Residential Market Outlook 28 May 2020

A roundup of the latest data and insight on key global residential markets

6 minutes to read

Residential digest

Housing market data is slowly starting to be published for the month of April, the point at which most of Europe and the US were under lockdown and some parts of Asia Pacific were starting to see measures relaxed.

Until now we have had to focus on real-time economic data and anecdotal comment to understand the impact that Covid-19 is having on property markets globally. The emphasis is now changing as we start to see price, rent and sales volumes data released.

Need to Know

As Europe approaches its peak tourist season, there are signs that travel rules are being relaxed and borders opening - welcome news for the region’s prime second home market. Eleven European countries have agreed a coordinated approach to re-open the Schengen Area including Germany, Italy, Portugal and Spain.

Germany has announced it will allow its citizens to travel across Europe from 15 June, whilst Greece and Spain will allow tourists from 1 July. In contrast, the UK will introduce a 14-day quarantine for most arrivals from 8 June.

Economic surveys from the UK, Eurozone and the US show early signs that the worst of the economic impact of the pandemic has passed. Meanwhile, there is concern that in emerging markets, where the rate of infection is still rising, economies are starting to unlock too soon.

For the first time since we started tracking data on traffic congestion and population mobility eight weeks ago, all 16 of the locations we monitor have reported an increase in movement over the past week and month with Paris registering the largest rise in population mobility.

Europe

In the UK, demand for residential property surged in the first full week of trading since the market reopened. The number of new prospective buyers registering in London was 28% higher than the five-year average in the week ending 23 May.

Our analysis of the France/UK border conundrum, reveals that despite no quarantine waiver as originally mooted, the Channel Tunnel is taking a “steady stream” of bookings from July onwards, suggesting France could be a key focal point for UK holidaymakers not sold on the idea of a staycation, providing rental income for second home owners in France. The piece also highlights the nascent trends we’re observing post-lockdown across France’s prime second home hotspots.

New data released for Spain confirms that six regions registered positive annual price growth in the year to Q1 2020: the Balearic Islands, Andalucía, Valencia, Madrid, the Canary Islands and Murcia. Time on the market indicators were also improving prior to Covid-19 with average marketing periods declining from 4.2 months in Q1 2019 to 3.7 months in Q1 2020.

In Ireland, the government announced a five-phase process for easing out of lockdown on 18 May with some construction firms now permitted to return to work. Data to March shows residential prices increased by 1% nationally year-on-year with average prices static in Dublin over the same period.

Asia Pacific

New Zealand, one of the first countries to ease out of lockdown, has not seen a resurgence in cases so far which is encouraging news. However, the impact of Covid-19 on the property market is becoming clear with residential transactions totalling just 1,305 in April 2020 nationwide, down from 6,082 in April 2019 according to the Real Estate Institute of New Zealand.

Prime Minister Jacinda Ardern is reported to be considering introducing a four-day working week to help boost domestic tourism, productivity and employment in the wake of the Covid-19 crisis.

Australia is loosening rules across most states from 1 June with pubs, bars and restaurants set to open, albeit with strict occupancy rates, further easing is planned for later in June. Our research team in Australia have released a suite of reports looking at living, working and studying in the country for both domestic and international buyers.

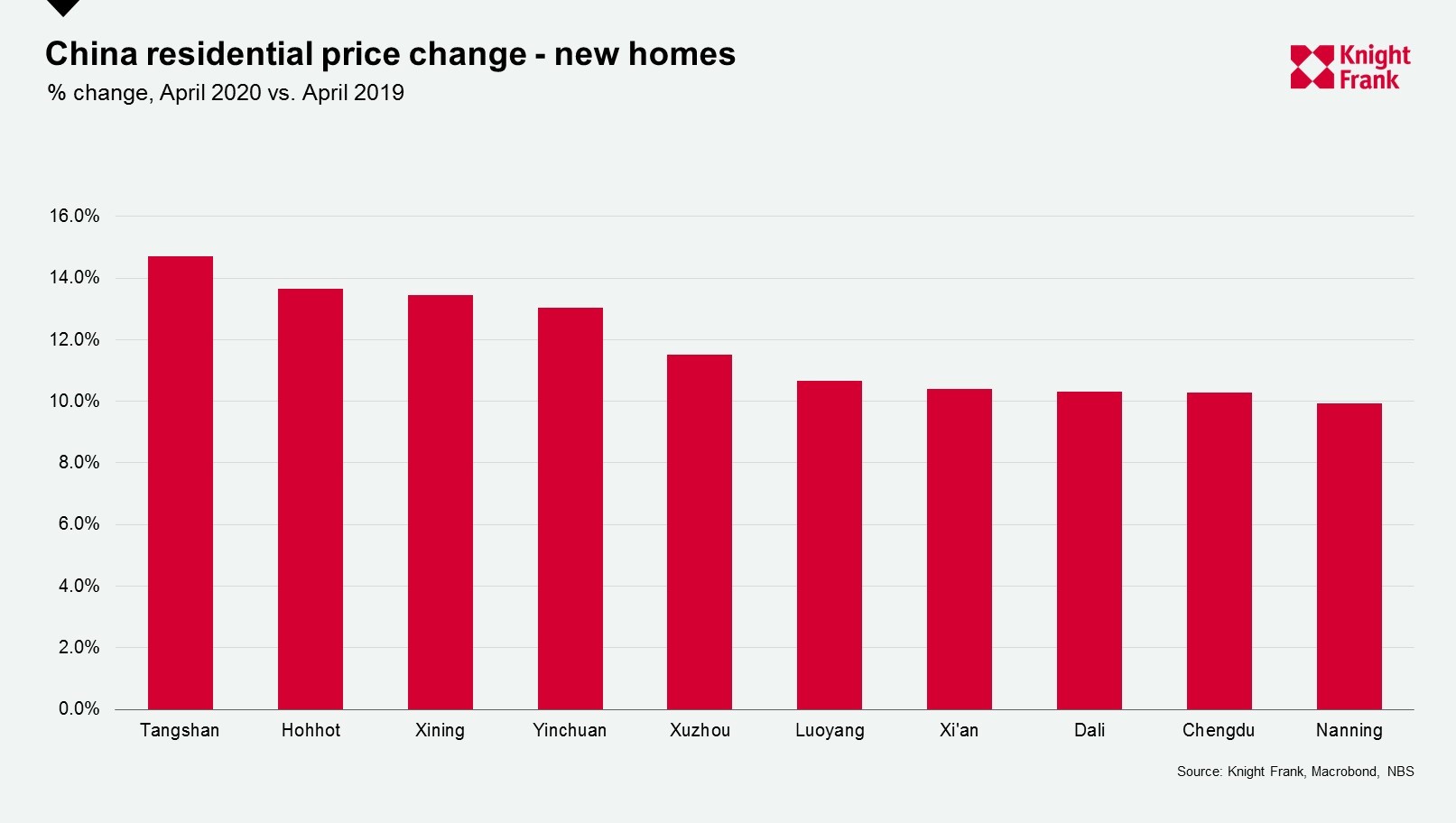

In his update from China, my colleague Nick Holt confirms that residential price performance has proved largely resilient. The 70 cities tracked by the National Bureau of Statistics registered average price growth of 0.5% year-on-year with most seeing modest residential price increases in April. Tangshan led the top ten performing cities with annual growth of 14.7%.

The RICS’s latest Hong Kong Residential Market Survey highlights a mixed regional outlook with respondents more bullish on the New Territories where they expect prices, rents and transactions to rise compared to Kowloon and Hong Kong Island where most indicators are expected to contract over the next 12 months.

US & Canada

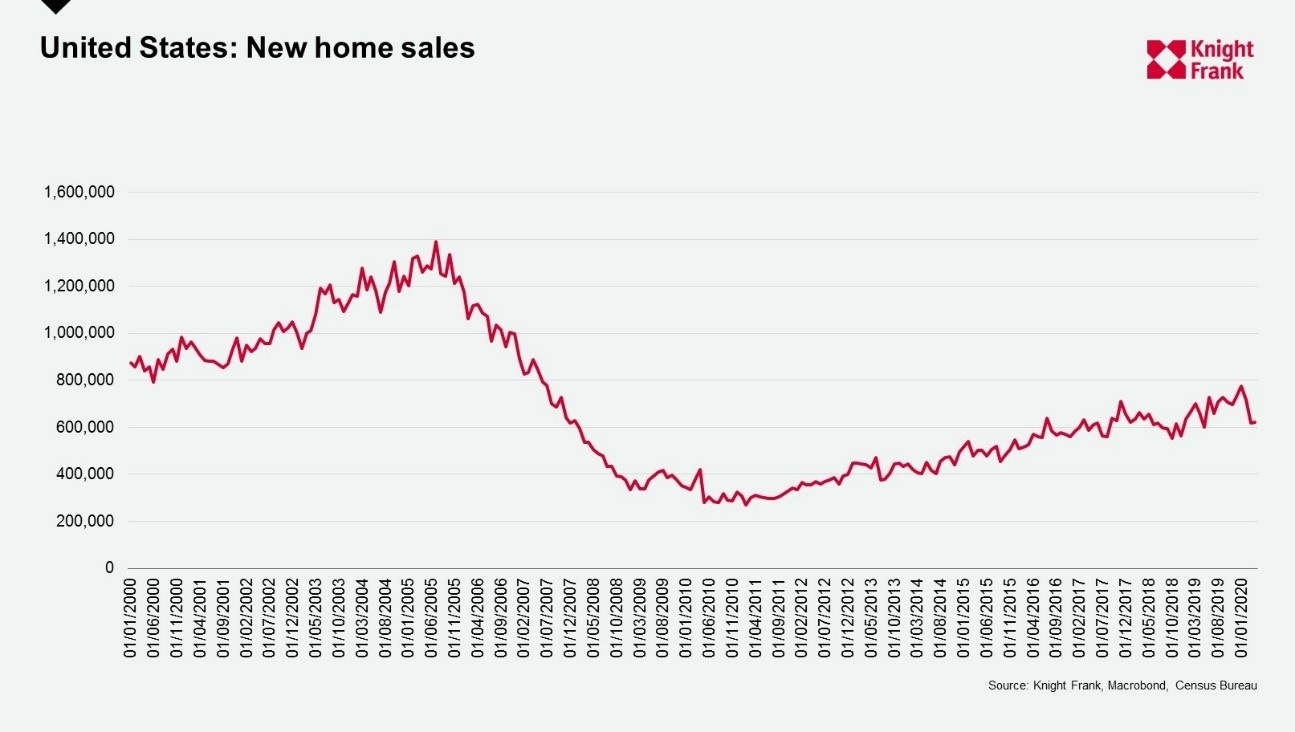

In the US, new home sales exceeded expectations by increasing by 0.6% in April month-on-month, although sales are down 6.2% year-on-year according to the US Census Bureau. This uptick mirrors the rise in mortgage applications we reported last week, but given record unemployment figures are likely to continue to weigh on the economy, Capital Economics doubts sales will reach pre-Covid levels before the end of 2020.

The latest national house price data for the US released by Case Shiller and FHFA confirm a 0.5% and a 0.1% increase in March month-on-month respectively. With most US states not enforcing stay-at-home rules until the end of March, all eyes will be on the release of next month’s data.

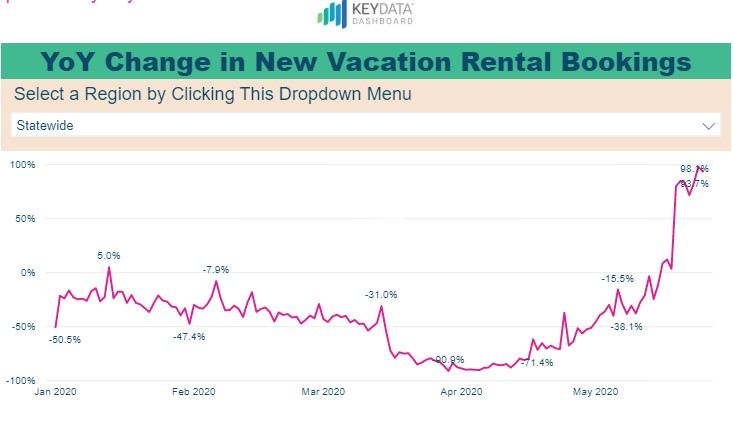

The Financial Times reports that the US holiday rental market is gaining traction. Data from VisitFlorida.org shows rental bookings are 90% higher than they were 12 months ago. With travel restrictions easing and rental demand strengthening this could prove a lead indicator of second home demand.

Middle East & Africa

In Dubai, the market was seeing momentum build at the end of 2019 and the emirate had high hopes for 2020 with it set to be the first GCC country to host Expo. Yet despite strict lockdown measures during April, initial data reveals off-plan transaction volumes increased by 5% in the year to April, whilst resale transactions slipped by 5%.

Average prices, which fell by 6.8% in the year to March 2020, are likely to remain under pressure, particularly due to the influx of supply scheduled to be delivered in 2020. Prices for new build units are likely to be more resilient in relative terms, particularly given current attractive payment plans. With Dubai Expo postponed until October 2021 it is expected this will still deliver the anticipated market stimulus next year.

A detailed look at all four key African regions by my colleague Tilda Mwai - North Africa, Southern Africa, East Africa and West Africa - confirms not only the extent to which the scale of the pandemic varies from country to country, but also the range of fiscal and monetary policies implemented to date to help support the real estate sector.

Subscribe to our daily research update