The end of Portugal's "Golden Visa" scheme

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

US homebuilders grow bullish

Sentiment among US housebuilders improved by the most in a decade during February amid signs that a turnaround in the housing market is underway. We talked on Wednesday about demand for mortgages returning to growth following falls in mortgage rates.

The National Association of Home Builders/Wells Fargo Housing Market Index showed 31% of homebuilders cut prices in February, down from 35% in December and 36% in November. The average price drop narrowed to 6%, from 8% in November. The share of builders offering incentives fell to 57%, from 62% in December.

How long this runs will depend on the Federal Reserve. Confirmation that inflation peaked months ago sparked falls in mortgage rates as investors bet that the Fed would begin cutting rates before the end of the year. Investors have been exiting those bets since this week's CPI reading came in above consensus.

Golden Visas

Portugal will end its "Golden Visa" scheme as part of a package of measures aimed at tackling its housing shortage. The nation is one of about a dozen that offers residency in exchange for foreign investment.

Official figures suggest the government has issued almost 12,000 resident permits to investors since 2012. Those investors acquired more than €6 billion worth of real estate and transferred more than €700 million into Portuguese bank accounts.

The UK dropped its Tier 1 Investor Visa scheme a couple of years ago, but similar programmes are still up and running in the US, Spain, Singapore and the UAE, to name just a few. The schemes create significant demand in prime property markets. Italy's version has proven particularly popular and is likely to be one of the more active prime property markets this year, as we'll be exploring in The Wealth Report 2023, out next month.

The flight to quality offices

Occupiers leased 809,121 sq ft of office space in the M25 market during the final quarter, bringing the annual total to 2.75m sq ft, according to Knight Frank data. That's up 6% year-on-year and about 10% short of the long-run average.

The TMT sector continues to drive significant activity in the market, accounting for almost a quarter of take-up during the year.

There was further evidence of the flight to better quality offices. Take up for grade A offices offering strong sustainability credentials and amenity offerings accounted for 87% of all space taken during the year. Overall vacancy for the South East finished the year just above the long- term average at 7.6%, however availability for new or recently refurbished offices remained unchanged. Meanwhile, representation of grade B, or secondary, office stock to overall vacancy is at its highest level since 2014. See the report for more.

The fashion capitals

Demand for city living is proving resilient as global property markets slow in the face of affordability challenges and weaker economic activity.

The average house price across 150 cities worldwide increased by 5.6% in the year to December 2022. This was down from a peak of 11.6% in April 2022, according to analysis of mainstream market data by Knight Frank.

London Fashion Week begins today, so Chris Druce checks the data for the world's fashion capitals. New York once again showed a clean pair of heels to its fashion rivals with annual growth of 8.1% in November. London was second to the Big Apple with annual growth of 6.4% in the same period. Milan was third with annual growth of 5.1%.

Prime mortgage lending

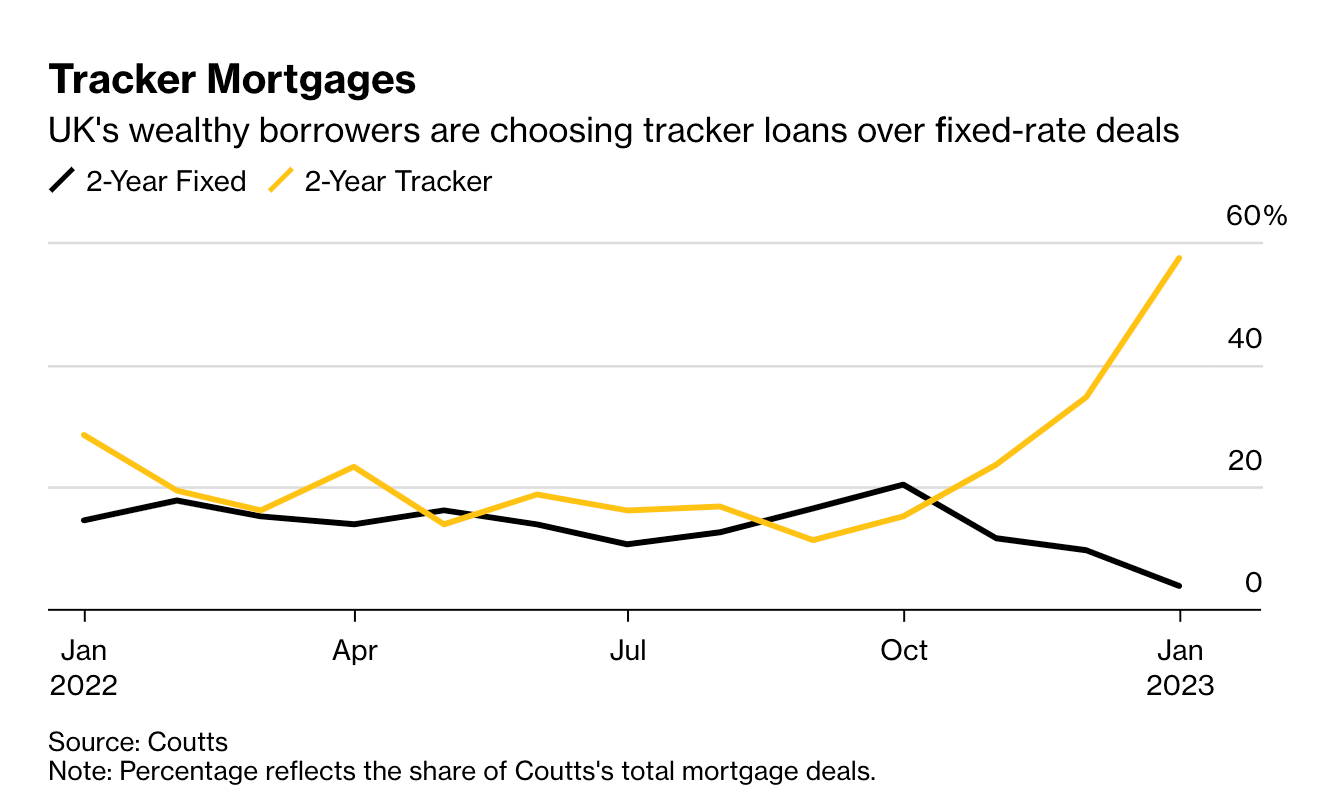

Some interesting titbits in this Bloomberg interview with Coutts: almost two thirds of the company's mortgage holders took two-year tracker deals last month, compared with 11.5% in September (see chart). The share of borrowers choosing two-year fixed loans dropped to less than 4% from 16.4% in the same period.

In other news...

Our round up of office market performance across European markets.

BoE economist Huw Pill drops hint of slowdown in interest rate rises (Times).