Global Residential Market Outlook - 14 May 2020

A roundup of the latest data and insight on key global residential markets

5 minutes to read

The start of this week saw countries such as France, Portugal and Switzerland make some headway in reopening their economies, however, at the same time others stumbled with a small outbreak of new cases reported in South Korea and China, whilst the all-important R value in Germany moved above 1 in three states. A ‘two steps forward one step back’ scenario is likely to be with us for the foreseeable future.

Nonetheless, some European housing markets are in the process of normalising with viewings and transactions now permitted in the UK, France, Spain, Portugal, Switzerland and Germany.

Economic activity is gradually improving as Flora Harley reports in her weekly assessment of real-time data. Three-quarters of cities tracked registered an increase in population mobility last week with Berlin, Milan and Sydney observing some of the largest increases according to data from The Citymapper Mobility Index*.

Despite indicators suggesting higher population mobility, the two-month shutdown is expected to have significant and long-lasting economic repercussions. The latest Global Risk Survey from Oxford Economics shows 39% of economists expect the global recession to last for three quarters, and only 8% now predict a “V” shaped recovery, compared to 44% in March.

Below we present the latest residential news and data from across the rest of our network and beyond.

Residential digest

Asia Pacific

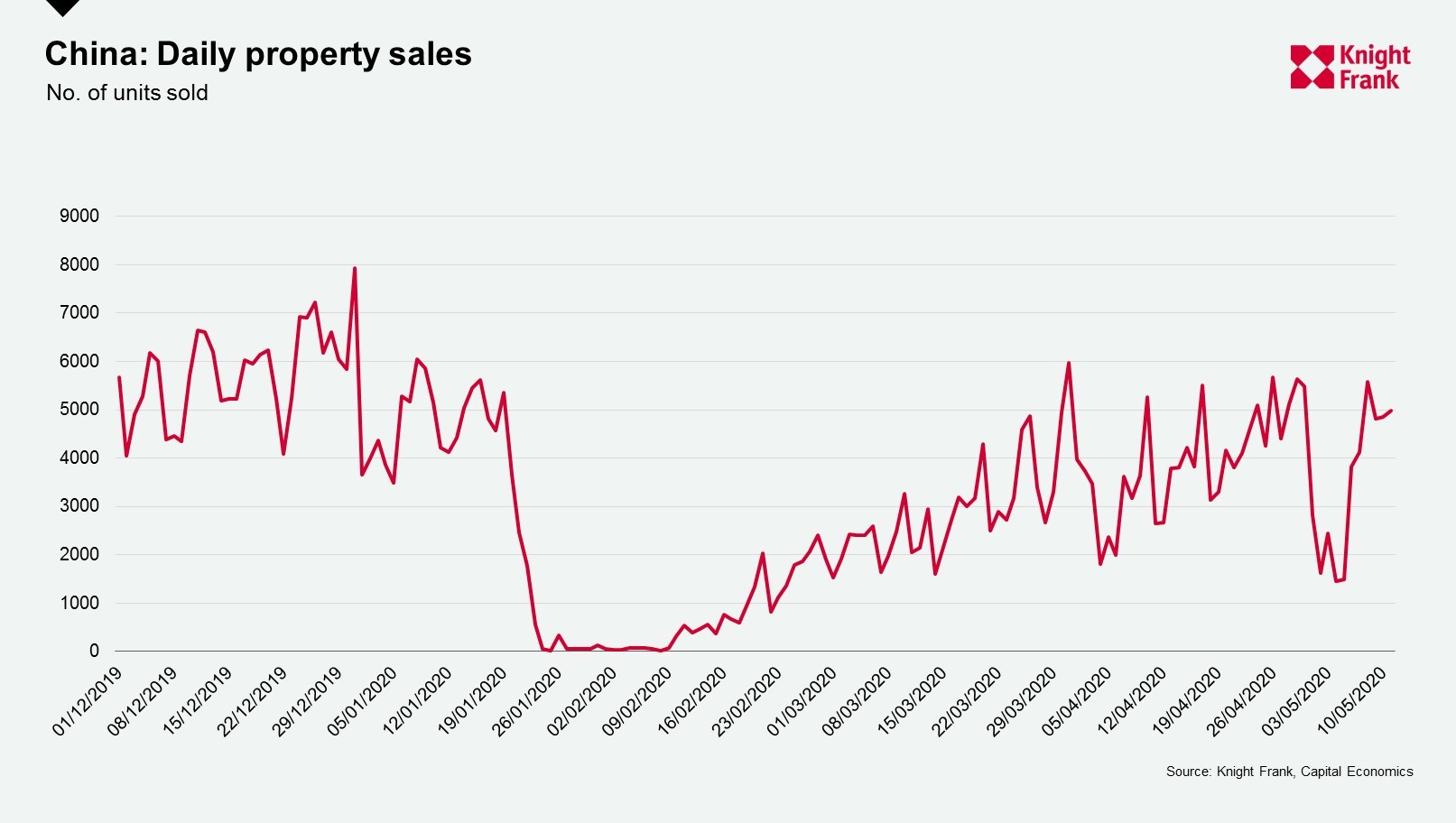

In China, property sales continue to recover up from a low of 22 sales on 8 February to almost 5,000 sales on 11 May, aside from a dip due to the public holidays around Labour Day, this is broadly back to levels seen in December 2019.

In Australia, my colleague Ben Burston looks at the shifts in the Australian dollar which declined to just 56 US cents on 19 March before rebounding strongly, in part due to the RBA’s economic stimulus package. The prime Sydney market saw prices increase by 4.7% in the year to the end of March 2020 and by 1.2% in the first three months of the year. With open homes and live auctions permitted to take place from 9 May, gauging buyer sentiment should soon be possible.

In New Zealand, the country moves to alert level two today enabling schools to reopen and workers to return to offices. Both the national and Auckland markets saw prices strengthen at the end of 2019 due to demand/supply imbalances. With foreign buyers largely limited to purchasing new-build units only and travel restrictions in place, sales will be dependent on domestic demand and the economy’s resilience in the coming months.

In India, Narendra Modi announced plans for a $266bn stimulus package to help India’s stalled economy recover.

Europe

In the UK, Boris Johnson has set out his roadmap for taking the country out of lockdown which included allowing estate agents to return to work from Wednesday.

In light of government’s projections - namely that it will now be July at the earliest before the UK emerges from lockdown - we have updated our UK residential forecasts.

Our view is that a decline of 7% in UK prices and 5% in prime London and prime regional prices will be experienced through 2020, with much of this decline already having taken place between March and May.

Our latest Intelligence Talks podcast discusses how else the UK government could assist the housing market and what our agents are seeing on the ground.

Italy, one of Europe’s hardest-hit countries and the first to go into lockdown, plans to allow viewings from 18 May but a Q&A with Alessandro Deghé our Lucca office confirms that transactions continued during lockdown as notaries remained open and the appetite from German buyers is notably strong.

The US & Canada

In the US, more than half of States have begun to ease lockdown restrictions and the Federal Reserve has announced further stimulus measures.

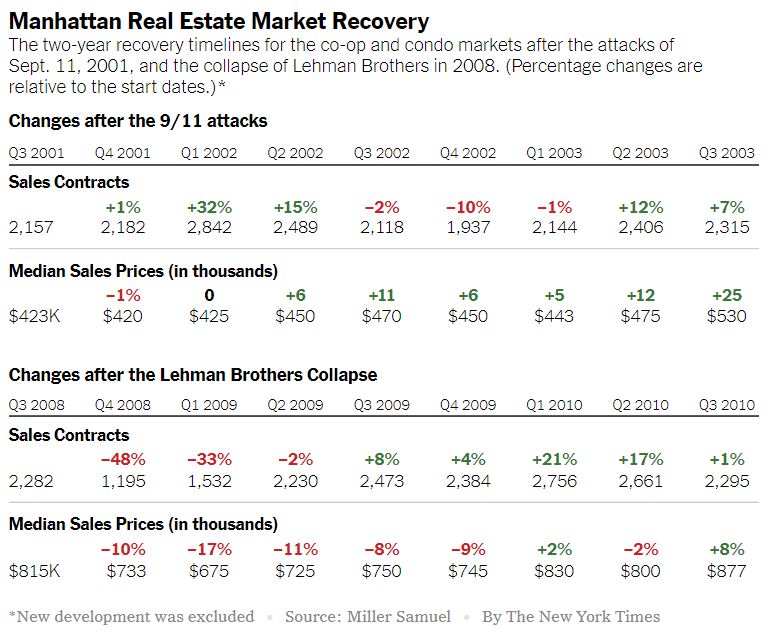

Jonathan Miller, who produces quarterly market reports for our US residential partners, Douglas Elliman, has taken a detailed look at how the co-op and condo market in Manhattan responded following previous crises such as 9/11 and the Global Financial Crisis. Unlike 9/11, sales dipped immediately after Lehman’s collapse and price growth remained in negative territory for five quarters.

Middle East and Africa

Saudi Arabia announced plans this week to triple VAT from 5% to 15% from 1 July. The country’s oil revenues fell to $34bn in Q1 2020, down 22% compared to a year earlier and the move is expected to be one of a wider austerity drive.

With over 69,000 confirmed cases of coronavirus across Africa, my colleague Tilda Mwai has outlined what impact Covid-19 is having on the economies and housing markets of Southern African nations where residential prices, both mainstream and prime, are likely to come under further pressure as a result of the economic downturn.

Data digest

With the performance of prime residential markets closely linked to the opening of travel routes we summarise below some of the latest announcements from airlines, setting out when they hope to restart key flight routes.

A number of airlines have been operating skeleton schedules in recent weeks and despite plans to increase capacity in the coming months several have estimated it will be 2022 or 2023 before flight traffic returns to pre-pandemic levels.

British Airways had planned to restart 1,000 flights a day from July but news of the UK’s 14-day quarantine means the company is rethinking its strategy.

One key change this week was the news that French and UK residents can travel between the two countries without being subject to a 14-day quarantine period.

Travel bubbles are also emerging, most notably offering free movement between residents of:

- Australia and New Zealand

- Austria and Germany

- Estonia, Latvia and Lithuania

| Life after lockdown airline plans |

|

|

| Selected airlines |

|

|

| Airline |

Month capacity will start to increase |

Capacity |

| Air China |

May |

22 international routes |

| Wizz Air* |

May |

10% |

| United Airlines |

May |

3 transatlantic flights to Europe, 2 to Latin America |

| Emirates |

21 May |

9 cities |

| Qatar Airways |

31 May |

50 destinations |

| Jet 2 |

17 June |

- |

| Korean Air |

June |

20% |

| Lufthansa (+ Eurowings & Swiss Air)** |

June |

additional 80 air crafts |

| Ryanair *** |

1st July |

40% |

| Air France - KLM |

July |

30% |

| Virgin Atlantic |

H2 2020 |

- |

| British Airways (+ Iberia, Vueling & Aer Lingus) |

TBC |

TBC |

| Easyjet |

TBC |

TBC |

*Increasing to 70%-80% in July & August

**Limited service at present - 330 weekly connections (domestic & Europe) & 15 long-haul flights

***Increasing to 80% by September