Covid-19 Daily Dashboard - 6 November 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 6 November 2020.

Equities: In Europe, stocks are lower this morning, with losses recorded by the DAX (-1.5%), CAC 40 (-1.3%), STOXX 600 (-1.0%) and the FTSE 250 (-0.2%). However in Asia, the S&P / ASX 200 (+0.8%), Topix (+0.5%), Hang Seng and the Kospi (both +0.1%) all closed higher, while the CSI 300 was flat on close. In the US, futures for the S&P 500 are down -1.2%.

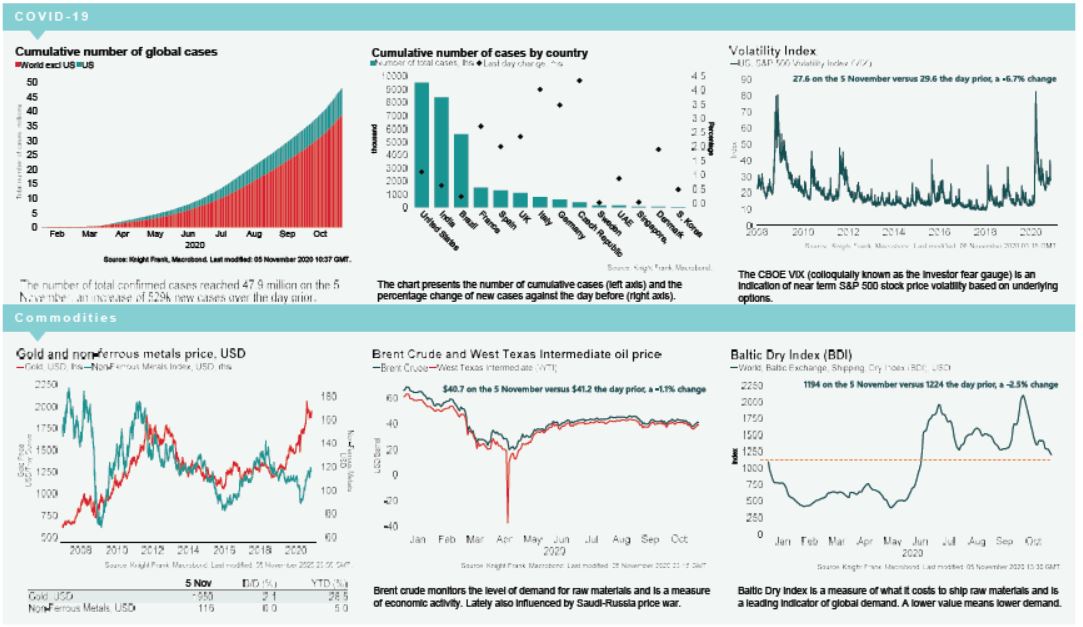

VIX: Following a -6.7% contraction over yesterday, the CBOE market volatility index has increased +6.0% this morning to 29.2. The Euro Stoxx 50 volatility index is also higher, increasing +4.6% to 27.6. Both indices remain elevated compared to their long term averages of 19.9 and 24.0.

Bonds: The UK 10-year gilt yield has compressed -2bps to 0.22%, while the German 10-year bund yield has contracted -1bp to -0.64%. The US 10-year treasury yield is flat at 0.77%.

Currency: Both sterling and the euro have appreciated to $1.31 and $1.19, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.38% and 1.24% per annum on a five-year basis.

Baltic Dry: The Baltic Dry decreased -2.5% yesterday to 1,194, the lowest the index has been since mid June. The Baltic Dry is now -39% lower than it was at the peak seen in July, and over the last 23 sessions, the index has seen cumulative declines of -43%. However the Baltic Dry remains +10% higher than it was in January.

Oil: Brent Crude and the West Texas Intermediate (WTI) have contracted -1.9% and -2.2% to $40.14 and $37.94, respectively. The WTI has remained below $40 per barrel since 23rd October.

US Election: The most recent probability of President Trump being re-elected is 15%, down from yesterday’s 20%, according to Predictit. Joe Biden’s likelihood of winning the election is currently 90%, an increase from the 86% probability recorded yesterday.

US Unemployment: There were 751k new unemployment applications in the week to 31st October, above market expectations of 732k, albeit lower than the previous week’s reading of 758k.