"Shaking the tree" of the UK land market

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

US house prices under pressure

US house prices fell 1.3% during August, according the S&P CoreLogic Case-Shiller Indices. Bloomberg makes that the largest monthly decline since March 2009.

The Federal Reserve's scorched earth approach to taming inflation has pushed 30-year mortgage rates to just shy of 7% and values will need to adjust. Annual growth is still running at 13.1% but that number will continue to shrink. All 20 cities in the index saw a monthly decline during August led by San Francisco (-4.3%), Seattle (-3.9%), and San Diego (-2.8%).

Context is important and August's falls leave prices in all 20 cities well above their levels just 12 months ago. Prices in Miami, for example, remain up 28.6%. Prices are up 28% in Tampa. Charlotte, Dallas and Atlanta have all chalked up increases of more than 20% compared to a year ago.

How far this runs depends on the Fed's ability to engineer the so-called soft landing - bringing down inflation without a spike in unemployment. Previous housing slowdowns have avoided mutating into crashes when employment has remained. resilient, which keeps forced sellers low, according to research from Innes McFee, chief global economist at Oxford Economics. He puts the chances of a double-digit fall in US house prices at 35%.

The pivot

The Fed is widely expected to execute another 75bps rate hike at its meeting next week, but it may start easing off after that.

San Francisco Federal Reserve President Mary Daly said in a speech Friday that policymakers were concerned about raising rates too quickly, prompting an unforced downturn. "I think the time is now to start talking about stepping down," she added.

Most Fed policymakers believe the key rate will need to rise to between 4.5% and 5% next year. Those projections are still reasonable, according to Daly.

Mortgage rates drop

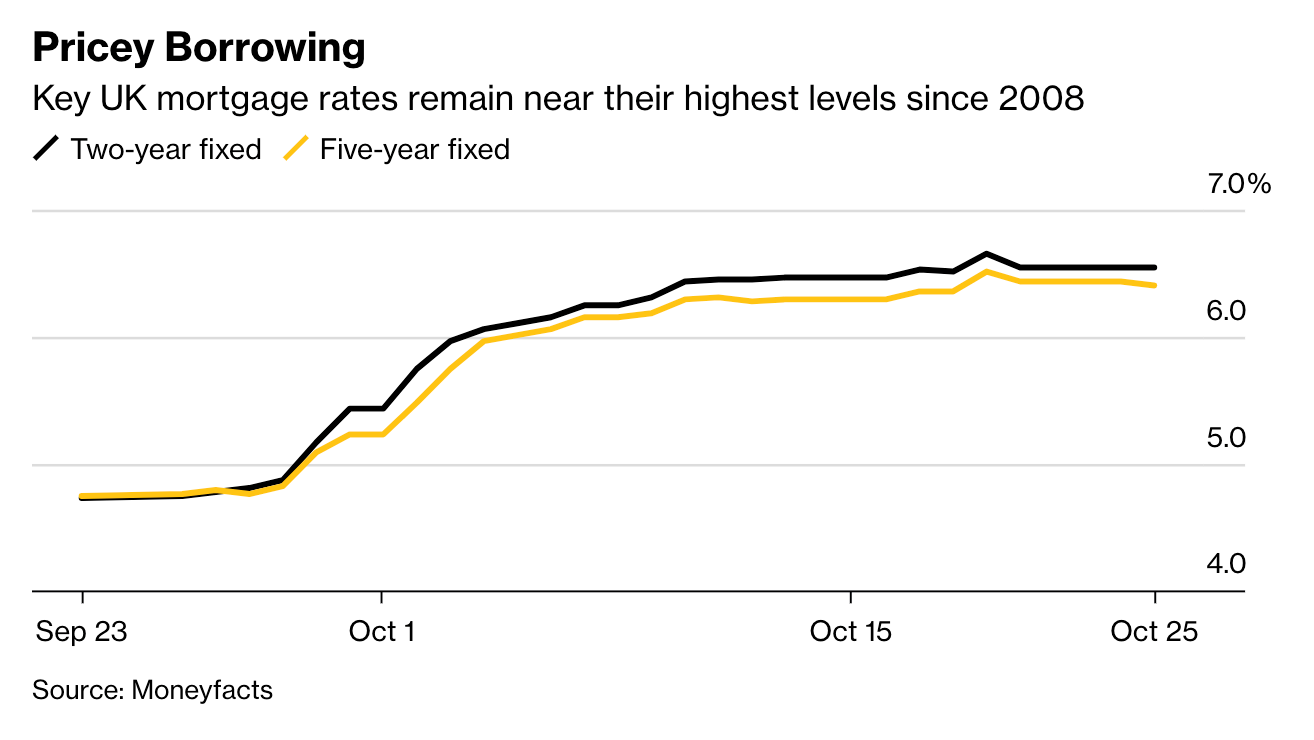

The UK mortgage market endured a week of chaos in the wake of the mini-budget as lenders pulled products or repriced ranges to eye-watering levels amid a huge spike in gilt yields.

The Bank of England's intervention followed by Rishi Sunak's eventual appointment to PM steadied the ship, swap rates have eased and investors have now priced in a base rate peak of a little under 5% next year, down from more than 6% just weeks earlier.

That made mortgage rates look pricey and lenders have now started dropping the price of some products. Santander and Accord announced rate cuts by up to 0.50 and 0.53 percentage points respectively yesterday, according to FT Adviser. Five-year fixed mortgages are seeing the biggest decreases.

This looks like a market stabilising rather than any meaningful reverse. Average two-year fixed rates across all LTVs now sit at 6.54%, down from 6.65% last week, according to Moneyfacts data covered by Bloomberg (see chart).

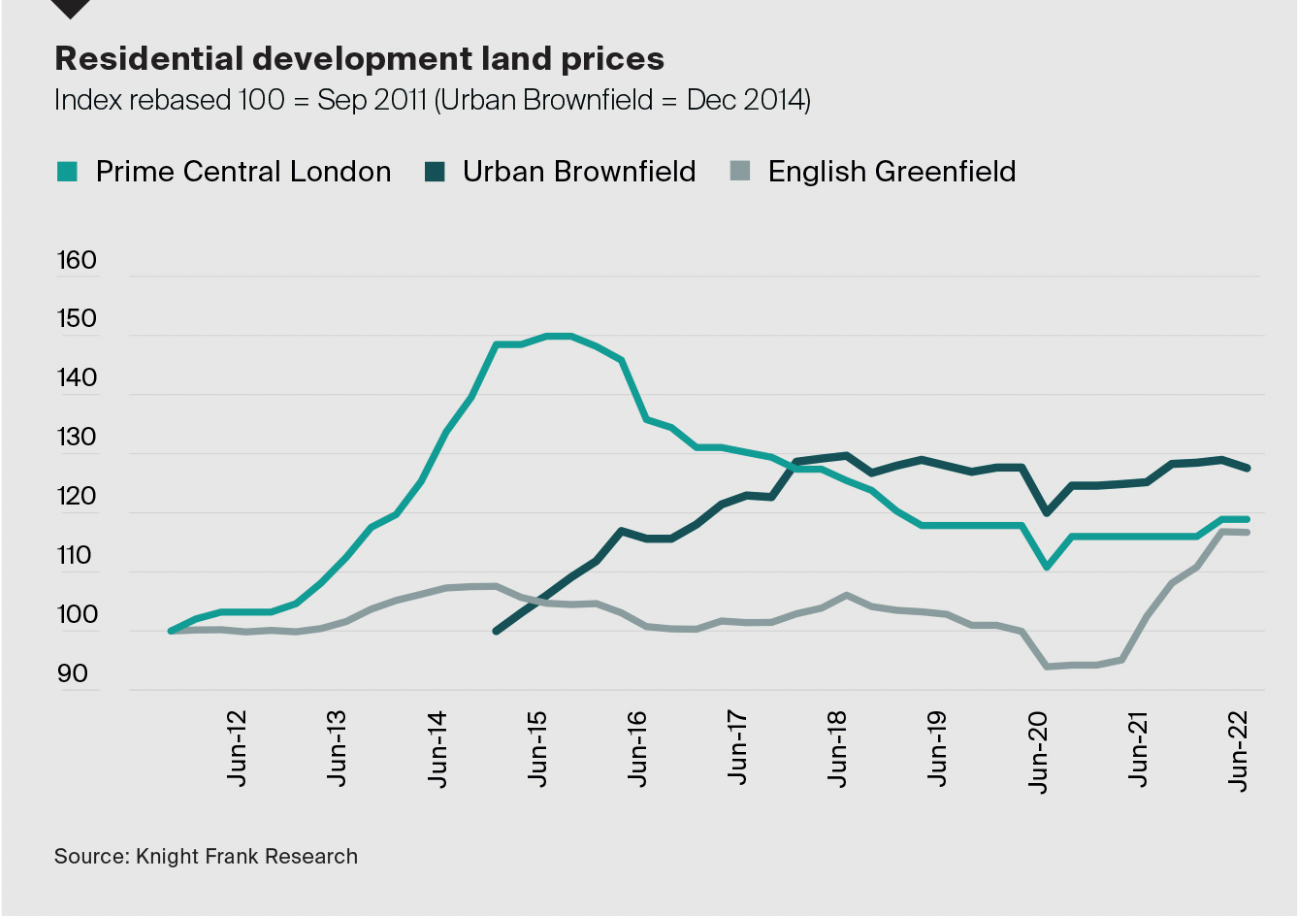

The UK land shortage

A shortage of residential development land has underpinned prices across the UK in recent years. Greenfield land remained the strongest performer during the year to Q2, up 13.9% annually, followed by PCL (+2.5%) and urban brownfield (+1.9%) (see chart).

The lack of supply has long frustrated housebuilders. Ultra-low interest rates meant land has been inexpensive to hold, enabling many landowners to sit tight. That's likely to change during the months ahead, Knight Frank's James Barton says in a column for React News:

"The natural pressure created on landowners through an increase in hold costs via increasing interest rates should “shake the tree” in terms of land supply and allow for a more fluid and liquid land market.

"Increasing interest rates will... ultimately lead to an increase in the supply of new homes, thereby bringing about natural price realignment across the property market. Pain will be felt by some, but this natural process of alignment is a much needed consequence and will likely start to filter through by Q2 2023."

We'll be publishing our Q3 index on residential land values next week.

In other news...

Spain's rental market sees rapid growth

Australia residential property update: ESG on the agenda

Elsewhere - FCA proposes rules to stamp out 'greenwashing' (Reuters), uncertain times pull City staff back to the office (Times), UK homes stall on energy efficiency (Bloomberg), and finally, why natural gas prices in Europe are suddenly plunging (NYT).