Pulse on the global economy – Rising tensions and why cities won’t lose their appeal

To help cut through the noise we bring you a weekly roundup of the latest news, real-time data emerging trends and forecasts across the global economy and asset classes and how this may impact residential markets.

5 minutes to read

Mixed signals

This week has been a real mix of positives and negatives. Covid-19 cases in the US have surged to their highest levels with many states reversing the opening of their economies, most recently Miami saw restaurants and other facilities reclose their doors. In the last week, the number of daily confirmed cases has exceeded 50,000 on four occasions – in positive news, however, the number of confirmed deaths is still trending downwards.

There is hope around the potential impact of second waves. Many locations have been enforcing localised lockdowns, most notably in Melbourne, Leicester and in North Rhine-Westphalia in Germany – yet with the use of mass testing a small lockdown proved successful in Beijing. If others follow suit - as the US is doing by setting up “surge” testing sites in several states, including Florida, Louisiana and Texas - this could be a successful model to limit future disruption.

Equity markets have been trending upwards this week. Markets in China helped push global stocks to their highest levels since early June, the rally on Monday alone added more than $460 billion to Chinese stock values. The Nasdaq in the US hit a new record high on Monday and sits 20% above the 2020 opening. These are being supported by positive economic news such as rising Purchasing Managers Indices (PMIs) in China and positive US jobs growth where employers brought back 4.8 million jobs in June, the second month of strong gains.

There is a cautious note that this sharp bounce back may not be sustainable and will be limited by social distancing measures which mean full operation is still some way off. However, as governments continue to support through fiscal policy - for example the UK’s summer statement on Wednesday brought the total cost of the Treasury’s Covid-19 support measures to an estimated £189bn since March - this should provide a boost to the recovery, consumer sentiment and provide longevity.

Geopolitical tensions

The past week has seen even more factions than those we reported just a few weeks ago. Following China's national security law in Hong Kong, the UK Government has offered effective permanent residency and a pathway to citizenship for almost three million Hong Kong residents who are eligible for British National (Overseas) passports and the Australian Government in considering proposals to also offer safe haven to Hong Kong residents. Over the pond and Canada suspended its extradition treaty with Hong Kong and the US Senate passed a bill imposing sanctions on banks that do business with Chinese officials involved in cracking down on pro-democracy protesters in Hong Kong.

China has responded with warnings of strong countermeasures if countries continue to take actions in response, saying foreign pressure would “never succeed.” This also comes in the midst of the ongoing technology debate centred around Huawei. China’s ambassador to London warned of “consequences” if the UK continues to treat China as a “hostile” power in its dealings over Hong Kong and Huawei.

The reactions of governments at a time when cross-border travel is limited and restricted will be key to watch for indications of future policy.

Urbanisation hasn’t run out of steam

Over recent decades we have seen the process of urbanisation gather speed, with the proportion of the population living in urban areas growing from around a third, 36.4% in 1969, to over half, 55.7% in 2019, according to The World Bank. As some of the hardest hit places throughout the pandemic have been cities many may think this could reverse the trend, but with their adaptability and fundamental appeal this is unlikely to happen.

Liam Bailey wrote on LinkedIn about how city living wont come to an end after the pandemic looking at Knight Frank data from the UK. The need for living and working in cities is clear as The Economist highlighted due to productivity gains and shared knowledge – if we want to continue to thrive and innovate there will always be a place for bustling cities and these cities are adapting fast.

Many are using the pandemic to enhance the way we live – for example in Lisbon they are planning to have over 30km of emergency cycle lanes by September and another 20km by the end of 2020 in addition to new cycle parking spaces, and a new fund to subsidize the purchase of bikes.

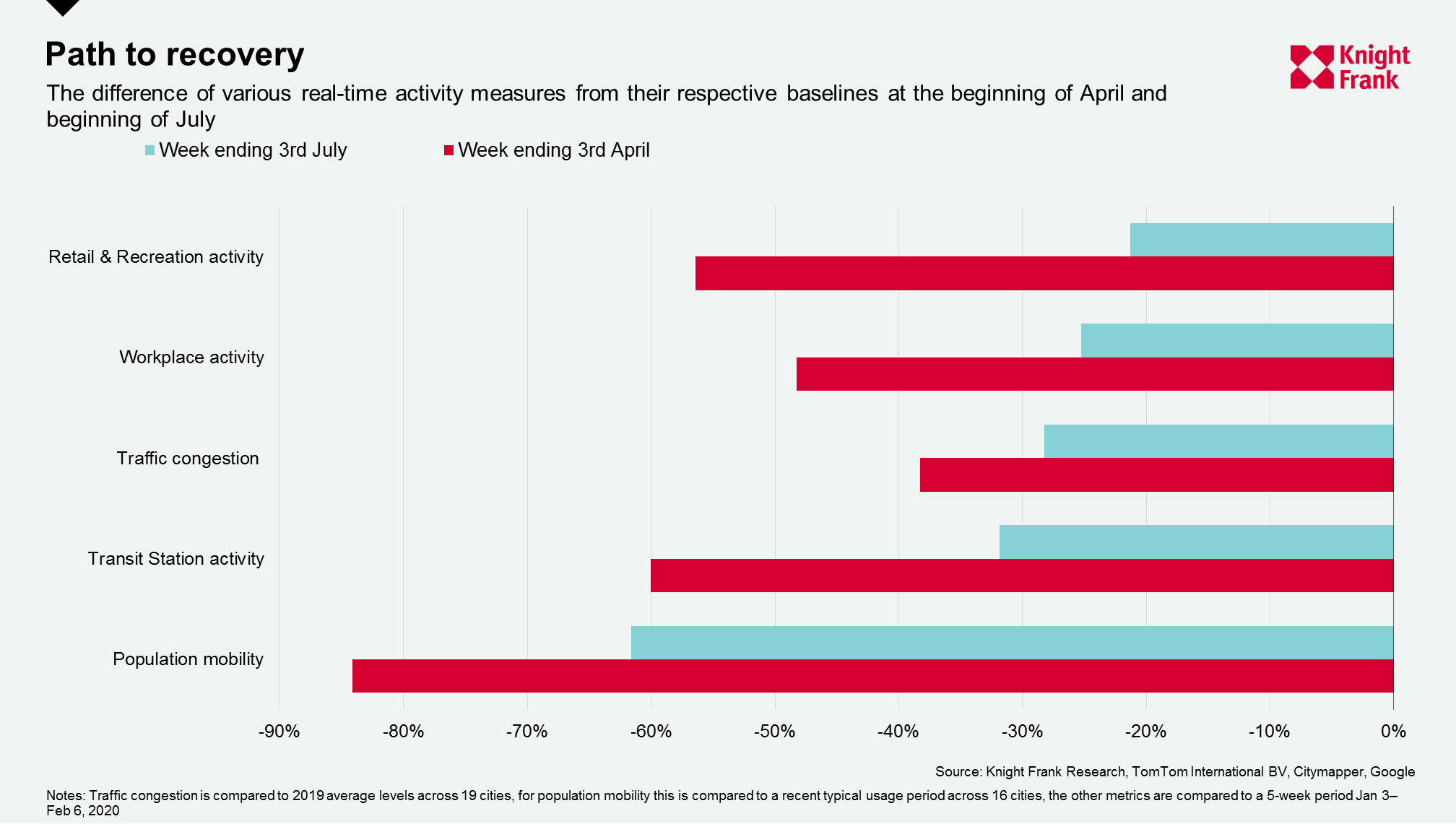

Throughout the pandemic cities have suffered, but we are also likely to see urban centres lead the way out. Economically they are back in business in some capacity – traffic congestion, on average across 19 cities is 28% below the 2019 average compared to 38% below in April and workplace activity is on average 25% below, up from 48% below baseline in April.

In terms of population mobility, as measured by Citymapper, Hong Kong and Paris are the most mobile with 71% and 67% of the population mobile compared to a baseline period. Tokyo, Los Angeles and New York remain the least active with less than 20% of the population mobile.

For workplaces Seoul, Hong Kong and Sydney are closes to ‘normality’ with 2%, 13% and 15% less activity in workplaces, respectively, compared to baseline according to Google’s monitor – the furthest away is London which sits 48% below baseline yet this is a marked improvement from the 73% below baseline in April.

As cities begin to pulse back into life, those that adapt will be able to thrive and attract and retain talent, which will need to be supported through adequate housing. Looking at a cities ability to come out of the pandemic stronger will be an indicator for which have the best underlying fundamentals for future growth.