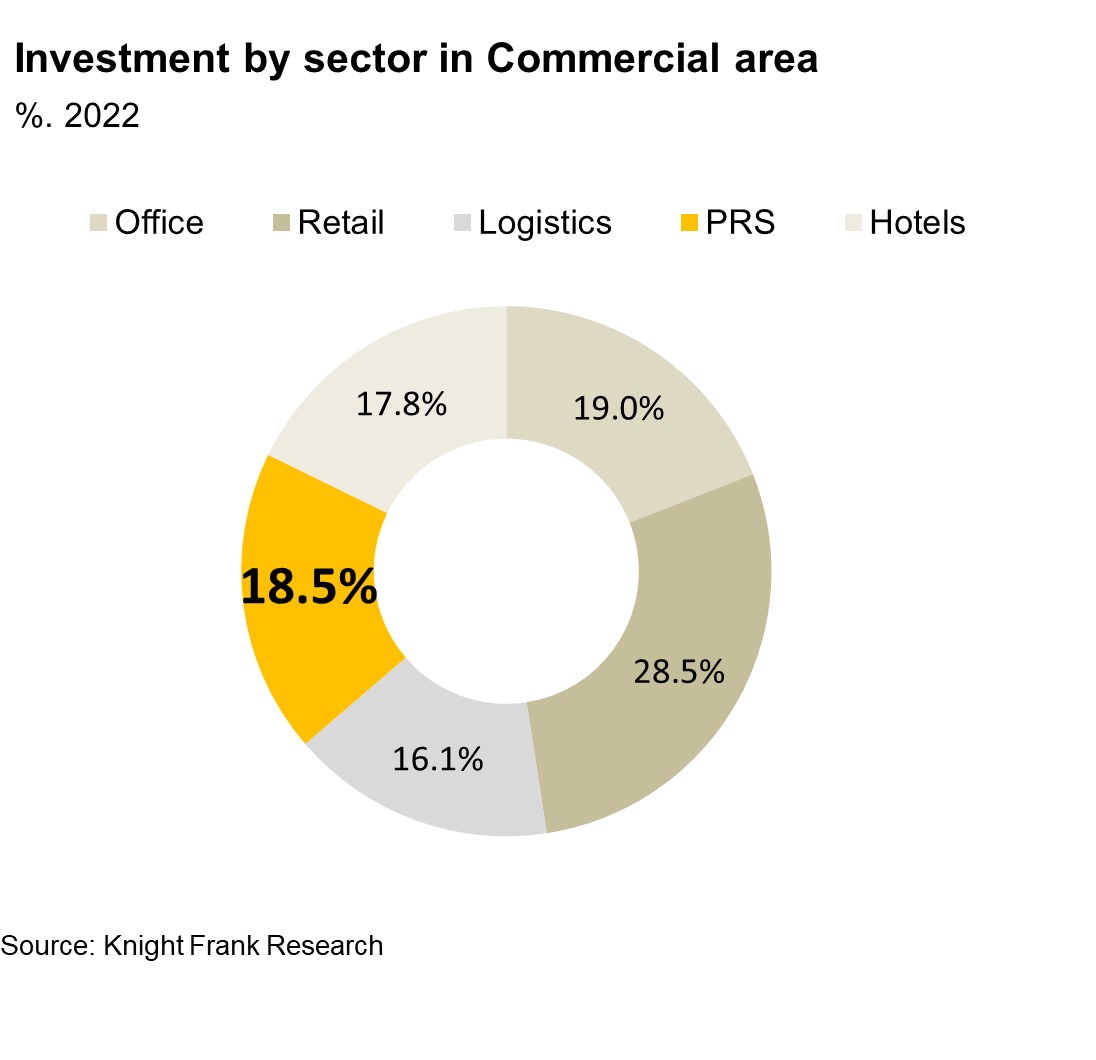

The total investment in commercial assets including PRS, offices, retail, logistics, and hotels reached over €13.5 billion in 2022.

Rental residential investment

Residential rental assets and projects have accounted for nearly 20%, the highest percentage in recent years, and only behind the office and retail sectors, which includes the sale of portfolios of bank branches that make it stand out in proportion to the rest of the sectors.

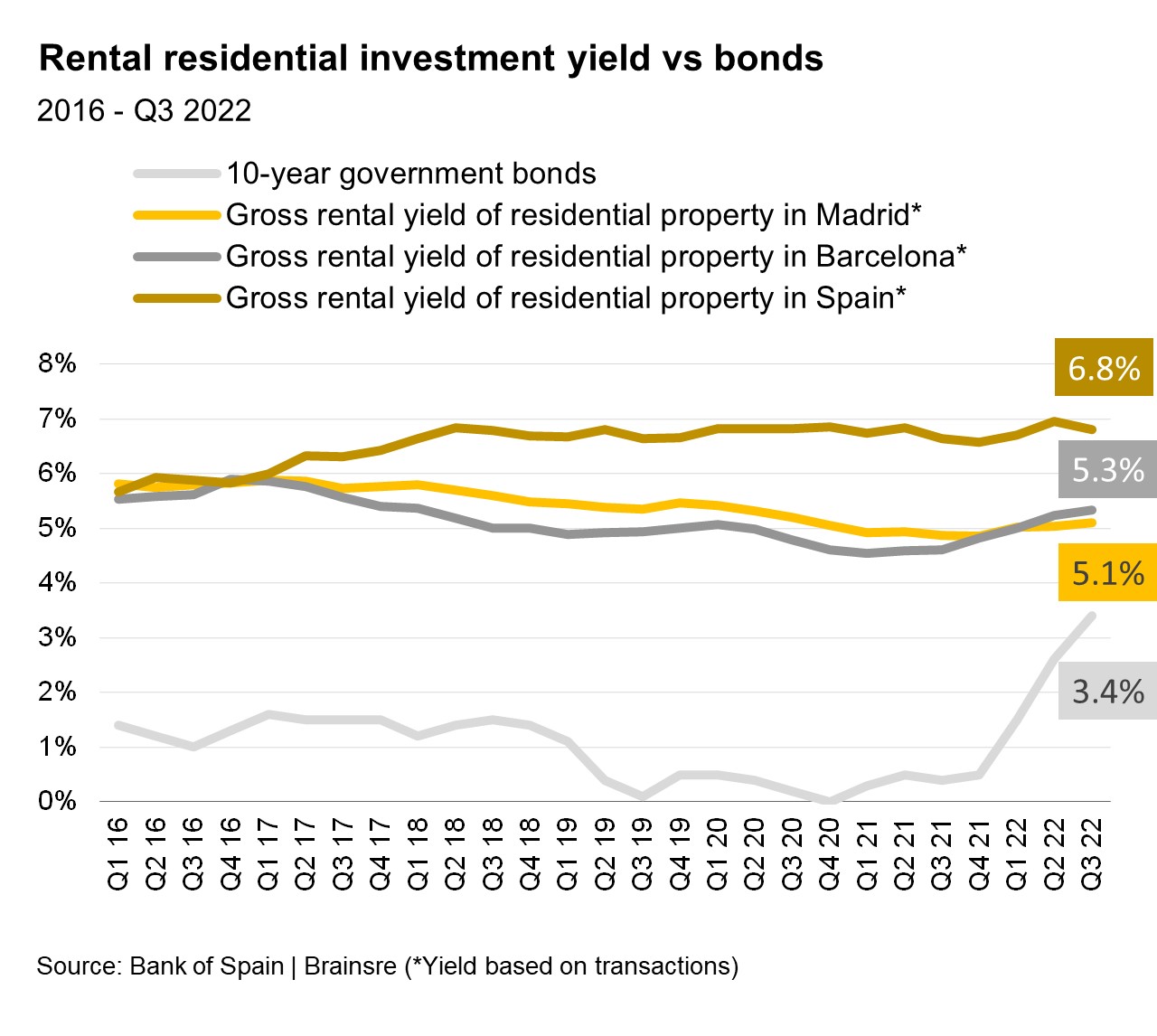

Investing in rental housing offers one of the most attractive returns compared to other alternative investments.

According to the latest available data, the gross rental yield in Spain stands at 6.8% nationwide, well above the yield of 10-year government bonds, which recorded 3.4% as of the end of the third quarter of 2022. The yield on government bonds is experiencing exponential growth due to the current inflationary environment, although it is important to consider the appreciation generated by real estate assets over the years.

Top 10 buyers

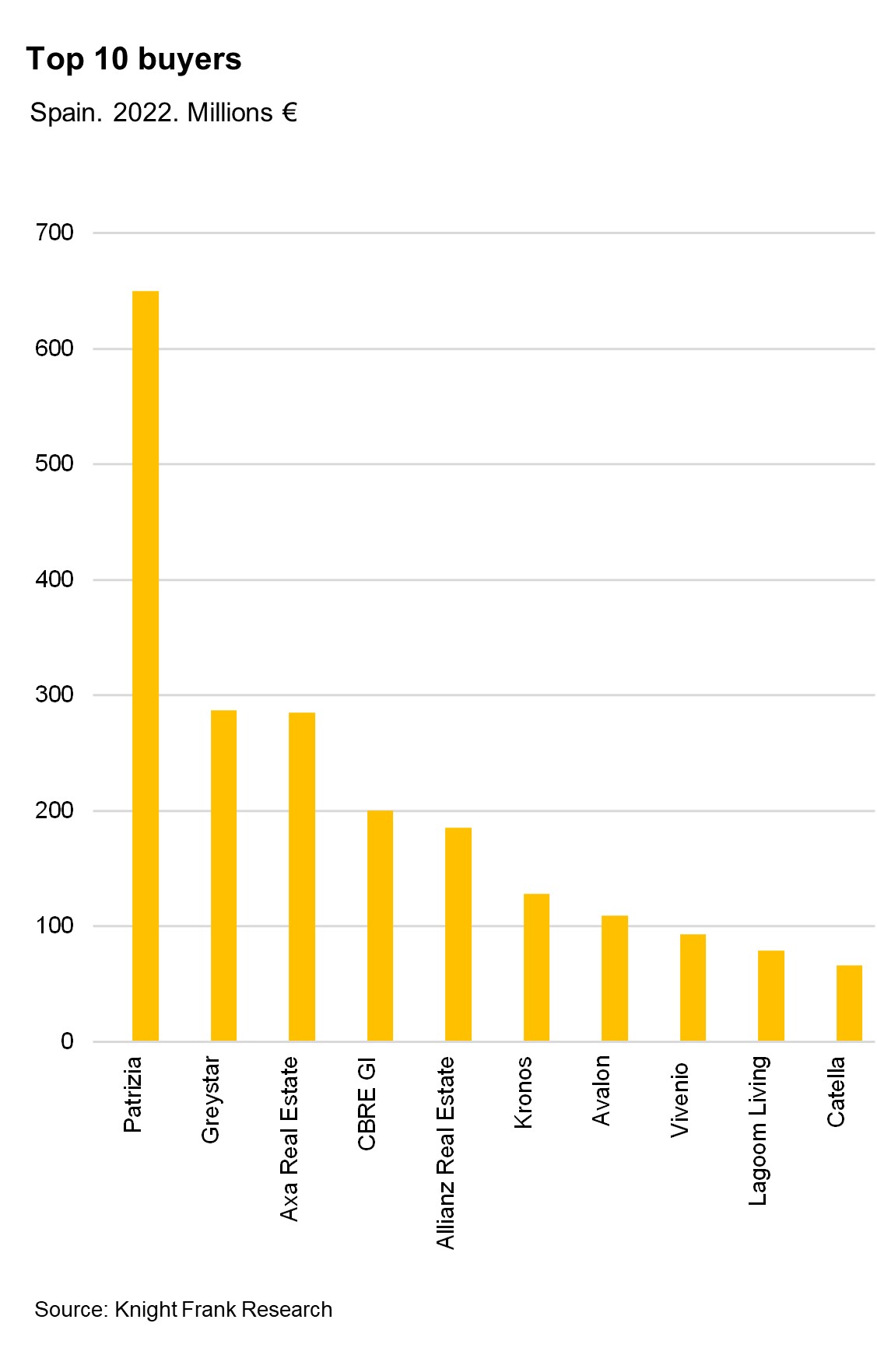

As for buyers, investment funds stand out, accounting for approximately 35% of the total volume. The ones with the highest transaction volumes are Patrizia, by a large margin, followed by Catella and Magno Living.

Developers follow the funds, representing about 25% of the investment, such as Greystar and Kronos. In third place are insurance companies, such as AXA, which, with a single transaction, has accounted for 11% of the annual PRS investment.

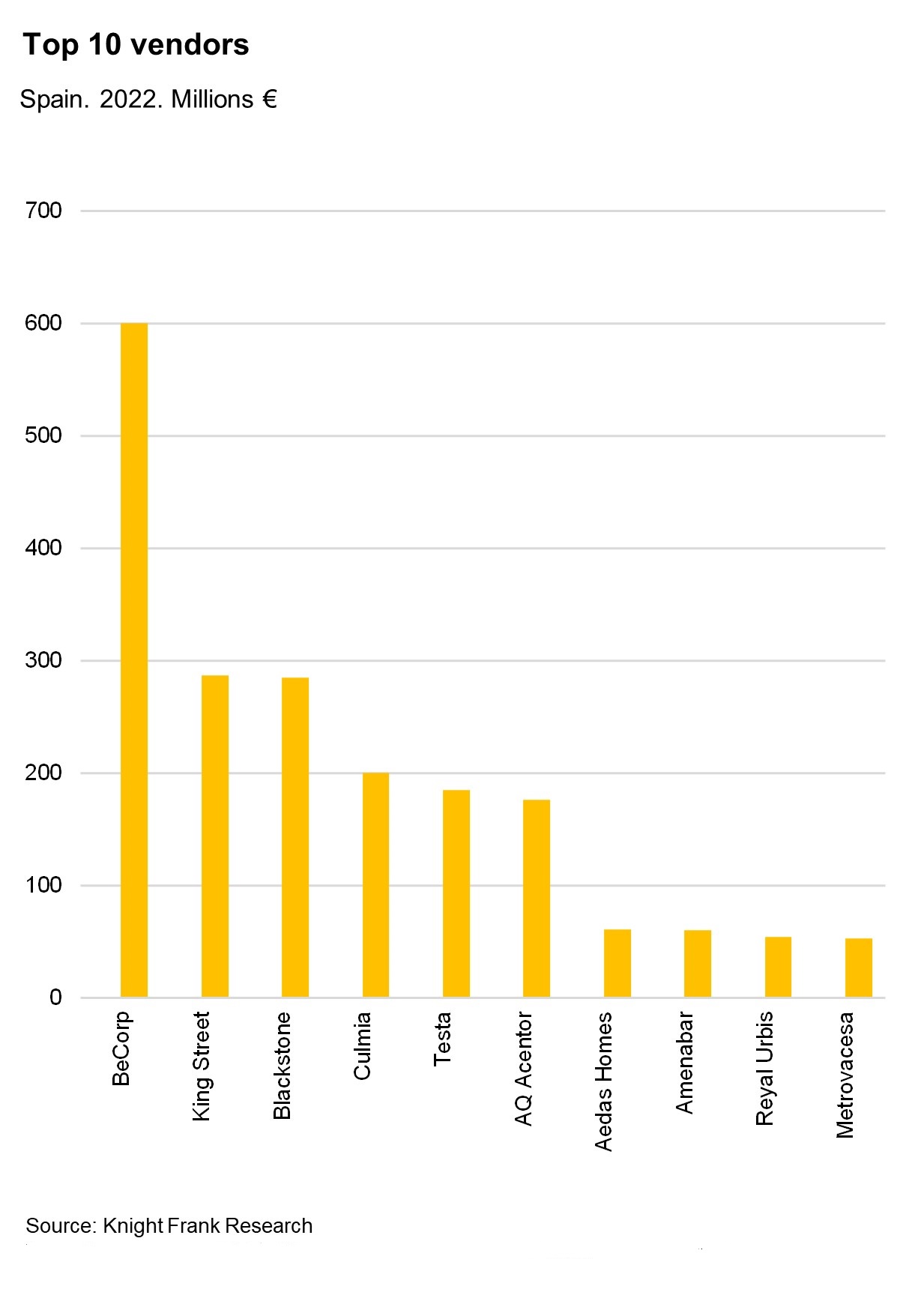

Top 10 sellers

Prominent sellers in this case are developers, accounting for over 50% of the investment, with BeCorp leading in transaction volume, followed by Culmia. Investment funds are the second-largest sellers by volume, representing around 25% of the total, with King Street being the top seller, followed by Blackstone.

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here