European office occupier market Q1 2023

Explore European office occupier activity in Q1 2023 as leasing markets start to moderate as economic headwinds feed through.

10 minutes to read

Local experts across the Knight Frank network have analysed the latest occupier activity in their region in the first quarter of 2023.

Updated quarterly, the dashboards provide a concise synopsis of occupier activity in Europe's markets.

Discover vacancy rates, take-up and prime rents from cities across Europe in more detail by exploring the dashboards for Q1 2023 at the bottom of each section.

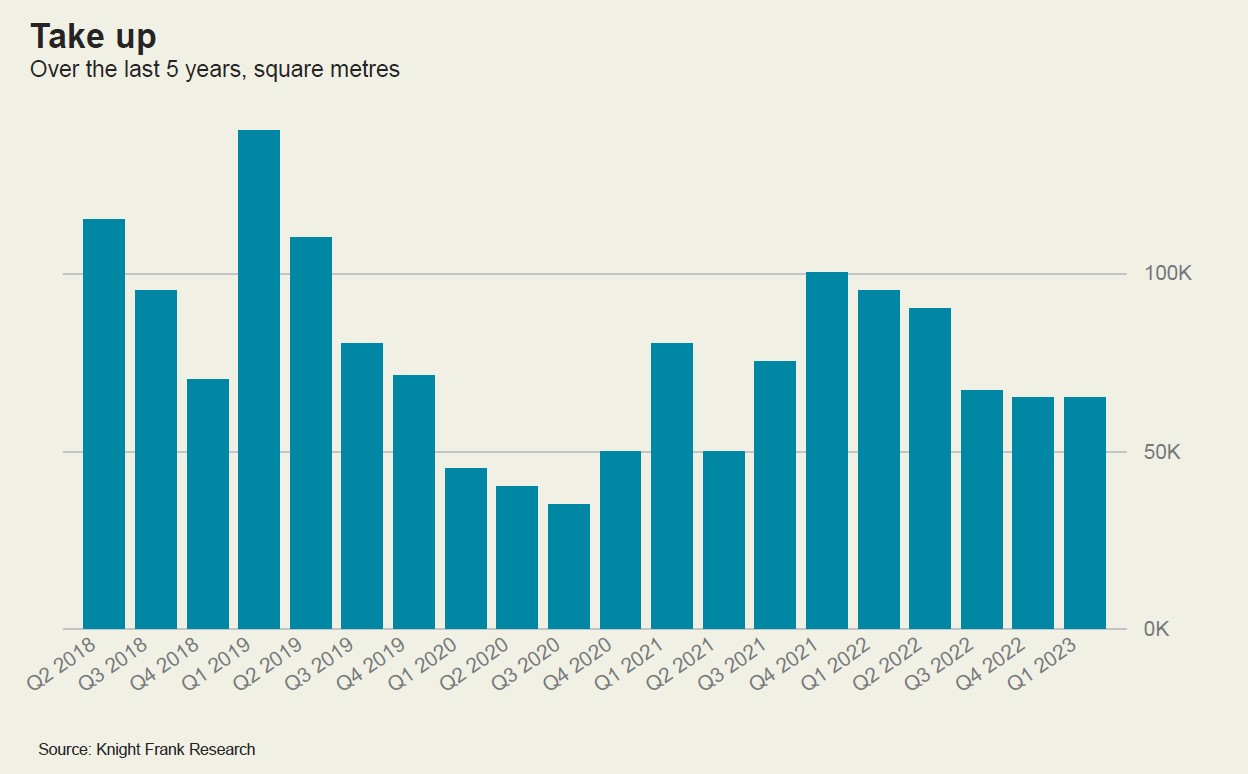

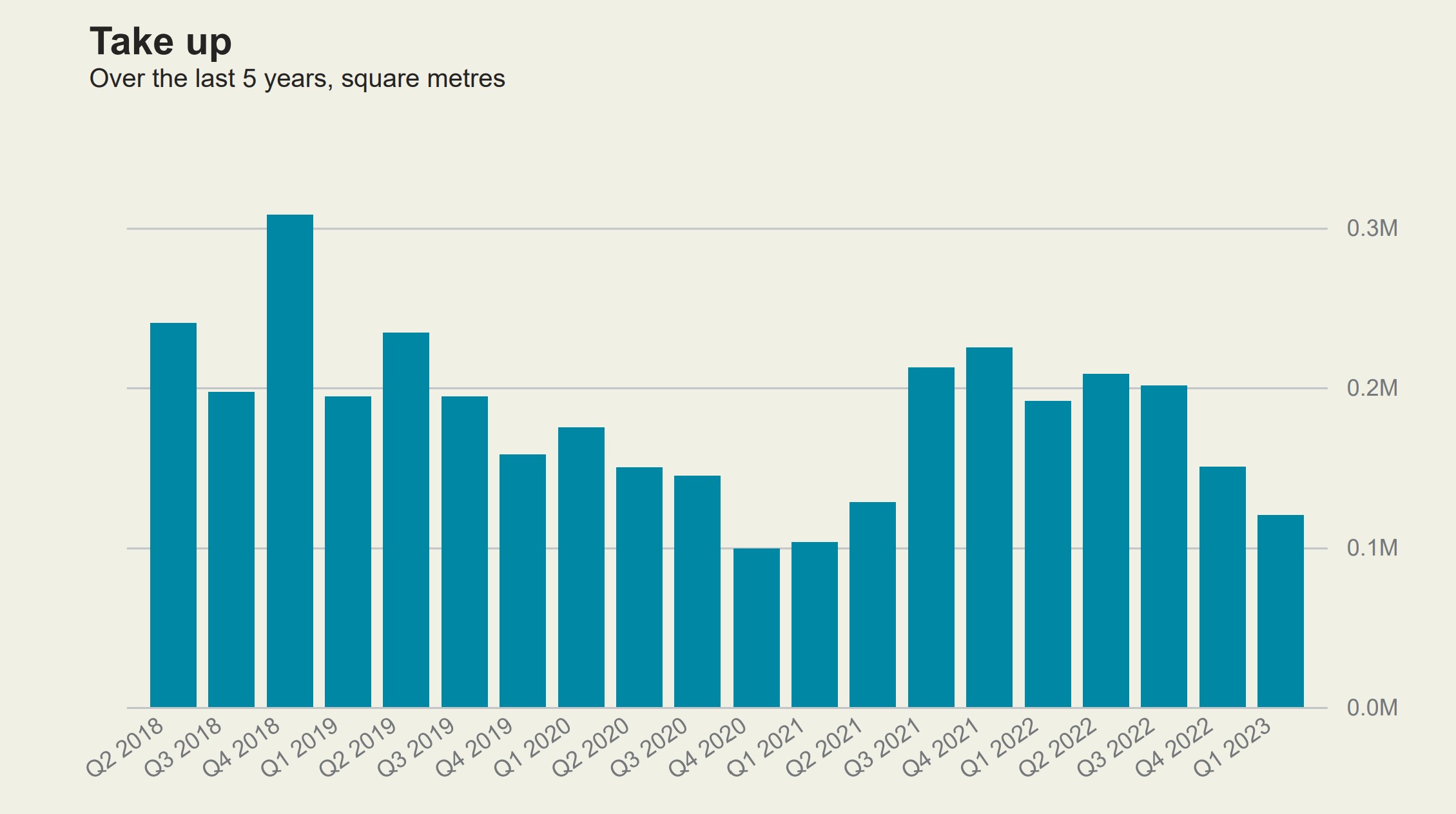

Barcelona office market

In the first quarter of the year, the Barcelona office market recorded take-up of 65,000 sqm. This is 32% less than the volume of transactions seen in Q1 2022, and 25% below the five-year first quarter average.

Activity was especially noticeable in the Health and Education sectors, which are gaining momentum. Top quality assets located in the CBD as well as 22@Barcelona, the city's technological and innovation district, continue to see the most demand.

The vacancy rate remains unchanged at 7.0%, where it has held steady since Q4 2020. This is only marginally above the five-year average of 6.8%.

Prime rents have also held firm at €336 psqm per annum, a level unchanged for the last few years. Rents are expected to rise moderately in coming quarters, and market favourability currently tipped towards the tenants may balance as a result.

There are 550,000 sqm of office space set to be completed throughout 2023 and 2024, of which 70% are located in the 22@ district.

View the latest dashboard

Berlin office market

In the first quarter of 2023, the Berlin market saw 137,100 square metres of leasing activity, representing a 7.7% decline compared to Q1 2022 and falling 30% below the five-year average.

However, some larger deal sizes were reported, including two deals above 10,000 sqm, a size range that was absent from what was seen in the first quarter last year. These included Boston Consulting Group and the Mazahn Job centre committing to 19,000 and 12,000 sqm, respectively.

With 754,400 sqm of vacancy in the Berlin office market, the vacancy rate ticked upwards 30 basis points since last quarter to 3.60% in Q1 2023. This is a 24% increase year-over-year from 2.90% in Q1 2022, and while it remains above the five-year average of 2.14%, it is still well below ten-year highs of 8.30% seen back in 2013.

Some 115,000 sqm of office space was completed this quarter, 30% pre-let. Under construction volumes for the remainder of the year total 629,000 sqm, of which 70% are pre-let. With a development pipeline in excess of 600,000 sqm every year until 2026, it is expected that vacancy rates may continue to climb in upcoming quarters. As a result, the balanced market may tip in favour of the tenant in 2024.

Prime rental rates were unchanged this quarter at €522 psqm, up 1.2% year-over-year.

View the latest dashboard

Bucharest office market

After a strong year in 2022, the Bucharest office market saw limited leasing activity in the first quarter of 2023, with only 46,000 sqm of transactions recorded. This is the lowest level of quarterly take-up in two years and represents a 35% decrease year-over-year from the volume seen in Q1 2022.

Renewals were found to comprise 60% of the deal activity for the quarter. The IT & Communications sector remained the most active sector this quarter, making up 38% of the total take-up. Inflationary pressures have created a challenging environment for relocations and expansions, due to increasing costs of utilities and fit-outs.

The vacancy rate remained at 15%, the same level as the previous quarter and as that in Q1 2022. The last time the vacancy rate was recorded at a level higher than this was in 2014.

Prime rents also held firm quarter-over-quarter at €228 psqm per annum, representing 5.6% growth from €216 psqm a year ago.

There were 42,000 sqm of construction completions in Q1 2023, down 43% from the same time period last year, and below the five-year average for the metric.

Another 100,000 sqm of development are in the pipeline to be completed this year, and an additional 500,000 sqm total are expected in 2024 to 2026.

View the latest dashboard

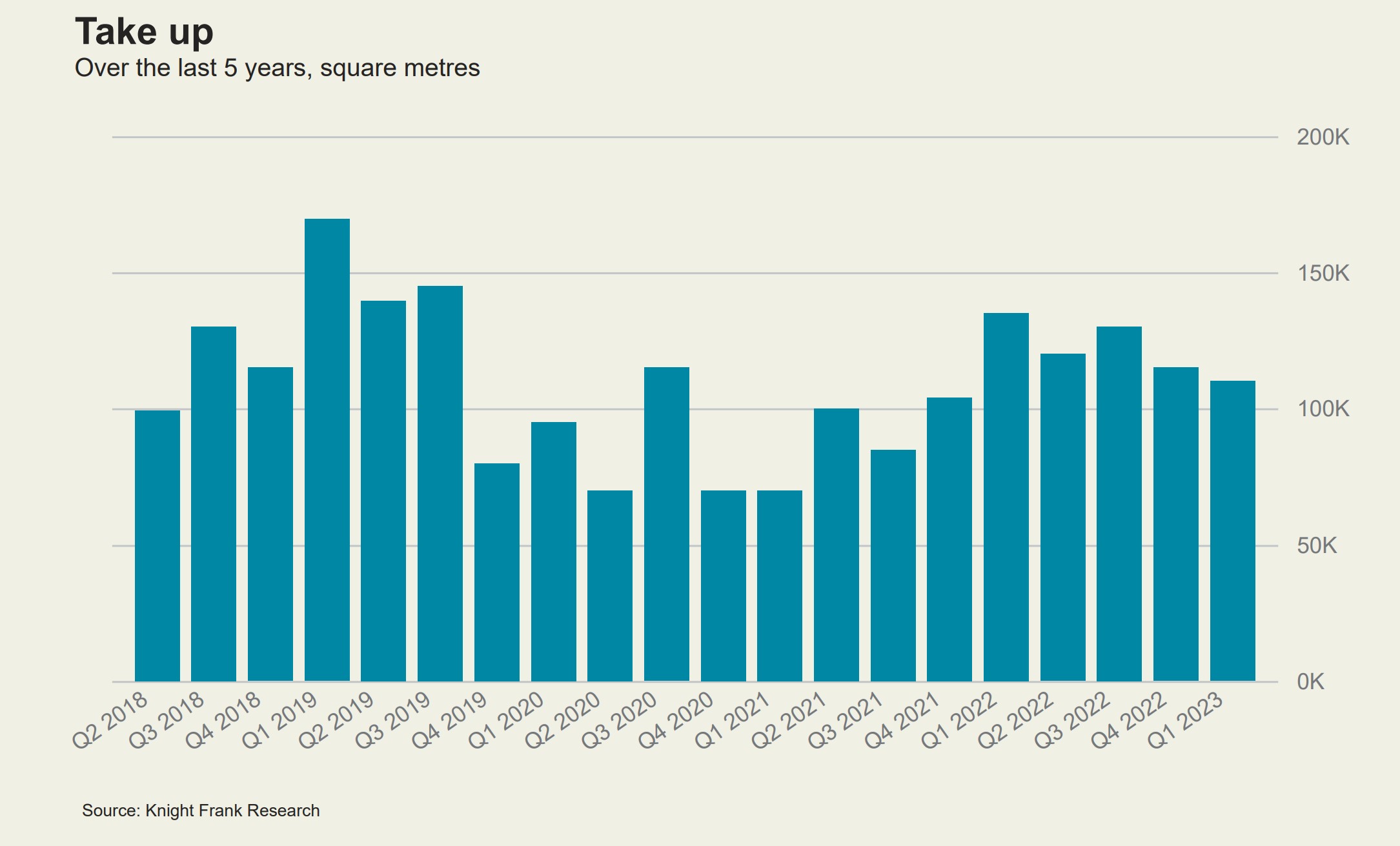

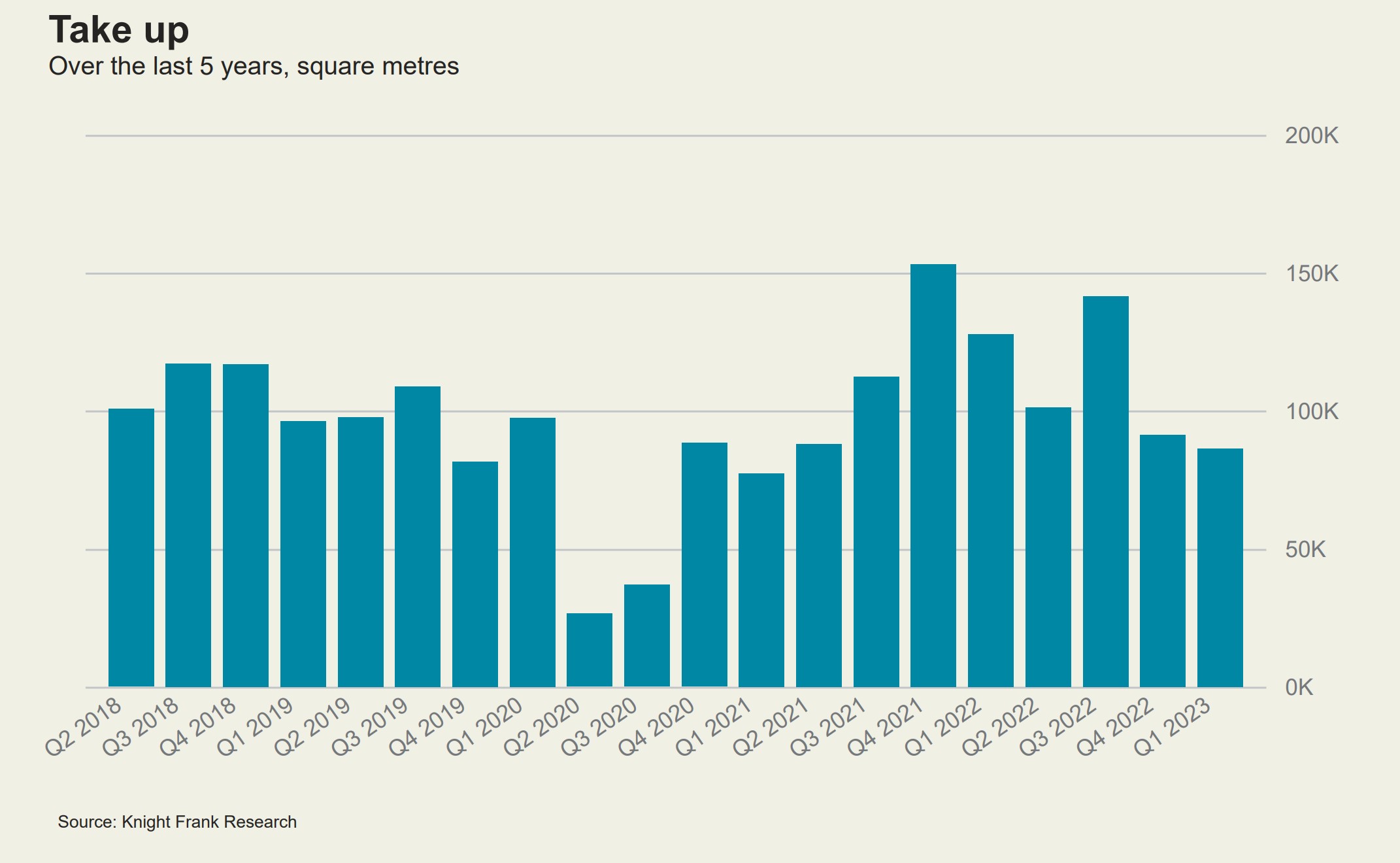

Madrid office market

After a strong year in 2022 with an annual total of 500,000 sqm of take-up, the Madrid office market performed relatively well in the first quarter of 2023.

There were 110,000 sqm of transactions recorded, 19% less than were seen in the same time period last year but close to the five-year average of 118,000 sqm.

The vacancy rate remains unchanged at 11.5%, representing a 50 bps drop from its recent peak at 12% in Q4 2021 and Q1 2022.

Construction completions totalled 10,532 sqm this quarter, and a further 220,300 sqm are expected to be completed this year. Currently, there are an additional 192,300 sqm in the development pipeline set for completion in 2024 and 2025.

Prime rents held firm for the third quarter in a row at €402 psqm per annum. This represents a 3% increase year-over-year from €390 psqm in Q1 2022, the level at which prime rents have held firm since Q1 2020.

View the latest dashboard

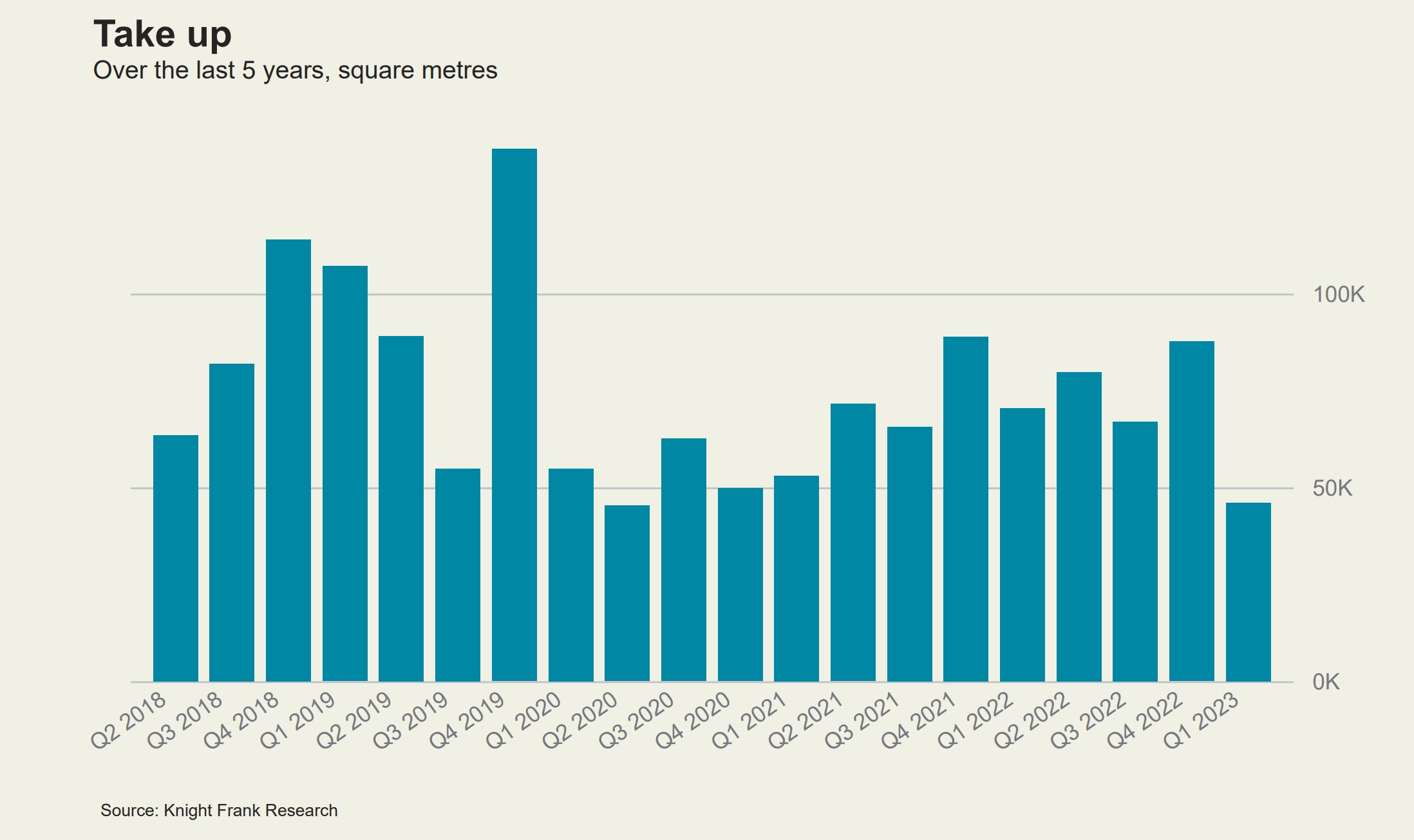

Munich office market

The Munich office market is off to a subdued start in 2023, with take-up of 120,200 sqm registered in the first quarter of the year. This is the third weakest quarterly result in the last ten years.

Prime rent has risen once again and stands at €534 psqm per annum in Q1 2023, meaning the market has seen prime rental growth of 6% year-over-year since Q1 2022.

The amount of available space is rising moderately, bringing the office vacancy rate to 5.4%, up 10 bps from 5.3% in Q4 2022. This represents a 10% increase when compared to Q1 2022.

The development pipeline is robust for 2023 to 2025, with more than 1.2 million sqm of completions expected.

Demand for office space will remain subdued in the coming months. The current uncertainty about the economic and financial situation means that take-up will struggle to match last year’s levels. Nevertheless, demand for central locations remains high. Prime rents are expected to continue to rise.

View the latest dashboard

Paris CBD office market

While the Greater Paris Region is experiencing its highest levels of office vacancy since 1997, the Central Business District (CBD) market continues to tighten, with vacancy ticking downward by 23 basis points since Q4 2022 to 2.6% in Q1 2023.

This represents a 27% year-over-year drop, and points to the ongoing appeal of the inner city.

Prime rents have reached €980 psqm per annum at the end of March 2023, marking an increase of 4% year-on-year and 13% since the start of the Covid19 pandemic. A further increase in rents would make it more difficult for some companies to access the Paris office market.

Construction completions totalled 18,394 sqm for Q1, down 76% from Q1 2022. A further 96,898 sqm are expected to be delivered this year.

A lack of large transactions across the Greater Paris Region has especially weighed on the performance of the Paris CBD. There were 86,500 sqm let in the 1st quarter of 2023, 21% below the five-year average for Q1 activity.

However, a few larger transactions are underway and expect to be completed soon. The CBD's appeal is not to be undermined as it continues to attract companies from other submarkets, while departures from the CBD remain very rare. This trend is unlikely to weaken in the coming months.

Although the economic context is more uncertain and some occupiers are less present (start-ups, coworking), other business sectors that are usually drawn to the CBD, such as finance, consulting and luxury, remain very active.

Finally, while the employment market is still very tight in high value-added sectors, the quality of offices and their location remain at the heart of strategies to retain and attract talent.

View the latest dashboard

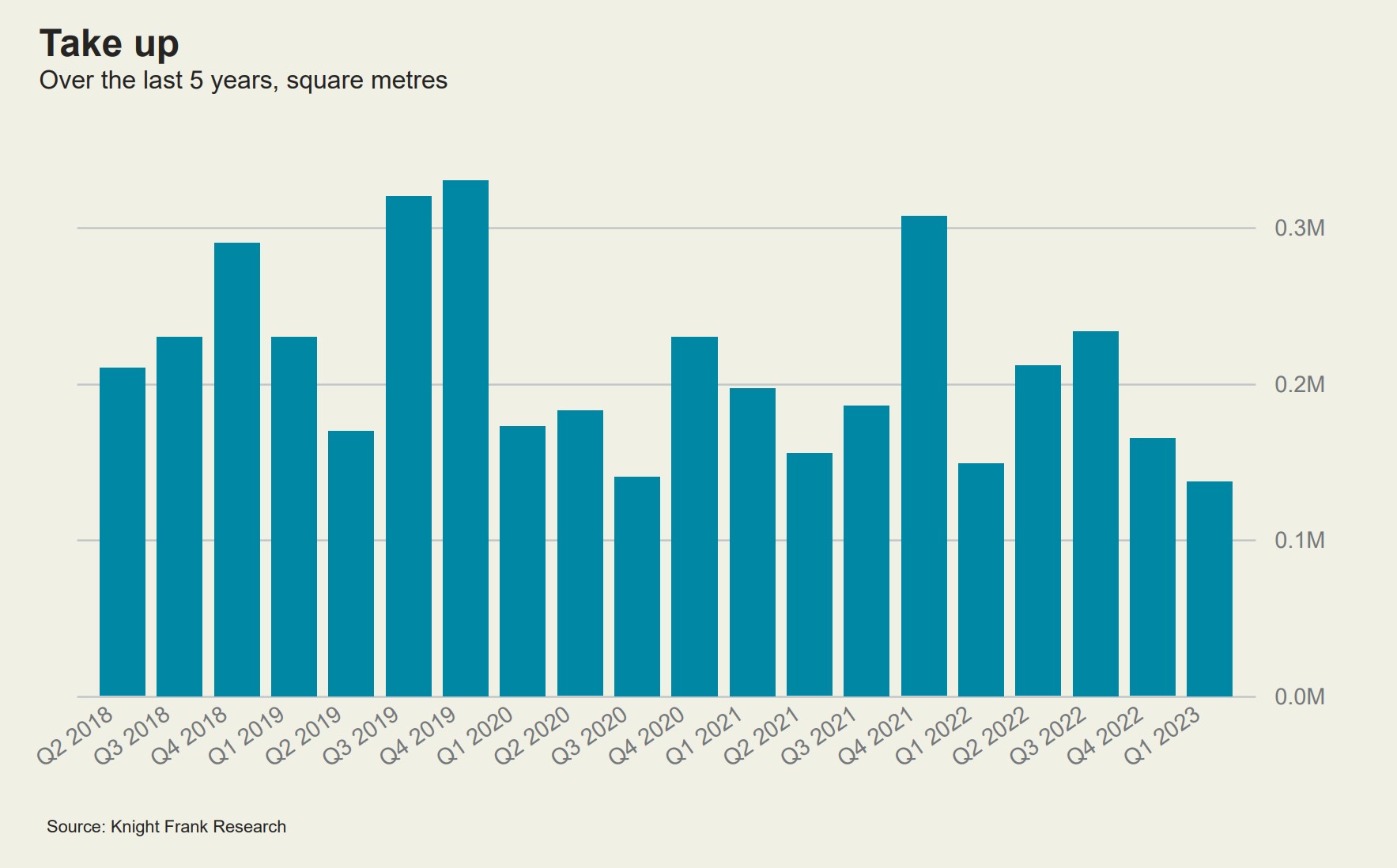

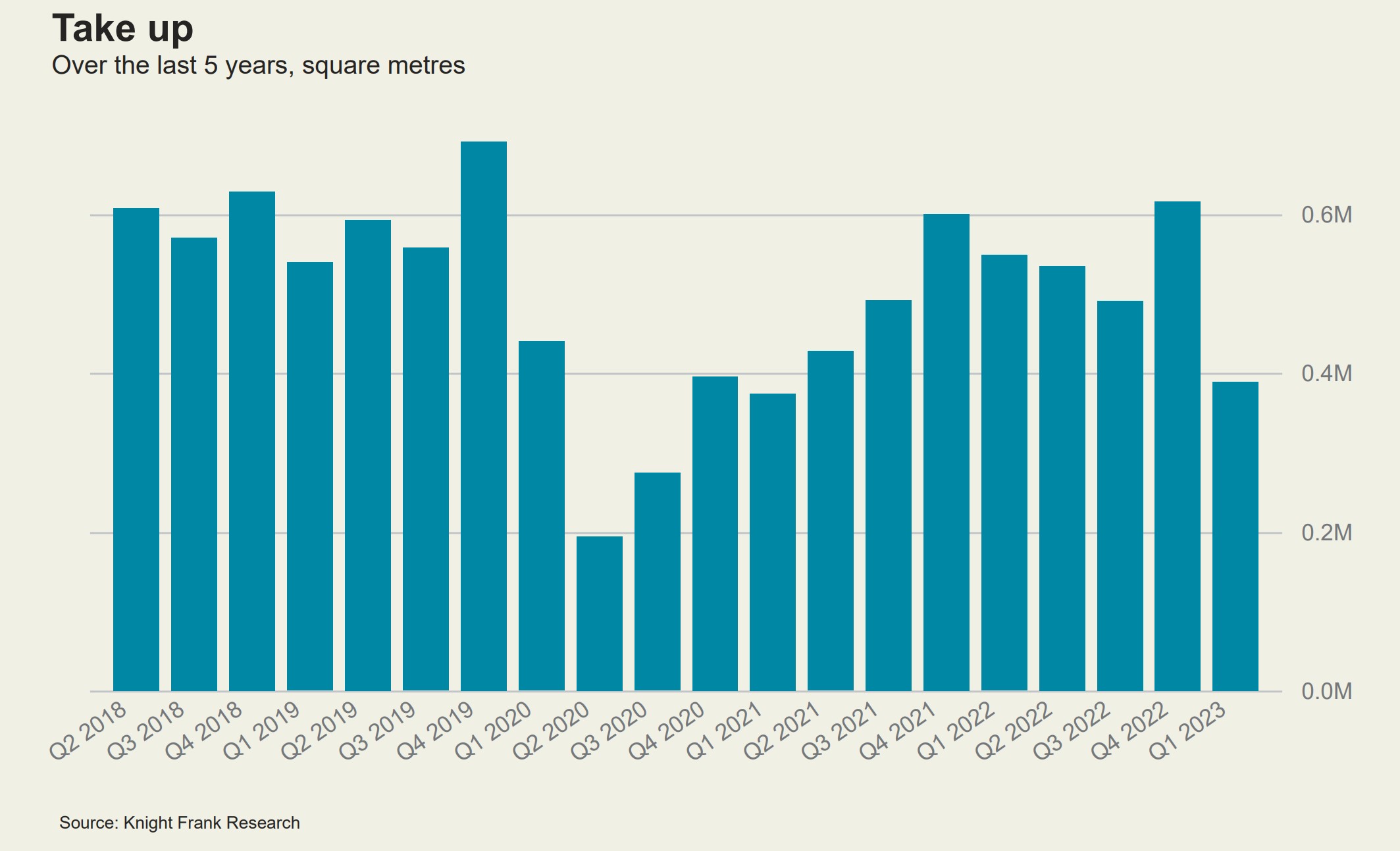

Paris IDF office market

After good results in 2022, activity has significantly slowed down since the beginning of 2023.

The Île-de-France region saw 388,579 sqm of take-up in the first quarter of 2023, a 29% decrease compared to the same period last year. This drop does not come as a surprise since the strong results in 2022 were partly due to the completion of a few large transactions that had been underway for a long time, and to a post-Covid catch-up effect that gradually ran out of steam.

Average rents have continued to hold firm at €480 psqm since the third quarter of 2022, marking a 7% increase from €450 psqm in Q1 2022. There were 157,690 sqm of new supply delivered in Q1 2023, down 33% from the first quarter of 2022. A further 705,181 sqm are expected to be delivered this year in the region.

The vacancy rate in the Île-de-France region reached its highest levels since 1997 in Q1 2023 at 7.8%, representing a 60 bps increase from Q1 2022.

Vacant supply has continued to increase in almost all markets of Western Paris and the Inner Suburbs, raising the vacancy rate in certain office areas to very high levels, such as in La Défense where it is now close to 15%, and even more so in the Péri-Défense and the Inner Northern Suburbs, where it is around 20%.

View the latest dashboard

Prague Office Market

The Prague office market performed fairly well in Q1 2023, with vacancy continuing to tick downwards from its recent peak of 8.25% in Q2 2022. The figure was recorded at 7.5% this quarter, down 22 bps from last quarter. This is despite the large volume of new completions in Q1 of 37,981 sqm, a robust 62% above the Q1 average.

The market saw 137,841 sqm of take-up this quarter, also well above the five-year first quarter average for the metric. This is the highest Q1 take-up volume recorded in the last ten years. However, a large portion, close to 45% of the transactions, were found to be renegotiations. Prior to 2020, this figure was usually below 40%.

Prime rents have increased again in Q1 to €324 psqm per annum, representing 10.2% growth year-over-year. They have been steadily on the rise since a recent low of €264 psqm in Q3 2021.

The under construction pipeline is very limited, with approximately 90,000 sqm scheduled for completion in 2023 and only 50,000 sqm in 2024. No construction commencements have been observed in the last three quarters.

As a large proportion of the pipeline under construction is already pre-let, the only option for potential new occupiers is anticipated to soon be second-hand office space. As such, prime rents can be expected to rise and the market balance may tip in landlords' favour in coming years.

View the latest dashboard

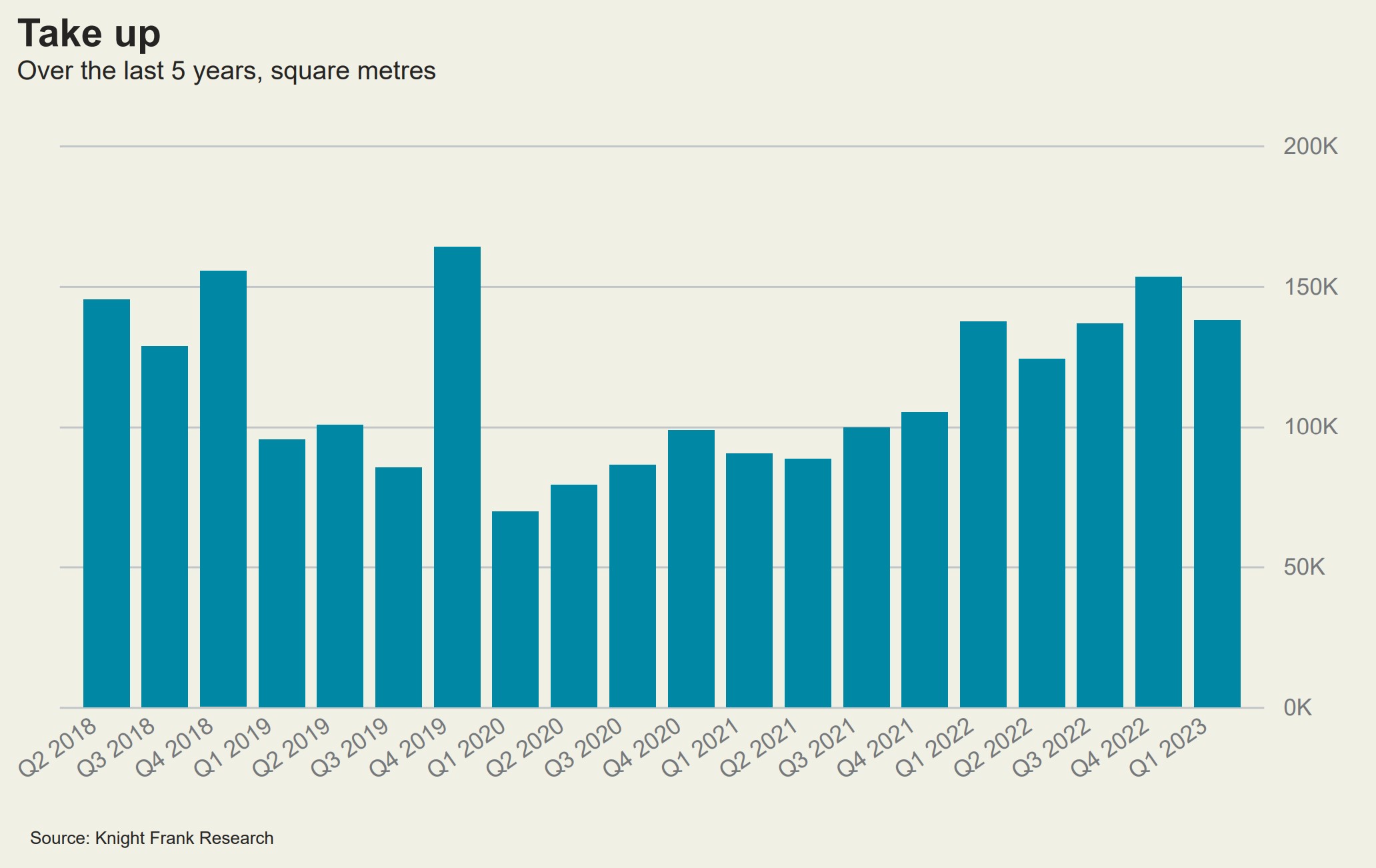

Warsaw office market

The Warsaw office market started off the year with relatively low tenant activity in comparison to the strong momentum seen in 2022. There were 159,000 sqm of take-up recorded in Q1 2023, down 42% from the volume in Q1 2022, but well above take-up from Q1 2021.

Most of the transactions that took place were new agreements (70%), with limited pre-letting activity. Only a small proportion (5%) of the deal volume were found to be expansions in footprint. Central districts remained the most popular choice among tenants in Q1 2023, accounting for 55% of the take-up volume.

The vacancy rate remained at 11.6% this quarter, representing a 60 bps decrease from 12.2% in the first quarter of 2022. The tightening of the market may in part be due to low levels of new supply being added to the city's total stock.

There were no construction completions recorded this quarter, and 2022 saw low levels of new supply deliveries compared to the five-year average. There are less than 75,000 sqm of construction completions anticipated for each the remainder of 2023, and 2024 and 2025. Rising construction costs, coupled with the ongoing high cost of servicing construction loans, are creating a challenging environment for launching new projects.

Prime rents for the city held firm at €312 psqm per annum for the third quarter in a row. Increases in service charges are still to be expected due to the ongoing price increases in services and utilities. Rents are expected to rise in the near future, and the market balance may tip towards the landlords' favour.

Due to changing regulations and a move towards climate neutrality by more and more organisations, ESG is exerting an increasing influence on the office market. Owners of older properties are being forced to modernise their office buildings in the interests of cost optimisation for both tenant and landlord.

View the latest dashboard